Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

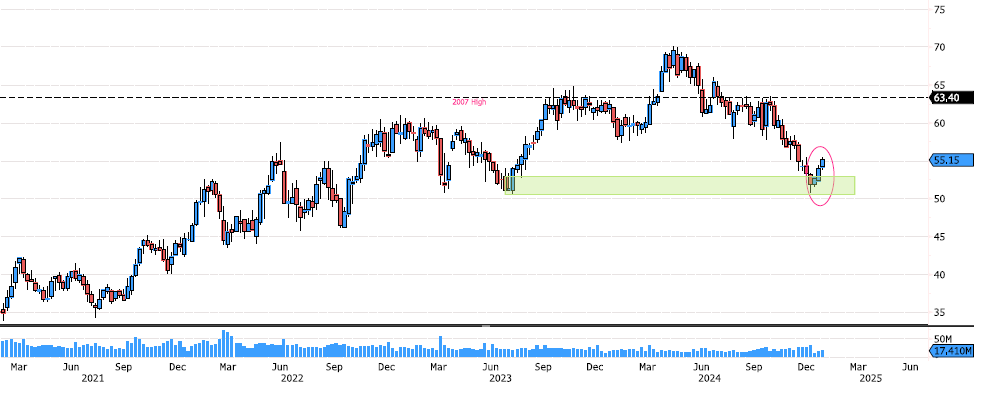

TotalEnergies Strong Demand

TotalEnergies (TTE FP) has consolidated more than 27% since its April 2024 highs. We’re seeing strong demand after a rebound from the major support zone between 50.55-52.95, with imbalance bullish candles indicating significant institutional buying. Source: Bloomberg

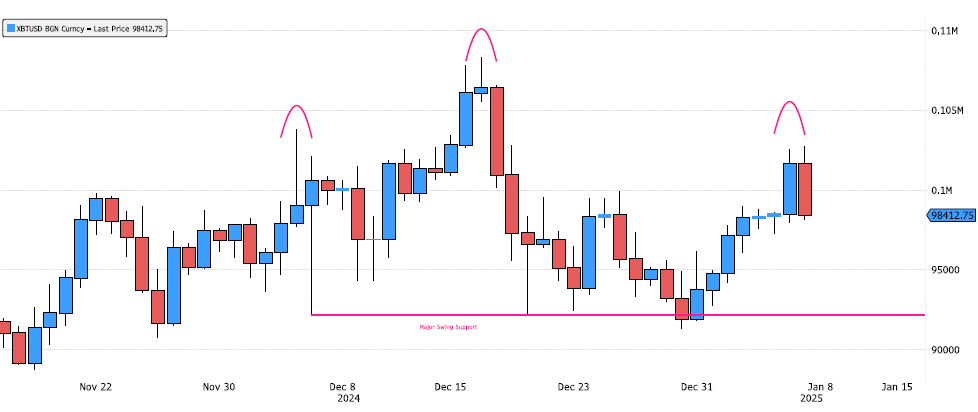

Bitcoin Head & Shoulders Pattern?

Bitcoin is showing signs of a strong reversal candlestick today (keep an eye on the close). A Head & Shoulders pattern is starting to form, though it's not confirmed yet. The recent close below 92,143 suggests some weakness, and the level to watch is the 91,306-92,14 zone. If this level breaks, fasten your seatbelt! Source: Bloomberg

Novo Nordisk Long-Term Bullish Trend Broken

Novo Nordisk (NVO) has seen its long-term bullish trend broken, with the stock losing 49% since its highs. It’s now trying to find support. On Friday, the stock rebounded from the major support zone between 504-535. The stock will likely be volatile in the coming days, so keep an eye on this support zone to see if it has found a low. Source: Bloomberg

Idexx Laboratories Rebounding Off Major Swing Support Zone

Idexx Laboratories (IDXX US) recently tested the swing support zone between 372-431 and is now rebounding off that level with increasing volume. Source: Bloomberg

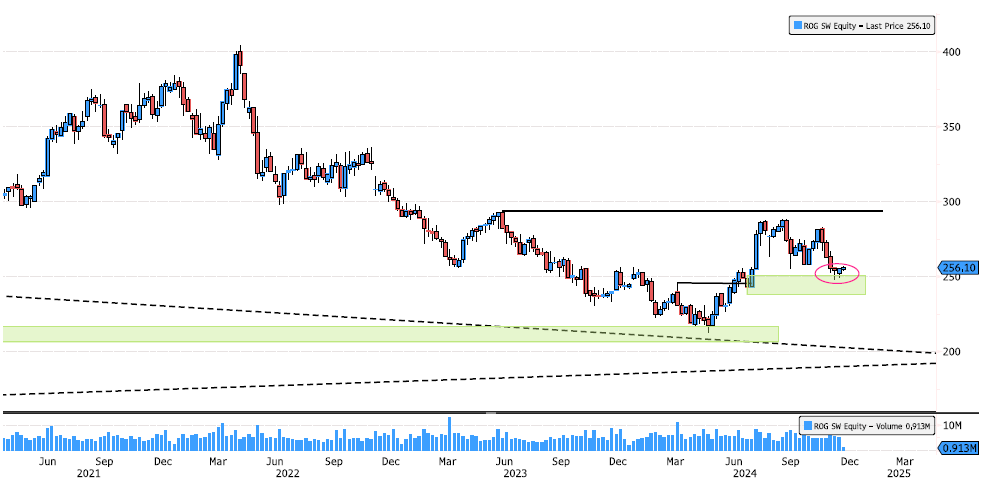

Roche Back on Demand Level

After a 47% consolidation over 2 years, Roche (ROG SW) broke its downtrend in June and has seen a 35% rally since the lows, suggesting that the low is now in place. The market is now back in the demand zone between 238-251, and we’re observing strong price action. The next key resistance to watch is 293.55. Source: Bloomberg

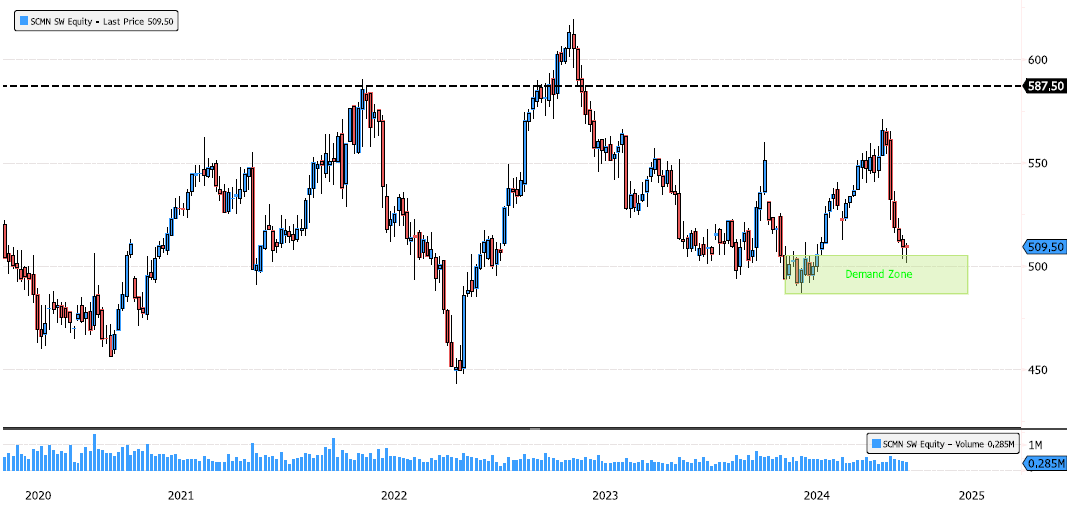

Swisscom Back on Demand Zone

Swisscom (SCMN SW) recently posted a strong swing, suggesting that the May consolidation could be over. Keep an eye on the demand zone between 486.80-505 for potential price action. Source: Bloomberg

Deere breakout ???

Deere & Company (DE US) has been attempting to surpass the $450 level for over two years. Recently, significant trading volumes have been observed, indicating a potential breakout. It's advisable to monitor this development closely. Source: Bloomberg

L'Oréal Rebounding off Major Support

L'Oréal (OR FP) showed strong signs of a rebound last week with a Hammer candlestick pattern. The stock tested the major swing support zone between 300-328 and has seen a 31% consolidation since June! Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks