Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Robin Brooks tweet: "In the first 8 months of 2023, German exports to Kyrgyzstan were up 1400% from the same period in 2019

A lot of these goods - mostly cars and car parts - never ends up in Kyrgyzstan, but go directly or indirectly to Russia"

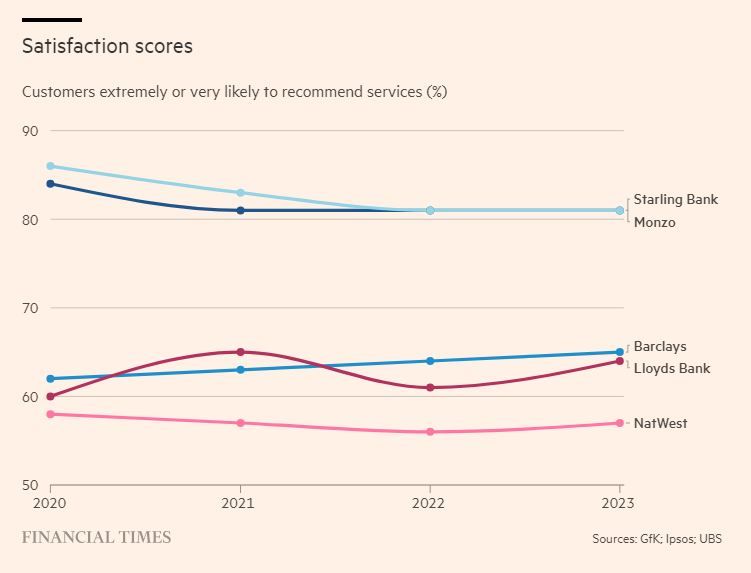

Interesting FT article on UK neobanks: "UK fintech: neobanks may end up blending in"

Low fees mean profits have remained elusive. But higher interest rates are now compensating for that, not least with better returns on client money put out on deposit. Satisfaction scores by customers are also much higher than traditional banks. Some lessons need to be learned. Source: https://lnkd.in/emZyY76d

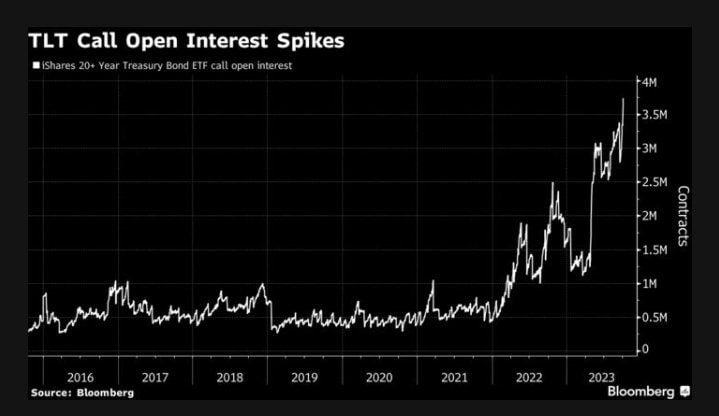

Open interest for bullish call contracts has soared to an all-time high for $TLT

Traders see an end to the market rout that has led to TLT’s longest streak of weekly losses since 2022. Source: Credit From Macro to Micro

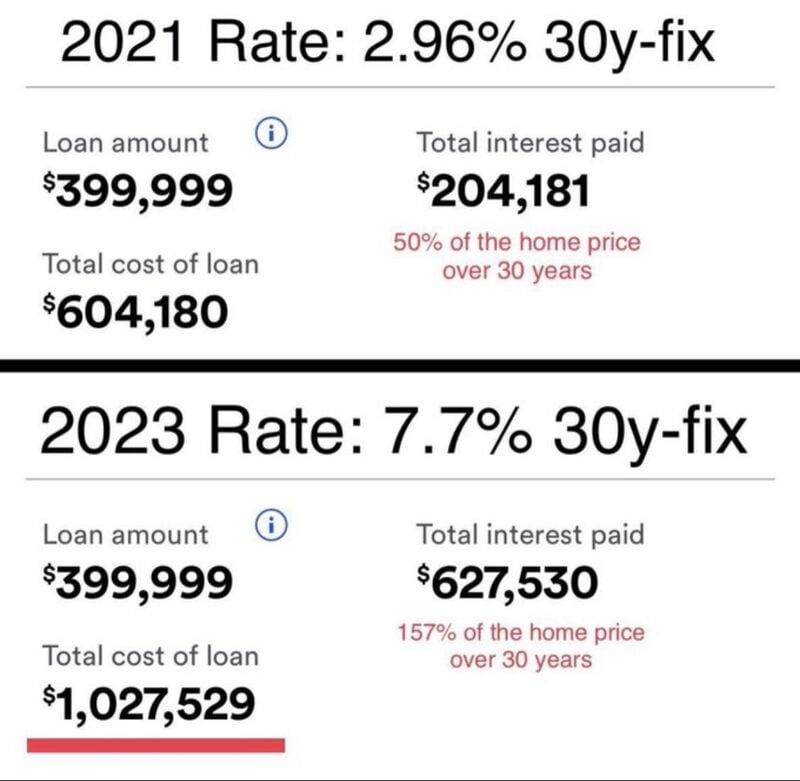

U.S. Mortgage Rates surpassed 8% this week for the first time in more than 23 years

Source: barchart

The construction sector in Germany is really crashing. The German PMI Construction Index fell to 39.3 in Sep from 41.5 in Aug, and the lowest level since statistics began

Source: HolgerZ, Bloomberg

The impacts of rising interest rates on the costs of your mortgage over the life of the loan

In the US, A $400,000 house now costs over $1,000,000, with interest rates now at 7.7% from 3%. Source: WallStreet Sliver

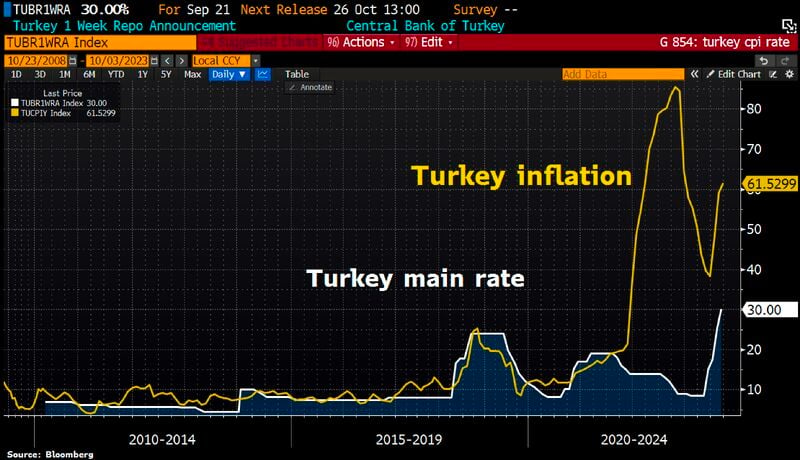

Turkey’s Inflation tops 60% despite massive interest rate hikes as oil surge worsens outlook

Source: HolgerZ, Bloomberg

Is ADP the start of something big or an anomaly, knowledge_vital asks as ADP report for September saw a huge drop in new jobs to just 89k vs. 150k forecast, & down from +180k in Aug

The 89k is the softest number since Jan 2021. Large comps drove downside, they shed 83k jobs in September. Souce: HolgerZ, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks