Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Nvidia stock, $NVDA, surged toward $1,000/share ($2.5 trillion market cap) in after-hours trading after reporting earnings and 10:1 stock split.

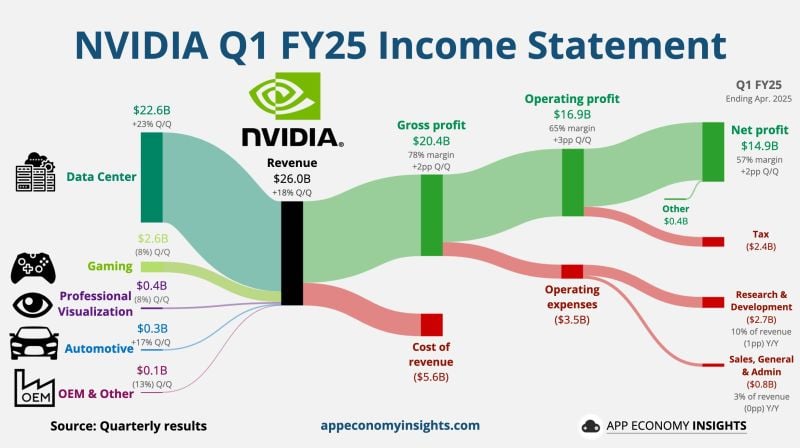

The company posted record quarterly revenue of $26 billion on EPS of $6.12, both above expectations. Here are the details: • Revenue +18% Q/Q to $26.0B ($1.5B beat). This marks a 260% jump in year-over-year revenue for the 3rd largest company in the world. • Gross margin 78% (+2pp Q/Q). • Operating margin 65% (+3pp Q/Q). • Net Income hit another record high at $14.88 billion in Q1. That's a 628% increase over last year's Net Income of $2.04 billion • Non-GAAP EPS $6.12 ($0.54 beat). • Dividend raised by 150%. Q2 FY25 guidance: • Revenue ~$28.0B ($1.2B beat). By some estimates, Nvidia controls a whopping 95% of the AI chip market right now. The rise of AI has added trillions in market cap over the last 2 years. Nvidia has made itself the leader of the AI revolution.

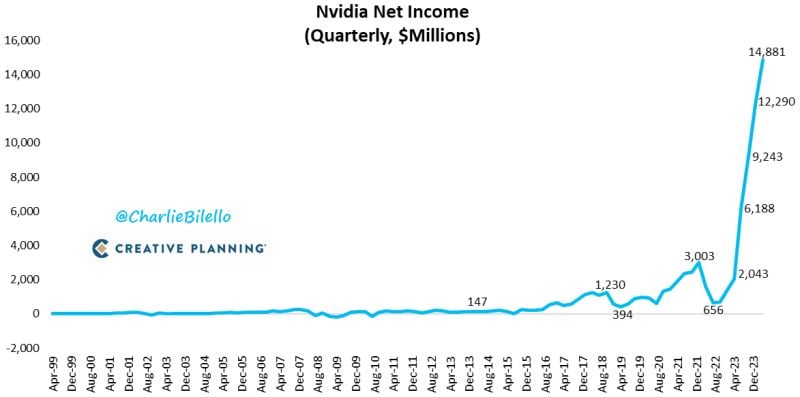

Nvidia's Net Income hit another record high at $14.88 billion in Q1.

That's a 628% increase over last year's Net Income of $2.04 billion. $NVDA Source: Charlie Bilello

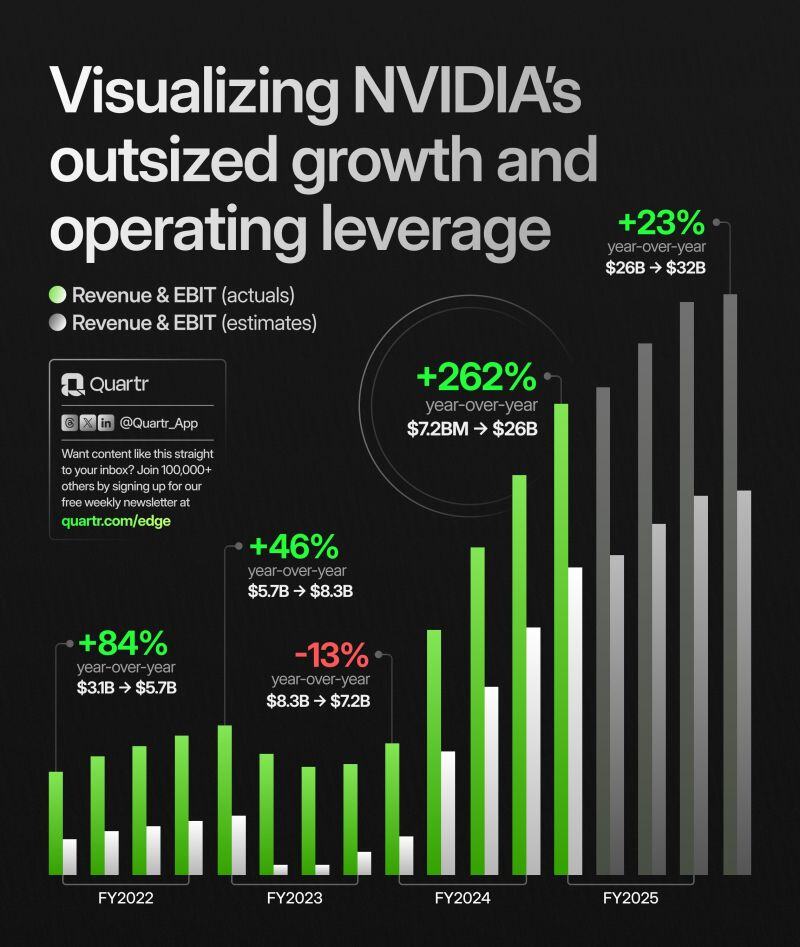

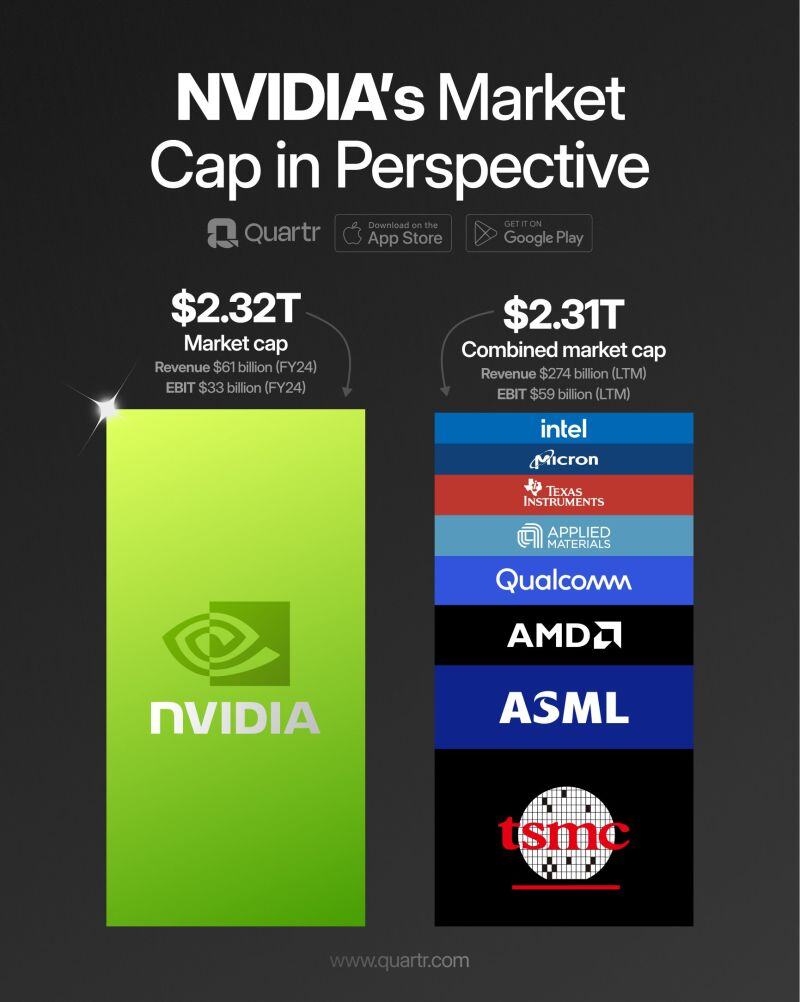

Visualizing Nvidia's outsized growth and operating leverage by Quartr:

$NVDA Q1 2025 Revenue +262% *Data Center +427% *Gaming +18% *Professional Vis. +45% *Automotive +11% EBIT +690% *marg. 65% (30) EPS +629% Source: Quartr

A $2.4 TRILLION STOCK TOMORROW?

BREAKING: Nvidia stock, $NVDA, surges toward $1,000/share after reporting earnings and 10:1 stock split. The company posted record quarterly revenue of $26 billion on EPS of $6.12, both above expectations. This marks a 260% jump in year-over-year revenue for the 3rd largest company in the world. $NVDA is set to open tomorrow with a record market cap above $2.4 TRILLION. Nvidia continues to crush expectations. Source: The Kobeissi Letter

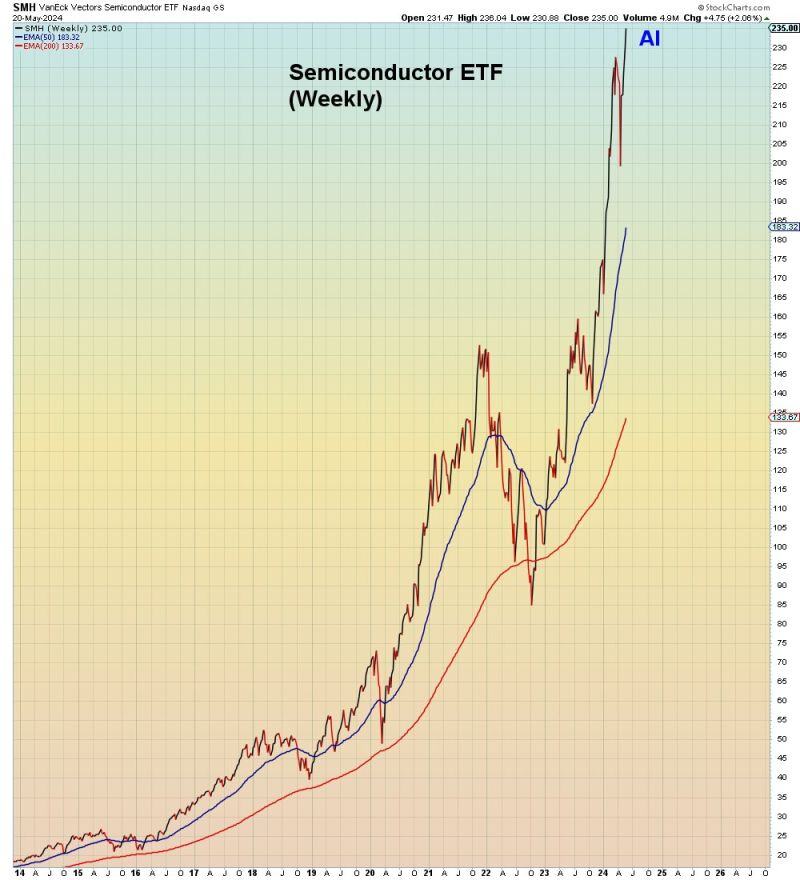

Is this sustainable? Nvidia results tonight might give us a clue...

Source: Mac10

$NVDA publishes its Q1 FY 2025 report today.

The company is now the third-largest in the world, trailing only $MSFT and $AAPL, after seeing its market cap rise by 200% over the last year alone. Will the brutal momentum continue? Source: Quartr

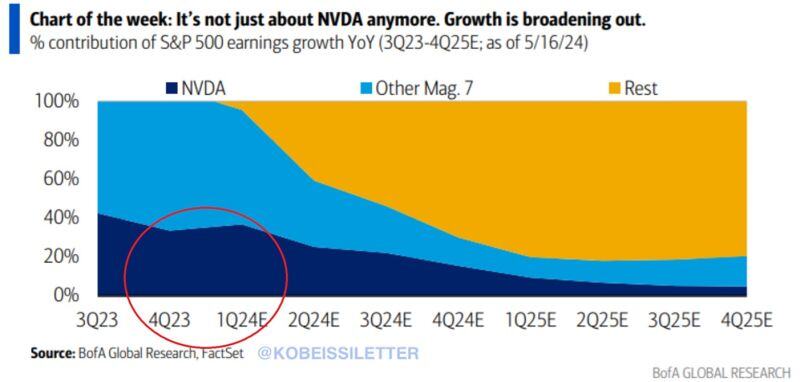

All eyes are on Nvidia this week: Nvidia, $NVDA, earnings alone drove 42% and 37% of the S&P 500 year-over-year EPS growth in Q3 and Q4 2023.

The company also accounted for 11% of the entire S&P 500's return over the last 12 months. In Q1 2024, Nvidia’s contribution to the S&P 500's EPS growth is estimated to reach ~40%. Nvidia's Q1 2024 EPS and revenue are projected to grow by 474% and 241%, respectively. Source: The Kobeissi Letter, BofA

Investing with intelligence

Our latest research, commentary and market outlooks