Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

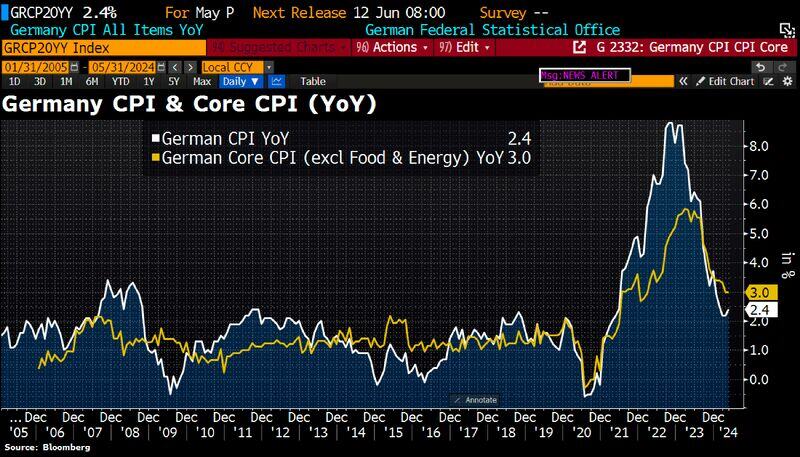

Germany's inflation rose to 2.4% in May from 2.2% in April while Core CPI remains unchanged at 3%.

Uptick was driven by base effects related to the introduction of a cheap public-transportation ticket (so-called 49€ ticket), which pushed prices down 12 months ago. But also food price inflation quickened (for a 2nd month). Source: HolgerZ, Bloomberg

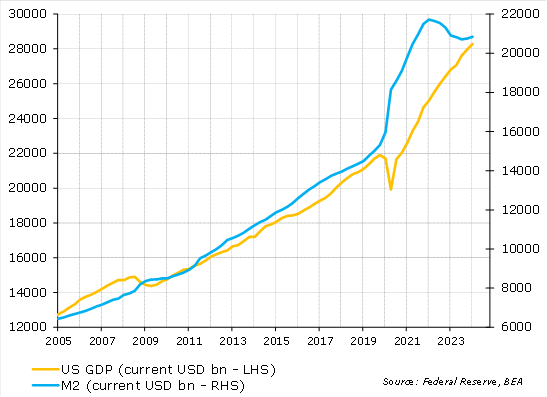

The US money supply is back in line with the size of the economy, after the excesses of the pandemic period

Time for the Fed to take its foot off the brake pedal regarding liquidity Source: US Federal Reserve, BEA

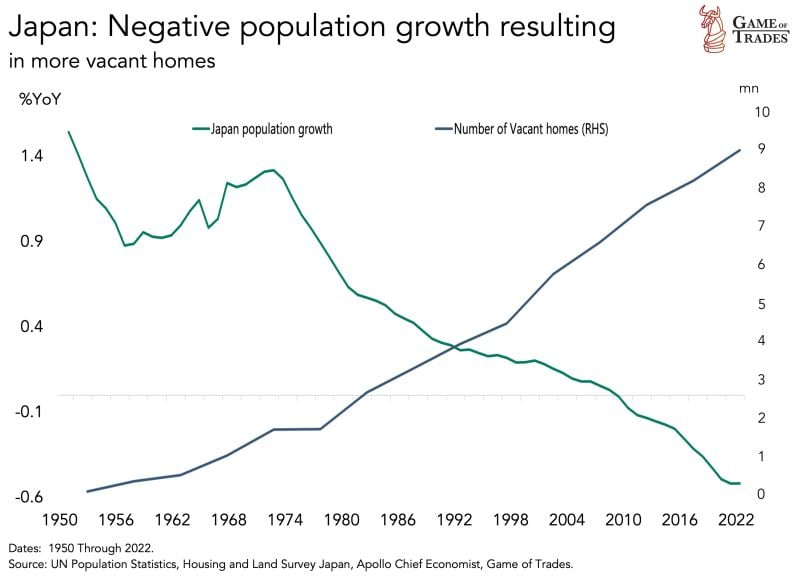

Japan’s population has now been contracting for almost 15 years

At the same time, number of vacant homes there has risen significantly Now reaching the 9 million mark At this rate, Japan’s demography poses long-term sustainability risks for their economy Source: Game of Trades

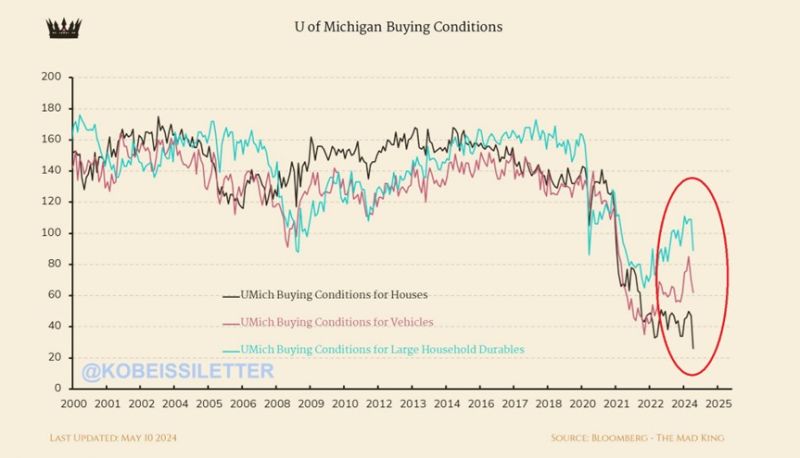

Homebuyer conditions for US consumers plummeted to their lowest level in history this month.

The index of buying conditions for houses fell to ~30 points which is below the previous low of ~40 points in the early 1980s. In just 4 years, conditions for buying a house have dropped by 110 points, a massive 73% decline. Meanwhile, buying conditions for vehicles and large household durables are down for 3 straight months. Source: The Kobeissi Letter

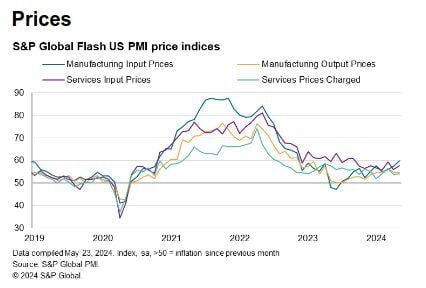

Wall Street pull-back yesterday is mainly explained by the PMI data.

And not because they show that the US economy remians resilient. The biggest concern was the prices print as it shows that more cost increases are coming for companies and consumers alike: - Input prices continued to rise sharply in May, the rate of inflation accelerating to register the second-largest monthly increase seen over the past eight months. - Manufacturers reported an especially steep increase, suffering the largest cost rise for one-and-a-half years amid reports of higher supplier prices for a wide variety of inputs, including metals, chemicals, plastics, and timber- based products, as well as higher energy and labor costs. - Service sector costs also rose at an increased rate, reflecting higher staffing costs in particular. - Companies again sought to pass higher costs onto customers in the form of higher selling prices, the rate of increase of which accelerated slightly compared to April. One good news though: although still elevated by pre-pandemic standards, the rate of inflation across both goods and services remained below the average recorded over the past year. Source: S&P Global, Markets & Mayhem

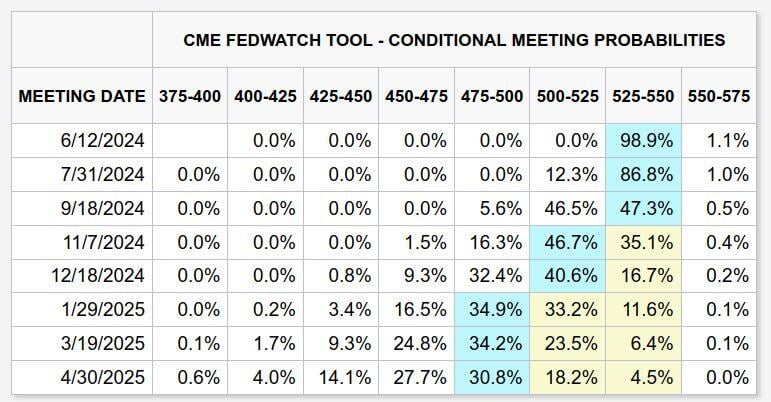

After the hotter than expected Flash PMI prints yesterday, the market is pricing in one cut for this year to occur in November or December, and another in early 2025.

Source: Markets & Mayhem

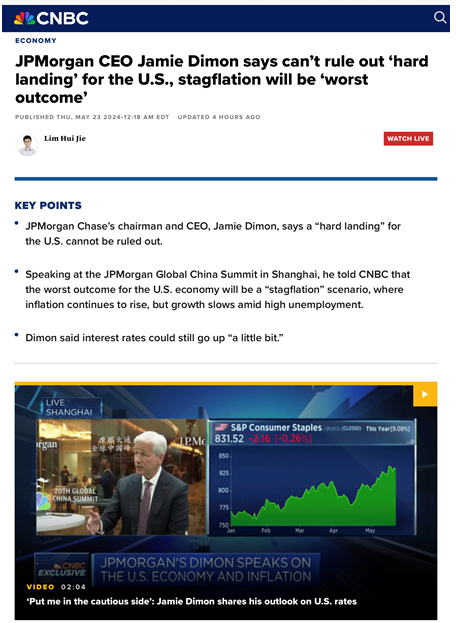

Jamie Dimon does not rule out a hard landing for the US economy

Source: CNBC

BREAKING: TANGIBLE SIGN OF US CONSUMER WEAKNESS?

Target stock, $TGT, falls 8% after reporting weaker than expected earnings with a 3% revenue decline due to consumer weakness. Target's CEO said the decline reflects “continued soft trends in discretionary categories.” The company's store traffic fell by 1.9% less quarter and the average amount spent by customer also fell 1.9%. Consumers bought fewer everyday items like groceries along with fewer discretionary goods. Another sign that consumers are struggling. Source: The Kobeissi Letter

Investing with intelligence

Our latest research, commentary and market outlooks