Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

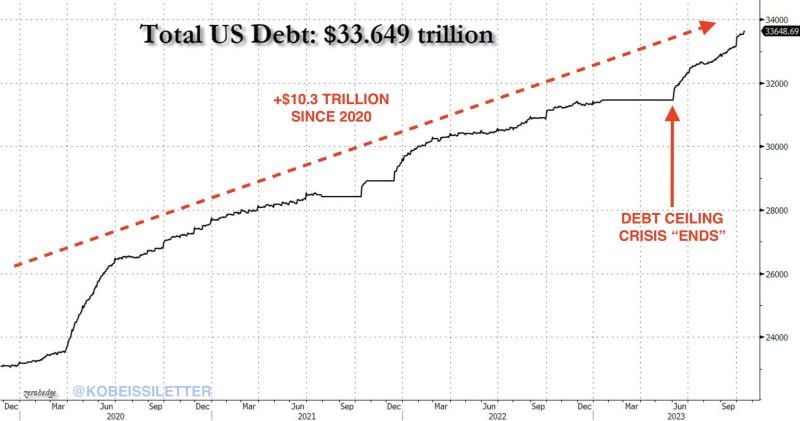

Total US debt is now up ~$650 BILLION since it crossed $33 trillion exactly 1 month ago, according to Zerohedge

Yesterday alone, total US debt jumped by another $58 billion. Total US debt has grown by ~$22 billion PER DAY for the last month. In other words, the US has added ~$915 million in debt every hour for the last month. Since the debt ceiling "crisis" ended, total US debt is up over $2 trillion. Since 2020, total US debt is officially up more than $10 TRILLION. Source: The Kobeissi Letter

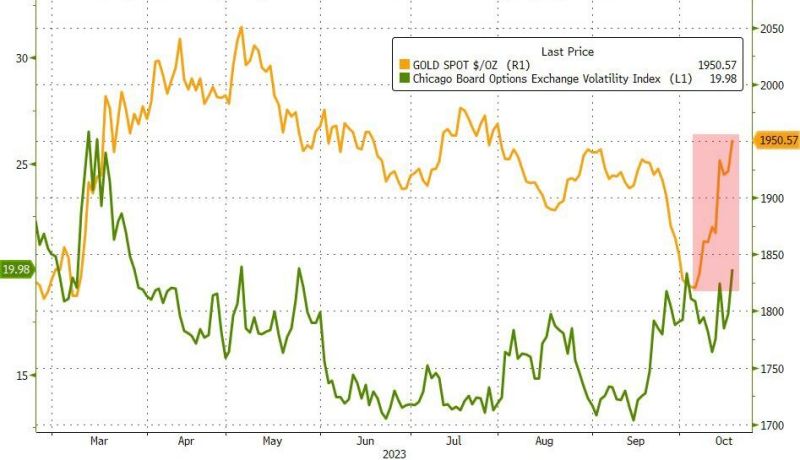

Gold (in yellow) vs. VIX (in green). Is gold the new 'fear index'?

It has systemically decoupled from real rates for sure. Source: Bloomberg

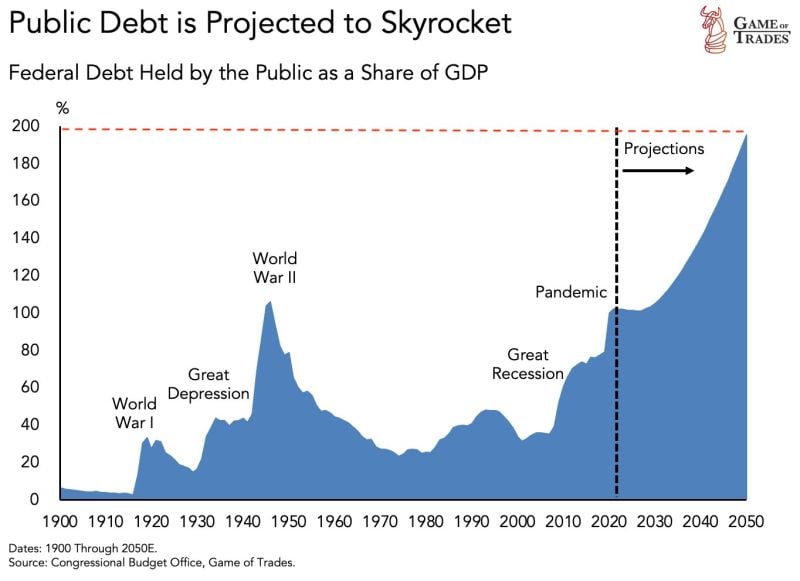

The US government has consistently shown fiscal irresponsibility

Debt-to-GDP is projected to reach 200% by 2050. The government is going to face a major problem with the amount of money they will have to pay in interest. Everybody, except the US government, seems to understand the unsustainability of this path. Source: Game of Trades

China shows signs of stabilization after a long period of slowdown and disappoitning data over the spring

China’s Q3 growth exceeds forecast, buoyed by consumer spending and industrial production. China posted 4.9% growth in the July to September quarter from a year earlier, stronger than the median forecast for 4.6%. Quarter on quarter, China’s GDP grew 1.3% in the third quarter, helped by a downward revision for Q2 from +0.8% to 0.5%.

After adjusting for inflation, US retail sales fell 0.7% over the last year, the 11th consecutive YoY decline

That's the longest down streak since 2009. Nominal retail sales increased 3.0% YoY vs. a historical average of 4.7%. Source: Charlie Bilello

There is a different culture of public debt in Germany than in France

Nevertheless, French Finance Minister Le Maire hopes to find a compromise for new budget rules w/Germany. “We will continue to work w/Christian Lindner in the coming weeks to try to reach a Franco-German accord that could serve as a basis for a wider deal,” Le Maire said ahead of a meeting with his EU peers in Luxembourg. Source: HolgerZ, Bloomberg

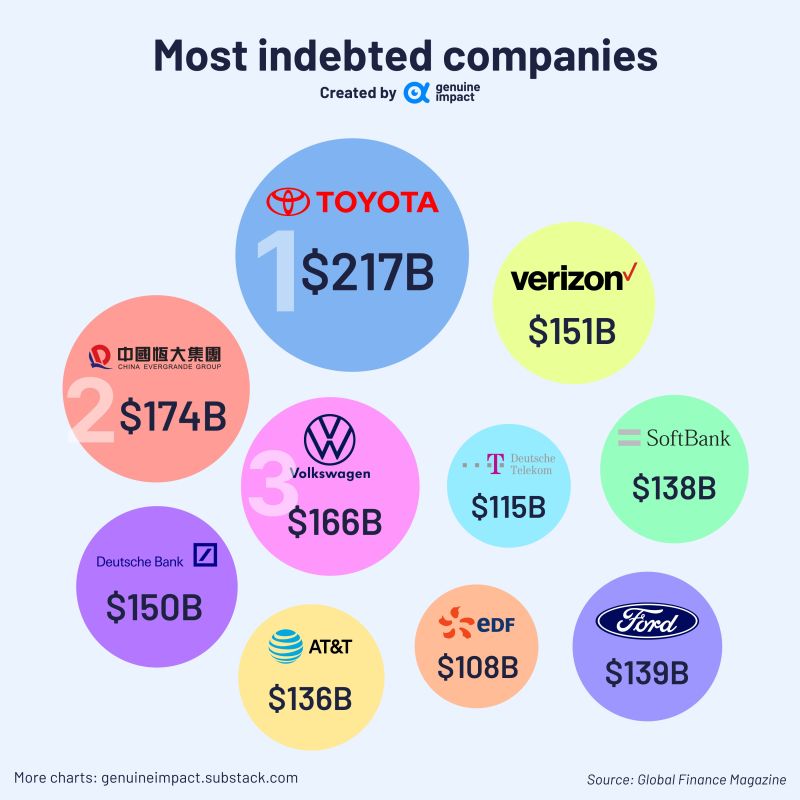

At the time of rising bond yields, here's a list of teh most indebted companies in the world by Genuine Impact

🚗Toyota Group is the most indebted company globally in 2023. 🏠While Evergrande Group, one of China’s biggest property developers, has lower debt than Toyota, its performance is significantly inferior to Toyota. It recently faced a debt crisis and is on the verge of collapse.

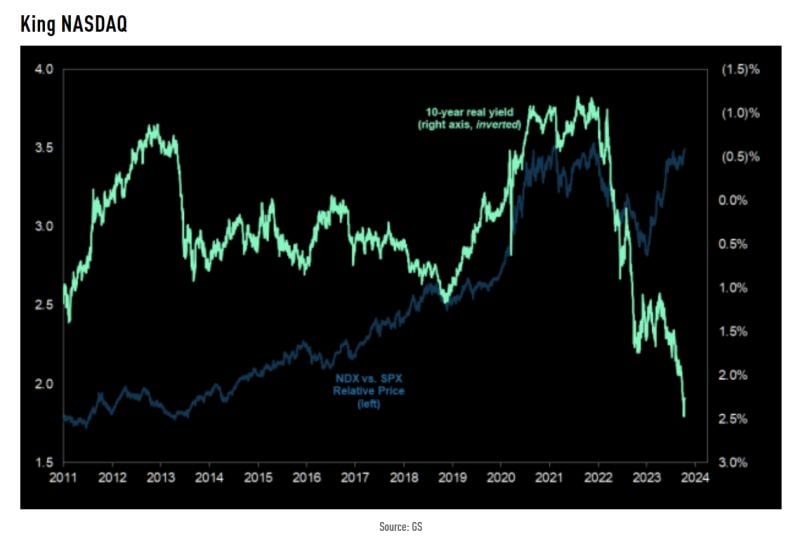

The relative Nasdaq 100 bull does not care about no rates moving higher...

Source: TME, Goldman Sachs

Investing with intelligence

Our latest research, commentary and market outlooks