Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

China ups stimulus response, shifts monetary policy stance for the first time in 14 years.

Politburo vows to stabilise both housing and stock markets. China stocks, commodities prices jump. CHINA EASES MONETARY POLICY STANCE FOR FIRST TIME SINCE 2011 *POLITBURO: CHINA MONETARY POLICY TO BE MODERATELY LOOSE *POLITBURO: CHINA'S FISCAL POLICY TO BE MORE PROACTIVE NEXT YEAR *POLITBURO: WILL STABILIZE THE PROPERTY AND STOCK MARKETS Source: Bloomberg, David Ingles

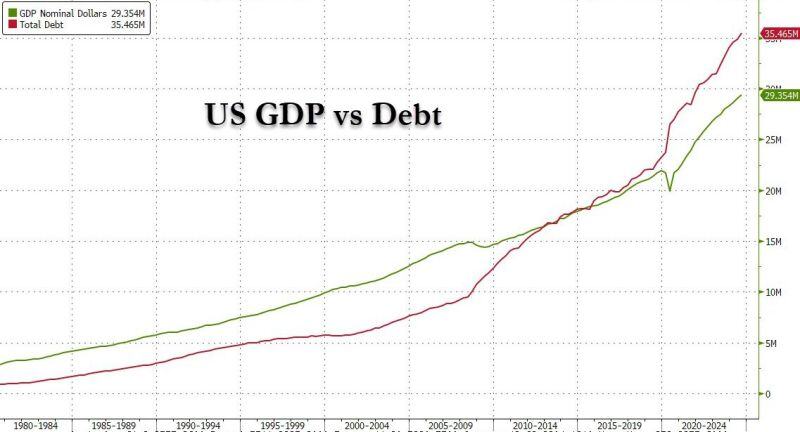

The problem in one chart

More $debt is needed to generate $1 of GDP Source: zerohedge

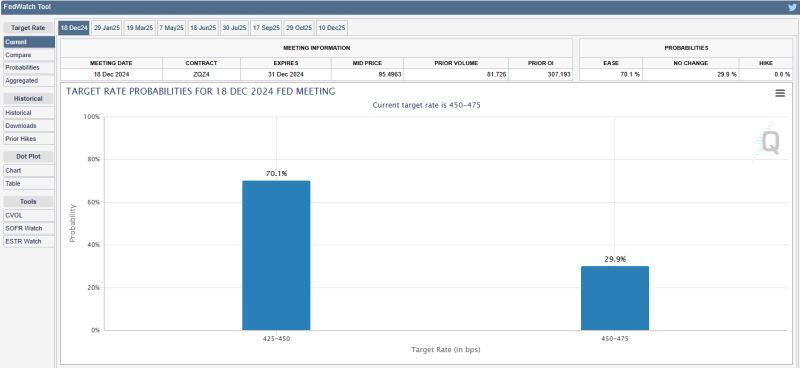

There is now a 70% chance of a 25 bps interest rate cut at this month's FOMC meeting 🚨

Source: Barchart

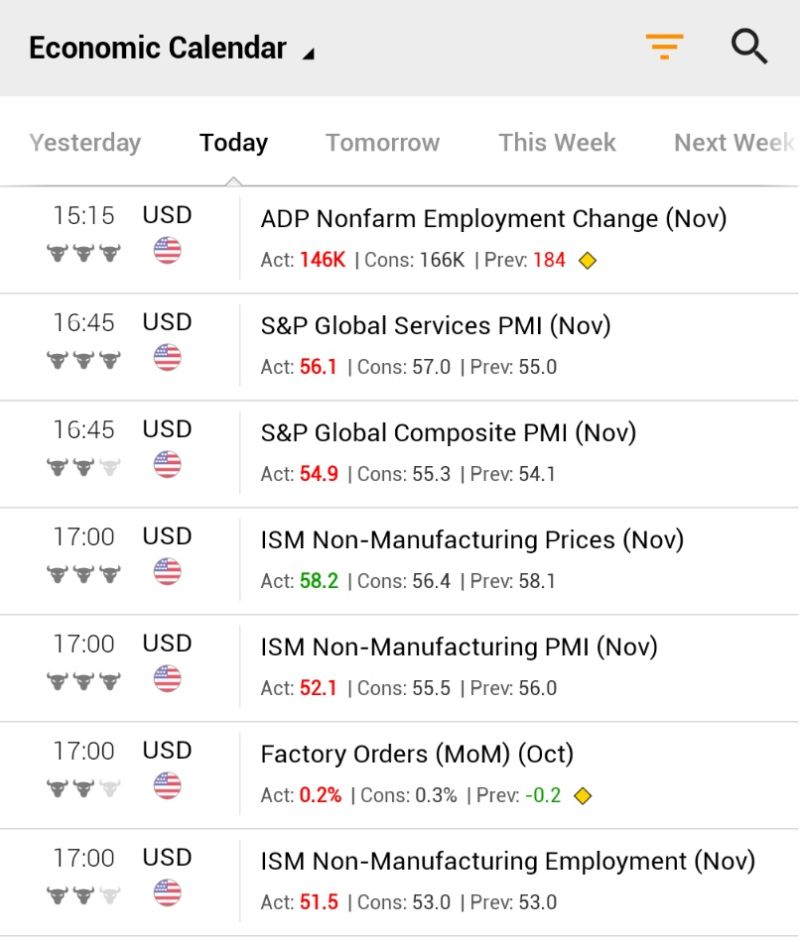

US Economic Surprises are starting to roll out.

See below yesterday macro numbers - majority of them missed estimates (hard & soft data) *ADP Payrolls: Miss 🔴 *S&P Services PMI: Miss 🔴 *ISM Services PMI: Miss 🔴 *ISM Services Employment: Miss 🔴 *Factory Orders: Miss 🔴 Source: Jessie Cohen

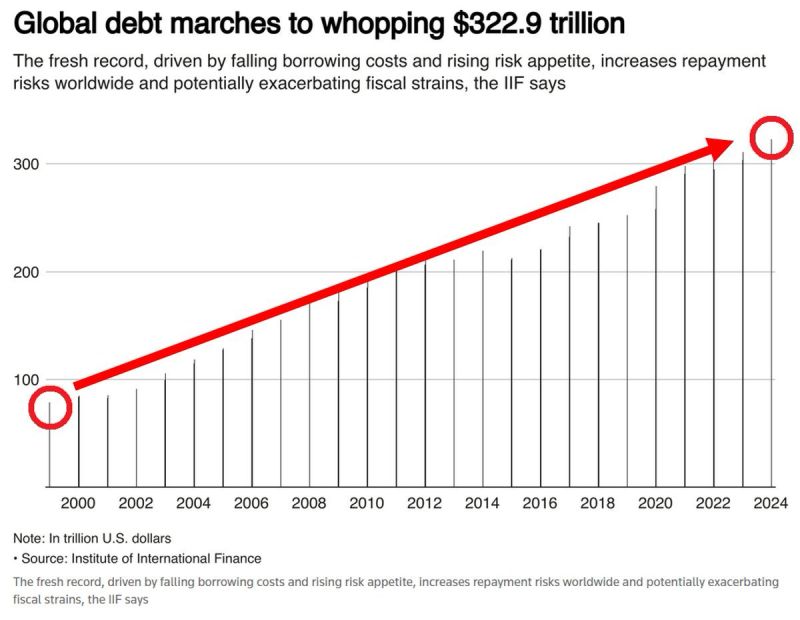

GLOBAL DEBT HIT A NEW RECORD

Global debt rose by over $12 trillion in Q1-Q3 and hit a MASSIVE $322.9 trillion, a new all-time high. Over the last 2 decades, world's debt has TRIPLED. Debt-to-GDP fell to 326%, ~30 percentage points below 2021 record but remains above 2019. Source: Global Markets Investor @GlobalMktObserv

GS: Chart of the Week

Global MAP (economic) Surprise Index Has Fallen Sharply, Driven by Weak Euro Area PMIs and a Plummet in US New Home Sales Source: Mike Zaccardi, CFA, CMT @MikeZaccardi, GS

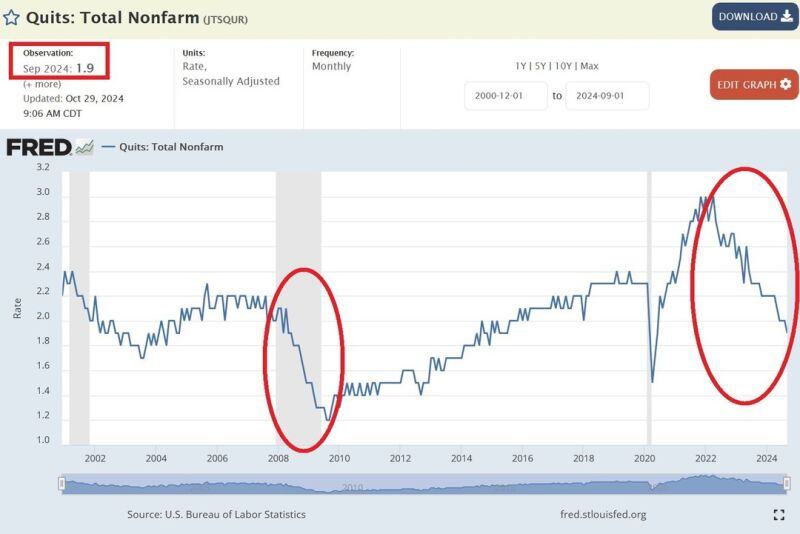

⚠️US QUITS RATE IS FALLING QUICKLY⚠️

The quits rate, the % of workers voluntarily exiting their jobs fell to 1.9% in September, the lowest since June 2020. Americans are increasingly depending on their current jobs as the hiring pace has declined. Data for October is due today. Source: Global Markets Investor

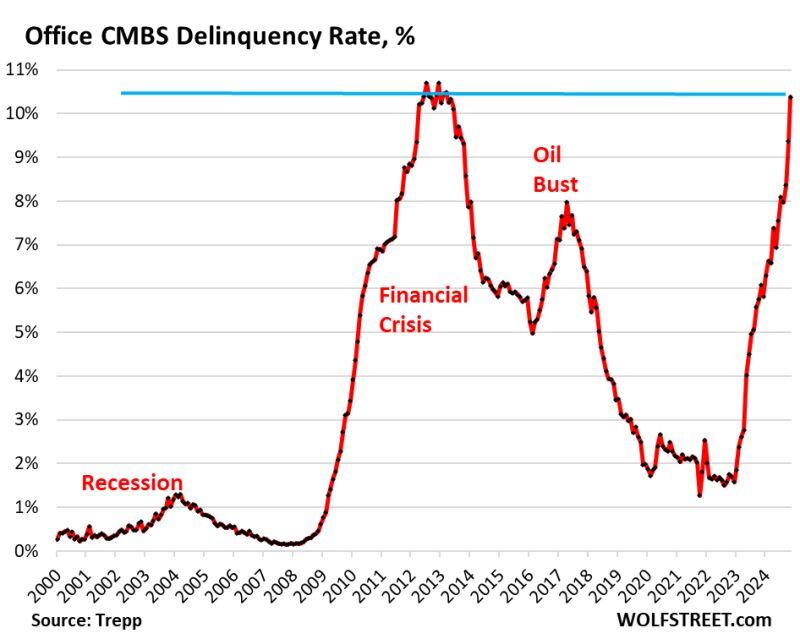

Office CMBS Delinquency Rate Spikes to 10.4%, Just Below Worst of Financial Crisis Meltdown. Fastest 2-Year Spike Ever.

Office-to-residential conversions are growing, but are minuscule because not many towers are suitable for conversion. Source: www,wolfstreet.com, Wolf Richter

Investing with intelligence

Our latest research, commentary and market outlooks