Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

$SPY We are halfway through 2024.

Let's see the best 10 and worst 10 performers in the S&P 500 so far: The Best 10: 1. $SMCI - Supermicro - 188.2% 2. $NVDA - Nvidia - 149.5% 3. $VST - Vistra - 123.2% 4. $CEG - Constellation Energy - 71.3% 5. $LLY - Eli Lilly - 55.3% 6. $MU - Micron - 54.1% 7. $NRG - NRG Energy - 50.6% 8. $CRWD - Crowdstrike - 50.1% 9. $ANET - Arista Networks - 48.8% 10. $TRGP - Targa Resources - 48.2% The Worst 10: 1. $WBA - Walgreens Boots -53.7% 2. $LULU - Lululemon -41.6% 3. $INTC - Intel -38.4% 4. $EPAM - Epam Systems -36.7% 5. $WBD - Warner Bros Discovery -34.6% 6. $ALB - Albemarle -33.9% 7. $GL - Globe Life -32.4% 8. $MKTX - Marketaxess -31.5% 9. $PAYC - Paycom -30.8% 10. $NKE - Nike -30.6% Source: The Future Investors

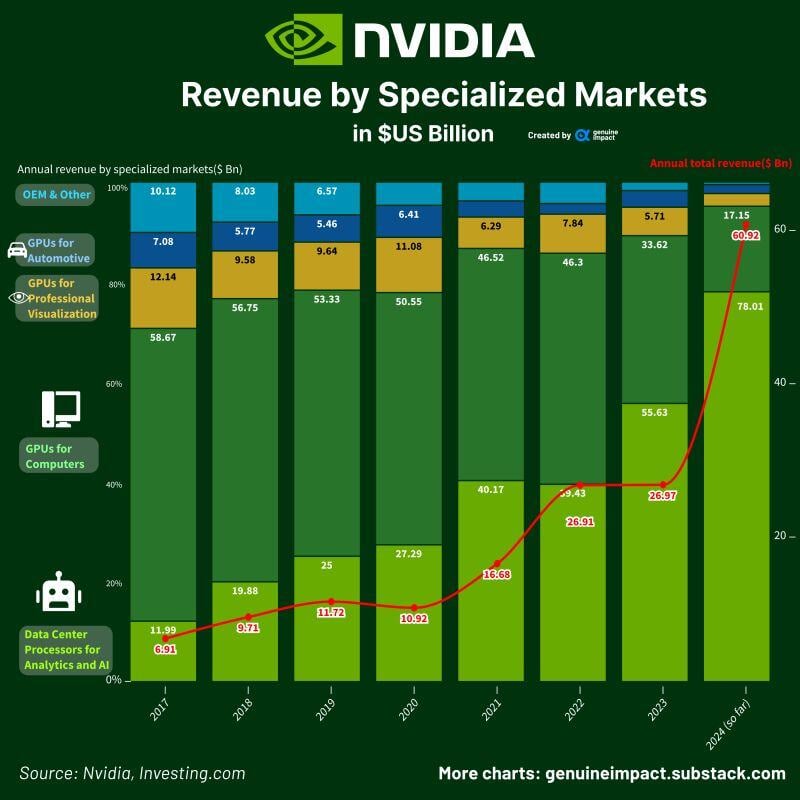

NVIDIA’s data center revenues have grown from 12% in 2017 to 78% in 2024 of total revenues.

Source: Genuine Impact

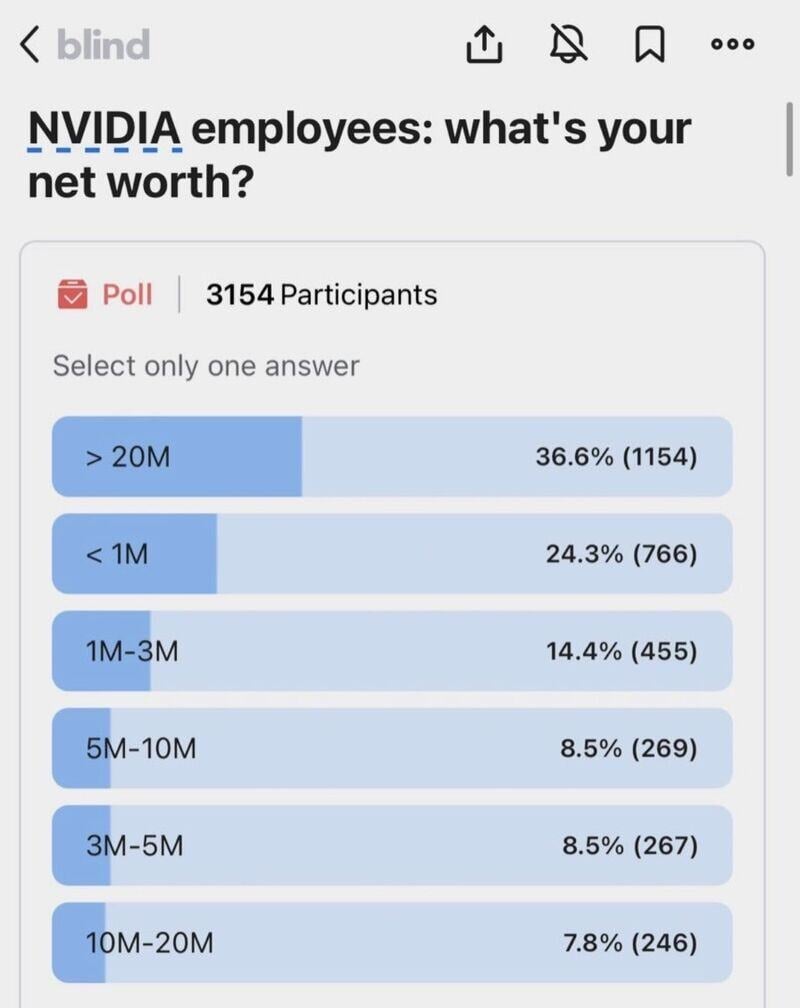

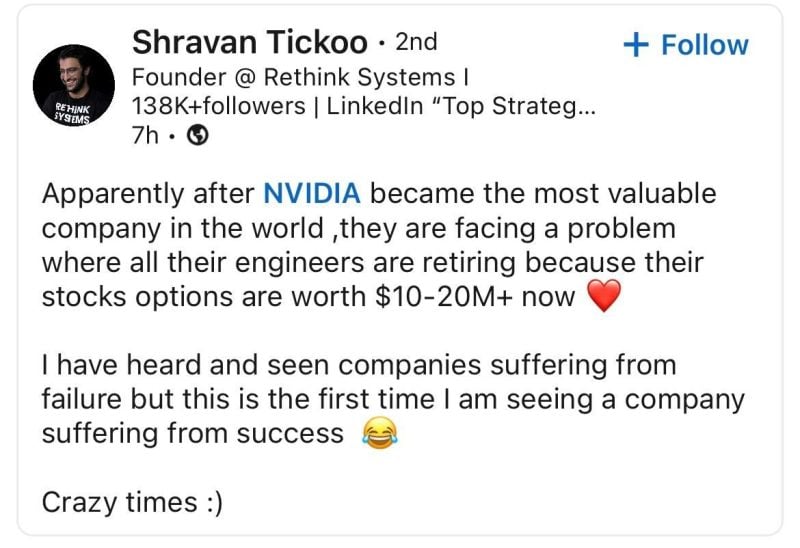

Is Nvidia suffering from SUCCESS?

Apparently a bunch of senior NVIDIA engineers are retiring early after they became multi-millionaires off of their $NVDA stock options. What a time! Source: Jesse Cohen

If you ever feel bad, remember that in 2019 SoftBank owned 4.9% of $NVDA and sold it all for a $3.3B profit

Today, that stake would have been worth over $160 BILLION. Source: Stocktwits

Nvidia, $NVDA, is making some INSANE moves:

From June 20th through June 24th, Nvidia lost $600 BILLION of market cap in 3 trading days. Today, the stock has added $250 BILLION in market cap from its pre-market low. That's an $850 billion swing in market cap over just 4 trading days. To put this in perspective, that's a swing of 1.5 TIMES the value of Tesla, $TSLA, in just 4 days. Nvidia is casually swinging almost $1 trillion of market cap in just 4 days with no news. Truly historic. Source: The Kobeissi Letter

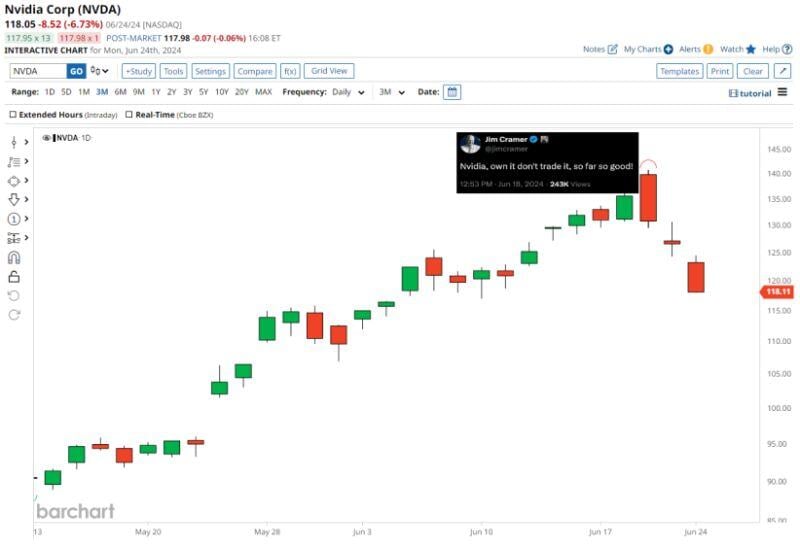

$NVDA is now down 13% since Jim Cramer said "Nvidia, so far, so good"

Source: The Kobeissi Letter

Investing with intelligence

Our latest research, commentary and market outlooks