Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

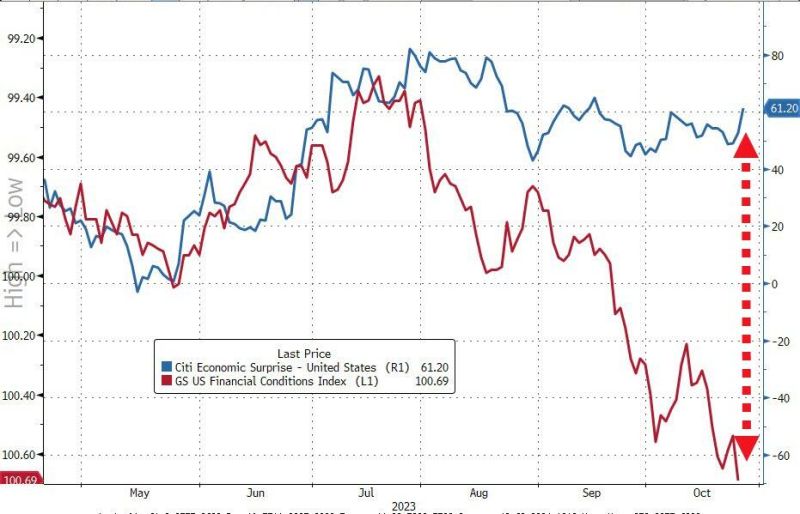

For now, the monetary policy transmission route of tightening US financial conditions are NOT reaching the economy...

Indeed, an avalanche of US macro data on Thursday presented a positive blend of updates across growth (better), inflation (lower), and labor markets (looser/worse). - Economic Growth: Real GDP rose 4.9% in 3Q (consensus 4.5%) driven by strong demand across consumer and federal/state government, and inventories. However, a major contribution from inventories could in turn weigh significantly on growth in 4Q - Manufacturing: Orders for Durable and core capital goods also grew by more than expected... thanks to a massive surge in non-defense aircraft orders (so don't expect it to last). - Housing: Pending home sales rose 1.1% month over month in September, above expectations for a decline... but brace for October to be a bloodbath as mortgage rates re-accelerated. - Inflation: Core PCE prices component of the GDP report rose less than expected. - Labor: Initial and continuing jobless claims both increased by more than expected -- a positive for markets which are focused on labor market re-balancing (i.e., could benefit from less wage inflation).

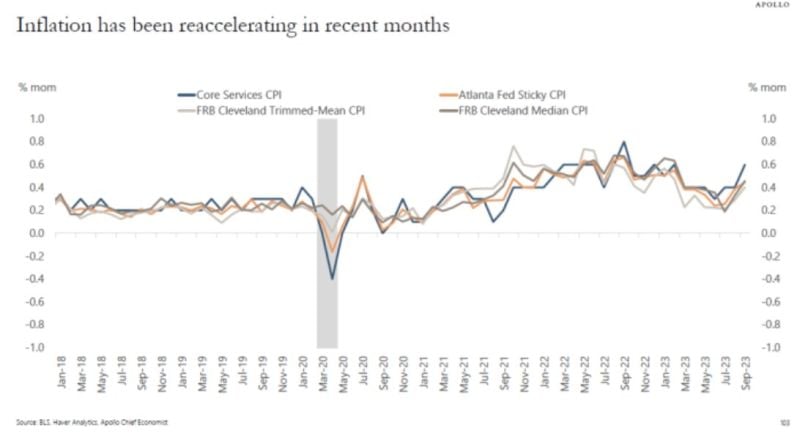

He probably has a point ->

"Key measures of inflation have reaccelerated in recent months...The implication for investors is that the Fed will keep rates high until nonfarm payrolls go negative, because that is what is needed to get inflation under control:" Apollo's Slok through Lisa Abramowitz

US GDP grew 4.9% in Q3 QoQ annualized, way faster than +4.3% expected

However, bond yields dropped in the afternoon session. This Bloomberg US GDP chart shows why. Indeed, US GDP growth in Q3 was mainly driven by private consumption & inventories. This may not last. Source: Bloomberg, HolgerZ

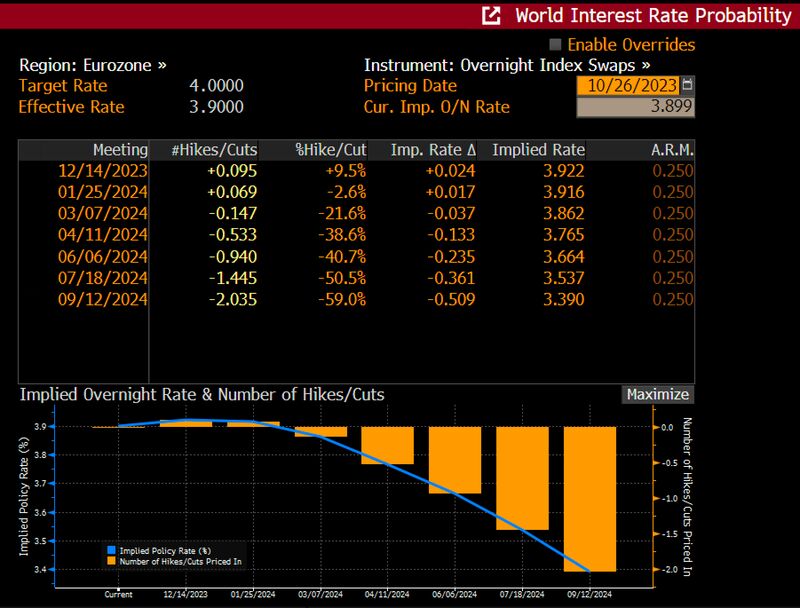

ECB's Lagarde: "Rate cuts weren't discussed, would be totally premature".

Meanwhile, markets see the first ECB cut at April 2024 meeting. Source: Bloomberg, HolgerZ

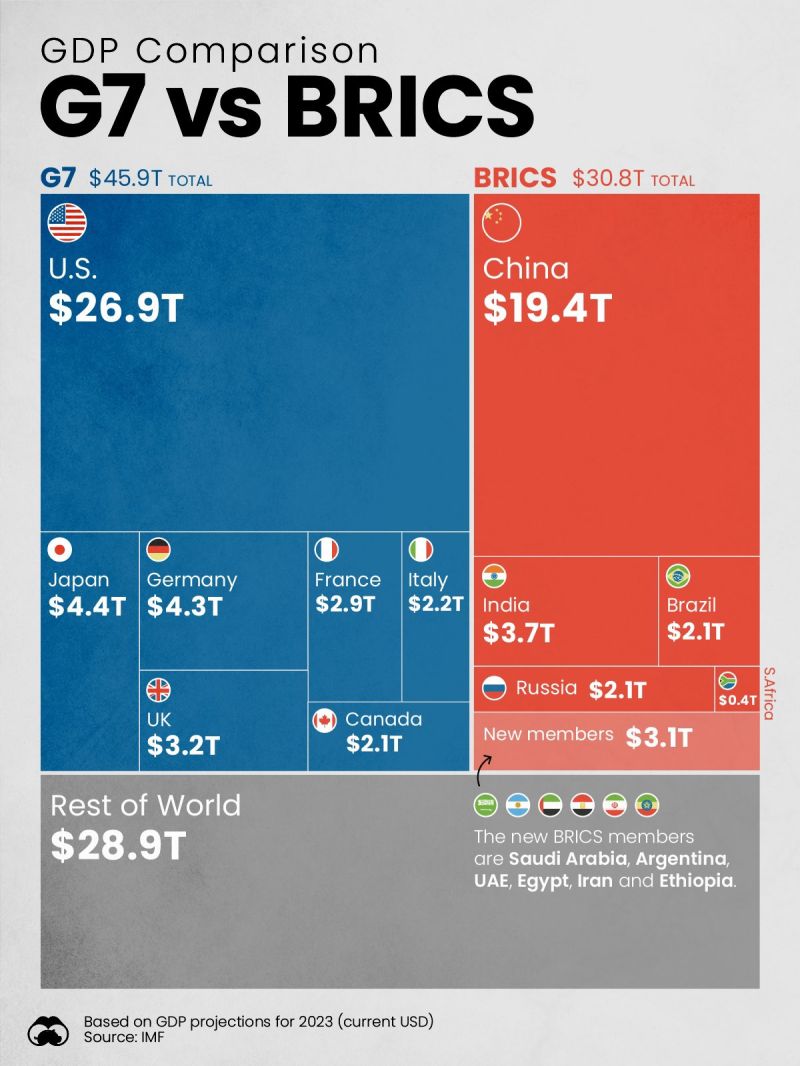

G7 vs. BRICS GDP

Source: Visual Capitalist, Barchart

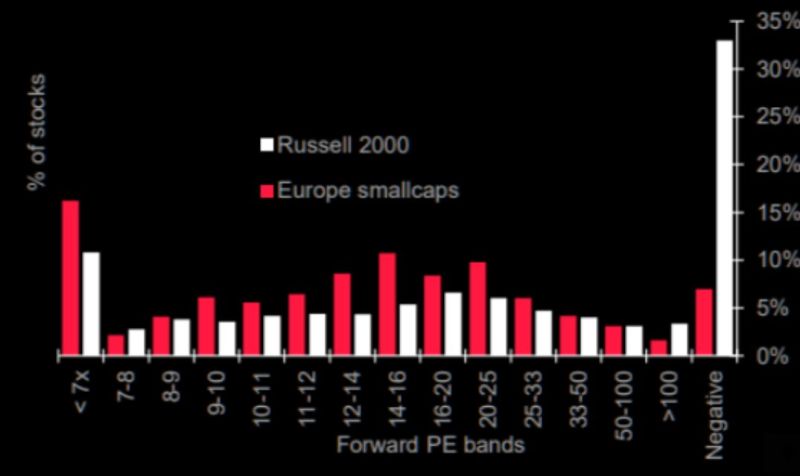

Welcome to Zombie Land

"There are some serious problems in small-caps, especially in the US. Good luck paying interest without profits. Great chart via Soc Gen showing the distribution of stock forward P/E valuations in the MSCI Europe small cap and Russell 2000 index. Source: SG, Themarketear, Lance Roberts

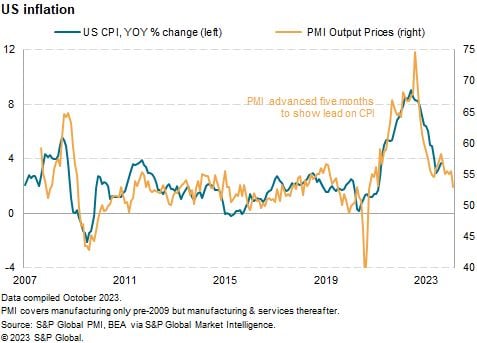

A Big drop in US flash PMI selling price gauge in October brings the FOMC 2% target into focus for the first time in three years

Source: Chris Williamson

German business outlook is improving, feeding rebound hopes

Ifo expectations index rose to 84.7 in Oct, up from 83.1 in Sep and way better than BBG consensus of 83.5. "What we see here does suggest that we see a certain stabilization,” Ifo President Clemens Fuest told BBG. “The German economy will be shrinking this year, but for the final quarter we do expect a stabilization, slight growth.” Source: HolgerZ, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks