Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

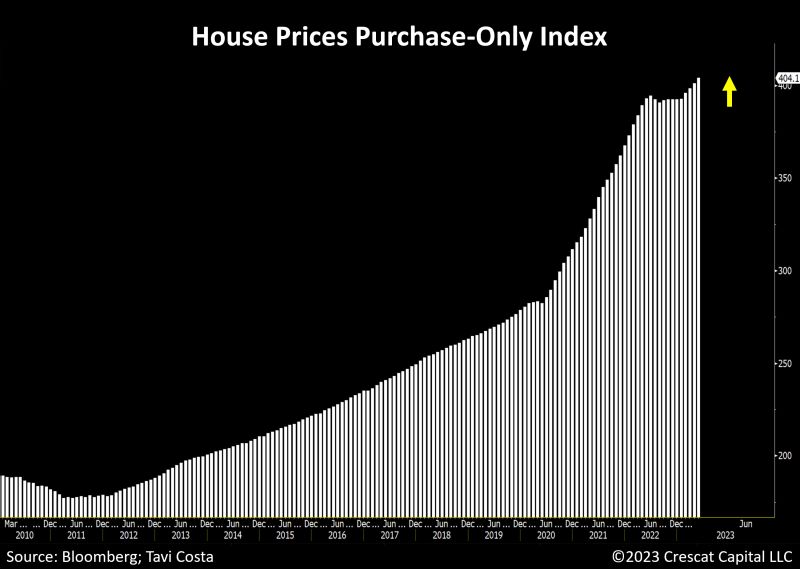

Looking at the recent sales transactions, house prices have accelerated significantly in the last 4 months to record levels, now growing at almost a 10% annualized rate

As a remainder, shelter costs / rents jave been putting upward pressure on core CPI and are expected to ease. Really? Source: Tavi Costa, Crescat Capital, Bloomberg

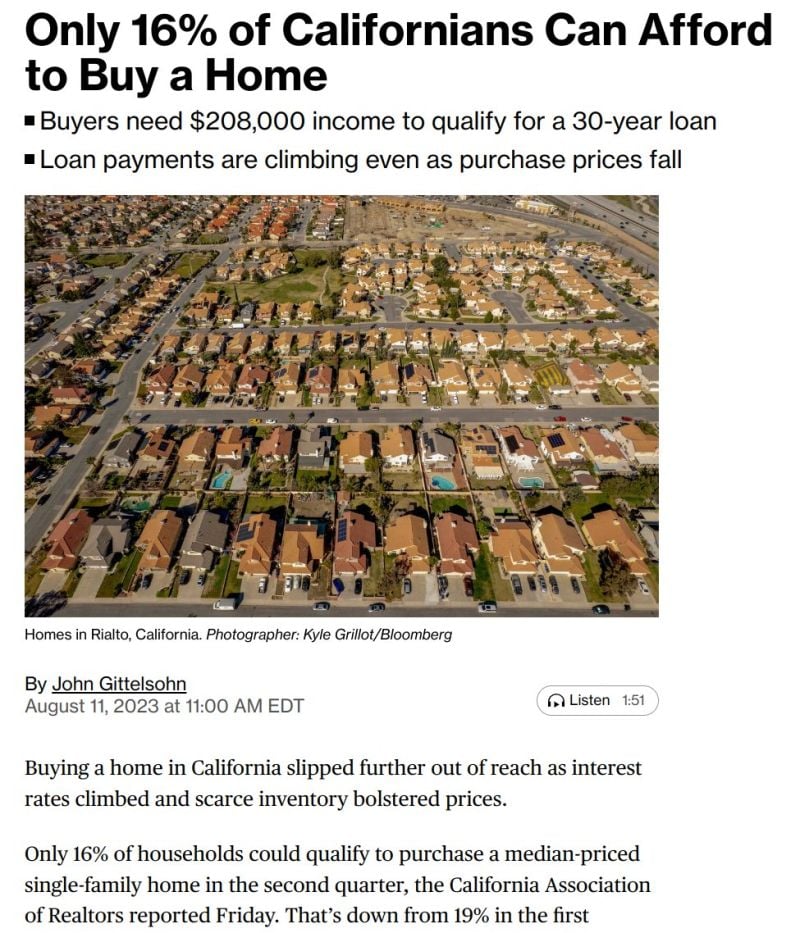

Only 16% of Californians can afford to buy a home, a situation that is unfortunately not unique to the state, but where they are leading the way

Source: Markets & Mayhem, Bloomberg

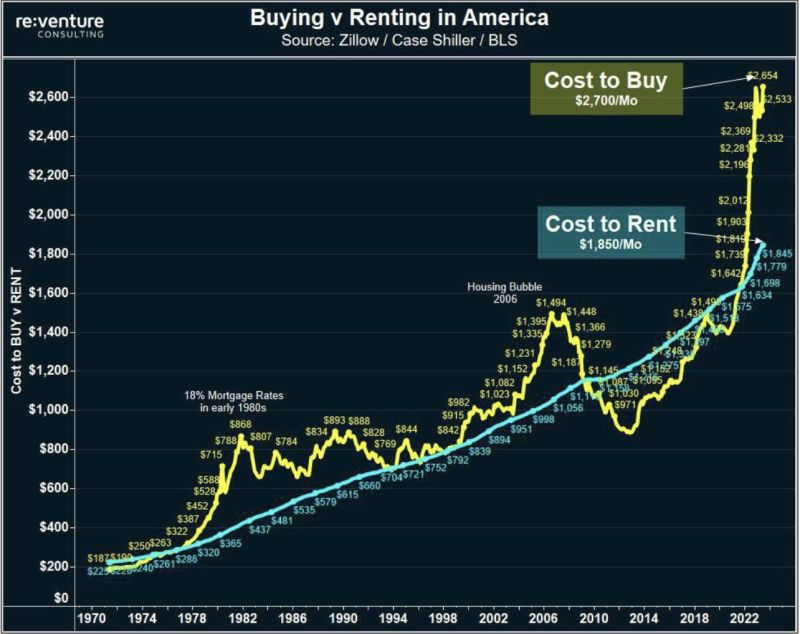

The cost of both buying and renting a house in America has skyrocketed since 2020

Buying a house now costs $2,700/month on average, up an alarming ~86% in 3 years. Renting a house now costs $1,850/month on average, also up ~25% in 3 years. Owning a home has become a luxury. Source: The Kobeissi Letter

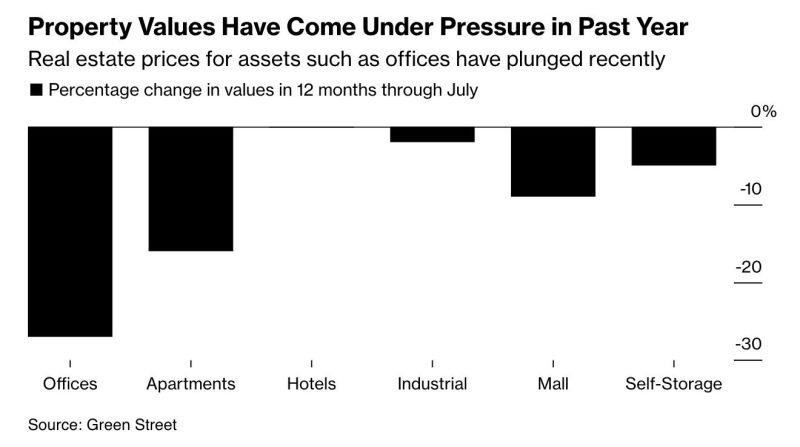

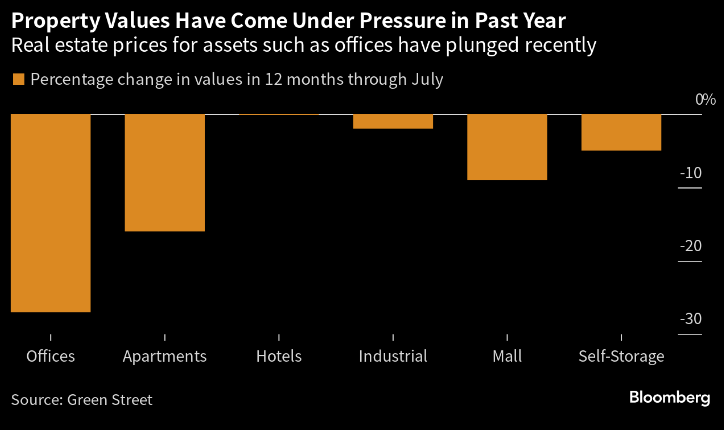

Property values in commercial real estate are beyond bear market territory

- Office buildings are down nearly 30% over the last year ALONE. - Apartments down 15% and underperforming malls. - Hotels are flat as markets await a potential drop in consumers spending. - Real estate markets are feeling the effects of higher interest rates. Source: The Kobeissi Letter, Bloomberg

US Property loans are so unappealing that banks want to dump them

Lenders including GS and JPM. have been trying to sell debt backed by offices, hotels and even apartments in recent months, but many are finding that tidying up loan books is no easy feat when concerns about commercial real estate have surged.

Maturing loans that will need to be refinanced is a major concern in a high-interest-rates environment. Source: Bloomberg, Green Street

US housing -> Lots of US Homeowners Want to Move. They Just Have Nowhere to Go

Locked into cheaper borrowing costs and unable to find a new place that fits their budgets, countless people are opting to remain in their current homes, adding to an acute shortage of available properties Source: Bloomberg

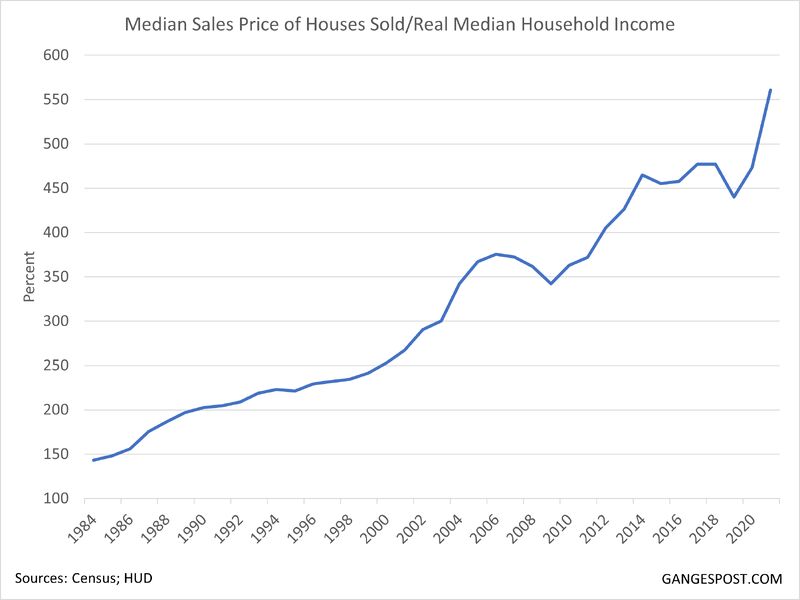

The median sales price of a home in the US is now 560% of the median household income.

In 2008, it was 360% of the median household income. This is the least affordable housing market in history. Source: The Kobeissi Letter

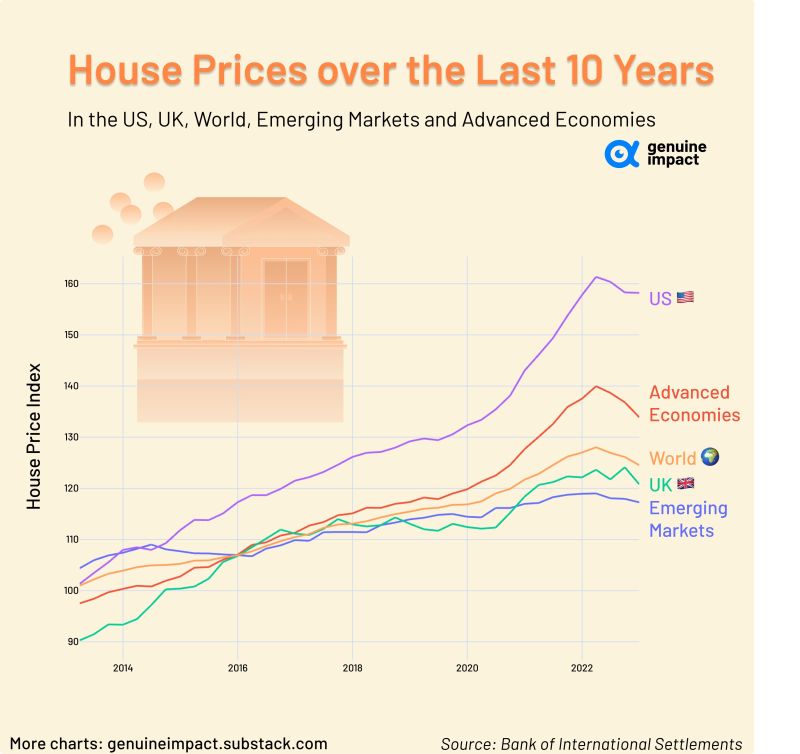

Housing is becoming unaffordable!

Over the last decade, property prices have steadily increased in many regions The index in the UK is lower than the global average, whilst the US is substantially higher. Source: Genuine Impact

Investing with intelligence

Our latest research, commentary and market outlooks