Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

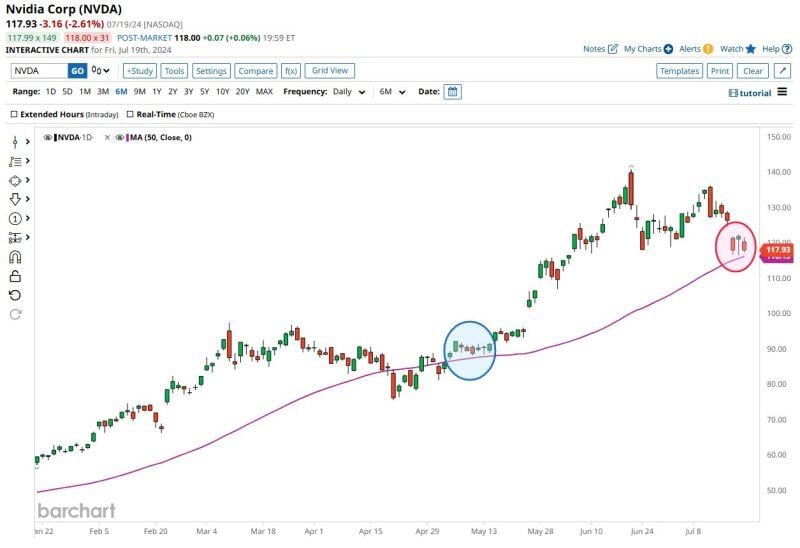

Since its after hours low seen just 18 hours ago, Nvidia has added $380 BILLION of market cap.

In other words, Nvidia has added as much market cap as the entire value of Costco, $COST, in 18 hours. This comes after the stock erased $1 TRILLION of market cap over the last 5 weeks. Source: The Kobeissi Letter

BREAKING: Nvidia, $NVDA, has now erased $1 TRILLION of market cap since its all time high set on June 20th.

In other words, $NVDA has erased $200 billion of market cap PER WEEK over the last 5 weeks. The stock is now down ~27% from its recent all time high. In just 5 weeks, Nvidia has erased as much market cap as 1.5 TIMES the entire value of Tesla, $TSLA. This also equals roughly the same value as the market cap of Berkshire Hathaway. Source: The Kobeissi Letter

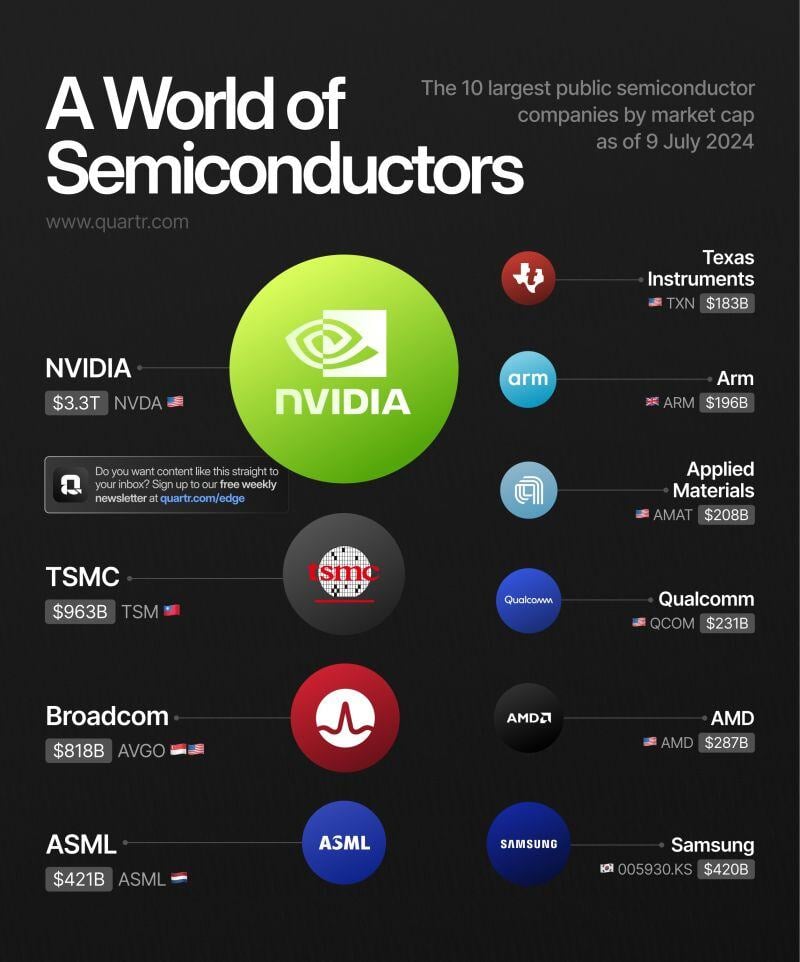

A visual overview of the world's 10 largest public semi conductor companies' market caps:

$NVDA $TSM $AVGO $ASML $TXN $ARM $AMAT $QCOM $AMD Source: Quartr

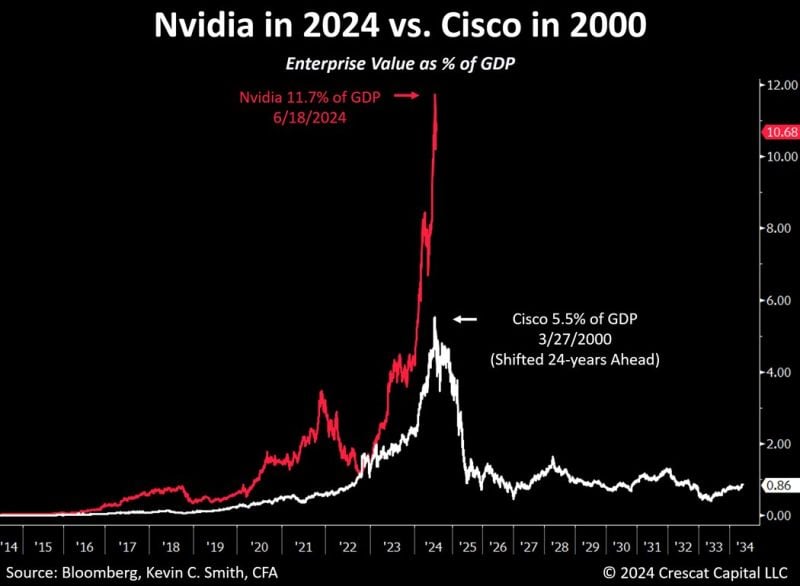

Nvidia in 2024 vs. Cisco Systems in 2000..

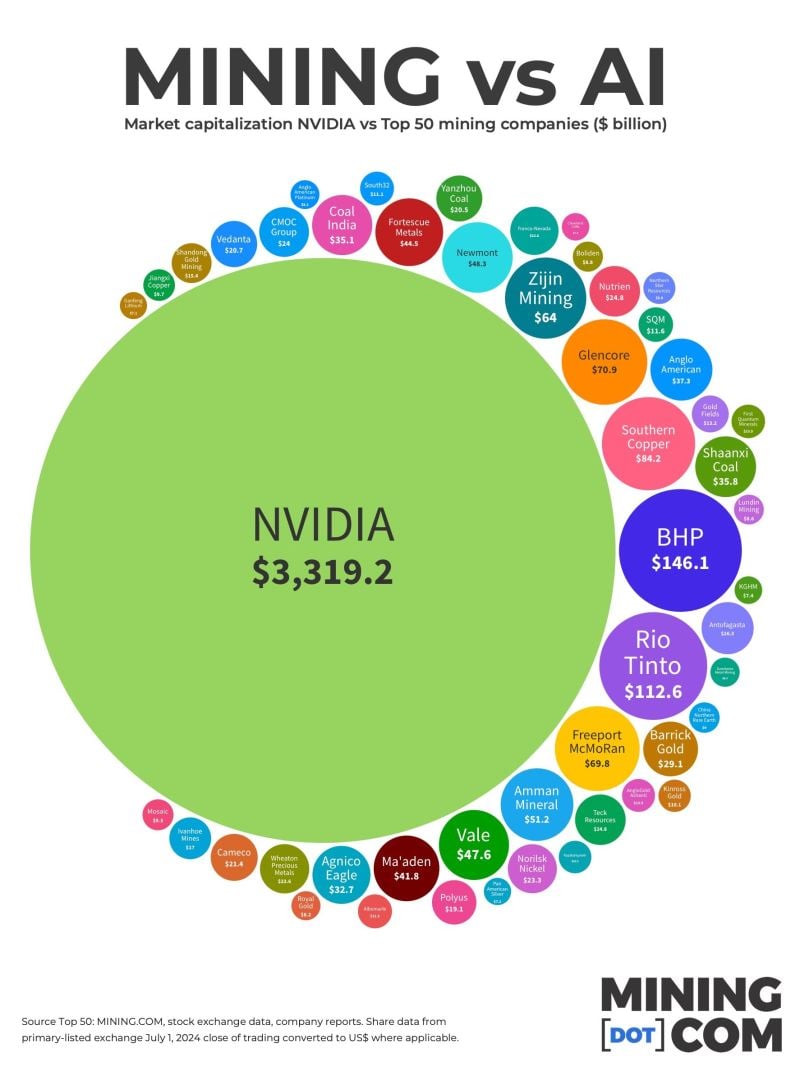

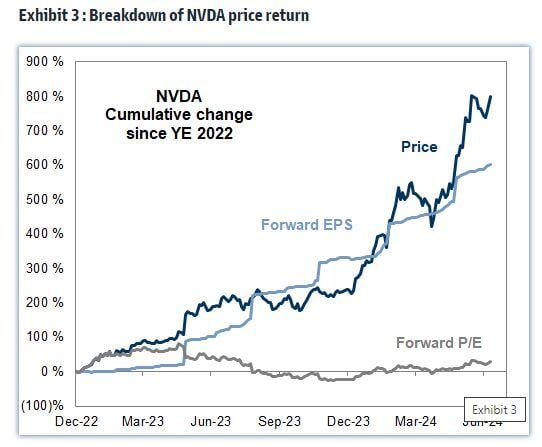

Nvidia recently earned the most valuable company in the world status with an EV of $3.3 trillion, a record 11.7% of total US GDP at its recent peak on June 18, more than twice as high as Cisco’s achievement in 2000. It also has an even richer multiple of 41 times revenues. Will be future growth be up to the lofty market expectations? Source: Crescat Capital, Bloomberg, Tavi Costa

Investing with intelligence

Our latest research, commentary and market outlooks