Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

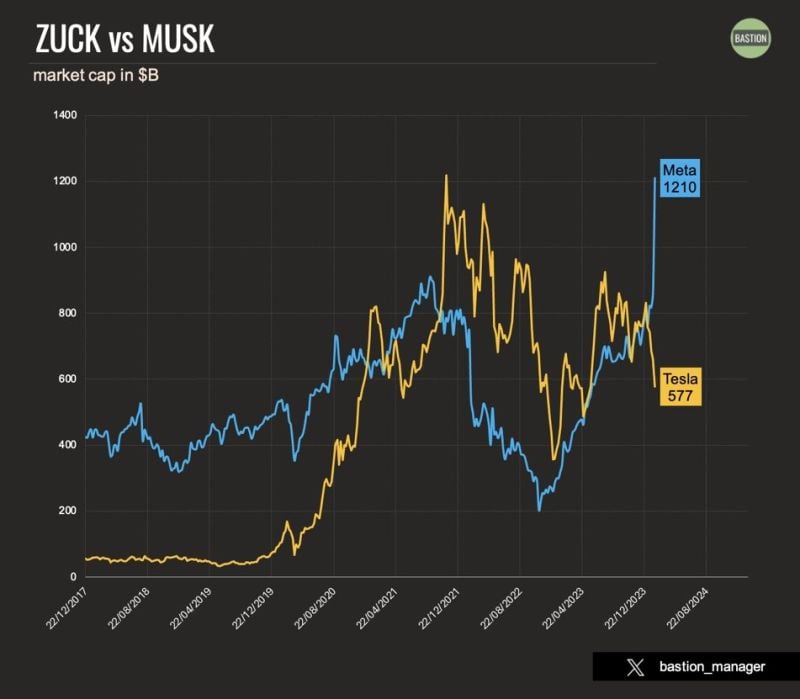

$META is up 70% this year and has soared 550% since bottoming in October 2022

If you invested $10,000 in October 2022, you would have over $65,000 Source: Stocktwits

JUST IN: *META, APPLE REPORTEDLY DISCUSSED AI COOPERATION - WSJ

The Wall Street Journal is reporting that Apple and Meta have discussed a partnership that would see Meta AI models integrated into iOS 18 for Apple Intelligence. This integration would likely be similar to the deal Apple has struck with ChatGPT, which is currently the only third-party partner for Apple Intelligence.

Meta plunges 18% on weak revenue guidance even as first-quarter results top estimates.

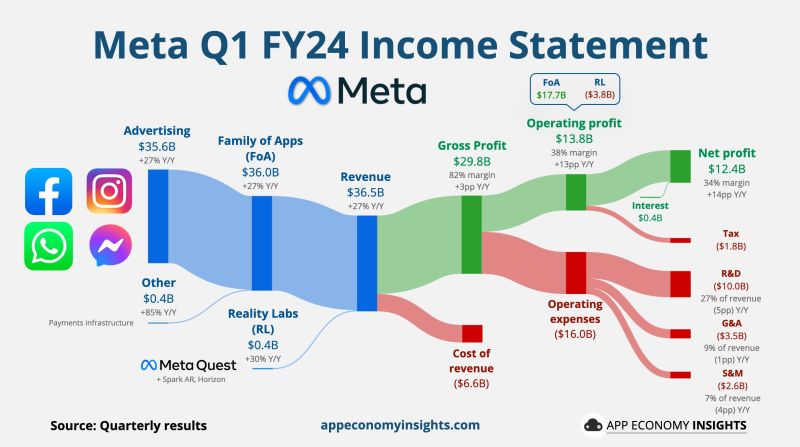

$META Meta Q1 FY24: Daily active people +7% Y/Y to 3.2B. Ad impressions +20% Y/Y. • Revenue +27% Y/Y to $36.5B ($0.2B beat), the fastest rate of expansion for any quarter since 2021. • Operating margin 38% (+13pp Y/Y). • FCF margin 34% (+10pp Y/Y). • EPS $4.71 ($0.39 beat). • FY24 Capex $35-40B ($30-$37B prev.) • Net income more than doubled to $12.37 billion, or $4.71 per share, from $5.71 billion, or $2.20 per share, a year ago. One reason for the pop in net income is that, while revenue growth accelerated, sales and marketing costs dropped 16% in the quarter from a year earlier. Meta said it expects sales in the second quarter of $36.5 billion to $39 billion. The midpoint of the range, $37.75 billion, would represent 18% year-over-year growth and is below analysts’ average estimate of $38.3 billion. The stock selloff accelerated early in the earnings call after Zuckerberg jumped into his discussion about investments, namely in areas like glasses and mixed reality, where the company doesn’t currently make money. The company no longer reports daily active users and monthly active users. It now gives a figure for what it calls “family daily active people.” That number was 3.24 billion for March 2024, a 7% increase from a year earlier. Meta has raised investor expectations due to its improved financial performance in recent quarters, leaving little room for error. The stock is up about 40% this year after almost tripling last year. Source: App Economy Insight, CNBC

BREAKING: Meta stock, $META, has now erased $240 BILLION of market cap after reporting earnings, down as much as 19%.

If $META closes at current levels tomorrow, it will mark the BIGGEST EVER 1-day loss of market cap by a stock. The previous record is also held by $META when the stock shed $232 billion on February 3rd, 2022. Source: The Kobeissi Letter

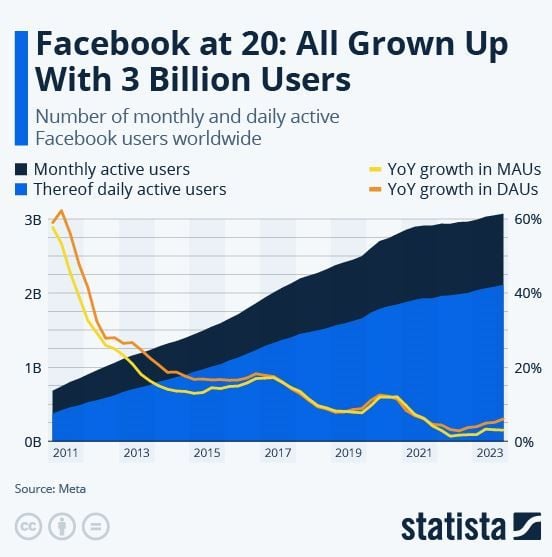

Happy 20th birthday, Facebook

To this day, Facebook has never seen a year-over-year drop in active users and once it happens, we won't know, because the company announced that it won't be reporting Facebook user numbers going forward. Instead, the company will focus on metrics that are more relevant to its advertising business, such as changes in ad impressions and the average price per ad at the regional level. source : statista

From Facebook to Meta...

Swith the benefit of insight the renaming wasn't that bad after all... More seriously, it seems that the shift from metaverse to ai and the focus on shareholder value have been working very well. What a turnaround by Zuck... By the way, he will receive a $175 million quarterly dividend, on track for making $700 million annually in dividend... Is Mark Zuckerberg the mist underrated tech CEO. Source chart: Mac10

Investing with intelligence

Our latest research, commentary and market outlooks