Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

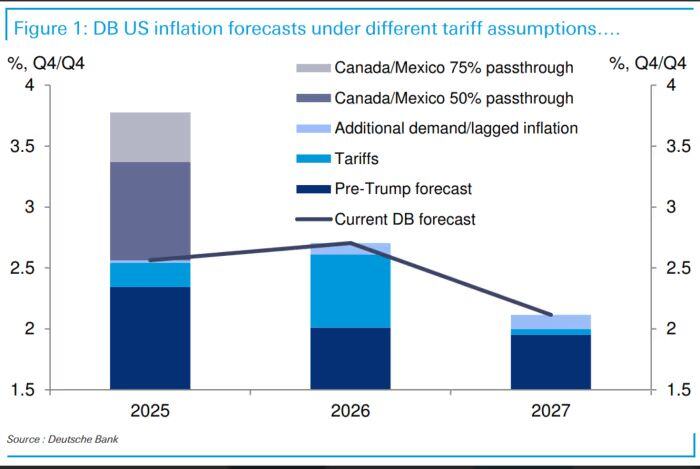

Deutsche Bank recently updated their Trump tariff inflation forecasts as shown below:

If the 25% tariffs on Canada/Mexico have a 50% pass-through, PCE inflation would rise 80 bps. A 75% pass-through would add 110 bps to PCE inflation. The Fed won't like this. Source: The Kobeissi Letter

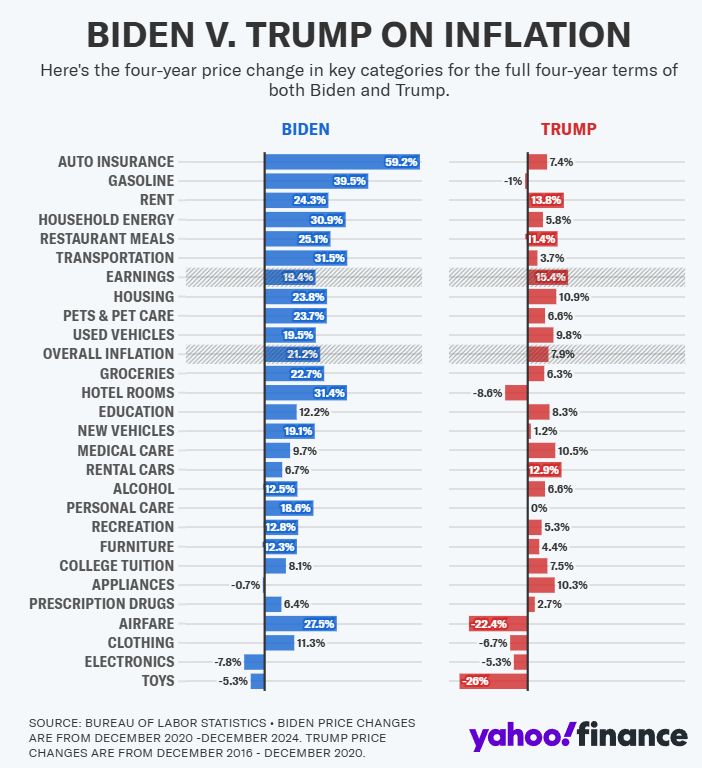

Biden vs Trump on Inflation

During Biden’s presidency, Yahoo Finance tracked inflation in 26 categories that account for most of the things people spend money on. In 12 of those categories, prices rose by more than incomes during Biden’s four years overall. That included housing, transportation, and food, the three things the typical family spends the most on. During Trump’s four years, earnings rose by more than prices in every single one of those 26 categories. source : yahoo!finance

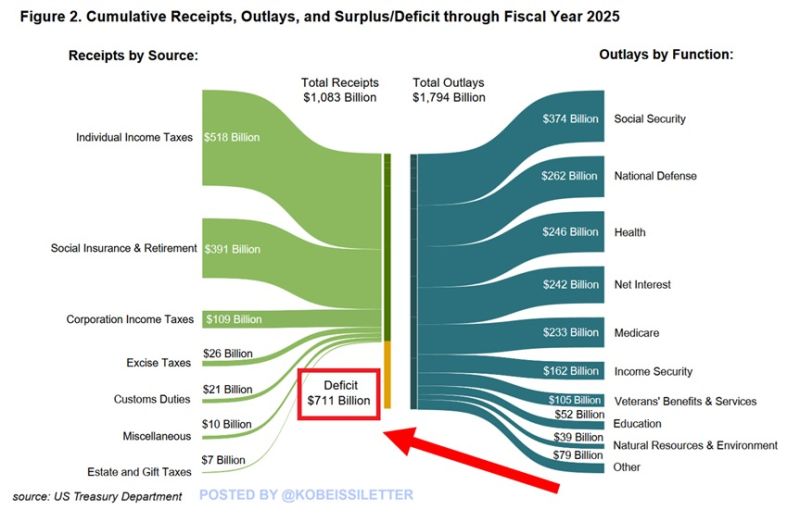

BREAKING: The US budget deficit hit a massive $711 BILLION for the first 3 months of Fiscal Year 2025.

This is ~$200 billion, or 39%, higher than in the same period last year. The deficit reached $2.0 TRILLION for the full calendar year 2024, up $248 billion YoY. Also, deficit spending rose from 6.4% to 6.9% GDP in 2024. Such a high percentage has never been seen outside of wars or major economic crises. Source: The Kobeissi Letter

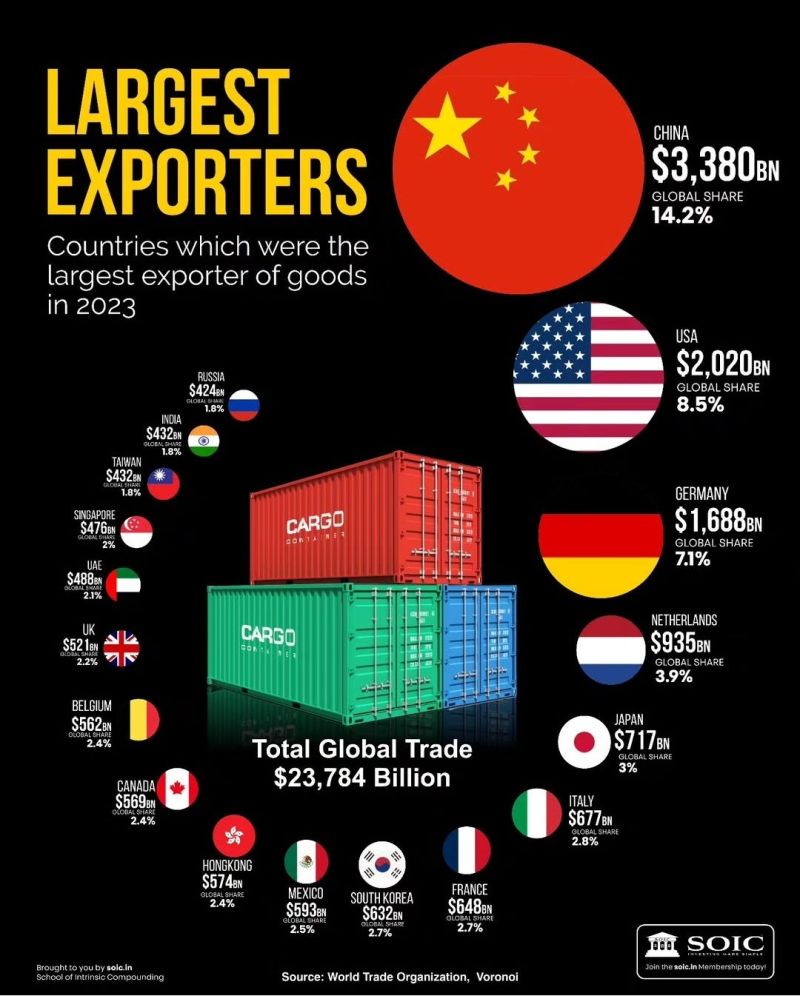

China is, by far, the largest exporter.

Source: Jason Smith @ShangguanJiewen on X

Yesterday, the easing of US inflation fears sparked a huge surge higher in rate-cut expectations for 2025 (back up to 40bps from 28bps)...

Source: Bloomberg, zerohedge

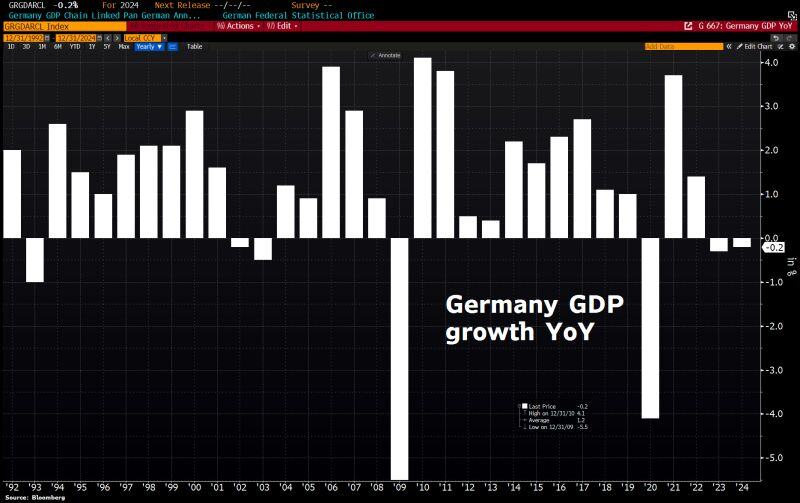

The German economy has shrunk for 2nd year in a row ahead of elections, driven by both cyclical & structural challenges

German GDP declined by 0.2% in 2024, following a 0.3% drop in 2023. This marks only 2nd time since 1950 that econ has contracted for 2 consecutive yrs. Germany's prospects for 2025 remain bleak. Bundesbank predicts growth of just 0.2% and warns that another contraction is even possible if US President-elect Trump follows through on his tariff threats. Source: HolgerZ, Bloomberg

Mortgage demand is collapsing:

US mortgage applications for single-family homes fell 3.7% last week, marking their 4th consecutive weekly decline. As a result, the mortgage demand index has fallen to the lowest since February 2024 and its 3rd lowest level in nearly 30 years. The index has now fallen a whopping -63% over the last 4 years. This comes as home financing costs have rapidly surged while prices remain at all-time highs. Since mid-September, 30-year fixed mortgage rates have risen ~110 basis points and are back above 7%. Mortgage demand is at 1990s levels. Source: The Kobeissi Letter, MBA Purchase index

Government spending is now half of the economy in most of the developed world....

Source: The Long View @HayekAndKeynes

Investing with intelligence

Our latest research, commentary and market outlooks