Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

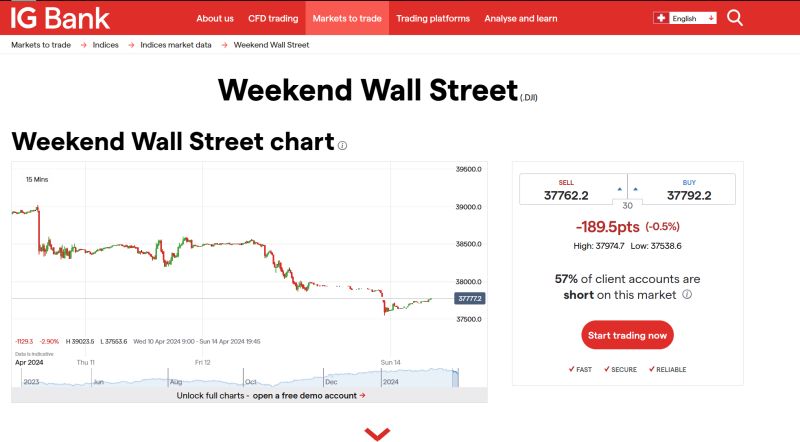

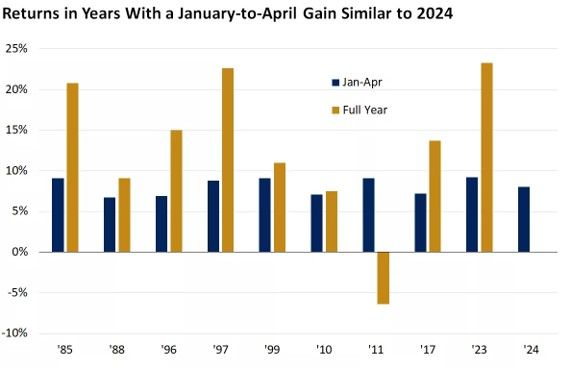

Healthy gains heading into May have historically been a good signal of a positive year for stocks.

Since 1982, when the stock market was higher on the year heading into May, it went on to post a full-year gain roughly 90% of the time. In that period, 1987, 2011 and 2015 were the only years in which the market was higher from January to April but finished the year lower.1 There were nine years in which the year-to-date increase heading into May was in the 6.5%–9.5% range, comparable to 2024’s 8% year-to-date gain. In those instances, the stock market went on to post an average full-year increase of 13%. Source: Edward Jones

CLS declines delaying FX cutoff as US stock changes loom

CLS Group, the largest currency settlement system, said on Tuesday it will not change its cut-off time for payment instructions for foreign exchange trades, dealing a blow to foreign asset managers hoping for some reprieve from a new U.S. rule putting them at risk of transaction failure. Beginning May 28, the U.S. Securities and Exchange Commission requires investors start settling U.S. equity transactions one day after the trade, or T+1, instead of the current two days. source : investing

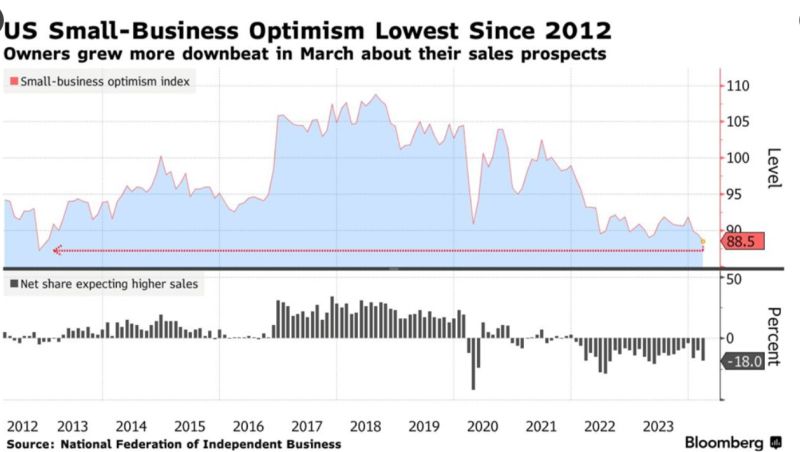

US Small-Business Optimism Falls to a More Than 11-Year Low

source : Bloomberg

SEC delays decision on spot bitcoin ETF options

American regulators are again delaying a decision by 45 days on whether to allow options on spot bitcoin ETFs. The Securities and Exchange Commission published a notice Monday saying that it "designates May 29, 2024 as the date by which the Commission shall either approve or disapprove, or institute proceedings to determine whether to disapprove," allowing the New York Stock Exchange to start listing options on spot bitcoin ETFs. source : theblock

China and Hong Kong stocks lost nearly $5 trillion in 3 years — more than India’s market cap

Stocks in China and Hong Kong sold off a massive $4.8 trillion in market capitalization since 2021, which according to HSBC, is more than the value of the Indian stock market. Indian stocks have rallied amid broader optimism about the country’s growth. Despite a subdued global IPO market, research from EY showed Indian stock exchanges also had the most IPOs in 2023. https://lnkd.in/eFCFMe2s Source: CNBC

Investing with intelligence

Our latest research, commentary and market outlooks