Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

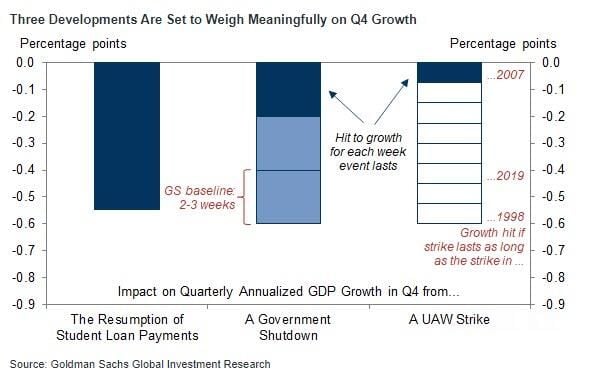

Goldman expects the resumption of student loan payments, a potential temporary federal government shutdown, and reduced auto production from a potential UAW strike to slow US GDP growth in 4Q23

Source graphic: GS

US CORE CPI LITTLE HOTTER THAN EXPECTED => A FED PAUSE IS LIKELY BUT NO RATE CUT ANYTIME SOON

Consensus expected a reacceleration of Headline inflation (+0.6% MoM after +0.2% in July) and a stabilisation of “core” inflation (+0.2% MoM after +0.16% in July). Key actual numbers are the following: ON A SEQUENTIAL BASIS (MoM) Headline inflation numbers are in-line with expectations (+0.6%). That is the biggest MoM since June 2022 and the second straight monthly increase in CPI...The energy index rose 5.6% in August after increasing 0.1% in July. There was a big turn-around in airline fares. They rose 4.9% after dropping 8.1% in each of the previous two months. But the gasoline index dominated with an increase of 10.6 percent in August, following a 0.2% increase in the previous month.

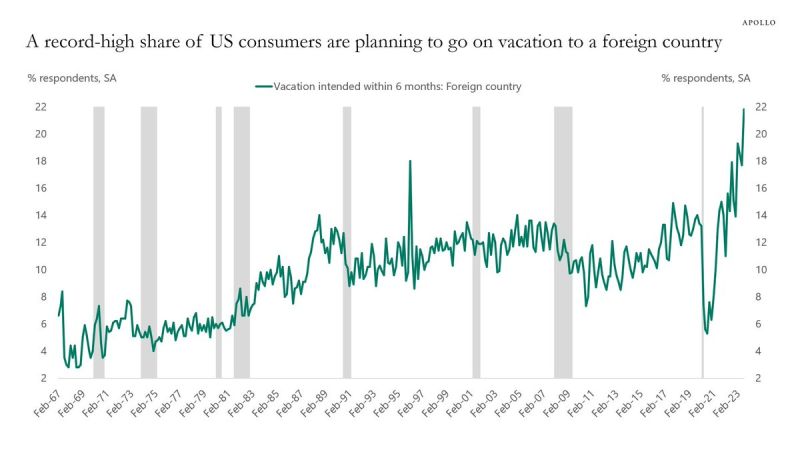

The continued strong demand for consumer services is why the Fed is unable to contain core inflation

According to Apollo, a record 22% of US consumers are planning to vacation in a foreign country. US households want to travel on airplanes, stay at hotels and eat out. The Kobeissi Letter: "That is why inflation in the non-housing service sector continues to be so high. No wonder credit card debt is skyrocketing". Source: The Kobeissi Letter, Apollo

Egypt inflation soars to 37.4% y/y in August as higher food costs add to currency angst

Another month, another record inflation number. Consumer prices in Egypt rose 37.4% in August compared with a year earlier. This is the highest number since 2010 -- higher than even the levels reached after the 2016 currency crisis. Note that food costs were up 71.4%

Steack-flation...Cattle Futures have once again closed at an all-time high. Steaks are going to be getting expensive!

