Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

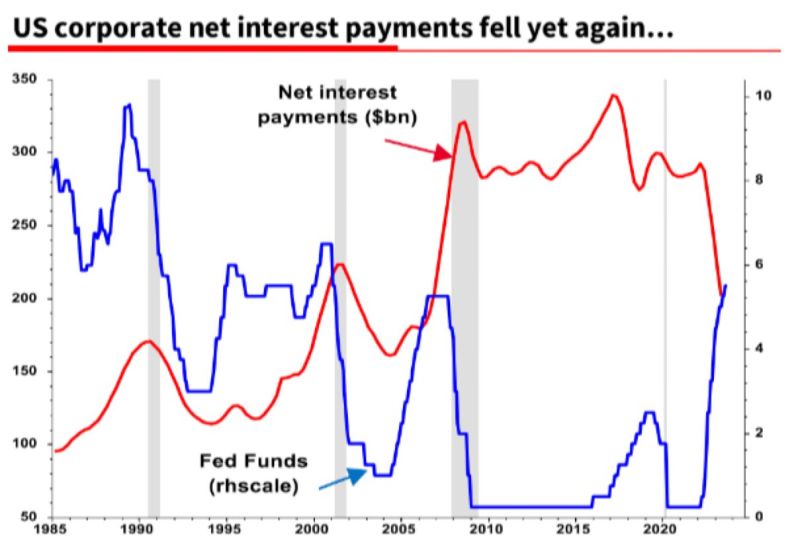

One of the reasons we are not in recession yet. Despite rate hikes US corporate net interest payments are going down so far👇

Source: Michel A. Arouet

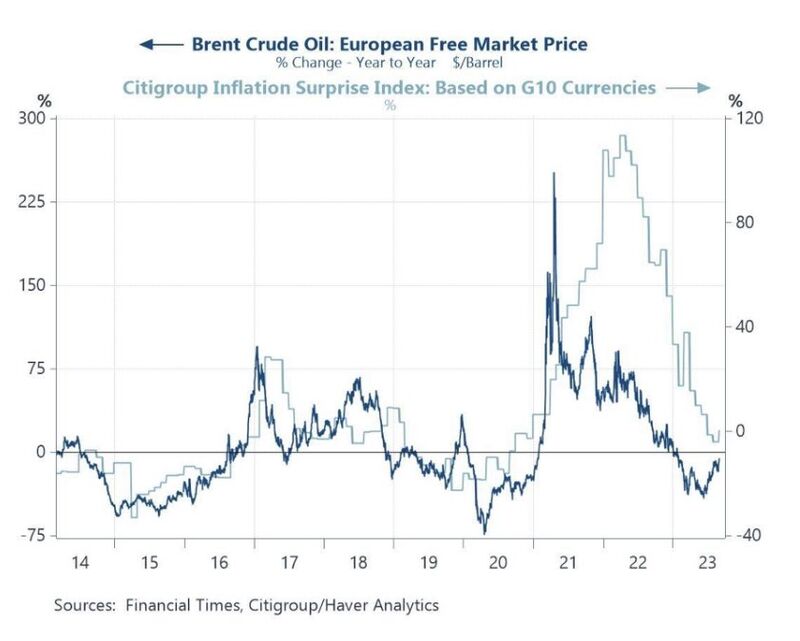

Brent oil vs. Citigroup global inflation surprises index

Oil price usually lead inflation 👇 The recent uptick in oil price will be probably not enough to materially change inflation surprises, but should oil continue to go up it would start to have an impact. Source: Michel A.Arouet

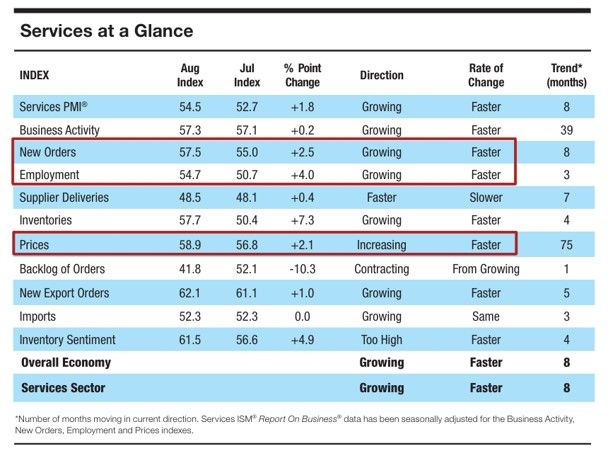

One key development of the week (beyond brent hitting $90) has been stronger than expected macroeconomic data - e.g the ISM services (see data table below from Markets & Mayhem)

Indeed what we are seeing in the last ISM Services PMI reading may not be the best news for the inflation situation: 1) New orders growing faster 2) Employment growing faster (from being nearly flat m/m) 3) Prices rising faster And the market reaction - stocks pulling back - means that good macro news is bad news for the market again. Indeed, while a growing economy supports rising corporate profits (which is a positive), a too strong economy would imply a more hawkish FED than it is currently anticipated by the market.

Next FOMC rate hike probabilities:

No hike → 93% 25 bps hike → 7% Source: Game of Trades

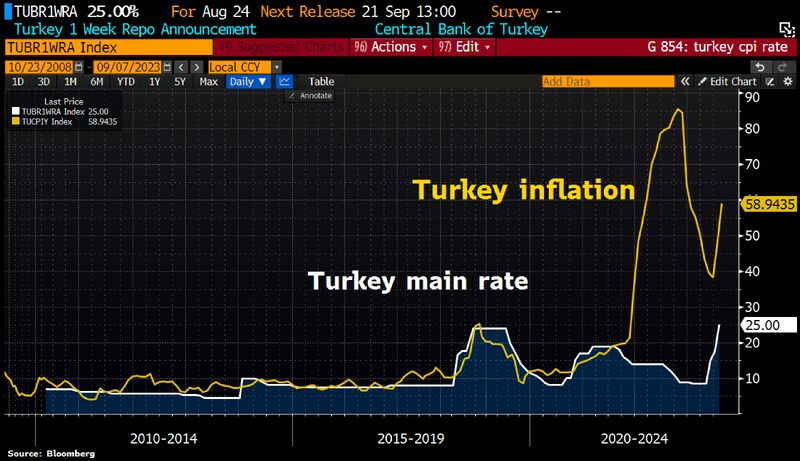

Turkey inflation has reaccelerated despite sharply increased key interest rates.

Source: Bloomberg

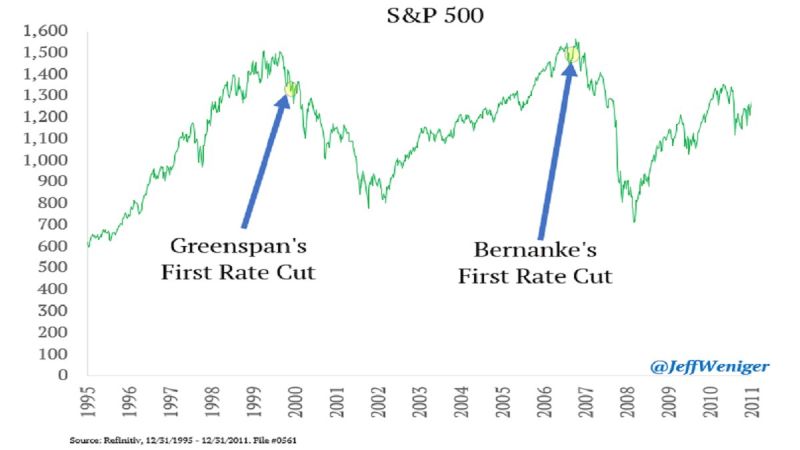

If the Fed cuts rates next year, is that a good thing?

Source: Jeff Weniger

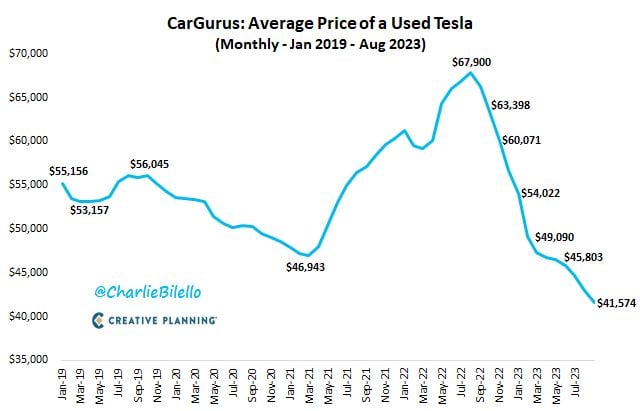

At least there is deflation somehwre...

The average price of a used #Tesla has declined 13 months in a row, moving from a record high of $67,900 in July 2022 to a record low of $41,574 in August 2023 (-39%). Source: Charlie Bilello

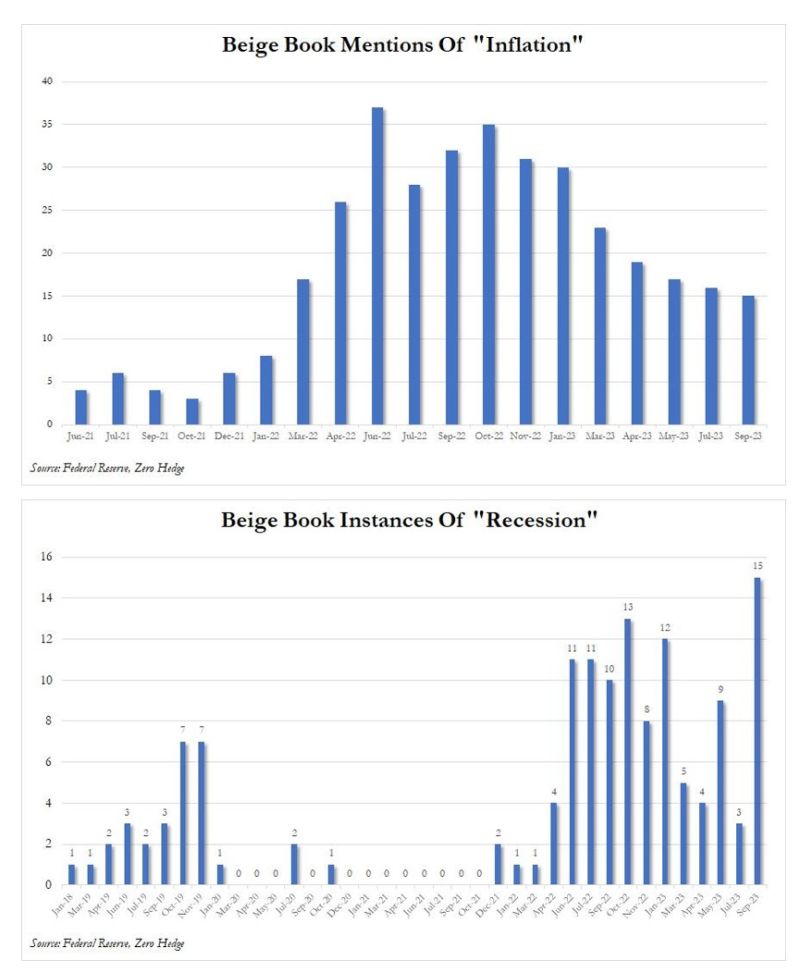

Are FED priorities shifting?

Mentions of inflation in the Fed's Beige book were the fewest since Jan 2022...Meanwhile, mentions of recession jumped to the highest level since at least 2018. The fact that there have been so many mentions of a word which as recently as 2020 and 2021 barely existed in the Beige Book vocabulary could give an indication what the Fed is most worried about today. Source: www.zerohedge.com

Investing with intelligence

Our latest research, commentary and market outlooks