Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

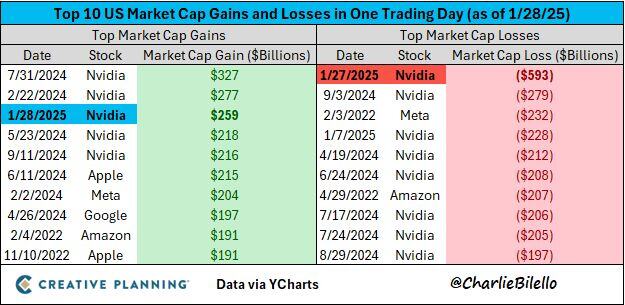

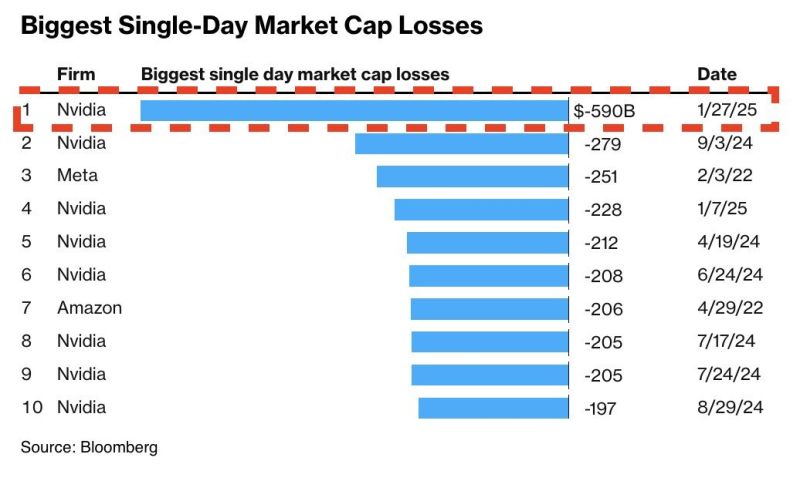

Nvidia's market cap increased by $259 billion today after the stock rallied 9%, bouncing back from yesterday's record decline.

This was the 3rd largest single day increase in market cap for any US company (Nvidia already holds the #1/#2 spots). $NVDA Source: Charlie Bilello

Nvdia closed at $118 yesterday,

below its 200-day Moving average yesterday. The last time it happened the stock was trading at... $16 Source: Trend Spider

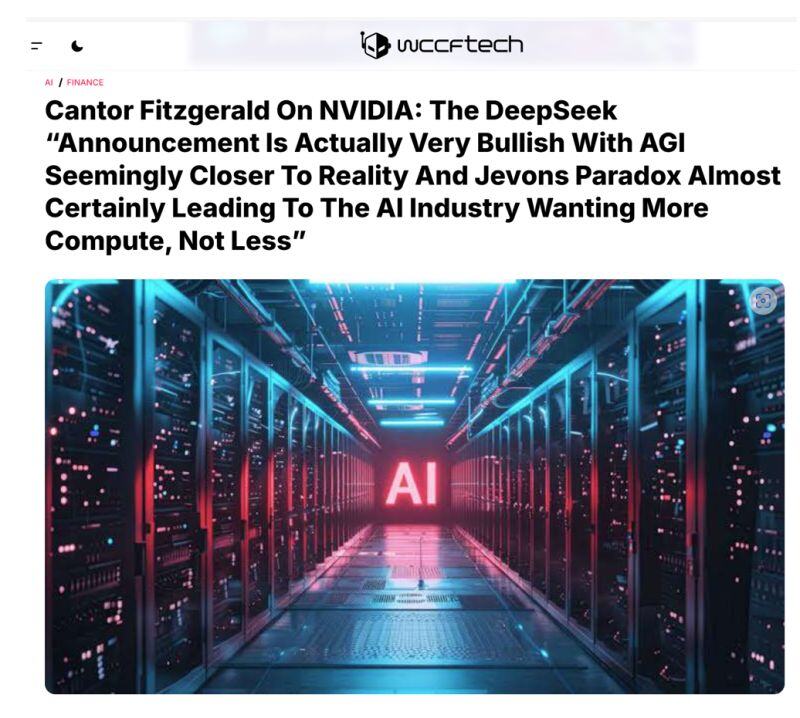

DeepSeek V3 ‘bullish’ for Nvidia, would buy on weakness, says Cantor Fitzgerald - Would you agree???

