Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

US To Borrow $1.5 Trillion In Debt This & Next Quarter, After Borrowing A Massive $1 Trillion Last Quarter

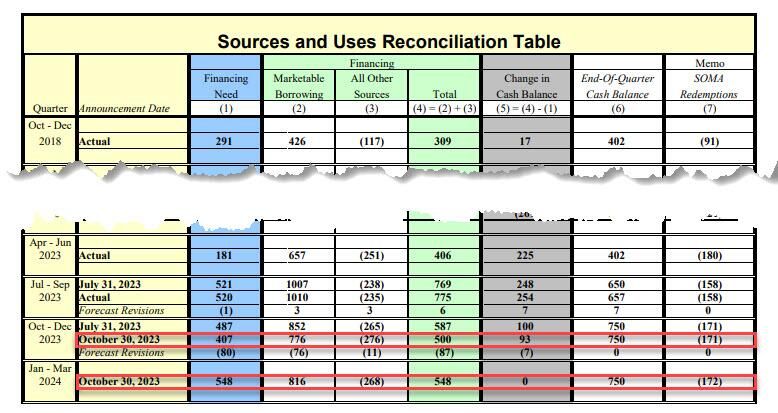

During the October – December 2023 quarter, Treasury expects to borrow $776 billion in privately-held net marketable debt, assuming an end-of-December cash balance of $750 billion. The borrowing estimate is $76 billion lower than announced in July 2023, largely due to projections of higher receipts somewhat offset by higher outlays. During the January – March 2024 quarter, Treasury expects to borrow $816 billion in privately-held net marketable debt, assuming an end-of-March cash balance of $750 billion. Source: www.zerohedge.com

Eurozone inflation sinks to 2y low as Eurozone economy shrinks:

CPI slowed to 2.9% in Oct, down from 4.3% and better than expected 3.1%. But Core CPI – that excluding food & energy is retreating less rapidly. It moderated to 4.2% in October from 4.5% the previous month. Our take: disinflationary trend is firmly in place in the EZ although wage inf’still stickiness and more difficult comps in H2 prevent core inflation to decline more meaningfully. We believe there is enough progress for the ECB to stay put (i.e rates hike cycle is over) and potentially cut rates next year if EZ economy slows down meaningfully Source: HolgerZ, Bloomberg

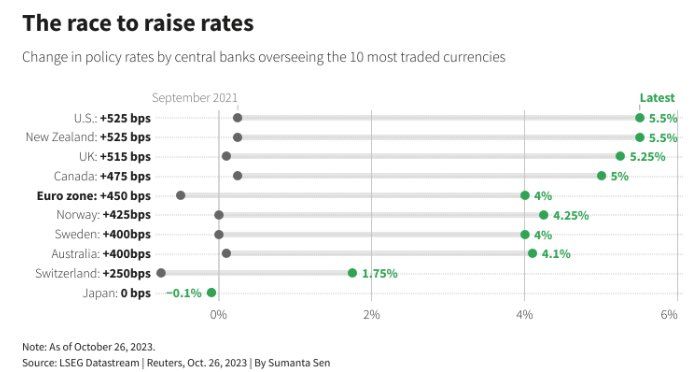

The race to raise rates summarized in one chart

Source: LSEG Datastream, Reuters

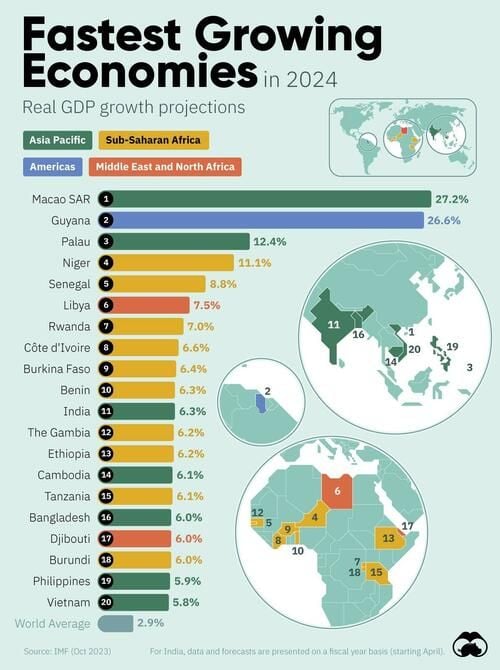

Visual Capitalist's Marcus Lu created the following chart, visualizing GDP growth forecasts from the IMF’s October 2023 World Economic Outlook

Unsurprisingly, many of these countries are located in Asia and Sub-Saharan Africa—two of the world’s fastest growing regions.

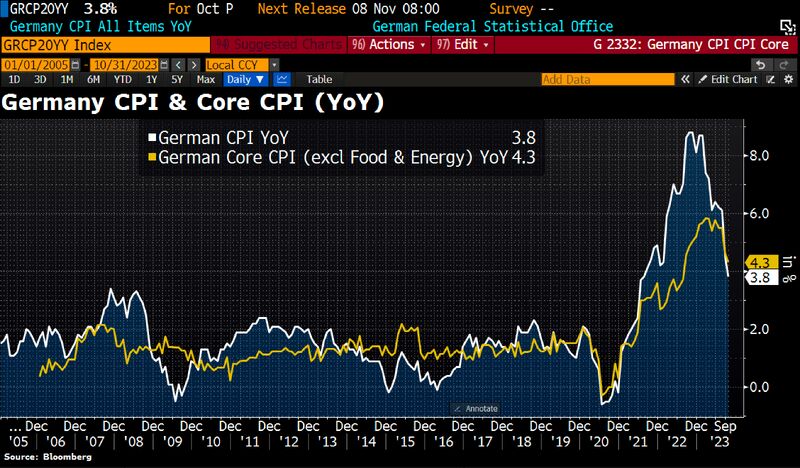

Germany's inflation slowed to 3.8% YoY in Oct from 4.5% in Sep vs 4% expected and lowest since Aug 2021 as energy prices dropped 3.2% YoY and food inflation slowed to 6.1% YoY

German October Core CPI dropped to 3.8% from 4.6% in September. Source: HolgerZ, Bloomberg

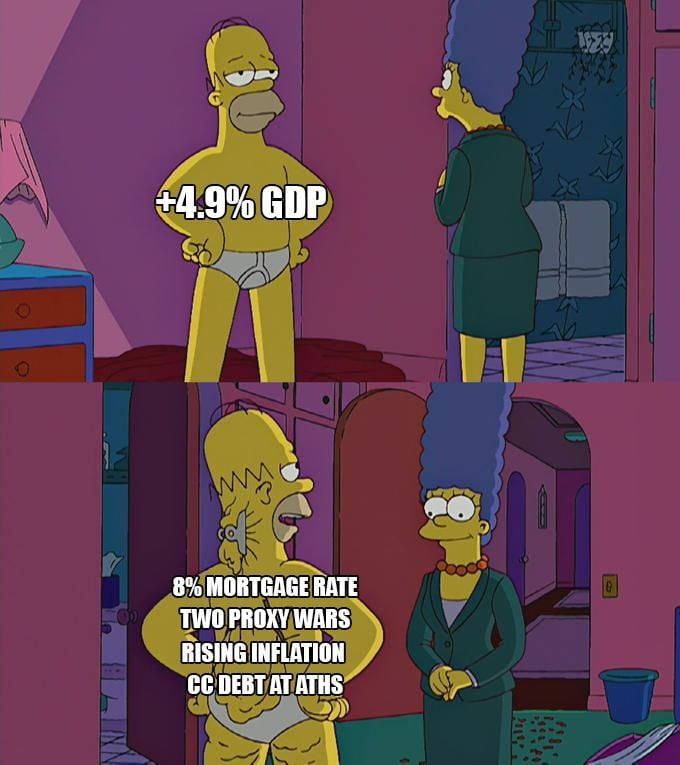

US Q3 GDP numbers summarized in one cartoon

Source: Elizabeth Oliveira Fonseca

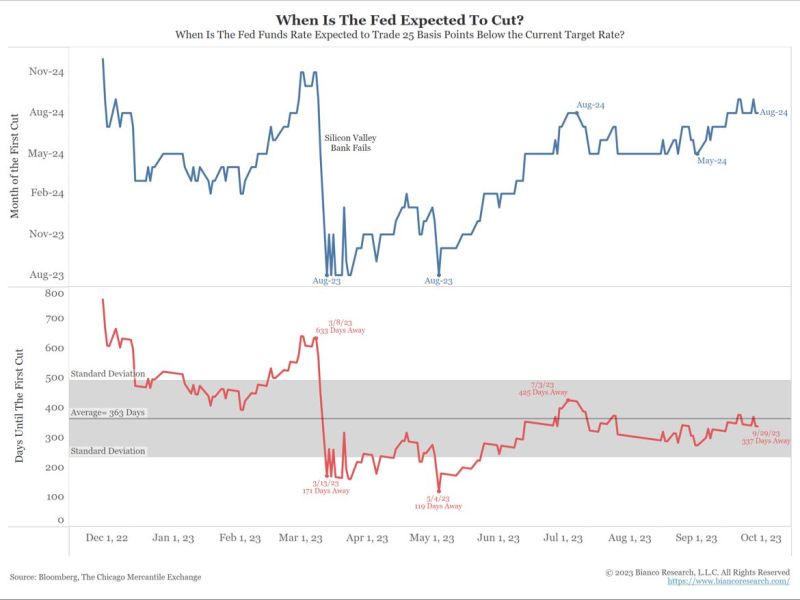

When will the Fed start cutting rates?

This chart from James Bianco is derived from market pricing. The first cut is currently priced for August 2024 (top panel), or 337 days away (bottom panel). Notice the first cut is always about 10 to 12 months away. It never gets any closer.

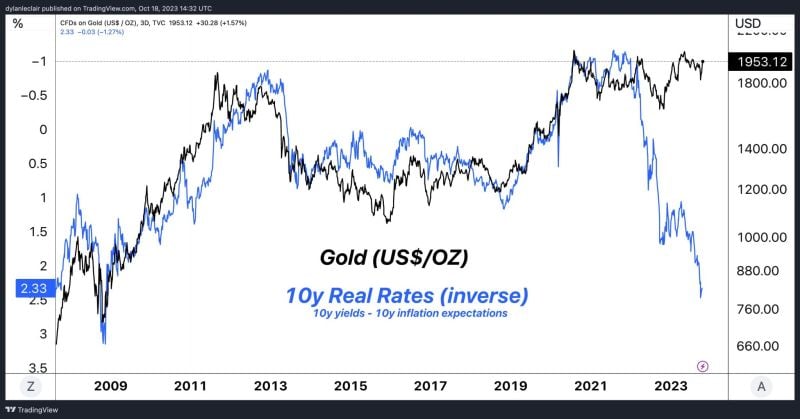

Here's the downside risk on gold. Either this longstanding correlation is broken or inflation is grossly understated and real rates remain negative

Source: Henry Smith

Investing with intelligence

Our latest research, commentary and market outlooks