Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

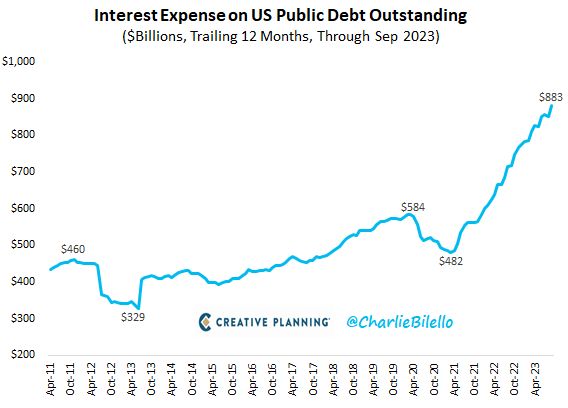

The Interest Expense on US Public Debt rose to $883 billion over the past year, another record high

If it continues to increase at the current pace it will soon be the largest line item in the Federal budget, surpassing Social Security. Source: Charlie Bilello

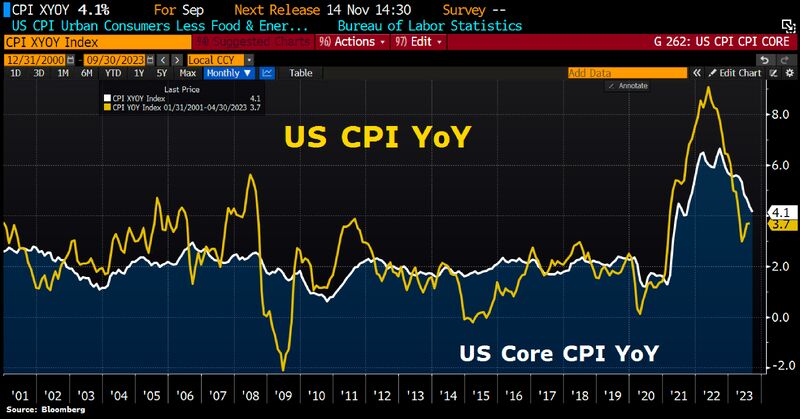

US inflation is cooling, but only slowly

From the perspective of the Fed, the figures are probably not worrying enough to trigger another interest rate hike. However, they are not good enough to sound the all-clear either, CBK says. Source: HolgerZ, Bloomberg

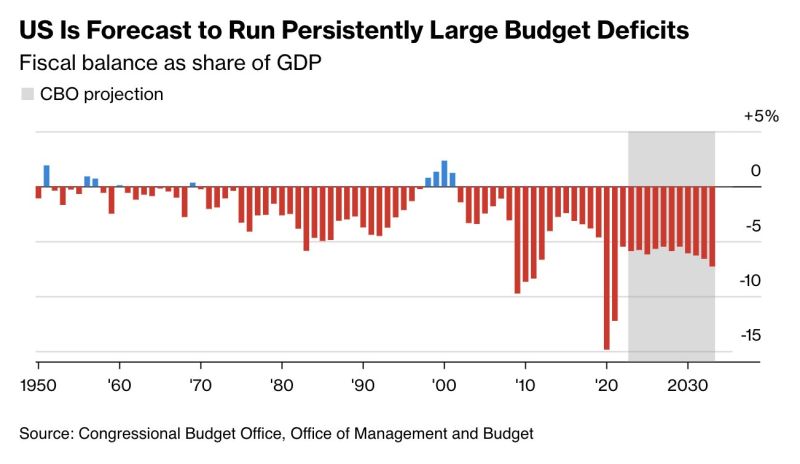

The United States is on an unsustainable fiscal path warns the IMF which projects the U.S. deficit to be 'elevated and persistent

Source: barchart, CBO

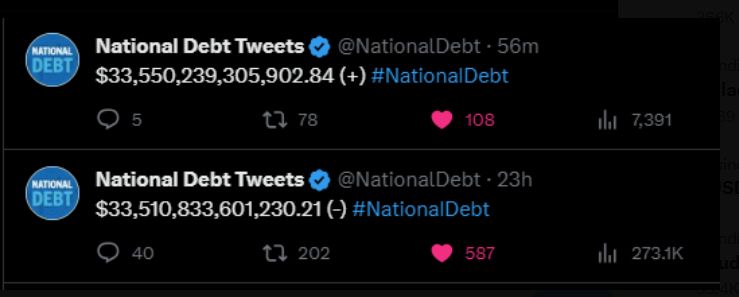

Another $40 billion in US debt today

US national debt has jumped by $550 billion in the past 3 weeks. This is WAY above the pace of $2 trillion per year expected by the government. The US was at $31.4 trillion just 4 months ago. Debt has increased by $2.1 trillion in the past 4 months. Source: WallStreetSilver

