Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

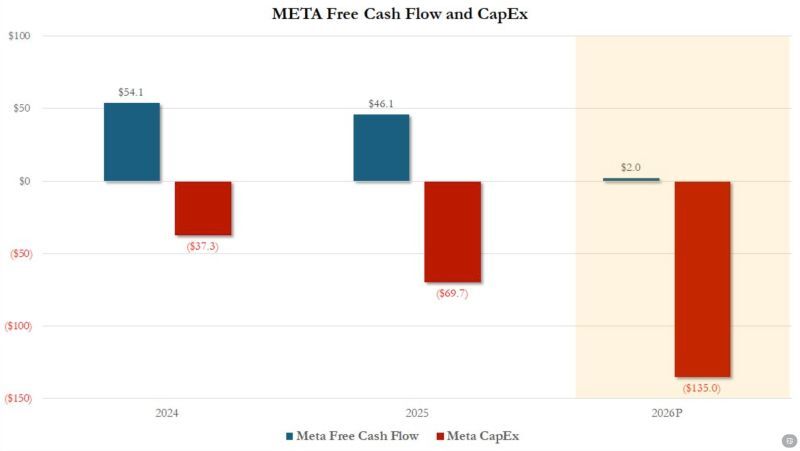

At the high end of its capex forecast ($135BN), META free cash flow in 2026 will be $0

Source: zerohedge

💥 Meta is building a $27 BILLION data center in Louisiana…

👉 But none of it shows up on Meta’s balance sheet. How? Meta shifted the entire project into a joint venture: 🔹 Meta owns 20% 🔹 Blue Owl Capital owns 80% 🔹 A holding company (Beignet Investor) issued $27.3B in bonds, mostly bought by Pimco 🔹 Meta will rent the data center starting in 2029 And here’s the kicker: the lease is structured to qualify as an operating lease, not a finance lease — letting Meta avoid listing the giant asset and the massive debt. But peel back the layers and things get messy: 🔥 Meta runs the data center 🔥 Meta carries the risk of cost overruns 🔥 Meta guarantees the full value of the bonds if they don’t renew 🔥 Yet Meta insists it doesn’t “control” the venture enough to count it on the books Even the Wall Street Journal called it “artificial accounting.” 🧩 It’s part of a bigger trend: Tech giants want unlimited AI infrastructure… 🚫 …but they don’t want the debt that comes with it. Morgan Stanley estimates the industry could need $800B in off-balance-sheet financing by 2028. Meta may not be borrowing on paper — but economically, this is debt with extra steps. What do you think: smart financial engineering or a red flag in disguise? Source: Hedgie

The market’s view has shifted dramatically.

Back in June, Alphabet and Meta were seen as roughly on par, w/only ~$200bn separating them in market value. Just 4 months later, the picture looks completely different – the gap has exploded to nearly $1.8tn. GOOG is now 2x the market cap of META. (HT Goldman) Source: Holger Zschaepitz @Schuldensuehner

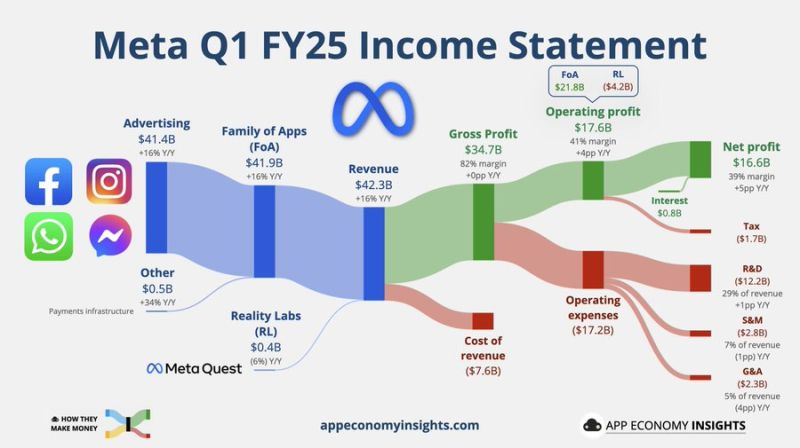

Social media giant Meta (META) reported its first quarter results after the bell on Wednesday, beating on the top and bottom lines.

But the company also raised its full-year capital expenditure estimates to between $64 billion to $72 billion, up from $60 billion to $65 billion. Despite fears of an advertising slowdown amid tariff uncertainty, Meta says it anticipates Q2 revenue of between $42.5 billion and $45.5 billion, ahead of Wall Street's expectations of $44 billion. $META Meta Q1 FY25: 👨👩👧👦 Daily active people +6% Y/Y to 3.43B. 👀 Ad impressions +5% Y/Y. • Revenue +16% Y/Y to $42.3B ($1.0B beat). • Operating margin 41% (+4pp Y/Y). • EPS $6.43 ($1.21 beat). • FY25 Capex: $64-$72B (prev. $60-$65B).

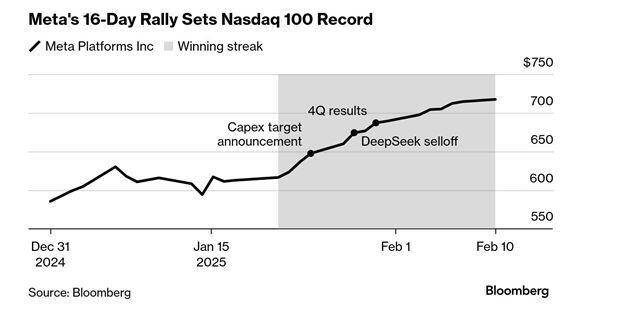

Meta's Record Run

The shares are coming off a rally of 16 straight sessions, the longest streak of any current Nasdaq 100 Index company going back to 1990. The stock added more than 17% over the surge, bringing its market capitalization above $1.8 trillion. source : bloomberg

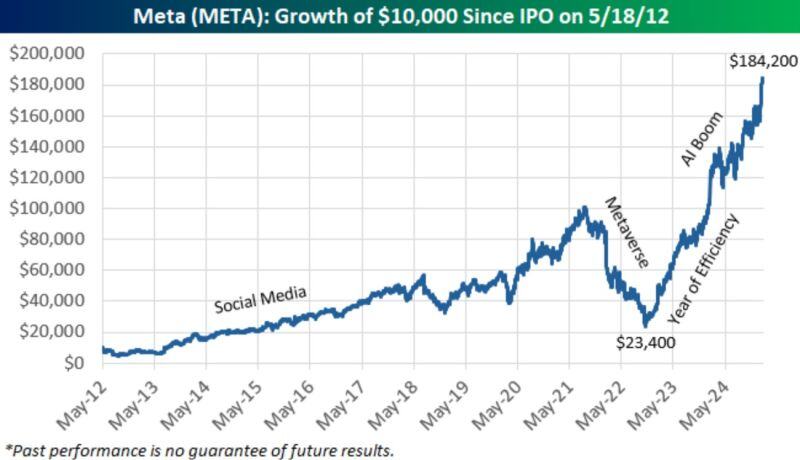

As Facebook turns 21, here's a look at the growth of $10k in $META since its IPO in May 2012.

As a reminder, this stock saw a 76% drawdown from late 2021 to late 2022. It has rallied nearly 700% since its 2022 low. source : bespoke

Investing with intelligence

Our latest research, commentary and market outlooks