Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

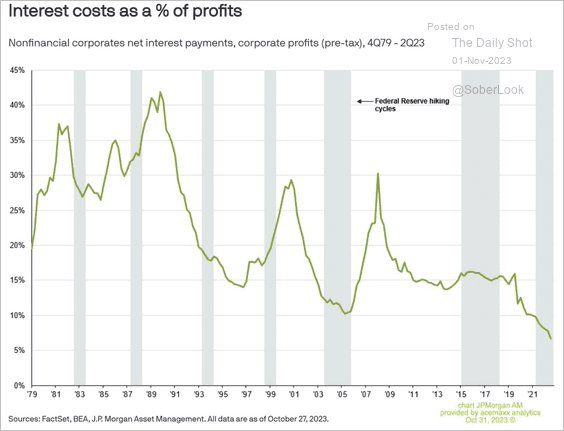

Interest costs as a share of US corporate profits are near the lowest levels in 40 years

This is partly because many companies have locked in long-term financing at low rates. This has kept profit margins elevated. Maybe companies are better to manage their debt schedule than the US Treasury... Source: The daily shot, Lance Roberts

Feed a family of 5 (hamburger, fries, shake) for $2.25 in June 1961

BLS CPI calculator says that's same as $23.24 today... Inflation calculator -> Source: Rudy Havenstein

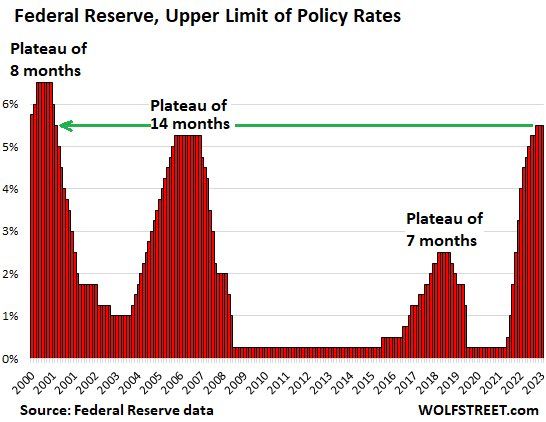

The end of the rate hikes is typically followed by plateaus before rate cuts begin

The end of the rate hikes may not be here yet, and the Fed has already said a many times for months that the plateau is going to be “higher for longer". How long will the plateau be this time? Source: Wolfstreet

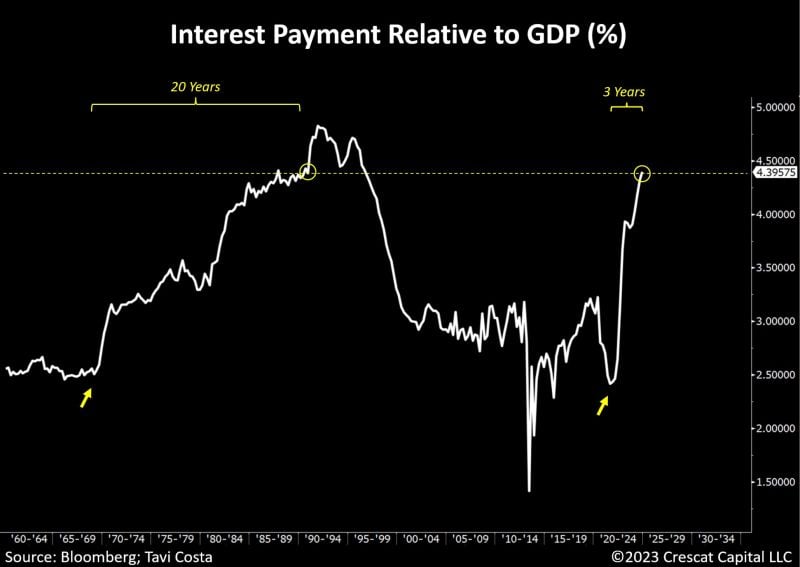

It took 20 years for US interest payments to reach 4.5% of GDP in the 1970s and 80s

