Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

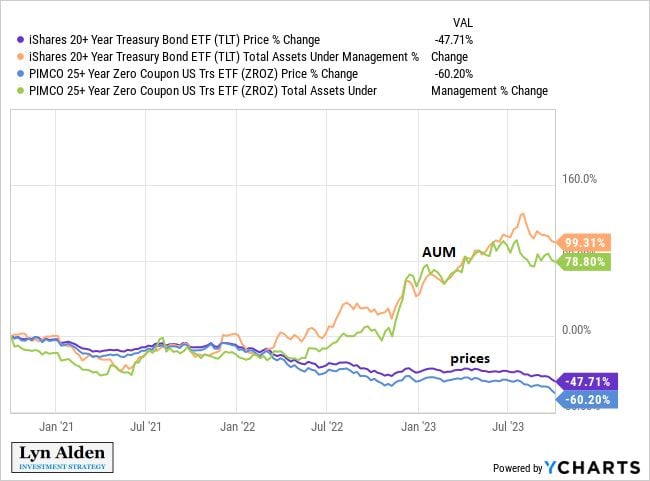

Long dated bonds: are investors in denial?

As $TLT and $ZROZ duration bond funds fell in price, their assets under management kept increasing as investors just kept pouring their funds in. Source: Lyn Alden

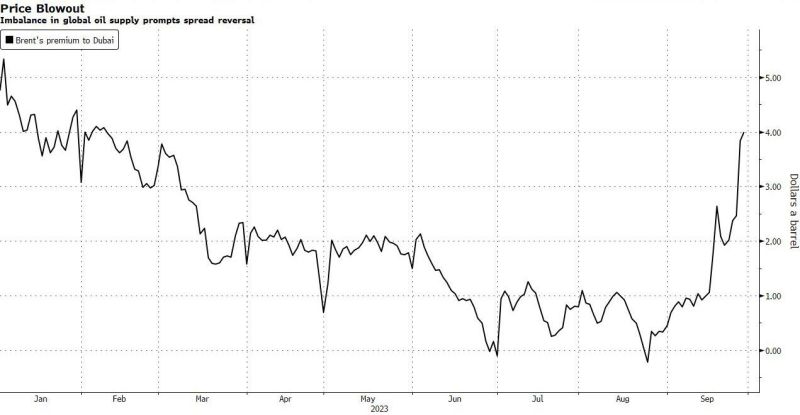

Plunging US Supply sends oil prices around the world soaring

>>> In recent months, the US had helped fill a void left in the market, routinely sending more than 4 million barrels every day to sate global appetite. Between overseas shipments and strong domestic demand, stockpiles quickly declined in the US. As oil stockpiles are running out in the US, they’re also running out in Europe, because it relies on US exports. As supplies collapse, cargoes of WTI Midland crude for January delivery to Asia are being offered for sale at premiums of $9 a barrel above benchmark Dubai oil, the highest premium seen this year, data compiled by Bloomberg show. In the futures market, the tightness in US supplies narrowed the gap between US crude and international benchmark Brent to under $3 a barrel, the smallest since May last year. Meanwhile, the spread between Brent and Middle East’s Dubai marker — also known as Brent-Dubai EFS — has skyrocketed (See below). Source: www.zerohedge.com

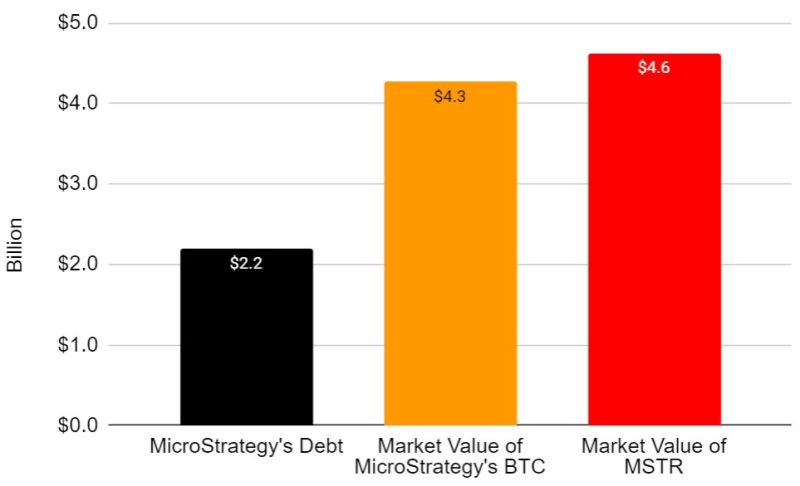

MicroStrategy has been able to outperform the underlying Bitcoin price mostly because of its use of leverage

Specifically, $MSTR took on a total of $2.2 billion in debt to purchase its BTC, the earliest of which matures at the end of 2025. This debt has a blended interest rate of only 1.6%. The markets in 2021 were distorted, and $MSTR capitalized by offering $1.05 billion in convertible debt with a 2027 maturity at 0%, which it used to buy $BTC. In other words, MSTR was able to borrow $1.05 billion until 2027 at 0% interest! This $2.2 billion of debt finances a $BTC position with a current market value of $4.3 billion. Source: Mark Harvey

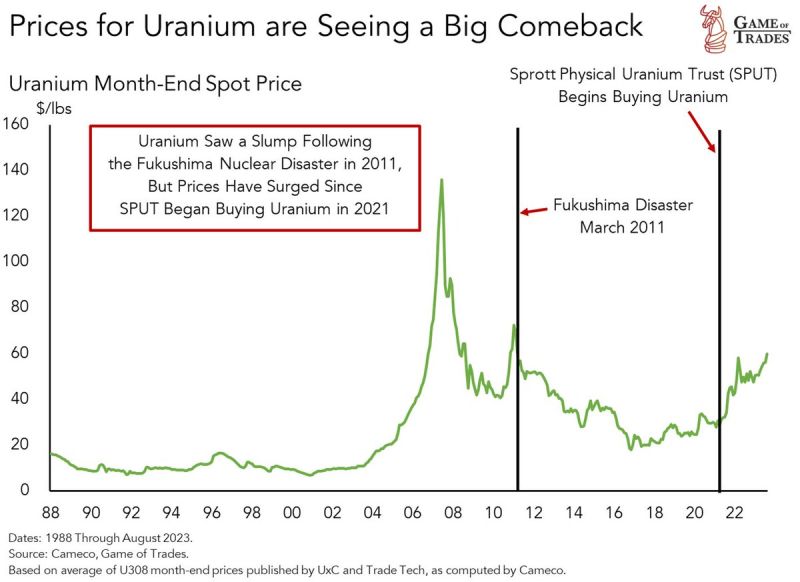

Uranium is back

The massive deficit + price insensitivity should be a solid tailwind Source: Game of trades

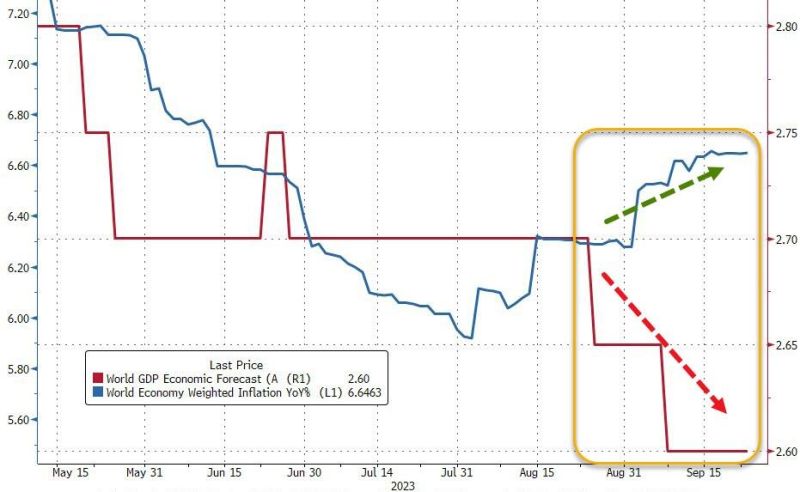

This chart explains by itself why the market mood has been deteriorating over the last few weeks:

Growth forecasts moving down / world inflation going up. What else? Source: www.zerohedge.com, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks