Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

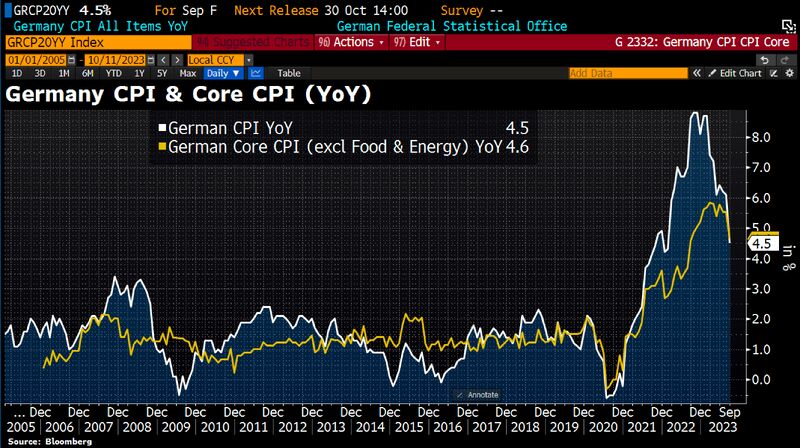

German inflation in September fell to its lowest rate since outbreak of war in Ukraine, confirming prior estimates

CPI slowed to 4.5% in September YoY from 6.1% in August. Headline CPI is now lower than Core CPI BUT food prices are already on the rise again. Compared to previous month, food has become 0.4% more expensive. Source: Bloomberg, HolgerZ

US 10-year Yield pullback from last week peak

US 10-year Yield pullback sharply from last week peak. After the Non-Farm Payrolls report on Friday, the US 10-year Govt Yield came close to hitting 4.9%. As of today, that Yield is down below 4.6%.