DeepSeek’s V3 large language model is “actually very bullish” for Nvidia (NVDA) and compute, despite “great angst” around the impact for compute demand and fears of peak spending on GPUs, Cantor Fitzgerald tells investors. The firm says DeepSeek’s advances mean artificial general intelligence is closer, and that work will continue on pre-training, post-training, and time-based inference/reasoning, and future investments in large-scale clusters will only accelerate, all of which is bullish for AI. The firm would buy shares of Nvidia on any potential weakness. Cantor has an Overweight rating and $200 price target on the shares. Source: Markets Insider

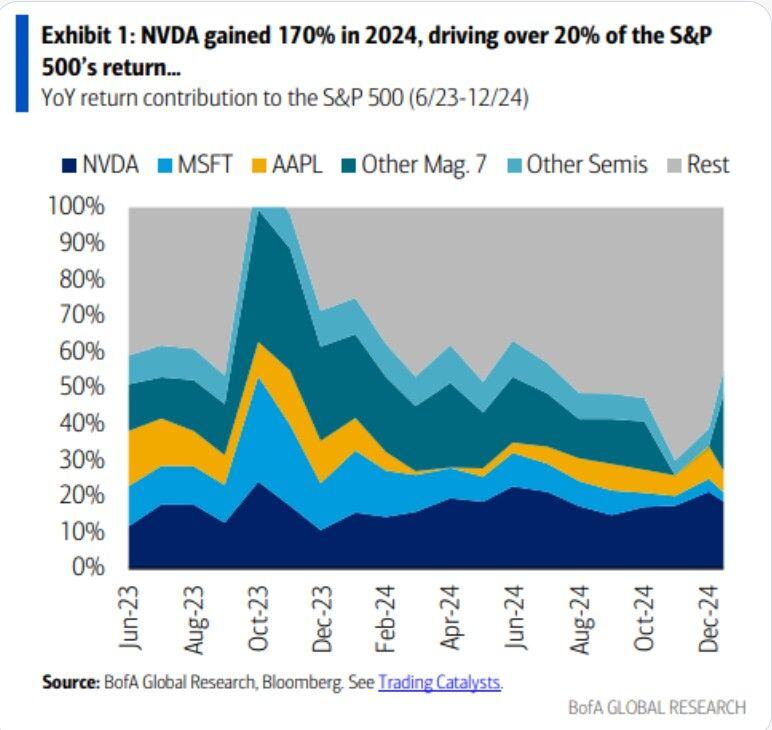

$NVDA: The Driving Force Behind the S&P 500’s 2024 Rally

NVIDIA’s incredible 170% gain in 2024 has played a pivotal role in the market’s performance, contributing to over 20% of the S&P 500’s return. source : BofA, Mike Zaccardi, CFA, CMT, MBA

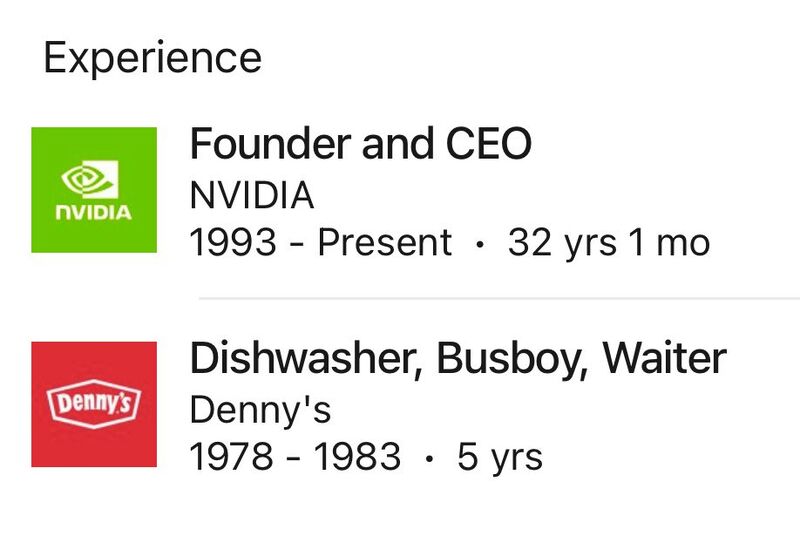

The CEO of Nvidia has a legendary LinkedIn profile:

Source: Brew Markets @brewmarkets

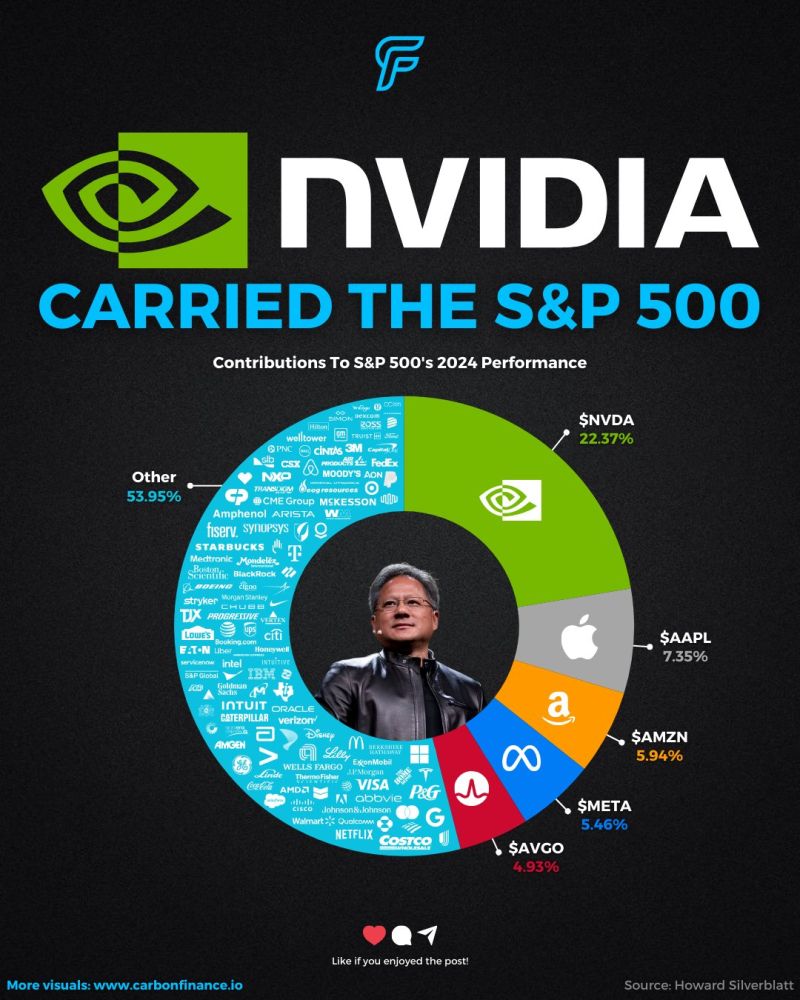

Nvidia $NVDA carried the S&P 500 $SPX in 2024

The AI leader drove 22% of the index’s total gains. Apple $AAPL, Amazon $AMZN, and Meta $META added another 19% combined. Broadcom $AVGO chipped in nearly 5%. These 5 companies powered almost half of the index's 2024 returns. Source: Carbon Finance

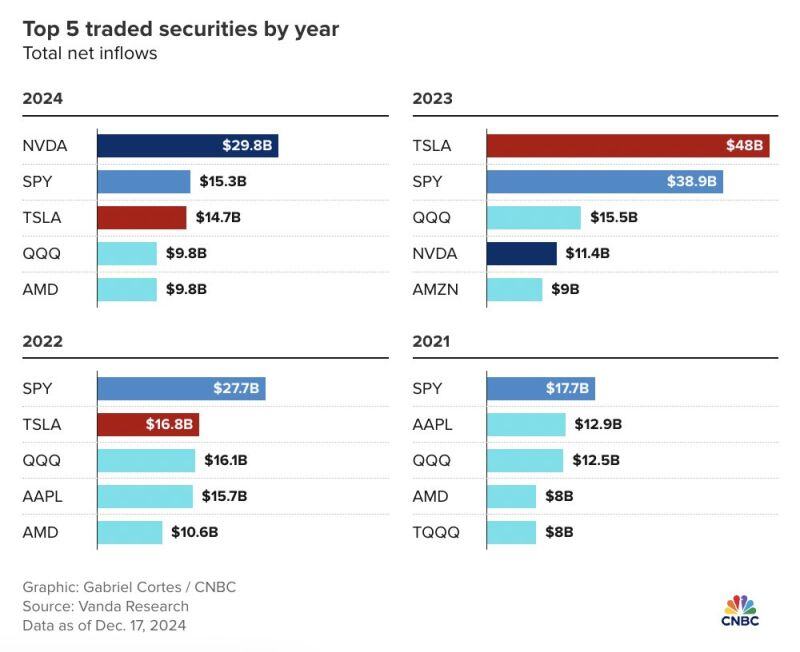

Nvidia $NVDA was the most-bought stock by retail traders on net in 2024

Source: CNBC, Evan on X

Investing with intelligence

Our latest research, commentary and market outlooks