Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

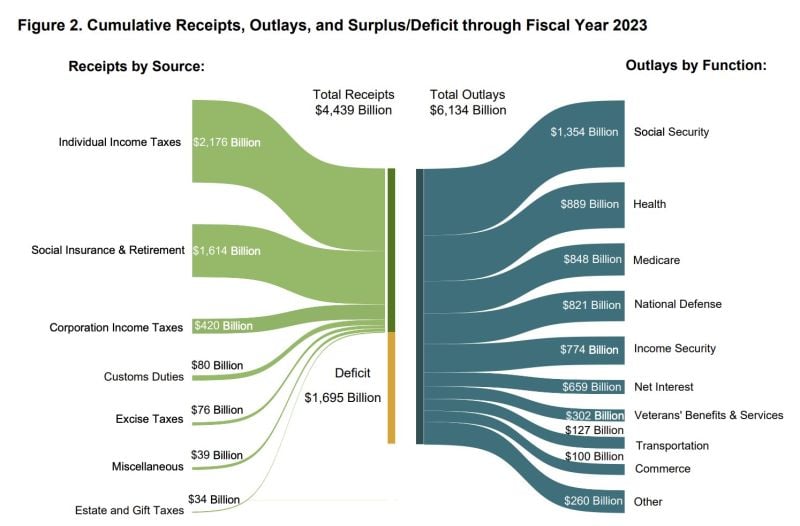

The Kobeissi Letter >>> In fiscal year 2023, the US ran a deficit of $1.7 trillion

If you add back the student loan forgiveness program adjustment, the deficit was actually $2 trillion. To put this in perspective, the annual US deficit is roughly equal to total individual income tax collected. It also means that the 2023 deficit is nearly 5 TIMES as large as corporate income taxes. The 2023 deficit as reported is ~25% larger than total Social Security outlays. Net interest was $659 billion and should soon pass the national defense budget. What's the long-term plan here?

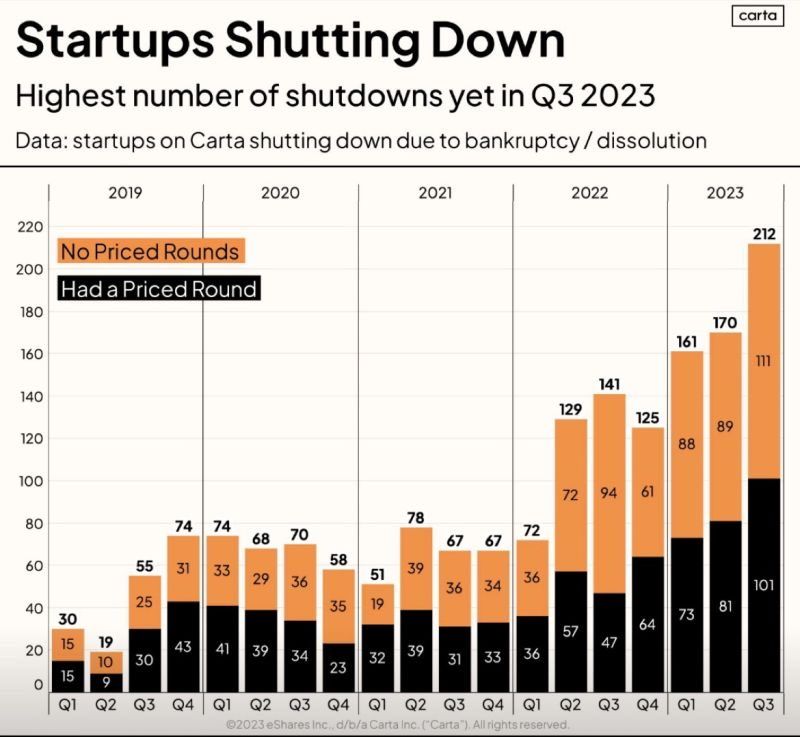

Startups are increasingly shutting down

Rising rates, lower liquidity and reduced risk appetite are hurting funding. Difficult business conditions are eroding viability further. Source: Markets & Mayhem

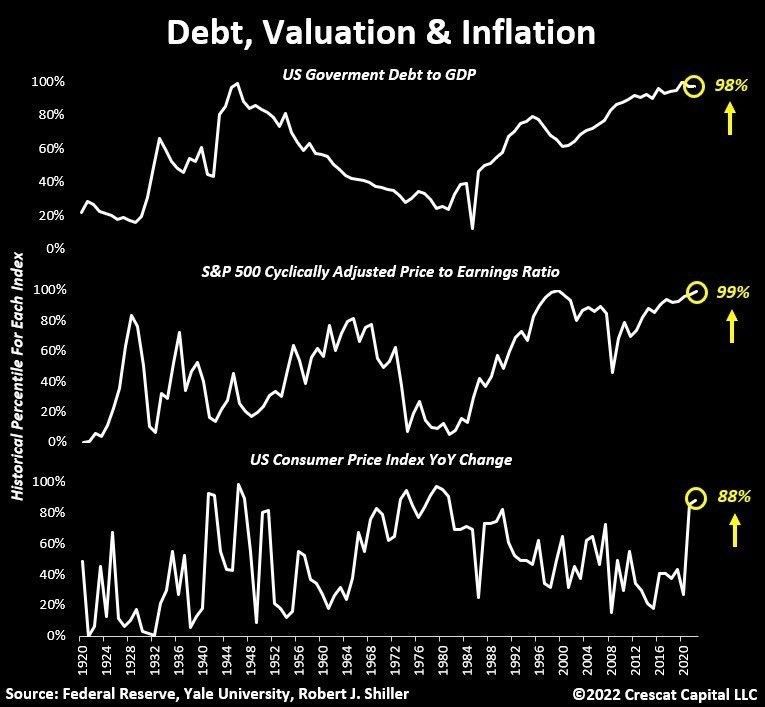

Where do we stand in terms of percentile each year for the below aggregates in the US:

- US Government Debt to GDP = 98th percentile - SP500 Cyclically-adjusted-PE ratio = 99th percentile - US Consumer Price Index YoY change = 88th percentile Sounds like an interesting trifecta... Source: Crescat Capital

Disinflationary forces are intensifying in Germany, at least for now

German PPI deflation deepened with PPI down 14.7% YoY, the most since the start of the statistic in 1949. Even compared to the previous month, producer prices fell by 0.2%. Source: HolgerZ, Bloomberg

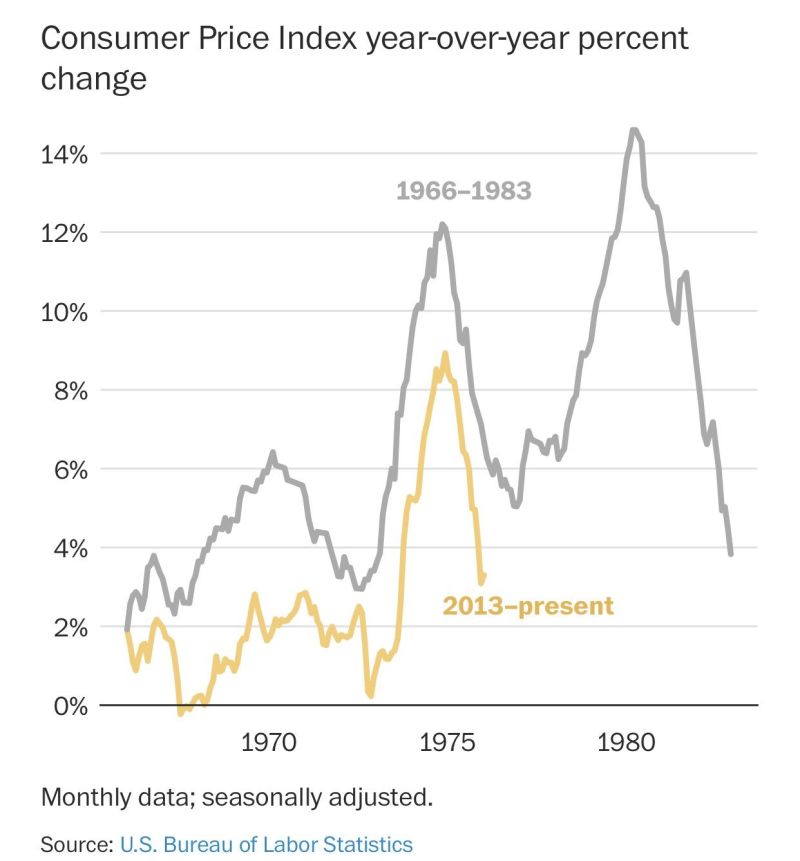

Is US inflation following the footsteps of the 1970s?

Source: Game of Trades

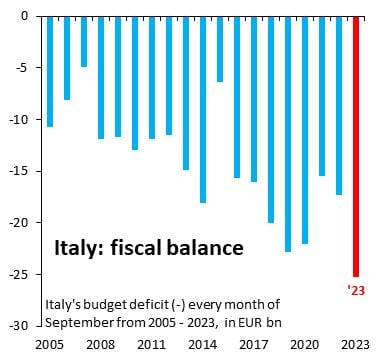

Italy budget deficit by Robin Brooks ->

Monthly data on Italy's fiscal balance are volatile, but the September 2023 budget deficit is the largest ever...

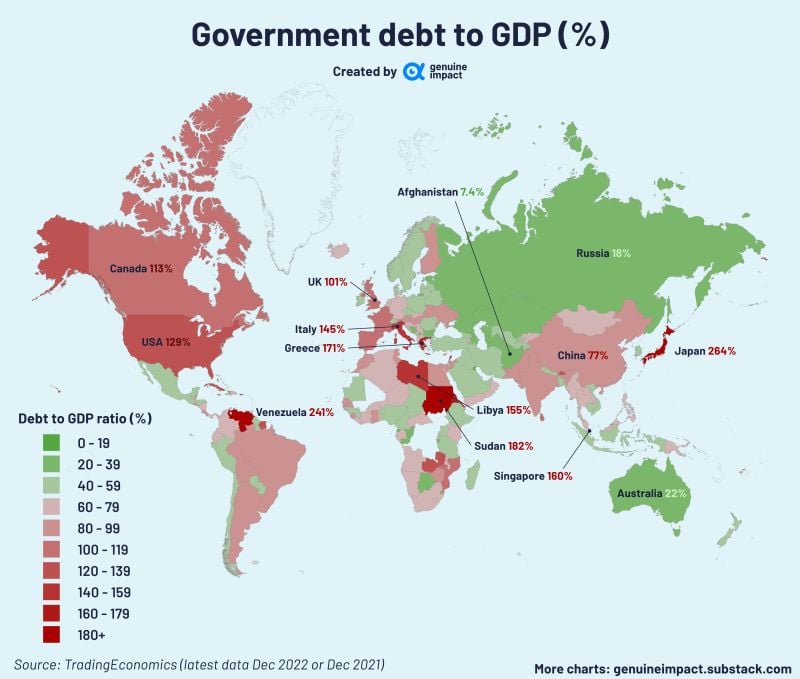

🌍Worldwide, many other countries have debt that is more than their GDP

Japan consistently ranks among the top nations with a debt-to-GDP ratio exceeding 200%. Source: Genuine Impact

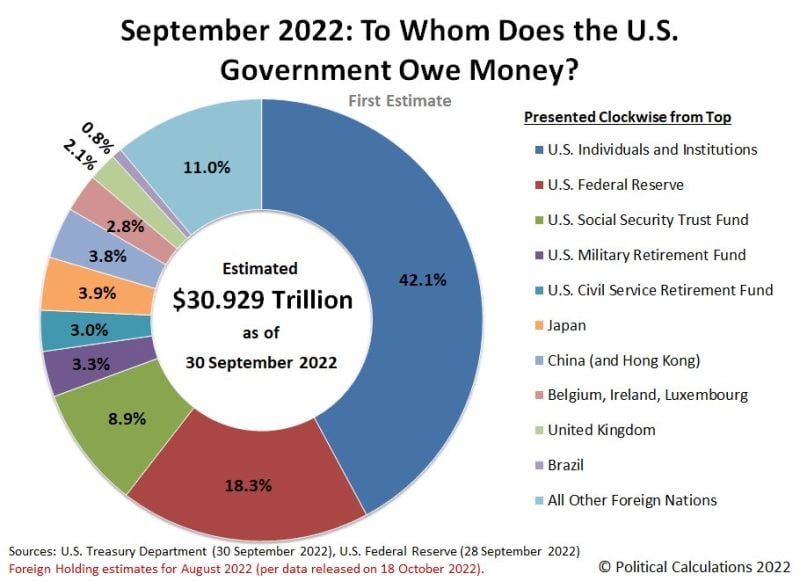

To whom the US owes money? Mostly to themselves actually...

Source: The King's Cheque En Qua

Investing with intelligence

Our latest research, commentary and market outlooks