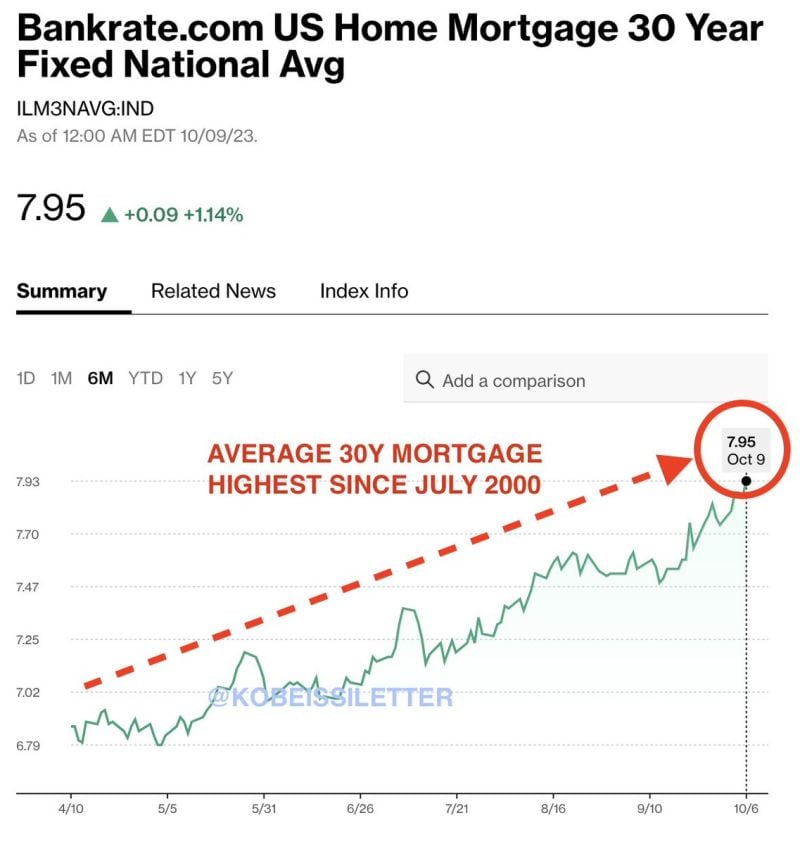

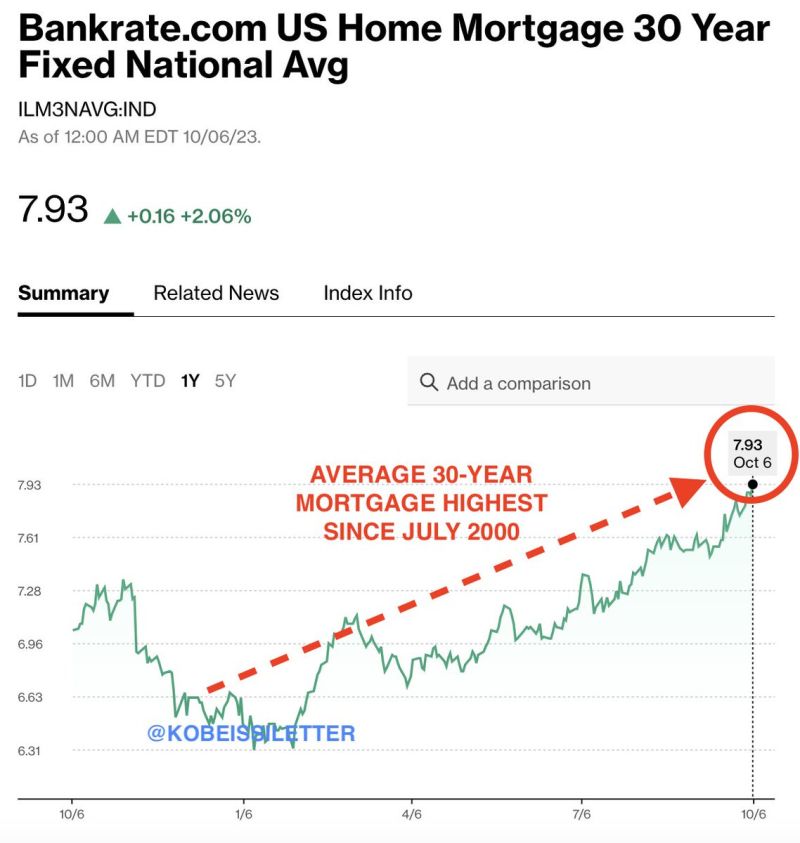

Average interest rate on a US 30-year mortgage rises to 7.95%, its highest since July 2000

Mortgage demand also just fell to its lowest level since 1995. 8% mortgages are the new normal. Source: The Kobeissi Letter

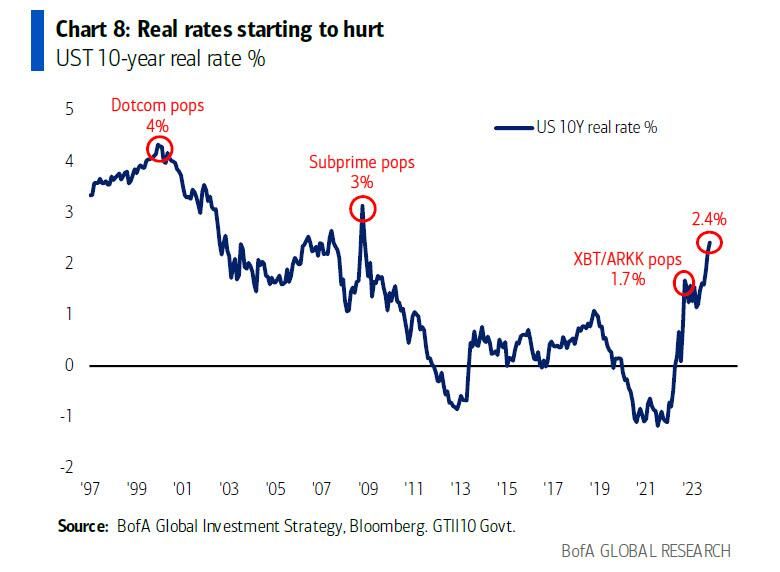

Rising real rates are going to inflict real pain on a variety of asset classes, particularly longer duration risk

BofA, Markets & Mayhem 🤖

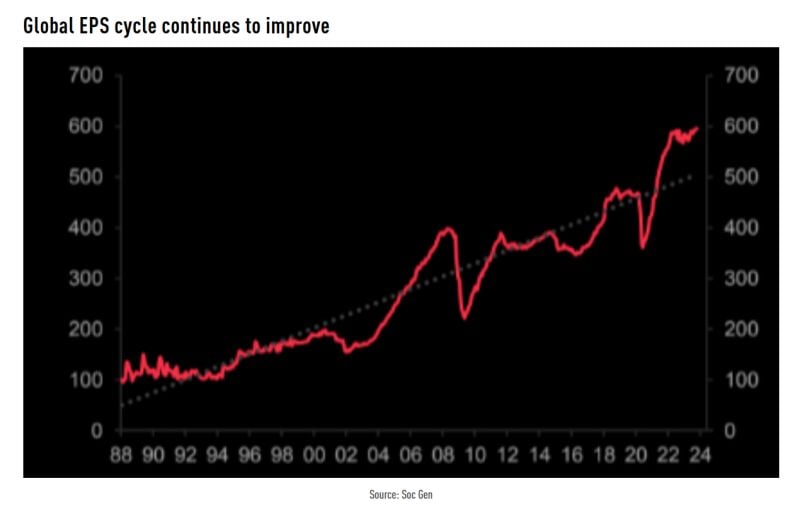

The global EPS cycle continues to improve, with nominal GDP growth continuing to support the cycle

Source: SocGen, TME

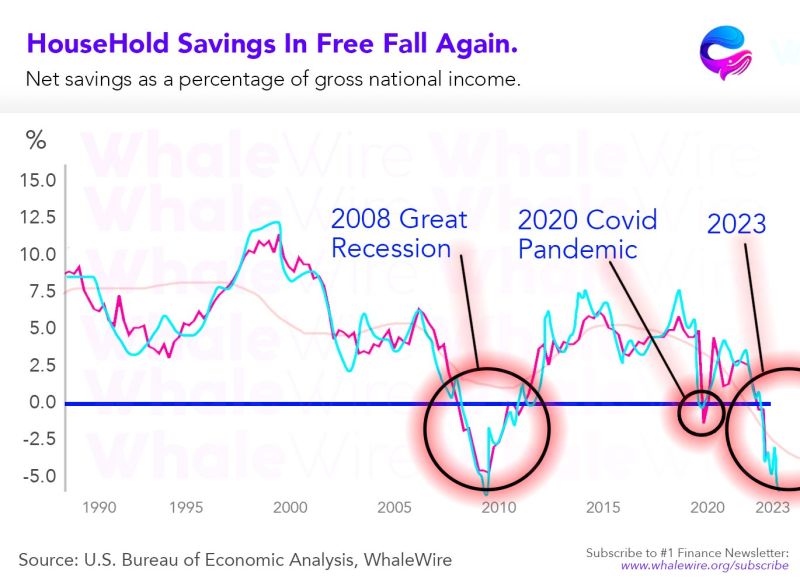

In the last 8 decades, savings as a percentage of national income has ONLY contracted three times:

2008 - Great Recession. 2020 - Covid Pandemic Crash. 2023 - The Everything Bubble. Source: Whalewire

BREAKING: Average interest rate on a 30-year mortgage rises to 7.93%, its highest since July 2000

Since January 2021, less than 3 years ago, interest rates have gone from 2.65% to 7.93%. This means that homebuyers just 3 years ago would see their interest rate TRIPLE if they decided to move. This is exactly why existing home sales are at their lowest since 2010. The average new home is about to cost LESS than the average existing home for the first time since 2005. You know something is wrong when old costs more than new. Why sell if your mortgage rate triples? From The Kobeissi Letter

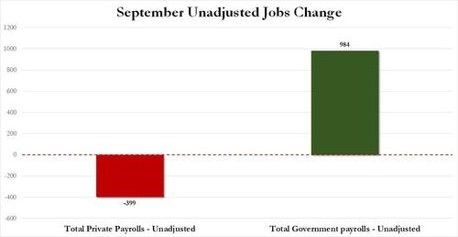

Looking at the September US payroll numbers through another lens

Unadjusted total payrolls rose by 585K and yet private payrolls dropped by 399K. All of the unadjusted jobs in September came from the government, which added a whopping 984K jobs (mostly teachers). What if all the mess in Washington (shutdowns, political gridlock in Congress, etc.) and rising cost of debt put a cap on the fiscal support? Where are the jobs going to come from? Source: www.zerohedge.com, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks