Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

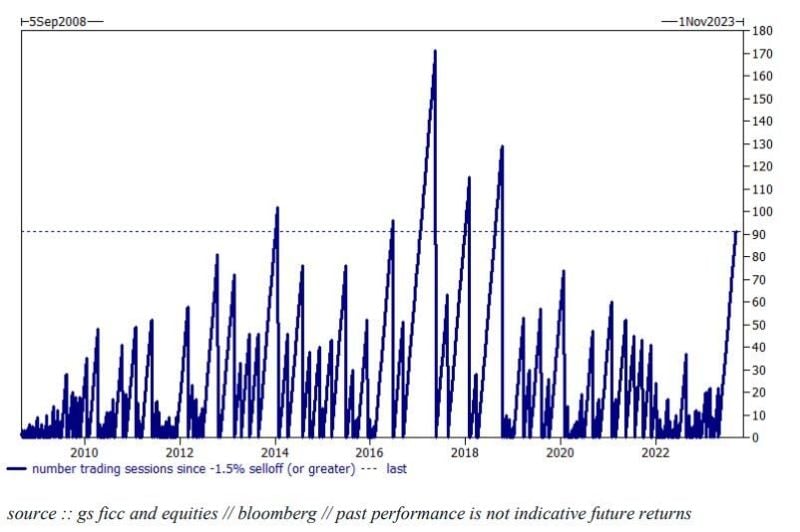

As Goldman's Brian Garrett noted yesterday, it has been 91 days since the sp500 suffered a 1.5% loss or greater in a day...

That's unusual - it has happened only 5 times in the last 15 years. As we have discussed recently, Sep + Oct are seasonally-volatile months... Source: Goldman Sachs

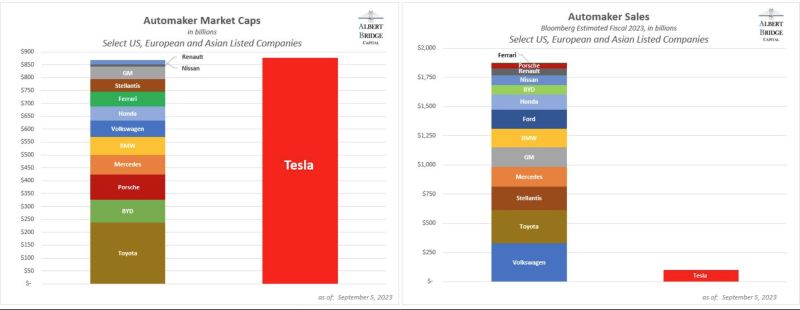

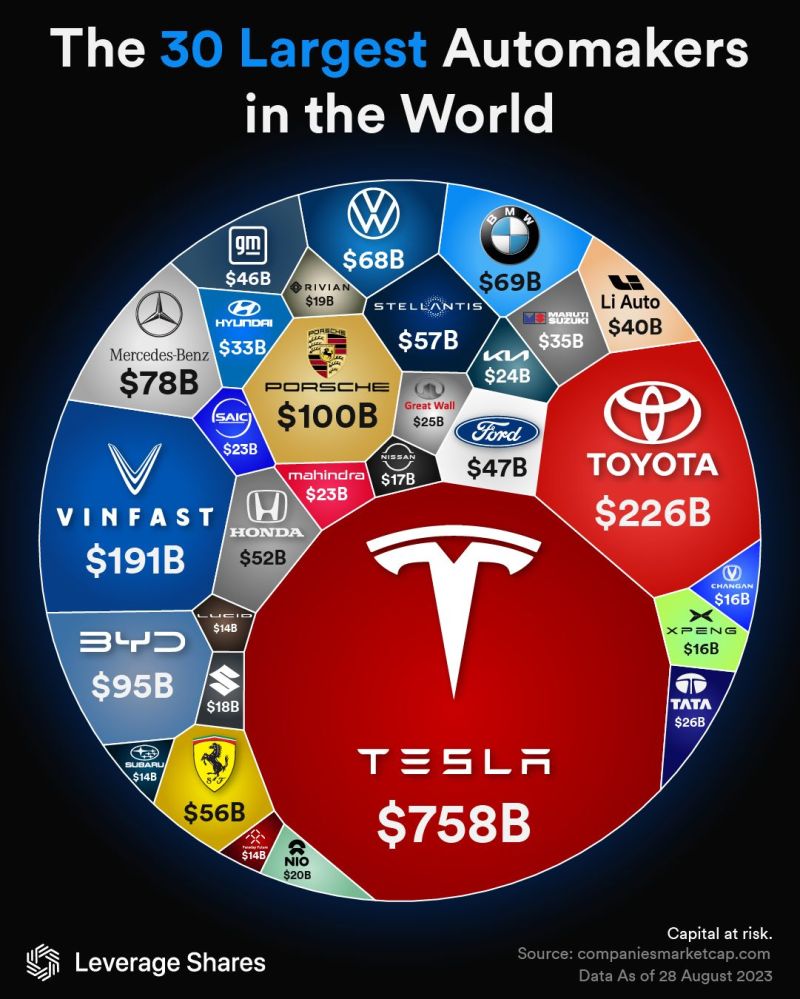

The largest automakers in the world by market cap

As highlighted by Oktay Kavrak, CFA, the largest US firm is only number 10. There is also an interesting (still relatively unknown) newcomer: VINFAST, a car brand from Vietnam. The stock is up nearly 700% since going public on the Nasdaq and - at least briefly - became the 3rd biggest automaker in the world and at one point was worth more than Boeing, Disney and Goldman Sachs. What is also notable is that VINFAST is not profitable yet. Moreover, the number of cars is still pretty low: 24,000 in 2022 (vs. millions for the more traditional automakers or Tesla). Source Chart: Leverage Shares

Investing with intelligence

Our latest research, commentary and market outlooks