Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

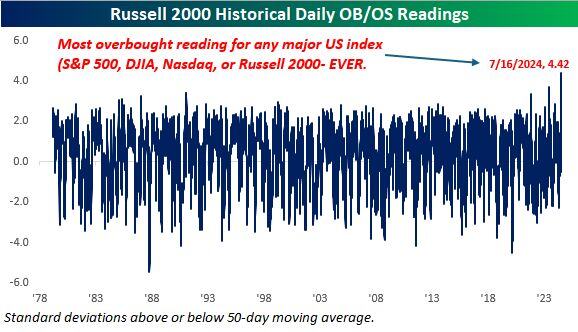

History was made yesterday! The Russell 2000 closed 4.4 standard deviations above its 50-day moving average.

No other major US index (Dow since 1900, S&P 500 since 1928, and Nasdaq since 1971) has ever closed at that much of an extreme. Source: Bespoke

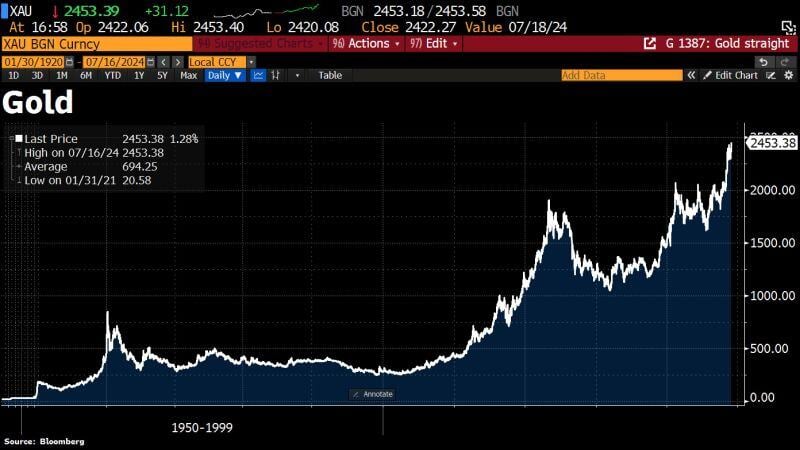

🚨 GOLD HITS $2,453 - A NEW ALL TIME HIGH 🔥

🔉 Just as Powell signals rates cuts before inflation comes down to 2%... Source: Bloomberg

Copper's $5 level reminds of the gold's critical $2,000 mark

nce gold breached that resistance, it kept moving with authority. Are we setting the stage for a similar move in copper? Source: Tavi Costa, Bloomberg

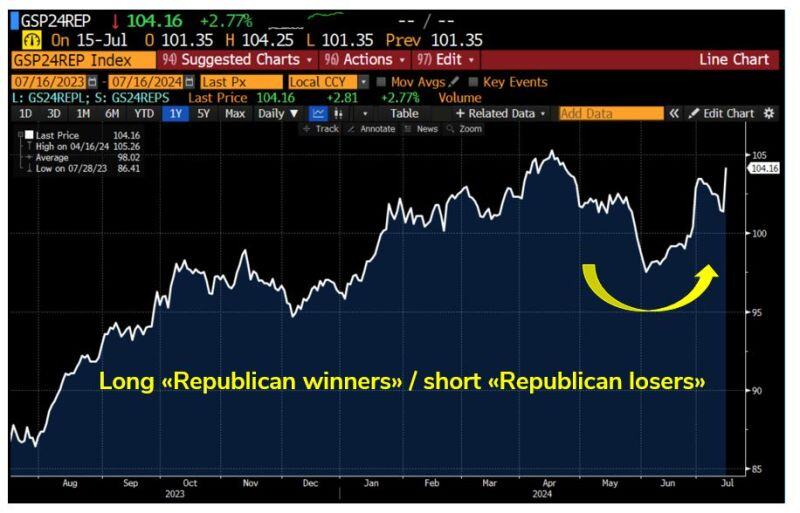

Goldman Sachs Republican winners versus losers basket (i.e long stocks likely to benefit from a Trump victory / short those who are likely to suffer from it) added 2.77% yesterday

Source: Bloomberg, RBC

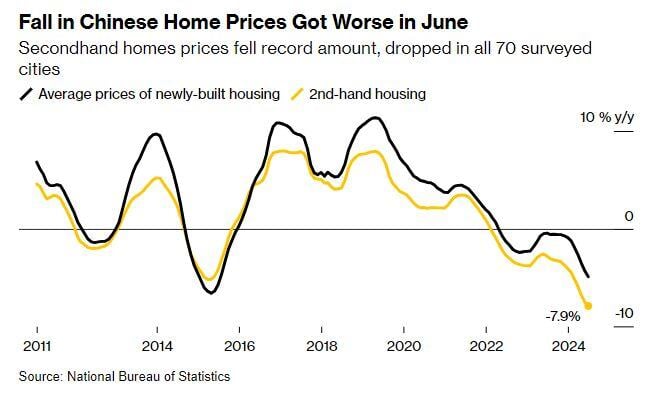

🚨 Chinese Existing Home Prices declined by 7.9% year-over-year last month, the largest decline in history!

Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks