Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Median US home prices are now contracting at a level only seen 2 times in the last 60 years:

- 1970 - 2008 Both ended in severe recessions Source: FRED, Game of Trades

If you think housing in the US is not affordable anymore take a look at New Zealand, Canada and Sweden 👇

BCA research through Michael A.Arouet

US commercial real estate prices prices are down sharply this year with offices building prices down ~30%

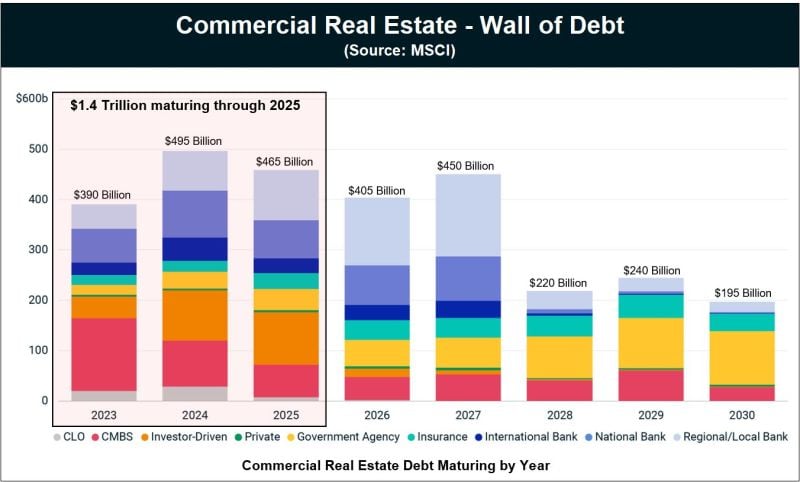

On top of declining prices, there are nearly $1.4 TRILLION of commercial real estate loans coming due by 2025. Meanwhile, rates on the commercial real estate loans have more than doubled since they were issued. Last but not least, vacancies in commercial real estate are skyrocketing (which means rent revenue is down). The coktail of rising rates on loans that need to be refinanced and declining income looks like a rather toxic one. Source: The Kobeisi Letter

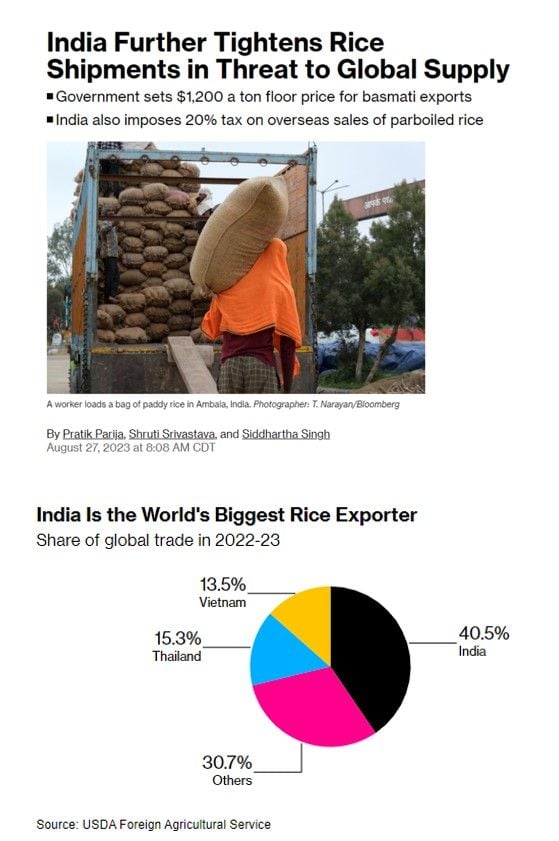

Rice likely to get even more expensive as India imposes additional restrictions

India further tightens rice exports as the government sets a floor price of $1,200 per tonne for basmati rice exports. India also imposes a 20% tax on rice sales abroad. Rice is a staple food for half the world. Source: Barchart, Bloomberg

Zillow expects U.S. home prices to jump by 6.5% over the next 12 months

Source: Barchart, Fortune

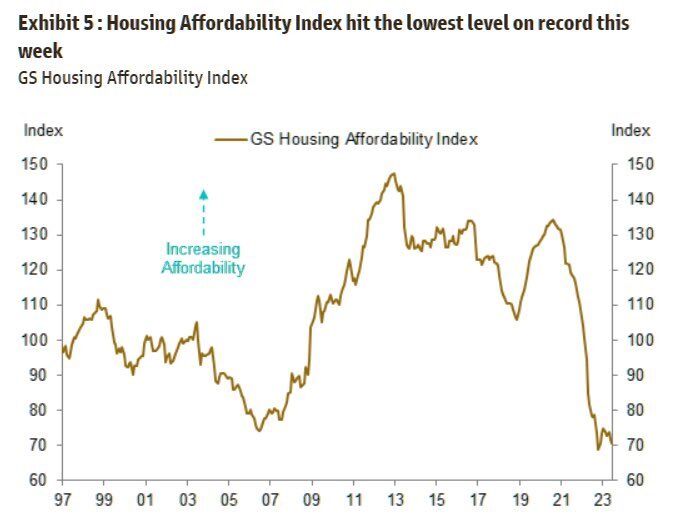

The US housing market affordability index is now ~10% BELOW the 2006 lows.

Even if prices fell 30%, housing affordability would still be above pre-pandemic levels. It’s a tough time to be a homebuyer in the US. Source: The Kobeissi Letter

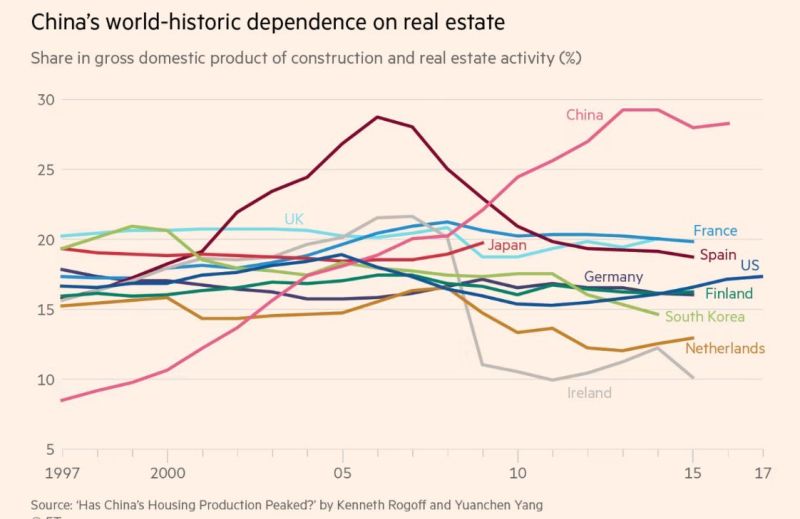

China is more dependent on real estate than any other country

Almost 30% of Chinese GDP dependent on #realestate combined with 50 million vacant apartments is a dangerous mix. Source: FT

The fact that Chinese State property developers are also in big troubles complicates the issue for the China real estate

Mainly, as it reduces their ability to support the sector by taking over incomplete projects by private sector. Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks