Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

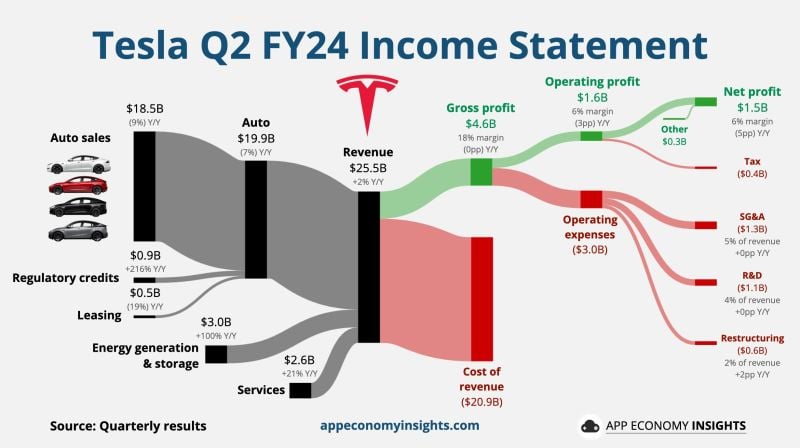

Tesla reports disappointing earnings for second quarter as revenue rises 2%

Tesla reported weaker-than-expected earnings for the second quarter as automotive sales dropped for a second straight period. The stock slid more than 2% in extended trading. $TSLA Tesla Q2 FY24 by App Economy Insights: • Revenue +2% Y/Y to $25.5B ($0.8B beat). • Gross margin 18% (-0.2pp Y/Y). • Operating margin 6% (-3pp Y/Y). • Capex +10% Y/Y to $2.3B. • Free cash flow +34% Y/Y to $1.3B. • Non-GAAP EPS $0.52 ($0.10 miss).

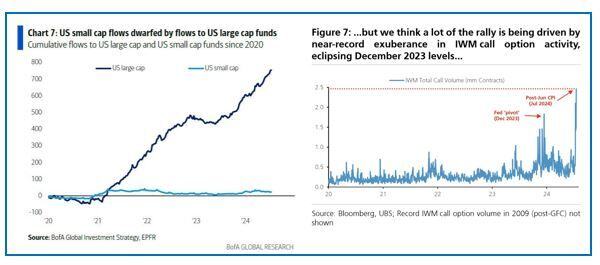

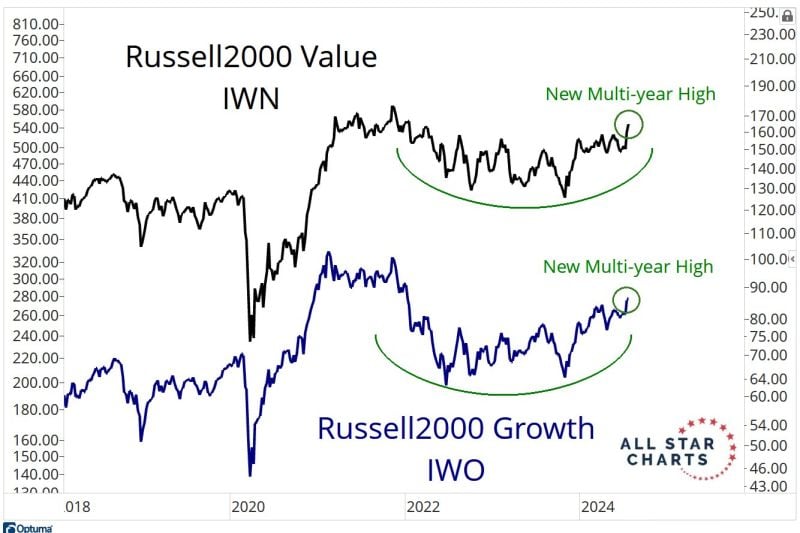

The current US small caps rally seems to be mainly driven near-record exuberance in Russell 2000 ETF $IWM call options activity

(chart on the right) rather than inflows into small caps funds (chart on the left). Source: BofA, UBS

Selling scarcity as illustrated by Quartr.

Visualizing the insane retail vs. resale price contrast of Patek Philippe's limited Tiffany (a part of LVMH) blue-colored timepiece. "You never actually own a Patek Philippe. You merely look after it for the next generation."

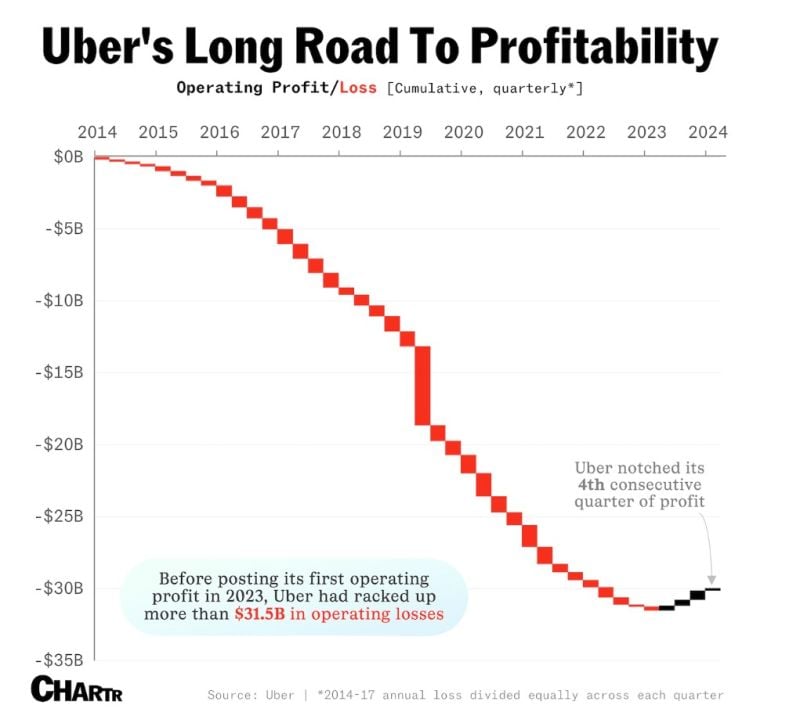

Uber long road to profitability...

In 2019, The Economist wondered aloud whether Uber would ever be profitable. The classic refrain from the company and its investors was that at a certain scale, it would be. It first had to get big enough and outlast enough of its competition. As it turns out, they were pretty much right. Last year, Uber had its first annual profit, and recent quarters have also been solidly in the black, with investors expecting another profitable quarter to be announced on August 6th. The company’s main rival still hasn't quite reached that scale. Lyft has narrowed its losses significantly, but is still in the red. Source; Chartr

That was the highest weekly close in over 30 months for both Small-cap Growth and Small-cap Value

Source: J-C Parets

Investing with intelligence

Our latest research, commentary and market outlooks