Source: Barchart

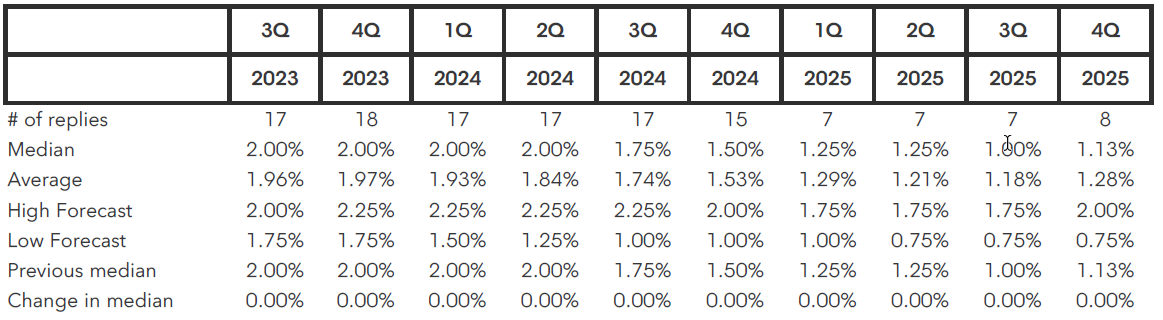

SNB Policy rate at 2.00% by end-Q3 2023 - Survey

The following table shows economists’ forecasts for Switzerland’s benchmark central bank rate as surveyed by Bloomberg News from Sept. 1st to Sept. 7th. All figures are as of the end of the quarter.

Current SNB Policy Rate: 1.75%

Sourcce: Bloomberg

In case you missed it...

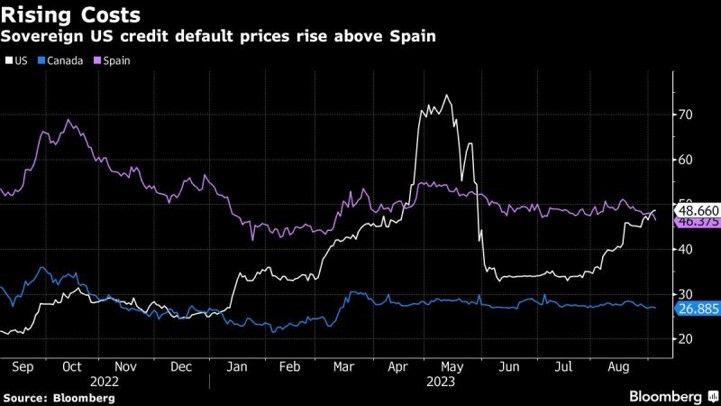

The credit default swap (CDS) prices for the US rose sharply during the small banks crisis back in spring, and then went down as the crisis subsided quickly. These prices have been rising steadily since early summer. US CDS are now above Spain, which is considered a higher risk country from a sovereign credit risk perspective. Source: Bloomberg

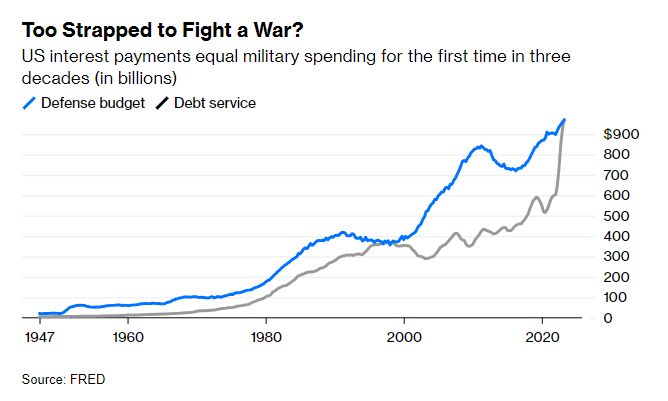

U.S. interest payments equal military spending for the first time in 3 decades (~1.9 Trillion combined)

Source: Barchart, FRED

Investing with intelligence

Our latest research, commentary and market outlooks