Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

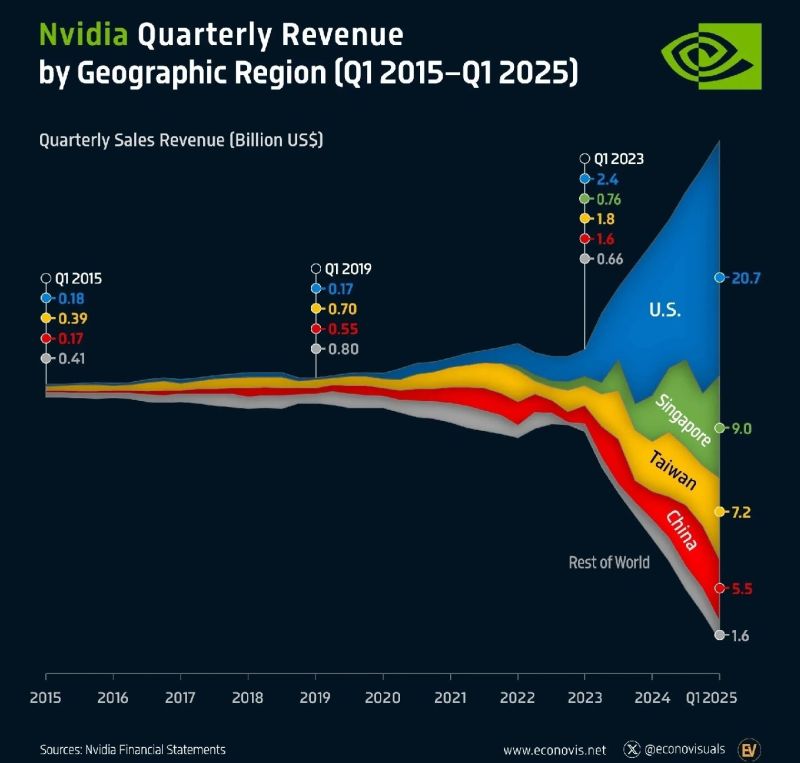

Nvidia quarterly revenues by regions over time...

Up to 20% of Nvidia’s revenue comes from Singapore a known gateway to China and when including direct sales to China and Hong Kong, roughly one-third of its total revenue ($15 billion) may be exposed to Chinese market risk. Source: econovisuals

$NVDA Q1 2026

"AI inference token generation has surged tenfold in just one year, and as AI agents become mainstream, the demand for AI computing will accelerate." - Jensen Huang Revenue +69% *Data Center +73% *Gaming +42% *Professional Vis. +19% *Automotive +72% EBIT +28% *marg. 49% (65) EPS +27% Source: Quartr

Nvidia $NVDA stock is up almost 4% in after hours after beating EPS and Revenue expectations

Source: Barchart

NVIDIA $NVDA CEO JENSEN HAUNG JUST SHARES HIS THOUGHTS ON US EXPORT CONTROLS FOR AI:

"The question is not whether China will have AI. It already does. The question is whether one of the world's largest AI markets will run on American platforms. Shielding Chinese chipmakers from US competition only strengthens them abroad. Weakens America's position. Export restrictions have spurred China's innovation and scale. The AI race is not just about chips. It's about which stack the world runs on." "The US has based its policy on the assumption that China cannot make AI chips. That assumption was always questionable, and now it's clearly WRONG. China, has enormous manufacturing capability. In the end, the platform that wins the AI developers wins AI. Export controls should strengthen US platforms not drive half of the world's AI talent to rivals" Source: Evan on X

Yesterday, NVIDIA announced a strategic partnership with HUMAIN, a subsidiary of Saudi Arabia’s Public Investment Fund (PIF), to advance AI and digital infrastructure.

The key components of this partnership include: 👉 AI Factories and Infrastructure: NVIDIA and HUMAIN will develop hyperscale AI data centers with a projected capacity of up to 500 megawatts, powered by several hundred thousand of NVIDIA’s advanced GPUs over the next five years. The initial phase involves deploying an 18,000 NVIDIA GB300 Grace Blackwell AI supercomputer with NVIDIA InfiniBand networking. 👉 NVIDIA Omniverse Platform: HUMAIN will implement NVIDIA’s Omniverse platform as a multi-tenant system to create digital twins, enhancing efficiency and safety in sectors like manufacturing, logistics, and energy. This supports Saudi Arabia’s Industry 4.0 goals.

🔴 Nvidia CEO Jensen Huang said Wednesday that China is “not behind” in artificial intelligence, and that Huawei is “one of the most formidable technology companies in the world.”

👉 Speaking to reporters at a tech conference in Washington, D.C., Huang said China may be “right behind” the U.S. for now, but it’s a narrow gap. “We are very close,” he said. “Remember this is a long-term, infinite race.” 👉 The Trump administration this month restricted the shipment of Nvidia’s H20 chips to China without a license. That technology, which is related to the Hopper chips used in the rest of the world, was developed to comply with previous U.S. export restrictions. Nvidia said it would take a $5.5 billion hit on the restriction. 👉 Huawei, which is on a U.S. trade blacklist, is reportedly working on an AI chip of its own for Chinese customers. “They’re incredible in computing and network technology, all these essential capabilities to advance AI,” Huang said. “They have made enormous progress in the last several years.”

China’s Huawei Technologies is preparing to test its newest and most powerful artificial intelligence (AI) processor

it hopes to replace some higher-end products of US chip giant Nvidia, the Wall Street Journal has reported. Huawei has approached some Chinese tech companies about testing the technical feasibility of the new chip, called the Ascend 910D, the United States newspaper reported Sunday, citing people familiar with the matter. This was part of our "10 surprises 2025": SURPRISE #6 FROM MAG7 TO LAG7 https://lnkd.in/eKXRsc58

Nvidia said on Tuesday that it will take a quarterly charge of about $5.5 billion tied to exporting H20 graphics processing units to China and other destinations

The stock slid almost 5% in extended trading. ➡️ Biden placed these original restrictions on Nvidia, to not allow China to get their hands on the latest generation chips. Nvidia spent billions on new less powerful chips that met the U.S. original criteria so it could still sell to China. And now Trump has ruled those same chips as illegal to be sold to China. For businesses, it is very difficult to operate with this level of policy volatility... Source: Bloomberg, Spencer Hakimian @SpencerHakimian

Investing with intelligence

Our latest research, commentary and market outlooks