Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

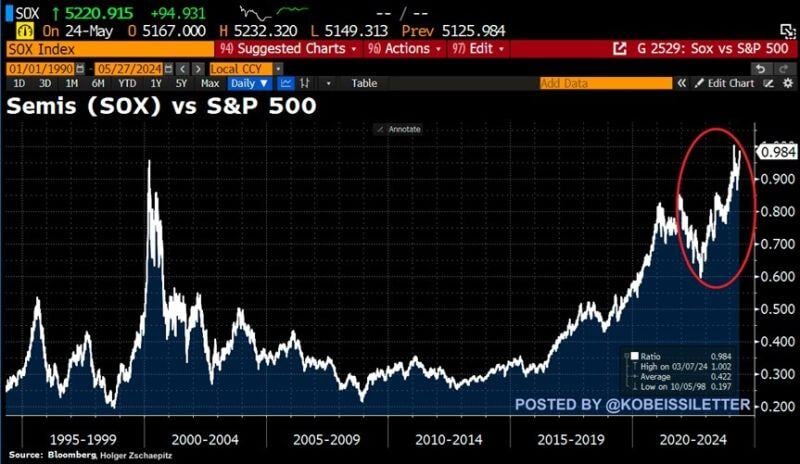

The Semiconductor Index, $SOX, relative to the S&P 500 has once again exceeded Dot-com bubble levels.

The Semis vs S&P 500 ratio has roughly doubled in just 2 years. This comes after a massive semiconductor sector rally of 85% compared to a 35% gain in the S&P 500. The rally has been led by NVIDIA, $NVDA, which has seen a 560% surge during this time. Meanwhile, the top 10% of stocks in the US now reflect ~75% of the entire market, the most since The Great Depression of 1929-1939. Source: The Kobeissi Letter, Bloomberg

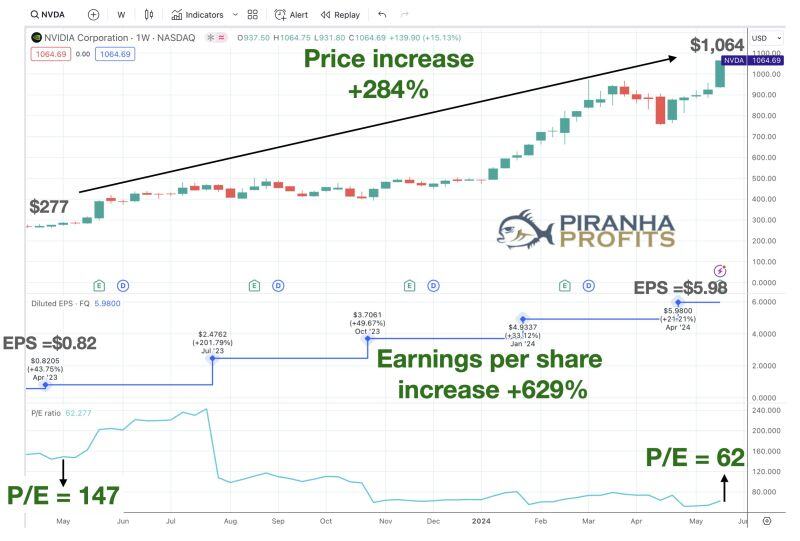

The higher a stock's price goes, the more expensive it gets. Right? Well, not always.

A year ago, when NVDA was selling at $277, its earnings per share was $0.82 and its P/E ratio was 147x Today, NVDA's share price is up +284% to $1,064.... BUT... Its earnings per share is up +629% to $5.98. Its P/E has fallen to 62x... forward P/E is now at 30x So, NVDA is CHEAPER today than it was a year ago. Source: Adam Khoo Trader, Piranha Profits

