Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Citi U.S. Economic Surprise Index is starting to roll over again

Source: Bloomberg

US Fed officials see interest rate cuts ahead, but only ‘gradually,’ meeting minutes show - CNBC

Federal Reserve officials expressed confidence that inflation is easing and the labor market is strong, allowing for further interest rate cuts albeit at a gradual pace, according to minutes from the November meeting released Tuesday. The meeting summary contained multiple statements indicating that officials are comfortable with the pace of inflation, even though by most measures it remains above the Fed’s 2% goal. With that in mind, and with conviction that the jobs picture is still fairly solid, Federal Open Market Committee members indicated that further rate cuts likely will happen, though they did not specify when and to what degree.

BREAKING: October PCE inflation, the Fed's preferred inflation measure, RISES to 2.3%, in-line with expectations of 2.3%.

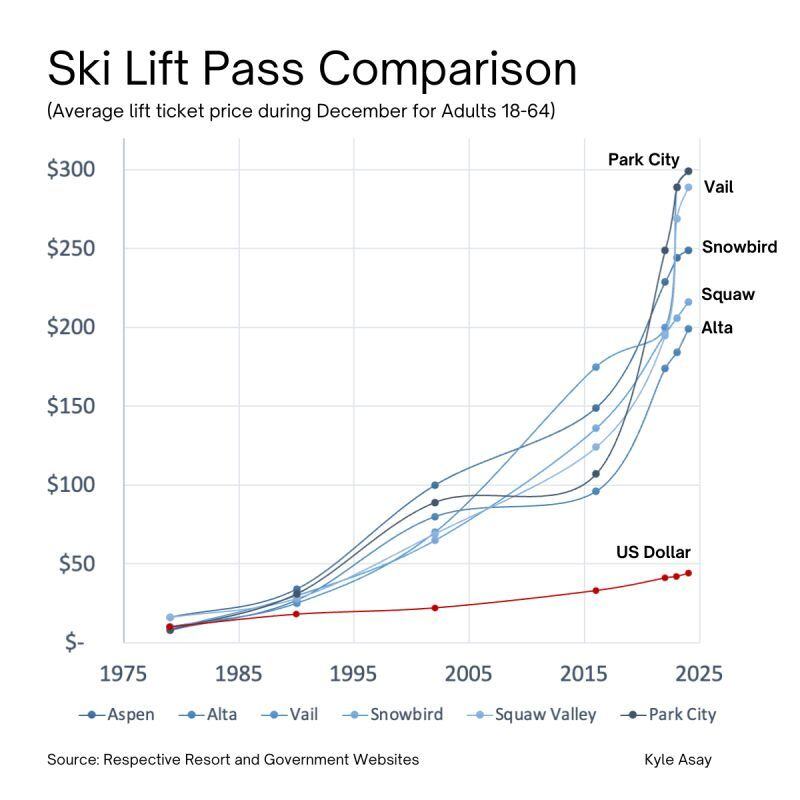

Core PCE inflation RISES, to 2.8%, in-line with expectations of 2.8%. The Fed's preferred measure of inflation hit its highest reading since April. Core CPI, PPI, and PCE are all back on the rise. Source: Charlie Bilello

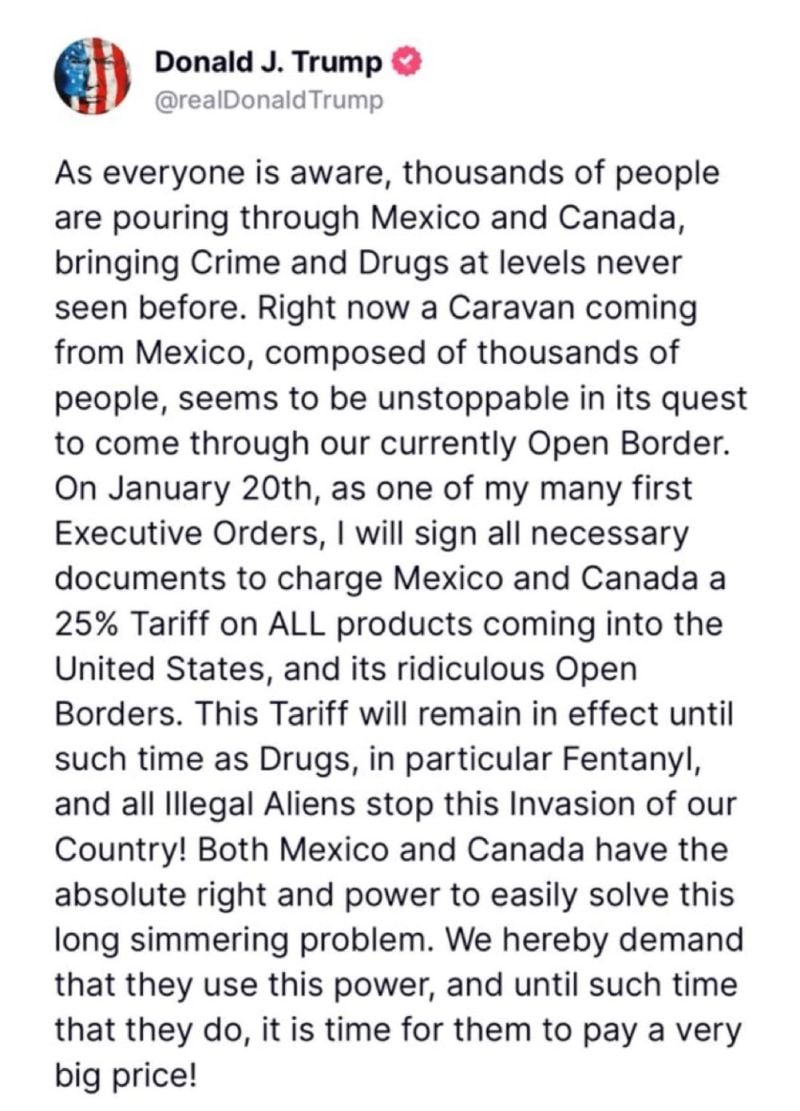

Donald Trump has said he would impose tariffs of 25 per cent on all US imports from Canada and Mexico on his first day in office (and an extra 10 per cent tariff on Chinese goods).