Today, achieving the same level will take less than 3 years. This starkly highlights the speed of the rise in Treasury yields and the magnitude of the debt problem. Source: Tavi Costa, Bloomberg

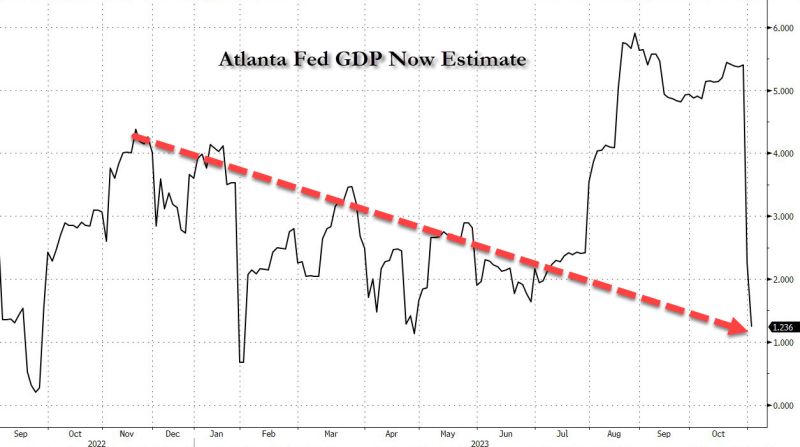

And we're back to Bidenomics trendline

Source: www.zerohedge.com

No change as expected

Nothing really new except that they acknowledge strong growth and strong wage gains versus September, effectively upgrading their economic assessment. This is the 3rd time they upgrade their view on growth. Our view is unchanged: we are due for a long pause. High rates is the new normal.

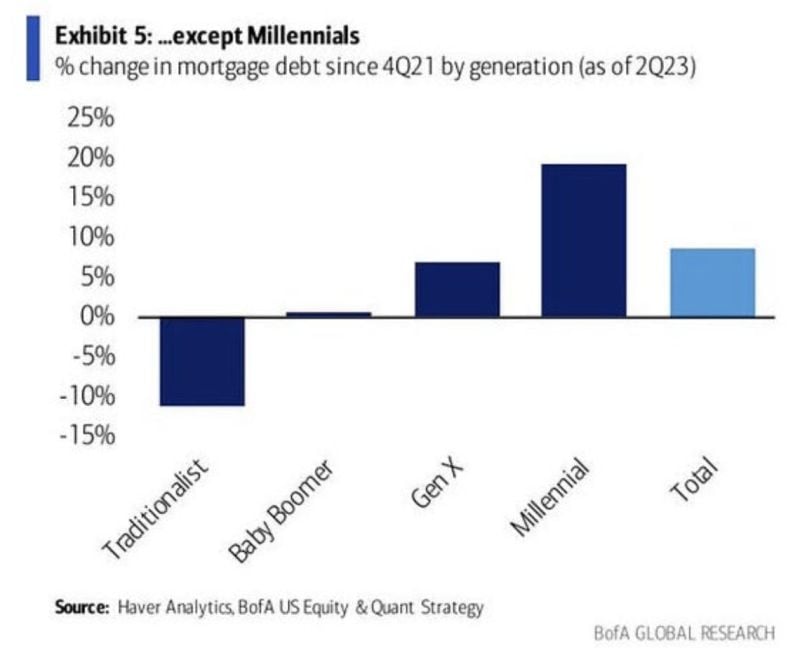

Who's buying houses with record high prices and 8% mortgage rates. The answer?

Millennials are piling in to new mortgages even with the spike in rates. Since Q4 2021, Millennials have seen a ~20% increase in mortgage debt. This is the same group of people who just had student loan payments return at an average of $500/month. It's a tough time to be a Millennial... Source: The Kobeissi Letter, BofA

Investing with intelligence

Our latest research, commentary and market outlooks