Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

The implications of an aging population for investment strategies

Source: Bloomberg

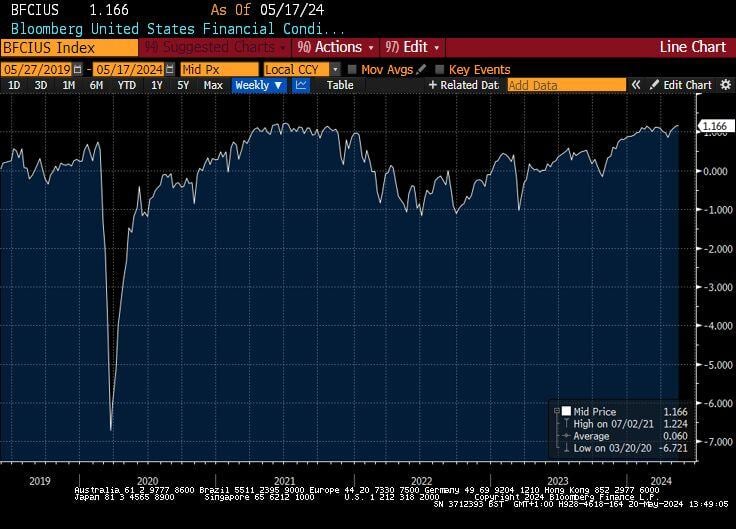

While the FED monetary policy is seen as restrictive, the Bloomberg US Financial Conditions Index is at record highs.

Risk premia in stocks and credit are near all-time tights as commodities are breaking higher. Source: Bloomberg

China may well be the world leader for de-risking trade ties

• Chinese firms have been developing ties with emerging markets over past ten years • This reduces China's reliance on unfriendly markets (🇺🇸🇪🇺), shielding Beijing from geopolitical tensions Source: FT, Agathe Demarais

JUST IN: The Biden administration announces it is releasing 1 million barrels of gasoline from a Northeast reserve.

These reserves were established to supplement in times of a natural disaster. However, the Biden Administration said this is a move to lower gas prices ahead of the summer. The sale, from storage sites in New Jersey and Maine, will be allocated in increments of 100,000 barrels at a time. Energy Department officials said this should help create lower gas prices by July 4th. Energy inflation is still a major issue. Source: The Kobeissi Letter

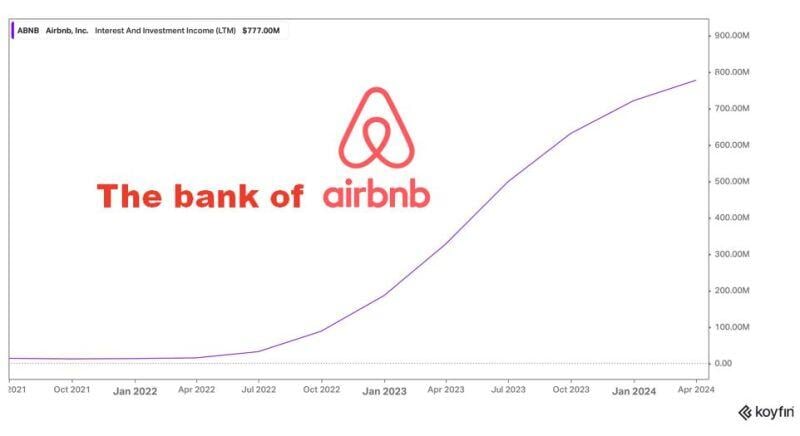

The Bank of Airbnb $ABNB by Wolf of Harcourt Street

ABNB's interest income has skyrocketed to $777 million over the past 12 months. This return is more akin to a bank than a travel company. ABNB benefits from being the Merchant of Record which means that it is the party that processes and distributes the actual payment for a product or service. When a customer makes a booking on Airbnb, Airbnb receives the cash in advance. This cash is held on behalf of the host and paid out once the service has been provided. With the interestrate hikes over the past year, Airbnb was able to benefit from investing the cash in short-term US Treasury bills before paying it out to hosts. Source: Wolf of Harcourt Street

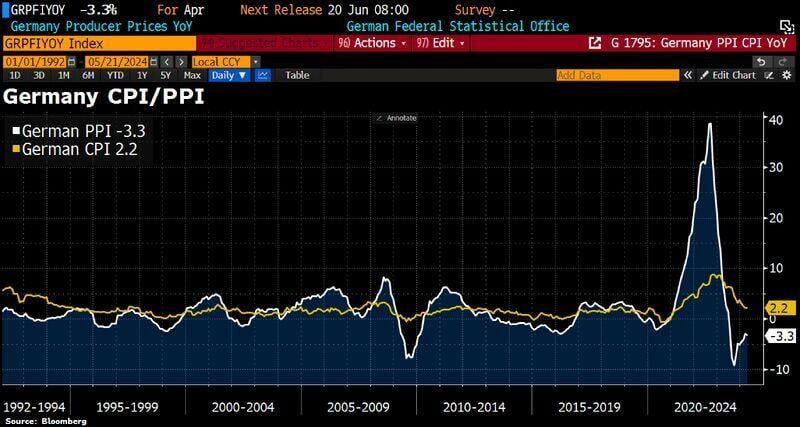

Deflationary forces are intensifying again in germany.

Producer prices fell by 3.3% YoY in April. In March, the decline was 2.9%. PPI is a good leading indicator for CPI. Source: Bloomberg, HolgerZ

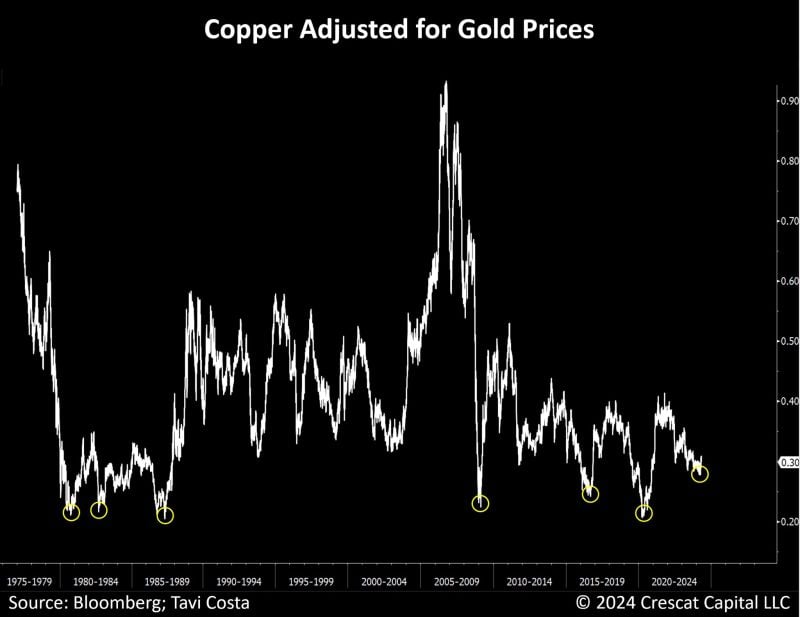

As highlighted by Tavi Costa ->

Despite the recent surge in copper prices, when adjusted for true inflation, the metal is trading at levels we saw in the early 1990s. Will copper prices adjusted for gold still be this low by the end of this decade if we proceed with one of the largest infrastructure developments we've seen in the last 100 years??? Source: Crescat Capital, Bloomberg

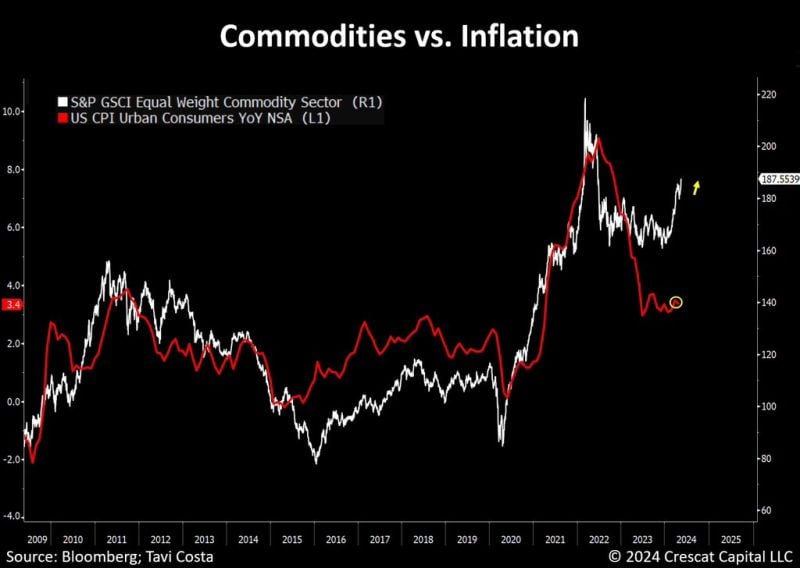

Could headline inflation start following the rebound in commodities prices?

Source: Tavi Costa, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks