Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

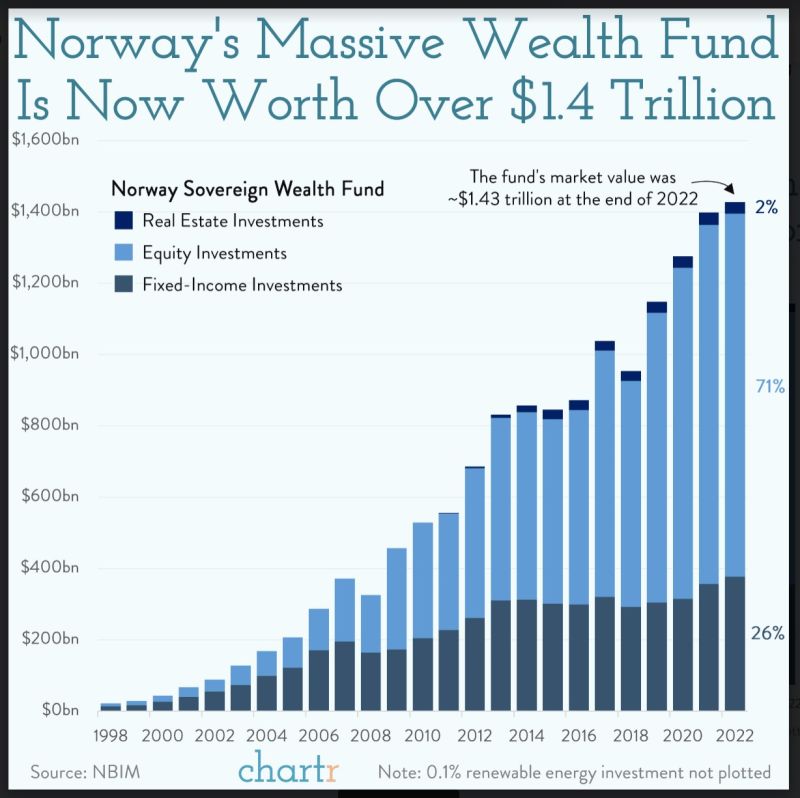

Norway sovereign fund’s assets have ballooned to over $1.4 trillion

That puts Norway's sovereign fund at a similar size to that of China's — yes, the same China that has more than 260x as many people as Norway has. Source: Chartr

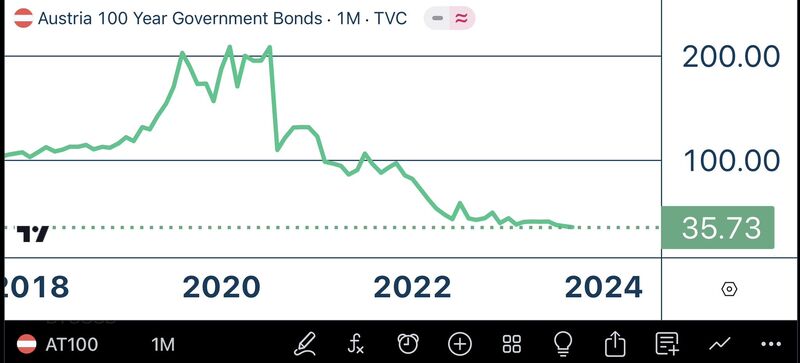

The Power of Duration! This is not the chart of an altcoin, this is the chart of Austria’s 100-year bond, down 82% from its 2021 peak!

Source: Jeroen Blokland

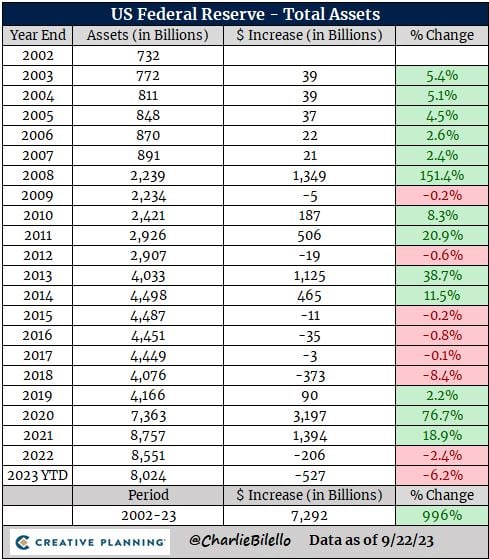

The Fed's balance sheet hit its lowest level since June 2021 this week, down $941 billion from the peak in April 2022

Changes in the Fed's balance sheet since 2002... Source: Charlie Bilello

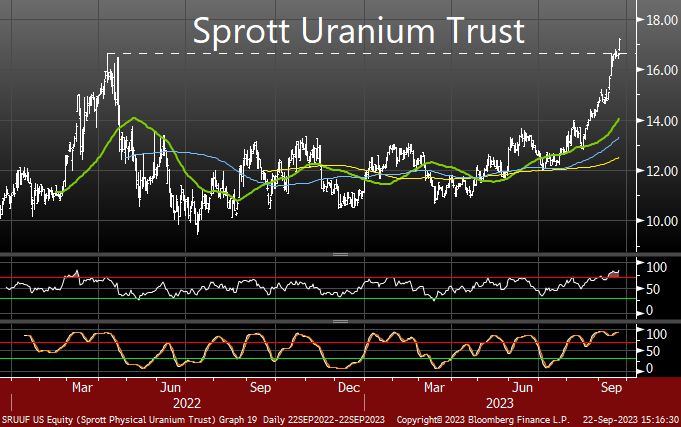

There is always a bull market somewhere... The Sprott Uranium Trust just broke a huge resistance

Source: Tony Greer

S&P 500 Index breaches 4400 level

The SPX Index breaches down its 4'400 Level and testing the 100 days Moving Averaged. Market continues yesterday downtrend after the Fed signaled it will keep rates higher for longer.

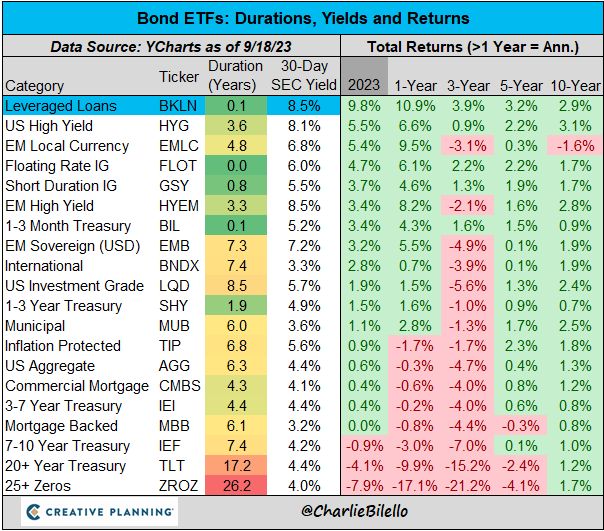

The best performing segment of the bond market this year? Leveraged Loans, up close to 10%. $BKLN

Source: Charlie Bilello

Investing with intelligence

Our latest research, commentary and market outlooks