Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

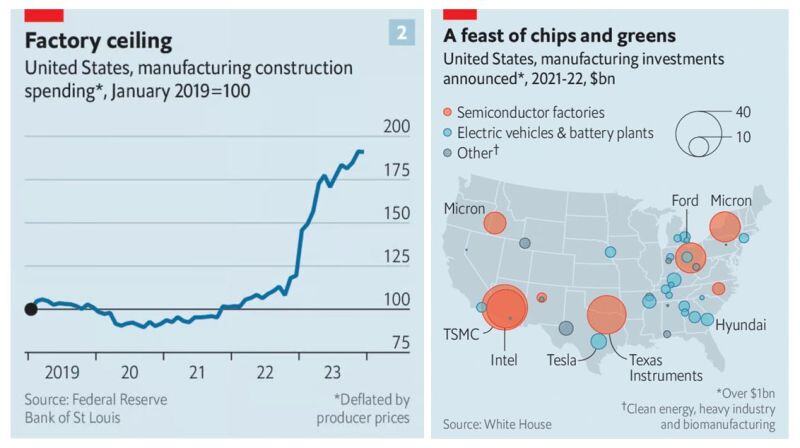

US manufacturing mega-boom in 2 images

Source: Science is Strategic, The Economist

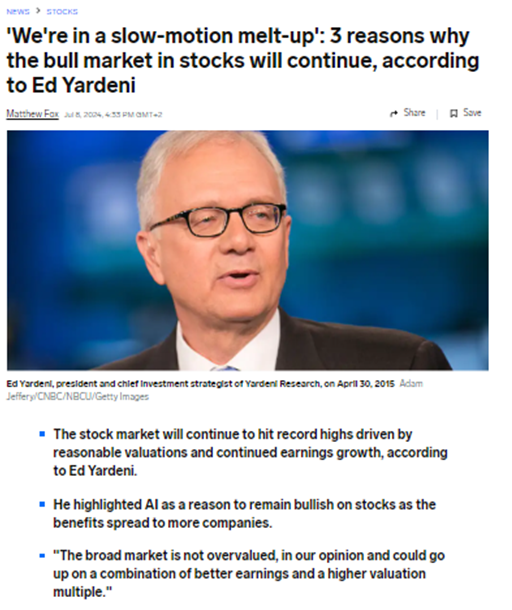

We're in a slow-motion melt-up according to Ed Yardeni

Source: Business Insider

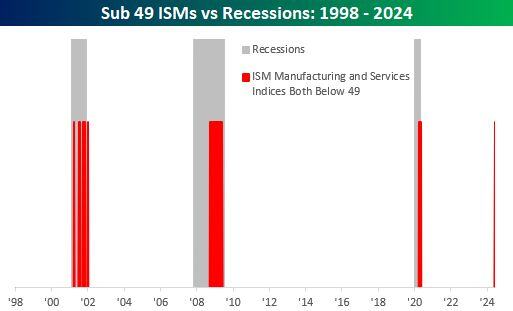

In June, both ISM Manufacturing and ISM Services fell below 49.

Here are all months where both PMI readings were below 49 Source: Bespoke

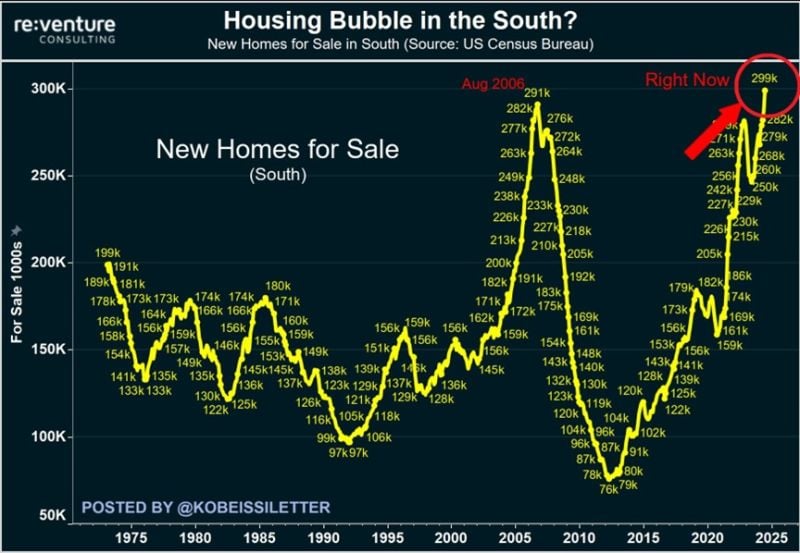

BREAKING: There are now a record 299,000 new homes for sale in the Southern US states, according to Reventure.

This is even higher than in 2006, a year before the housing market crash began. The number of new houses for sale in the South has nearly DOUBLED in just 4 years. Meanwhile, new home sales have officially dropped below pre-pandemic levels for the first time. It would take ~9 months current new inventory to sell if it sold at the current pace without new inventory coming to the market, 2nd longest duration since 2009. Source: The Kobeissi Letter, Reventure

Investing with intelligence

Our latest research, commentary and market outlooks