In social media posts, Trump accused the countries of permitting illegal immigration and drug trafficking. Trump said the new China tariffs would come on top of existing levies. He had also threatened on the campaign trial to impose “whatever tariffs are required” to stop Chinese cars from crossing into the US from Mexico. FT >>> The tariffs on the US’s three largest trading partners would increase costs and disrupt business, one expert said, adding that “even the threat of tariffs can have a chilling effect”. A former US trade official agreed the disruption would be significant, especially given the degree of integration in North American manufacturing across sectors such as the automotive industry. He added that “tariffs are inflationary and will drive up prices”.

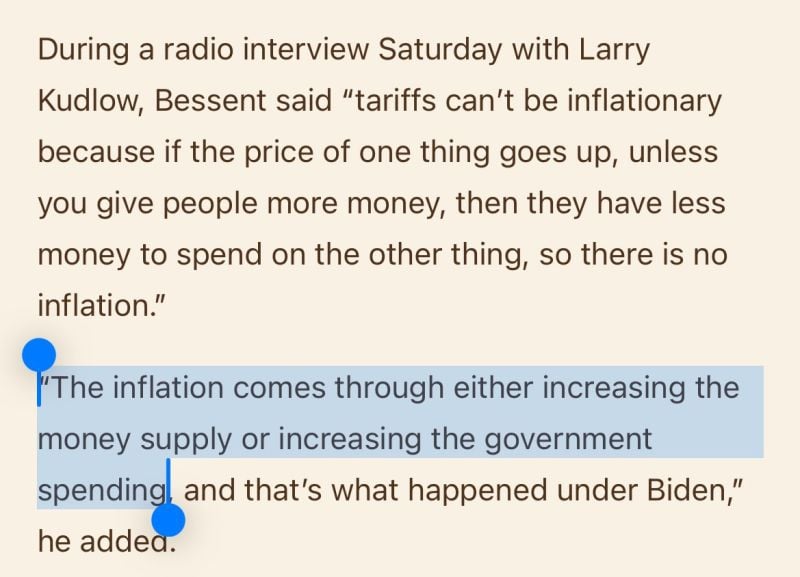

Scott Bessent on tariffs:

"Tariffs can’t be inflationary because if the price of one thing goes up, unless you give people more money, then they have less money to spend on other things, so there is no net inflation.” Source: Geiger Capital

It has been a very quiet year... Can we expect the same in 2025??? (Clone)

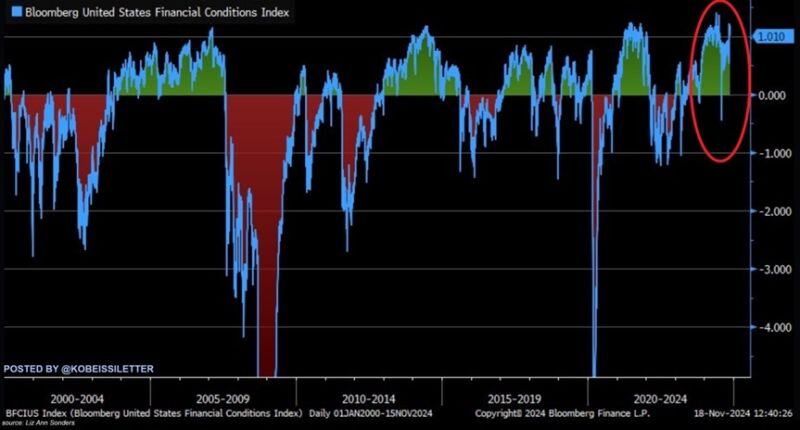

Financial conditions are now even easier than previous records seen in late 2020 and 2021. In fact, this makes financial conditions easier than when the Fed cut rates to near 0% overnight in 2020. Meanwhile, the market is pricing in a 59% chance of another 25 bps Fed rate cut in December. Source: The Kobeissi Letter, Bloomberg

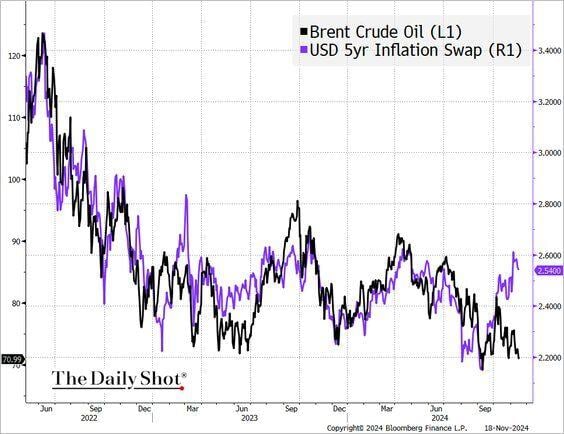

Inflation expectations have diverged from crude oil prices.

Source: The Daily Shot

Investing with intelligence

Our latest research, commentary and market outlooks