Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

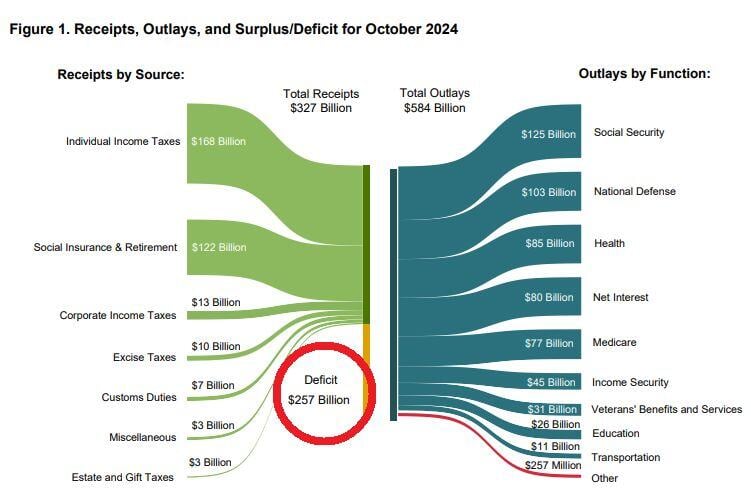

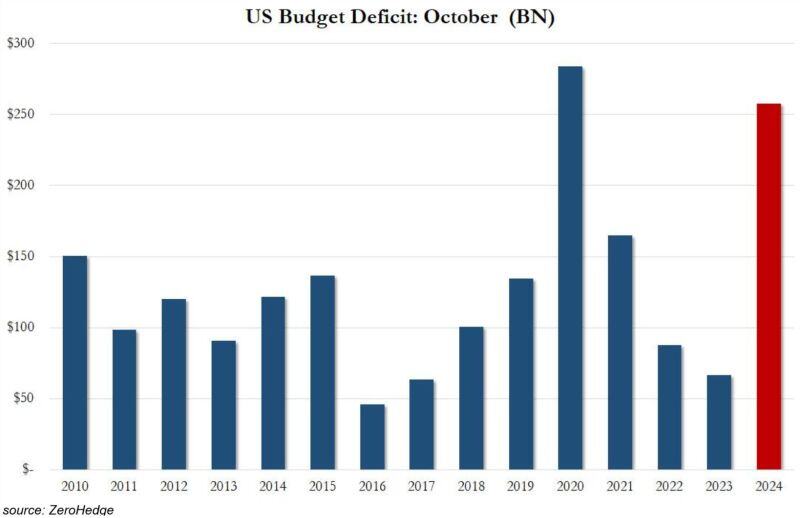

US GOVERNMENT BORROWING EXPLODED IN OCTOBER

US budget deficit hit a STAGGERING $257.5 BILLION in October. This is up nearly 400% year-over-year versus $66.6 BILLION last year. This was also the 2nd highest deficit in the entire US history. Source: Global Markets Investor

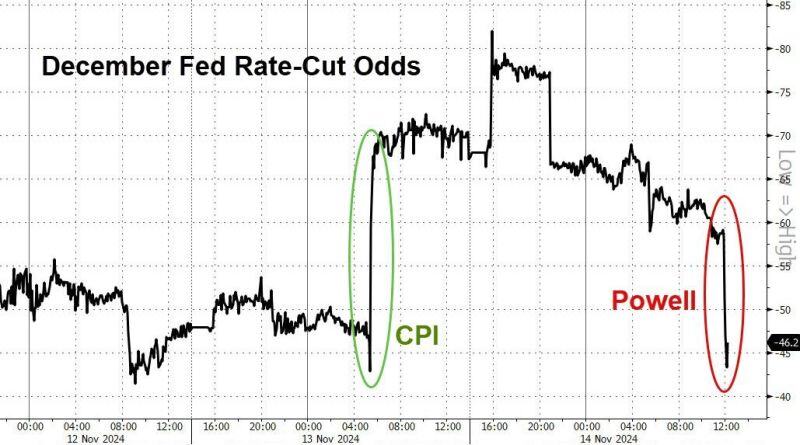

Higher than expected US PPI + Powell's remarks yesterday sent rate-cut expectations notably lower - December less than 50-50 now...

Source: Bloomberg, www,zerohedge.com

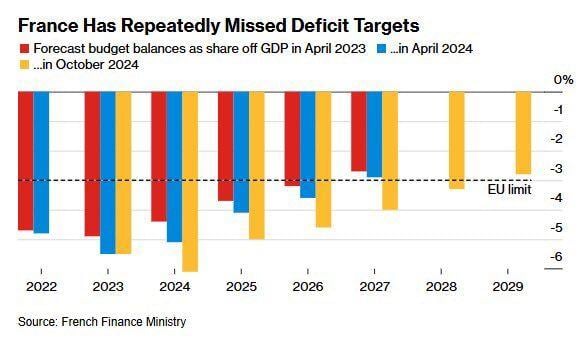

Spoiler: France will continue to miss deficit targets.

It already has the highest tax burden in Europe, and there are no real structural reforms on the horizon. Source: Michel A.Arouet

⚠️US GOVERNMENT BORROWING EXPLODED IN OCTOBER⚠️

US budget deficit hit a STAGGERING $257.5 BILLION in October. This is up nearly 400% year-over-year versus $66.6 BILLION last year. This was also the 2nd highest deficit in the entire United States history. Mind-blowing numbers. Source: Global Markets Investor, zerohedge

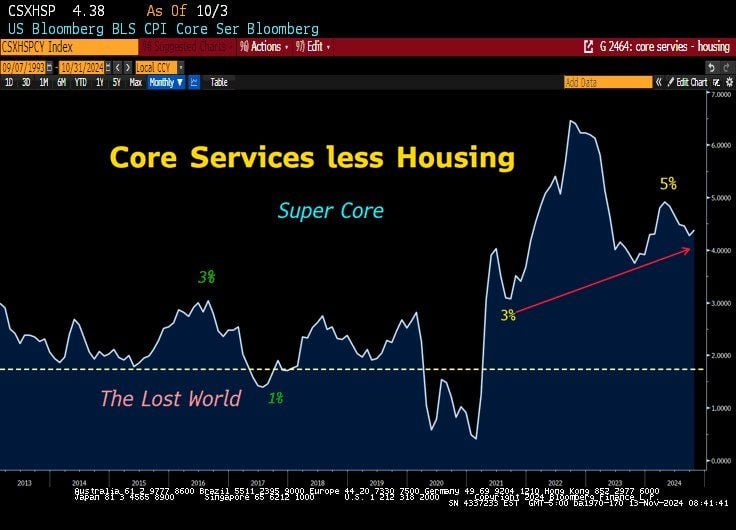

It seems that the FED's neutral rate is higher.

Are they going to throw the towel on the 2% target? Source: Bloomberg, Lawrence McDonald

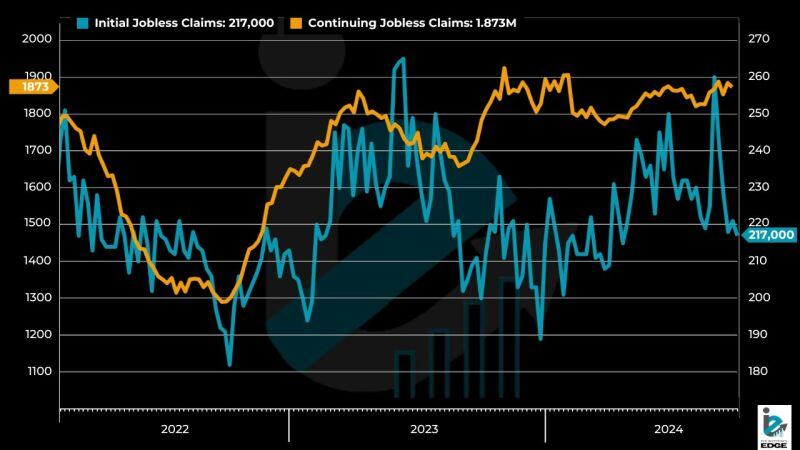

Both initial jobless claims and continuing claims were lower than expected last week.

🔊 Initial Jobless Claims came in at 217K versus the consensus forecast of 223K. 🔊 The 4-week average came in at 221K versus the consensus forecast of 226K. Source: CMG Venture Group

BREAKING 🚨 PPI data came out…

YoY Growth: • PPI (Oct), 2.4% Vs. 2.3% Est. (prev. 1.8%) • Core PPI, 3.1% Vs. 3.0% Est. (prev. 2.8%) MoM Growth: • PPI (Oct), 0.2% Vs. 0.2% Est. (prev. 0.0%) • Core PPI, 0.3% Vs. 0.2% Est. (prev. 0.2%) Source: Stocktwits

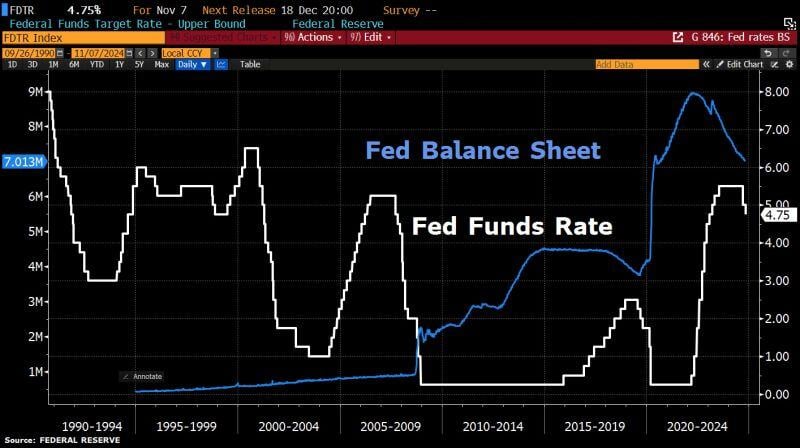

Fed cuts rates by 25bps in unanimous decision as expected. So what did the Fed do?

👉 FED LOWERS BENCHMARK RATE 25 BPS TO 4.5%-4.75% RANGE 👉 FED SAYS RISKS TO GOALS REMAIN 'ROUGHLY IN BALANCE’ 👉 FED: LABOR MARKET CONDITIONS HAVE 'GENERALLY EASED' No dissent on this rate-cut decision. 🚨 Key changes: - Most notably, removing language that Fed has "gained greater confidence that inflation is moving sustainable toward 2 percent". - Adding that labor market conditions have "generally eased" since earlier in the year, replacing "job gains have slowed". Source: Bloomberg, www.zerohedge.com

Investing with intelligence

Our latest research, commentary and market outlooks