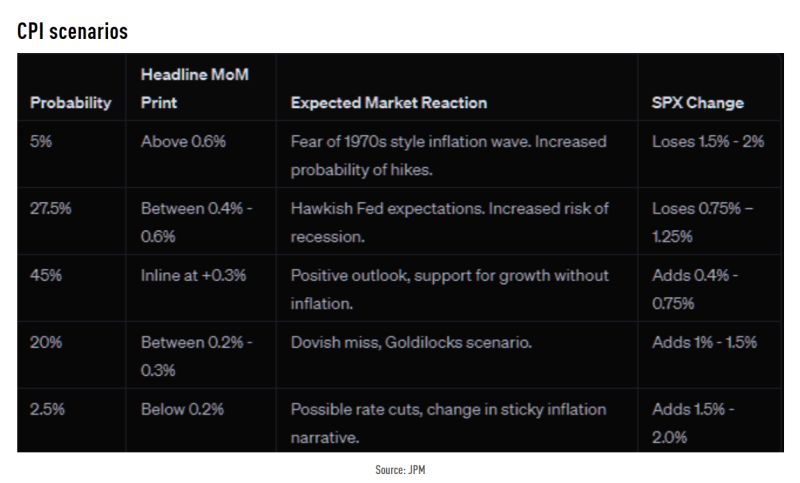

What to expect from today's US CPI data? Main take via JPM's market intelligence team

Source: JPM, TME

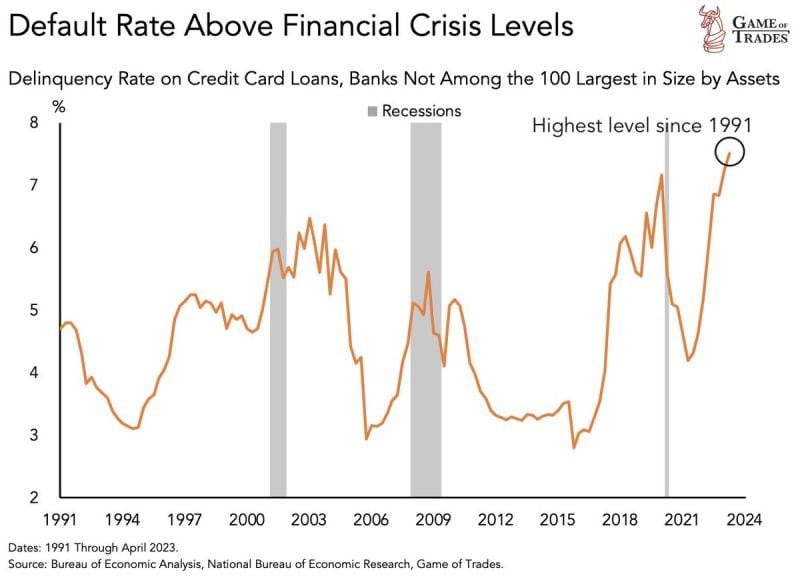

The consumer is borrowing more than they can afford to pay

The consumer default rate on credit card loans from small lenders has seen a sharp spike to 7.51% This level is higher than the: - Dot Com bubble - Financial Crisis - C-19 With credit card interest rates still above 20%. Consumers are going to continue feeling the pressure. Source: Game of Trades

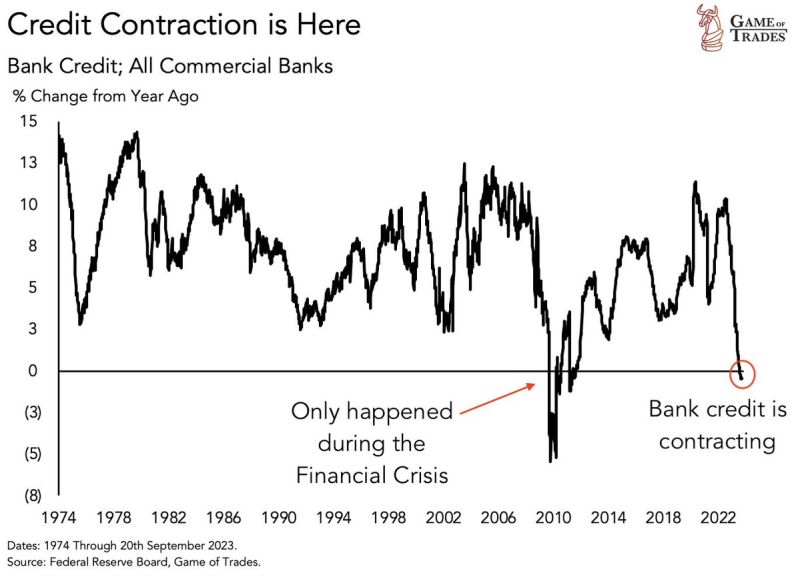

Bank credit has now entered contraction territory. After witnessing one of sharpest declines on record

Since 1974, this has only happened ONCE: → The Financial Crisis. Back then, this metric reached levels as low as -5%. At the current rate, the risk of a credit event is on the rise. Source: Game of trades

Prices paid to US producers rose by more than forecast in September

The PPI for final demand advanced 0.5% from a month earlier, according to the Bureau of Labor Statistics. The cost of gasoline increased 5.4% The biggest driver of today's PPI beat: a near record surge in PPI Deposit Services. In other words high rates (and inflation) lead to higher rates (and inflation) Source: www.zerohedge.com

Investing with intelligence

Our latest research, commentary and market outlooks