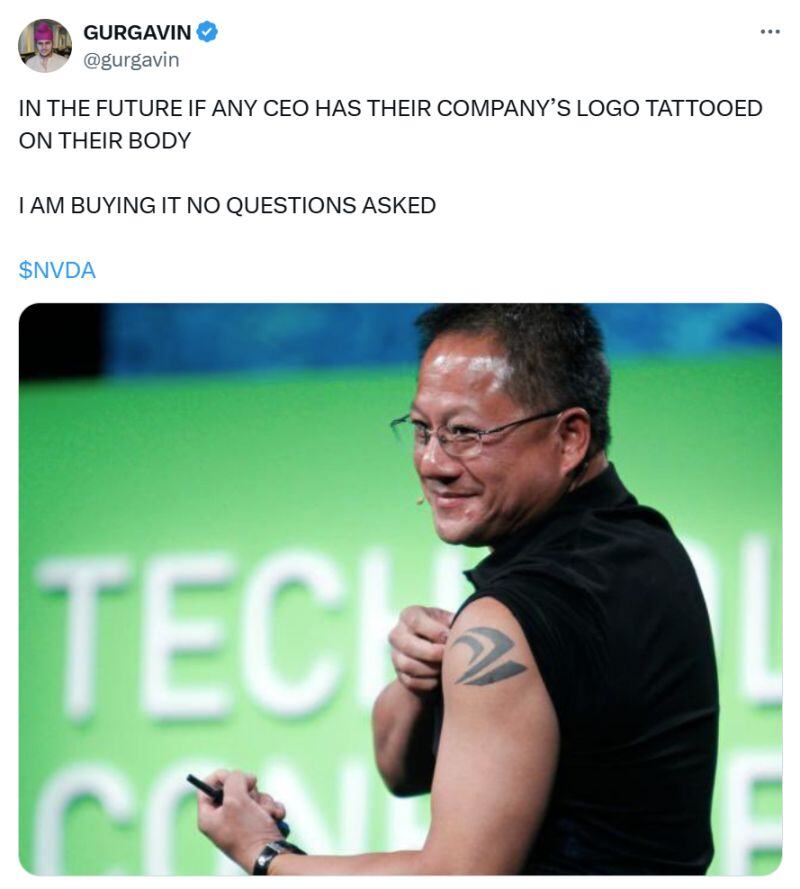

A key point on Nvidia story: $NVDA CEO Jensen Huang doesn't lack demand. What he lacks is supply.

In an exclusive interview following last week's earnings Huang said demand for its programs will soon outstrip supply, with the complexity of these chips also challenging the company's efforts to keep pace. Source: Yahoo Finance

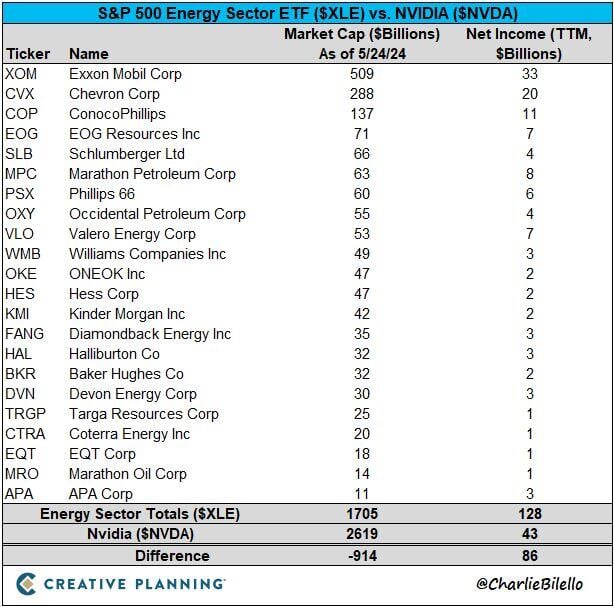

Nvidia vs US energy sector...

At $2.6 trillion, Nvidia's market cap is now over $900 billion higher than all of the companies in the S&P 500 Energy sector ... combined. The net income of the Energy sector is $128 billion vs. $43 billion for Nvidia. $NVDA $XLE Source: Charlie Bilello

Thursday's US stock market heat map. $NVDA is literally holding up the entire market.

Source: The Kobeissi Letter

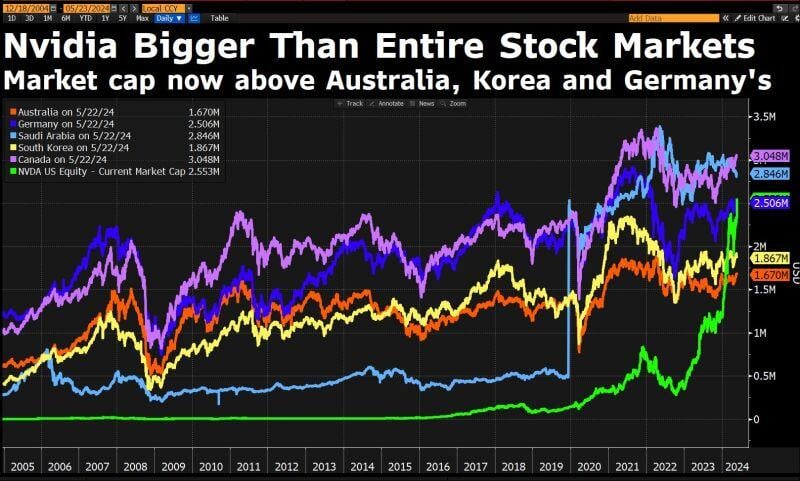

Nvidia is bigger than entire German stock market, the entire Australian market or the entire Korean market.

Canada and Saudi are within reach. Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks