Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

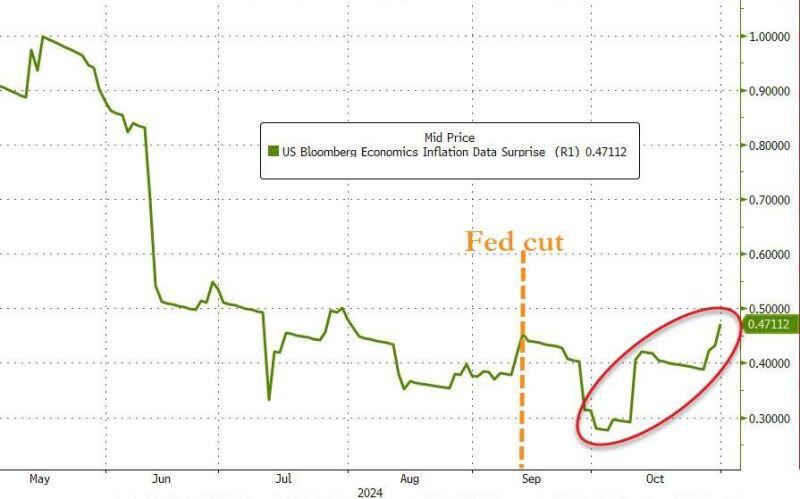

Inflation surprises are picking up since Fed rate cut...

Source: www.zerohedge.com, Bloomberg

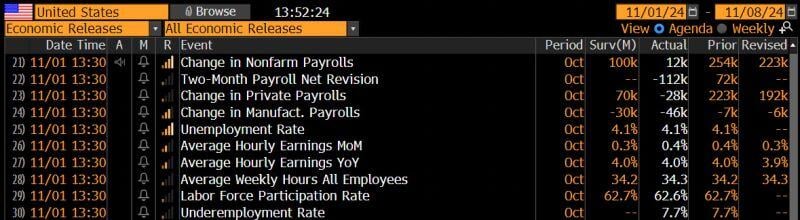

US employment numbers are out... and what a miss... 😱

🚨 It is indeed a confusing US jobs report with ugly headline numbers. US economy added just 12k jobs, according to Establishment Survey, far below consensus forecast of +100k and down from +223k in September. 🚨 Private payrolls were negative 28k, below the Street’s +70k forecast and down from +192k in September. 🌪 August was revised down by 81,000, from +159,000 to +78,000, 🌪 September was revised down by 31,000, from +254,000 to +223,000 👉 Odds of a 25 bps Fed cut next week increase per SOFR. Source: HolgerZ, Bloomberg

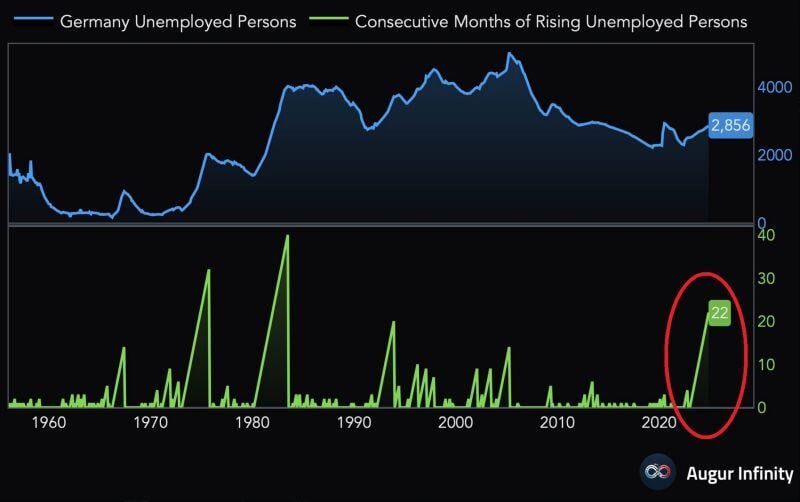

UNEMPLOYMENT IN GERMANY SPIKED TO THE 2ND-HIGHEST IN 10 YEARS

The number of unemployed people in the world's 3rd largest economy has risen for 22 STRAIGHT MONTH. There are now 2.86 MILLION unemployed people in Germany, the most since the COVID CRISIS. Chart: Global Markets Investor, @AugurInfinity on X

JPMorgan CEO Jamie Dimon just said the American 🇺🇸economy is still booming and inflation may not go away so quickly

Source: Evan on X

Just in 🔉 Reuters sources: China's leading legislative body weighs approval of new fiscal package exceeding 10 trillion yuan ($1.4 trillion dollars) on November 8

Sources: China intends to approve raising new 10 trillion yuan debt through special treasury and local government bonds in upcoming years. fiscal plan to allocate 6 trillion yuan for local government debt and up to 4 trillion yuan for idle land and property acquisition. China could unveil enhanced fiscal measures if trump secures U.S. presidency.

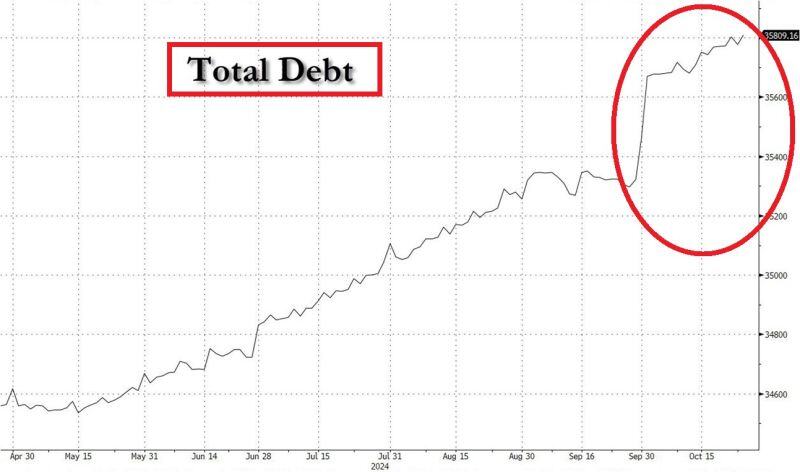

🚨US FEDERAL DEBT IS SKYROCKETING🚨

The US public debt just hit another RECORD of $35.8 TRILLION. In less than a month, the total debt SPIKED by $700 BILLION. This is $23 BILLION A DAY. To make things worse, these forecasts assume lower interest rates over the next year... Source: Global Markets Investor

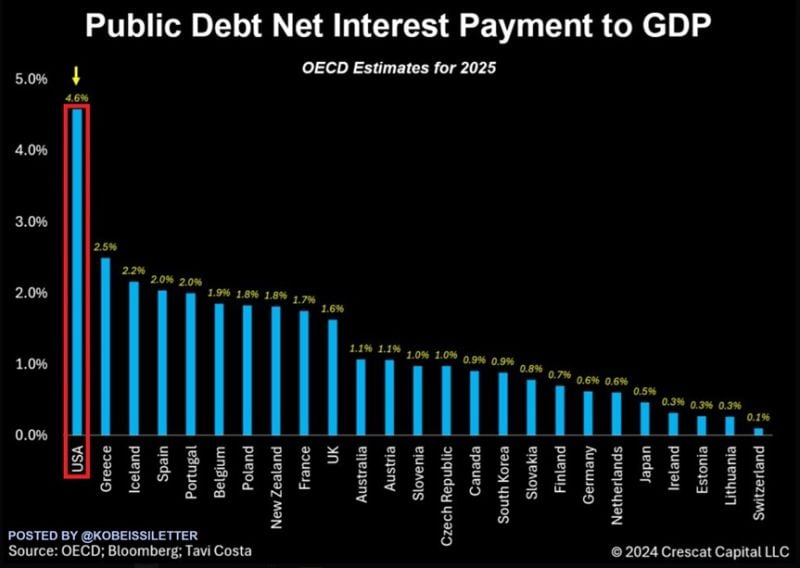

The US public debt situation is going to get worse:

US net interest payments as a share of GDP are expected to reach a record 4.6% next year. That would more than DOUBLE World War 2 levels and exceed the all-time highs seen in the 1990s. This is also much higher than net interest as a % of GDP in all 38 OECD countries. Countries with relatively high interest such as Greece, Ireland, Spain, and Portugal are expected to reach interest-to-GDP ratios that are HALF the size of the US. To make things worse, these forecasts assume lower interest rates over the next year. Source: The Kobeissi Letter, OECD, Tavi Costa

Billionaire investor Paul Tudor Jones today on CNBC:

“All roads lead to inflation. I’m long gold. I’m long Bitcoin. I own ZERO fixed income. The playbook to get out of this [debt problem] is that you inflate your way out.” Source: CNBC

Investing with intelligence

Our latest research, commentary and market outlooks