Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

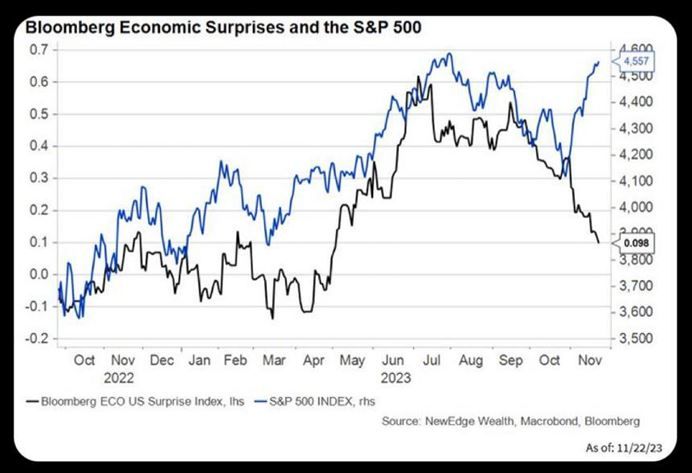

The "bad (macro) news is good (market) news" in one chart

Source: Michel A.Arouet, Bloomberg

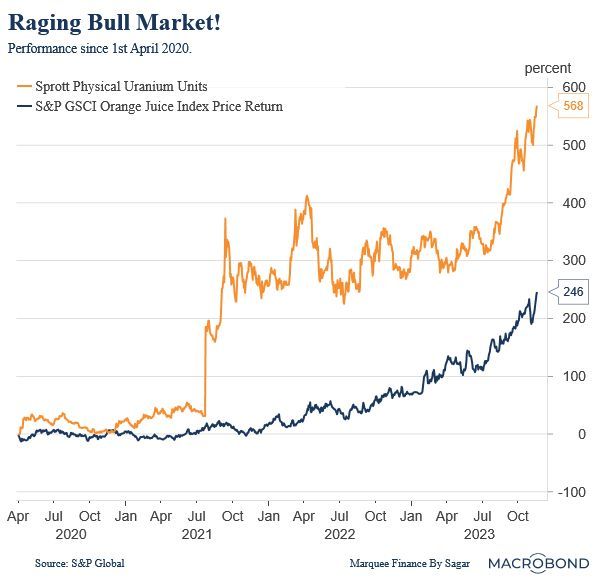

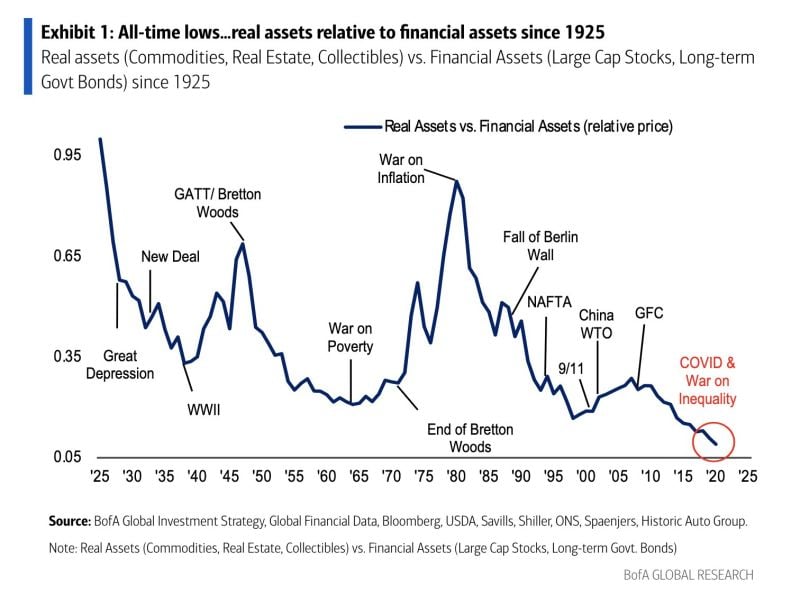

The biggest bull market post-COVID has not been in the Magnificent 7 or any other equity markets; it has been in these two commodities:

1) Orange Juice: 246% 2) Uranium: 568% Source: Macrobond, Sagar Singh Setia

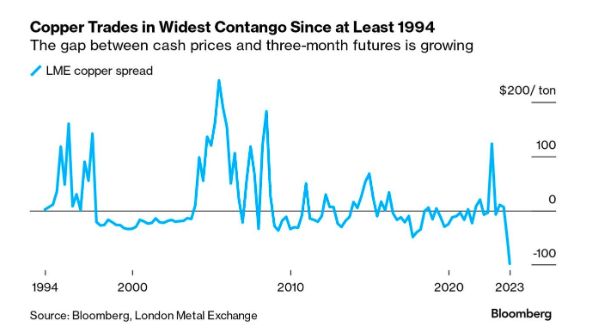

Copper hits widest contango in AT LEAST 29 years

Source: Barchart, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks