Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

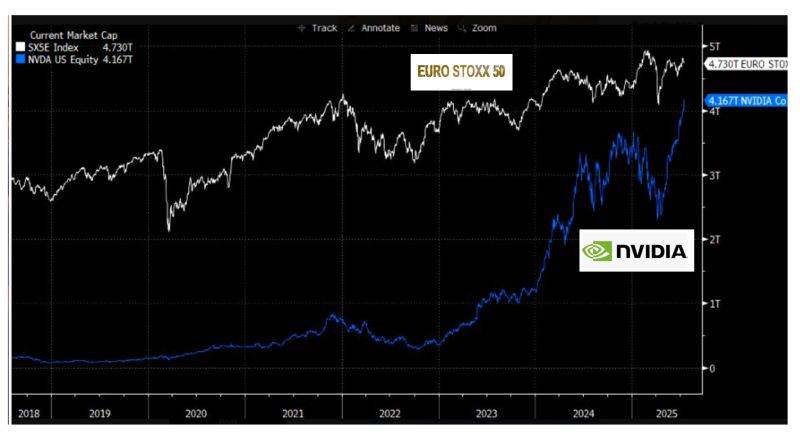

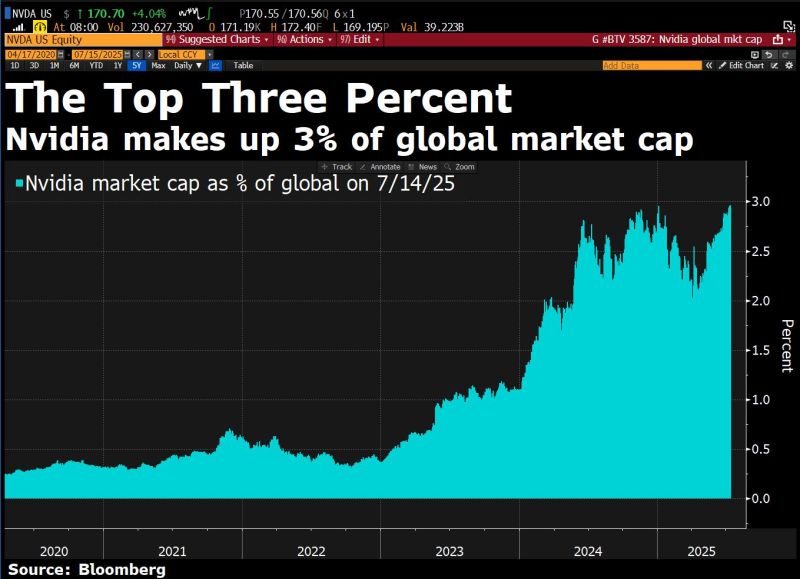

Nvidia is 3% of global market cap. The other 82,292 stocks (Bloomberg-tracked primary listings) make up the other 97%.

Source: David Ingles, Bloomberg

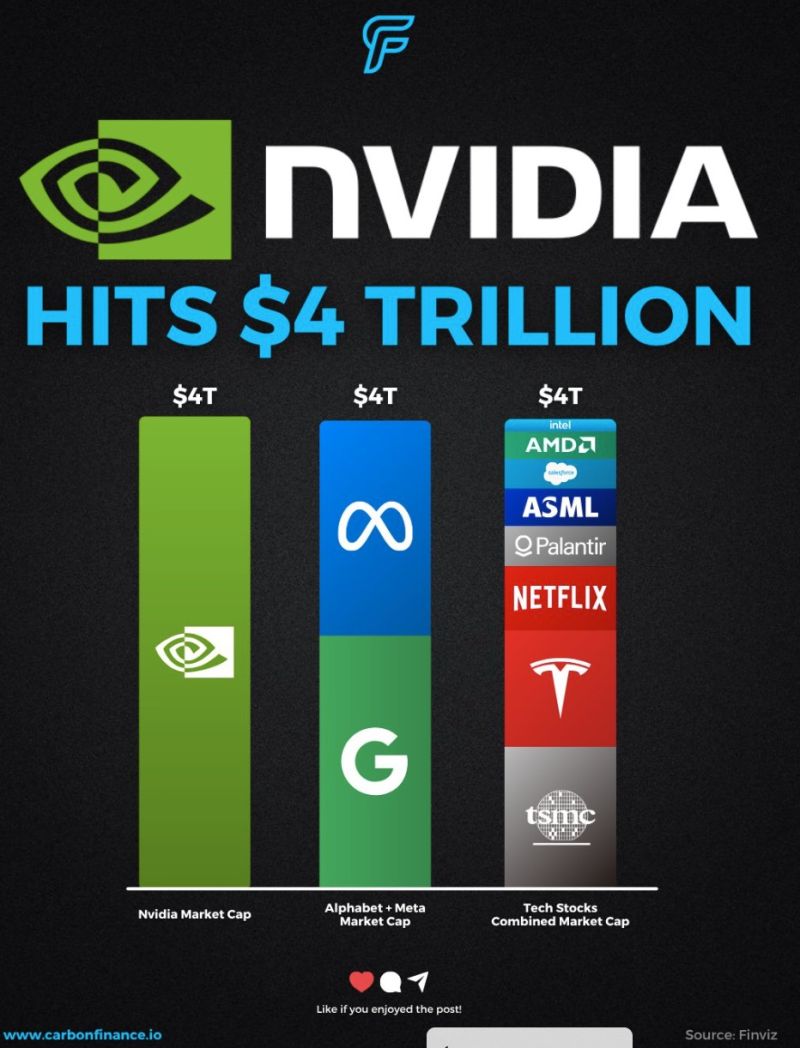

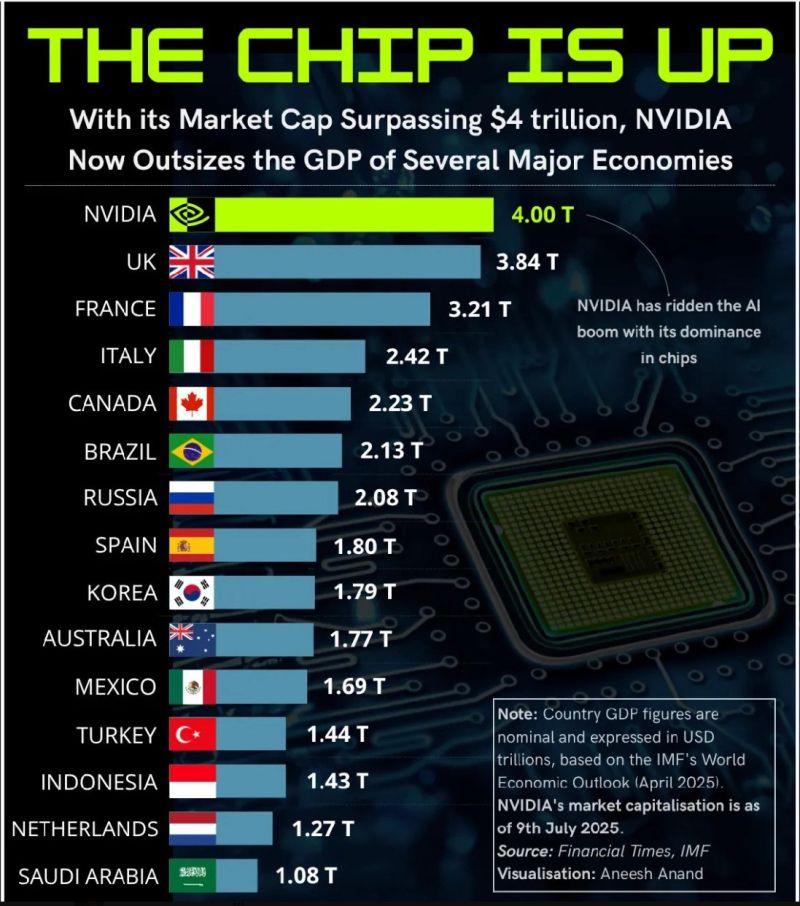

Nvidia's market capitalization exceeds Germany's by nearly $1 trillion.

The size and success of this giant, and the other US tech behemoths, underscores how much the AI trade can overwhelm the market's response to week-to-week fluctuations in economic data and policy headlines - Lisa Abramowicz @lisaabramowicz1 on X, Bloomberg

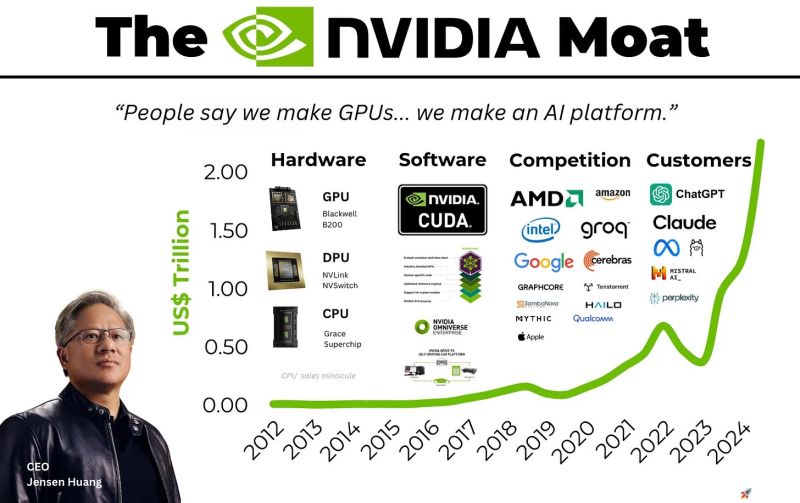

Nvidia $NVDA MOAT IS PROTECTED BY THREE KEY PILLARS

• CUDA lock-in -- decades of ecosystem depth and unmatched developer tooling • Supply chain control -- co-designed with $TSM, early access to HBM3E, and vertical coordination • Inference dominance -- where most AI workloads are headed, and where NVIDIA leads on both efficiency and software Source: Futurum Equities @FuturumEquities

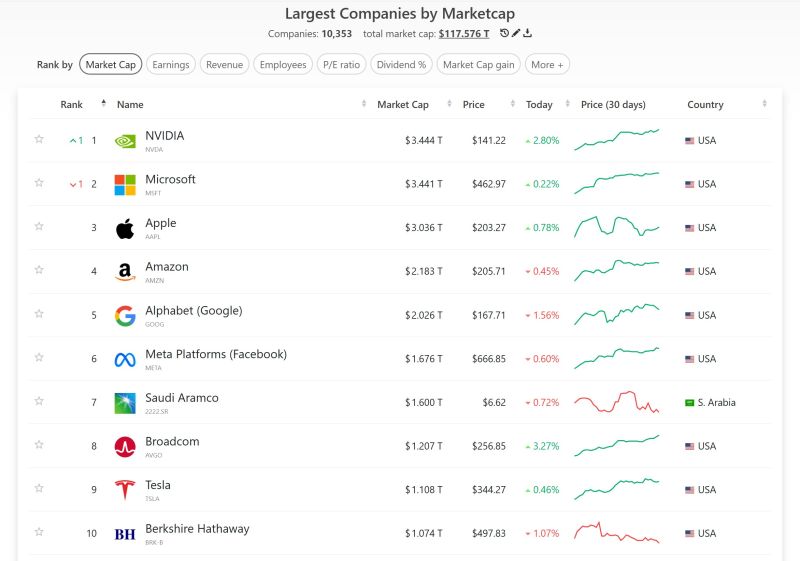

Yesterday, Nvidia $NVDA became the world's most valuable company at $3.444 Trillion, surpassing Microsoft $MSFT

Source: Companies Market Cap

Investing with intelligence

Our latest research, commentary and market outlooks