Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

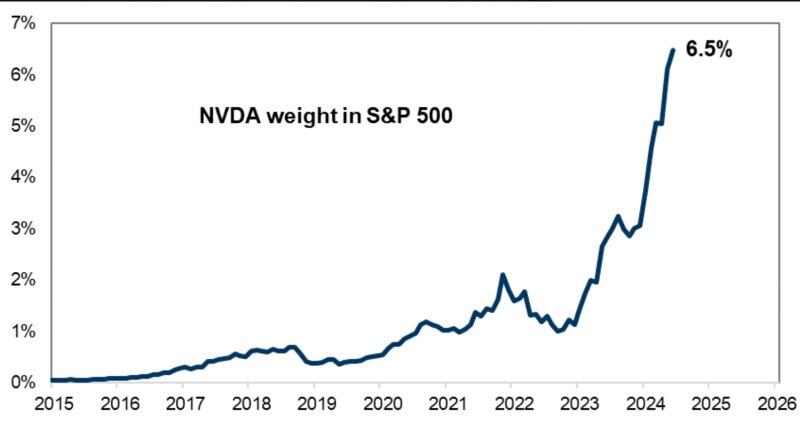

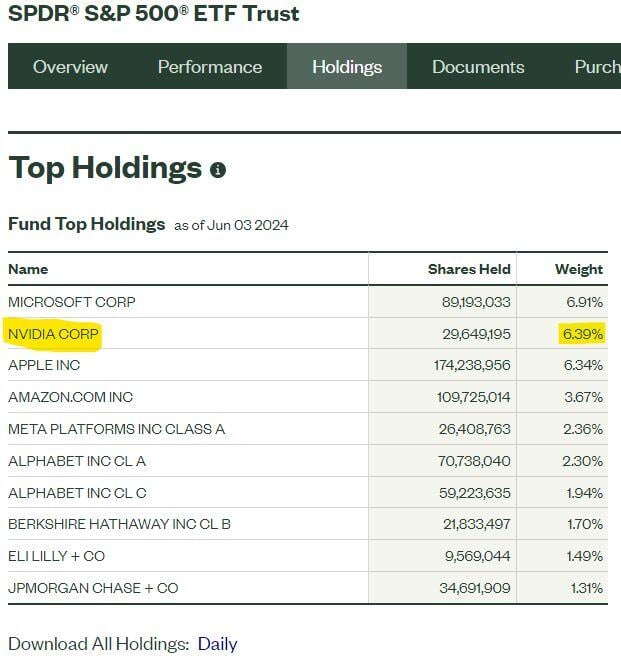

Nvidia $NVDA hit a new all-time high today of $1,166 and has passed Apple to become the 2nd largest holding in the S&P 500.

$SPY $NVDA $AAPL Source: Charlie Bilello

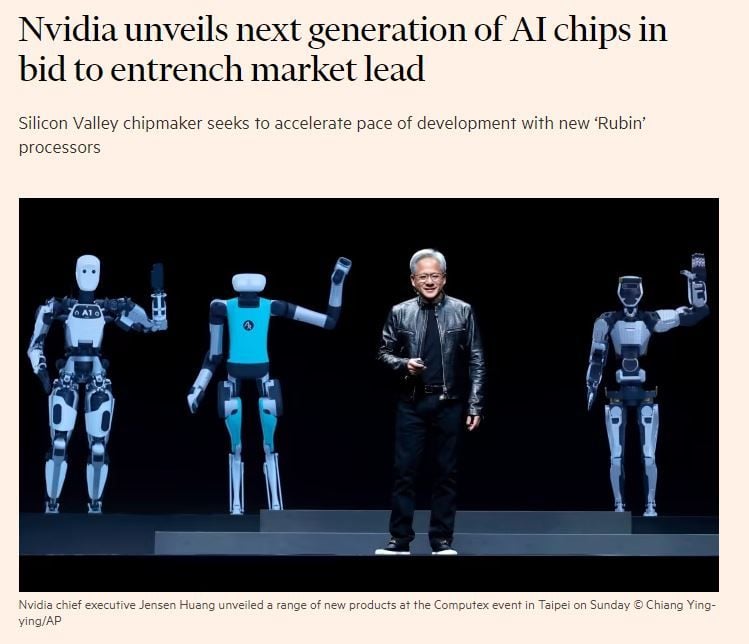

Tech CEOs are the new modern day rockstars $NVDA

Source: Trendspider

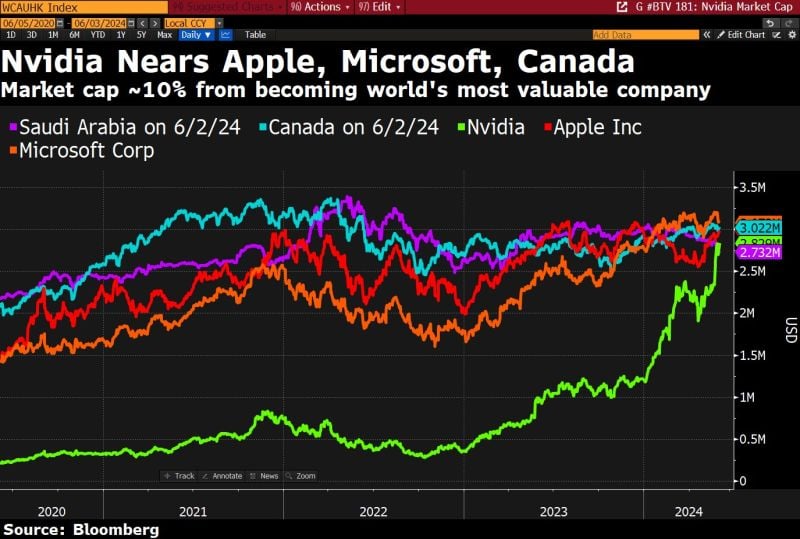

Nvidia is within single digits now of becoming the world's most valuable company $NVDA

•5% away from Apple •6% away from Canada •9% away from Microsoft Source: Bloomberg, HolgerZ

Nvidia $NVDA announced the next generation of its artificial intelligence processors on Sunday in a surprise move less than three months after its most recent launch.

At the Computex conference in Taipei, the chipmaker’s chief executive Jensen Huang unveiled “Rubin”, the successor to its “Blackwell” chips for data centres, which are currently in production after being announced in March. The unexpected move to reveal its next wave of products before Blackwell has even started shipping to customers shows how the world’s most valuable chipmaker is racing to entrench its dominance of AI processors, which has propelled it into the ranks of the world’s most valuable companies. “A new computing age is starting,” Huang said, as Nvidia also unveiled new AI chip deals with PC makers. Source: FT https://lnkd.in/edmWpGEZ

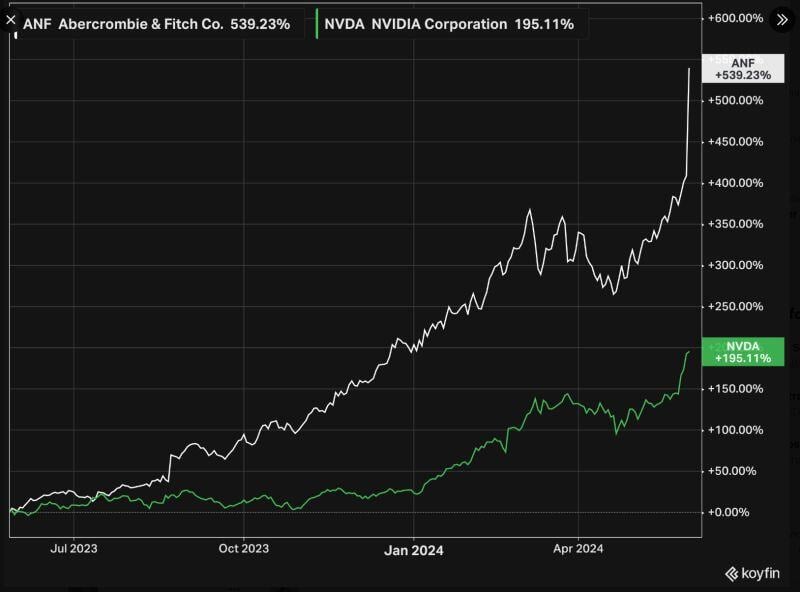

Abercrombie & Fitch $ANF making Nvidia $NVDA shareholders look poor...

Abercrombie & Fitch reported its financial results for the first quarter today. Here's what its CEO Fran Horowitz said in a press release on Wednesday. Abercrombie & Fitch stock is now up close to 70% versus the start of 2024. Source: Conor Mac, InvestmentTalkk

If you exclude $NVDA from the Mag 7, it would be trailing the S&P 500 YTD.

Source: Koyfin

Nvidia has added the size of LVMH in market cap since last week...

Source: Quartr

Investing with intelligence

Our latest research, commentary and market outlooks