Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Orange juice hit another all-time high this week

Source: Tradingview

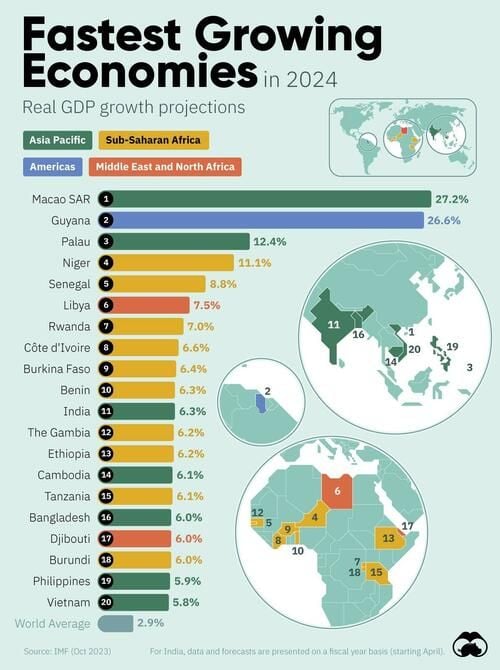

Visual Capitalist's Marcus Lu created the following chart, visualizing GDP growth forecasts from the IMF’s October 2023 World Economic Outlook

Unsurprisingly, many of these countries are located in Asia and Sub-Saharan Africa—two of the world’s fastest growing regions.

Goldman's Derivatives desk:

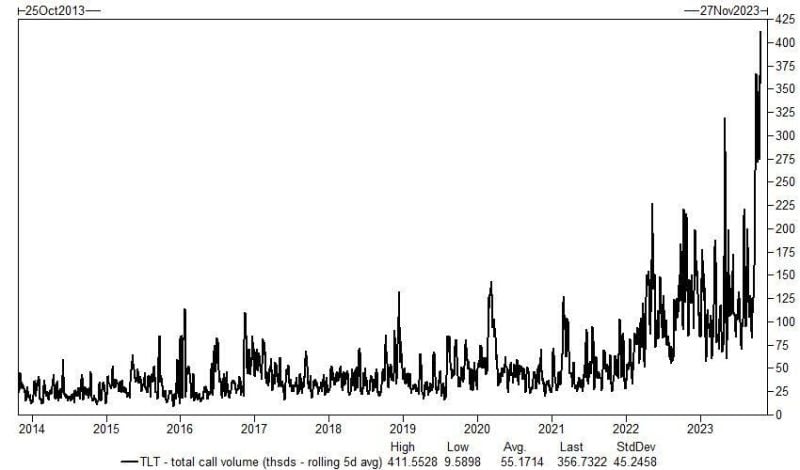

Demand for TLT calls and call spreads exploded this week. That's because "this is a cheap way to play for a snapback in bonds." As shown below, average TLT call volume this was over 350k contracts per day, an all-time highs...

Getting cheaper...

Global stocks have lost another $1.5tn in mkt cap this week on still-elevated US 10y yields and on not good enough earnings results. All stocks now worth $98.2tn, less than global GDP. This means that the Buffett Indicator is once again below the critical level of 100. Source: HolgerZ, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks