Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

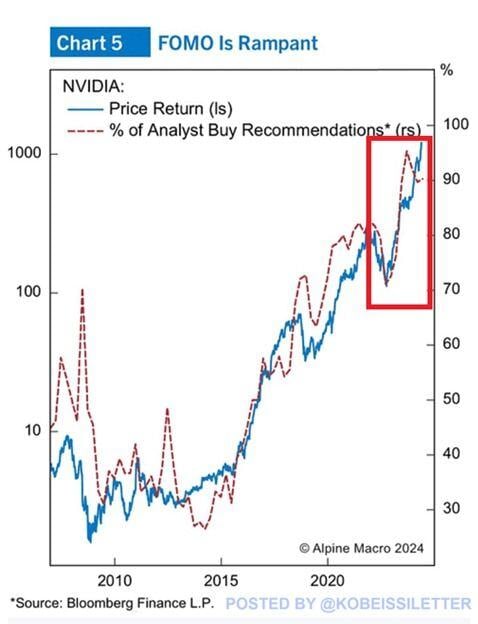

Nvidia FOMO ? This is interesting:

~90% of Wall Street analysts have now a buy rating on NVIDIA, up from ~30% a decade ago. This comes after the chipmaker's share prices have skyrocketed 27,989% over the last 10 years. As the stock rally intensified, the number of buy ratings rapidly increased. Wall Street has never been more bullish of $NVDA. While fundamentals are strong, there is indeed a risk of short-term pullback. A buying opportunity? Or just the start of something more severe? Source chart: Alpine Macro

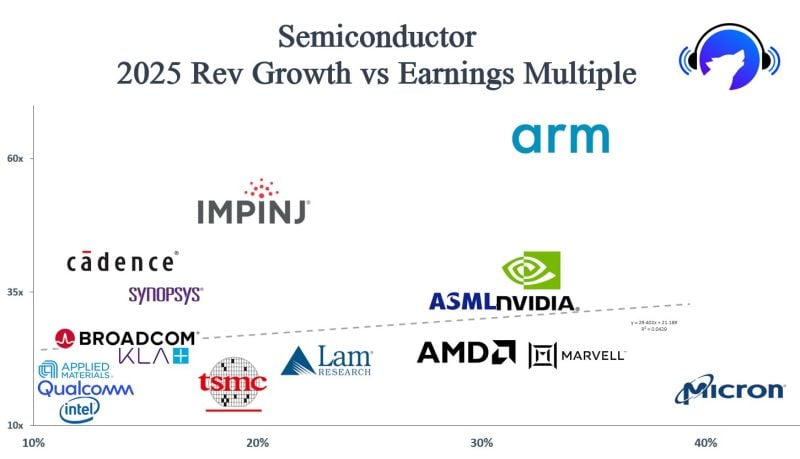

Semiconductors 2025 revenue growth (expected) vs. earnings multiple

Source: Shay Boloor

⚠️ JUST IN: *DELL, NVIDIA AND SMCI COLLABORATE TO POWER ELON MUSK'S GROK AI FACTORY

$SMCI and $NVDA, rose over 4% in overnight trading after Elon Musk says they are working on AI supercomputer for xAI. $DELL has announced a partnership with hashtag#NVIDIA to construct an AI Factory designed to boost the capabilities of Grok, an AI model developed by Elon Musk's company, xAI. Source: www.investing.com, www.msn.com

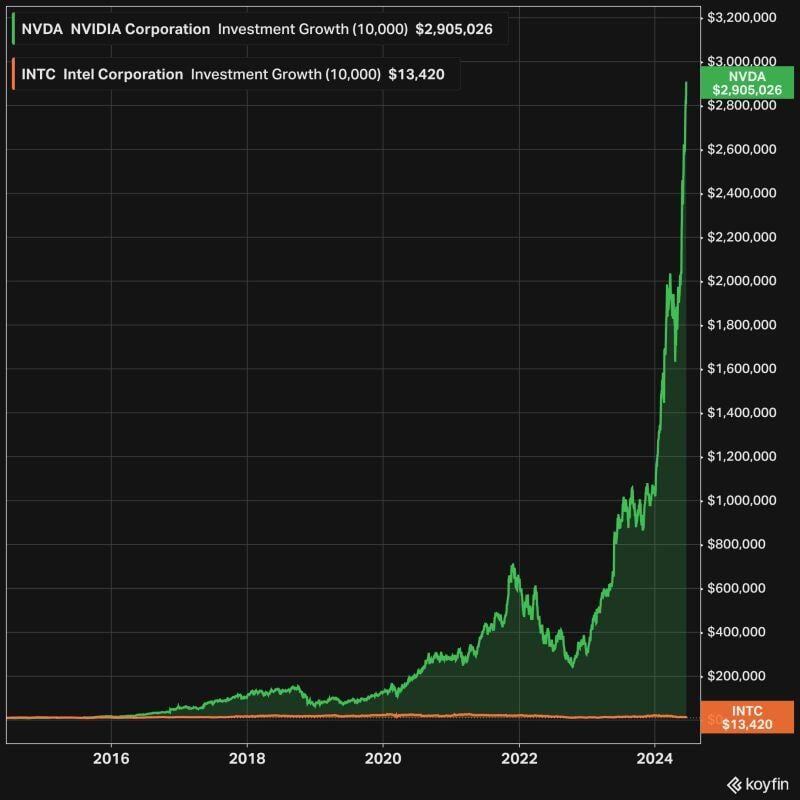

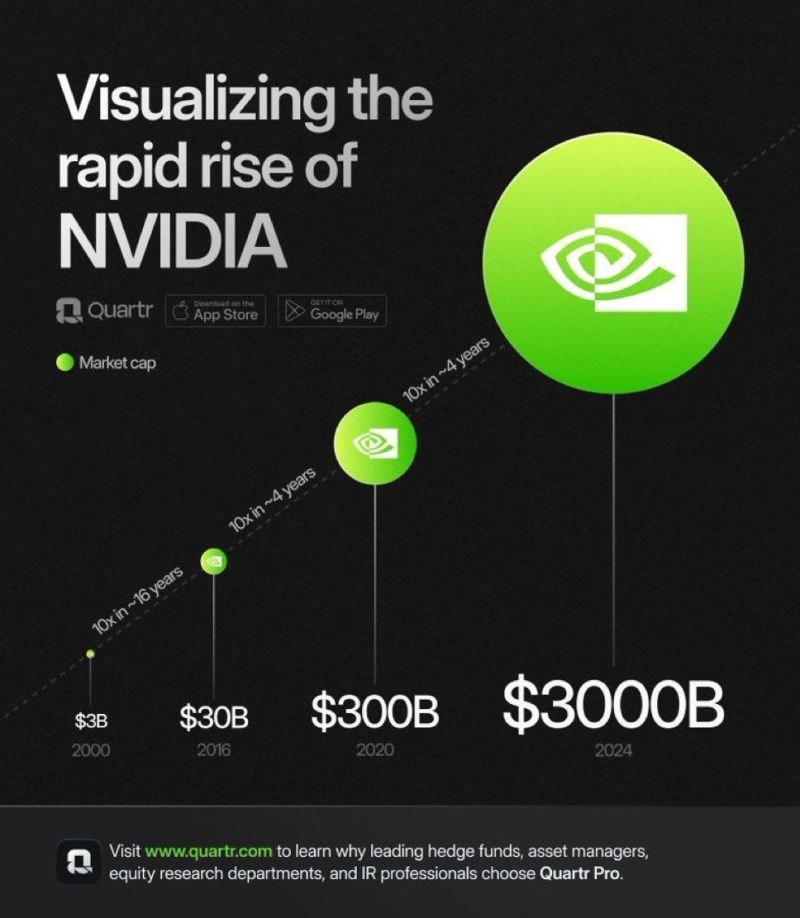

Almost 23 years ago, Standard & Poor's selected Nvidia to replace the departing Enron in the S&P 500 stock index...

Source: Michel A.Arouet

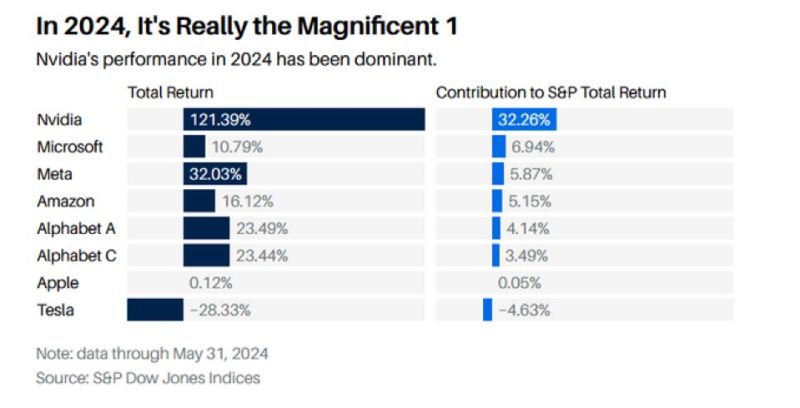

From Mag 7 to... Mag 1

$NVDA is up 122% ytd and contributed to toughly 33% of $SPX gains… Source: Rahul on X

Investing with intelligence

Our latest research, commentary and market outlooks