Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

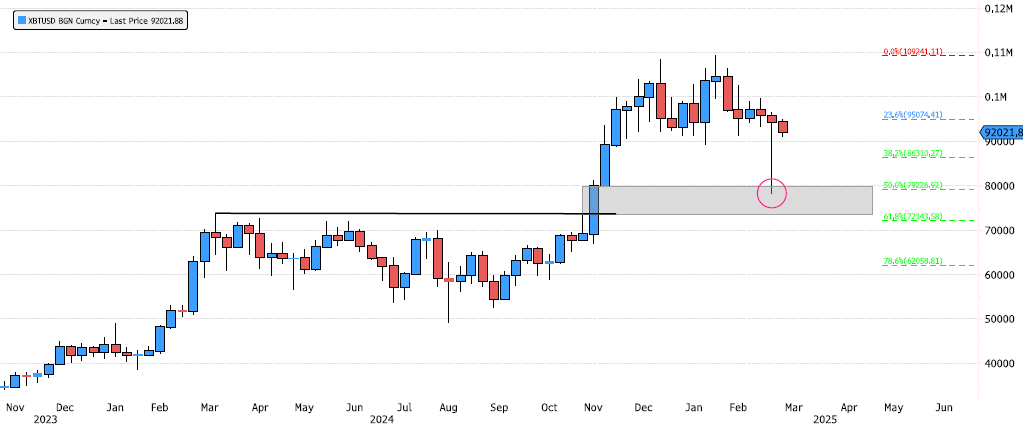

Bitcoin Amazing Move Last Week

Last week, Bitcoin (XBTUSD) saw a strong sell-off to 78,225, revisiting the imbalance zone between 73,563-79,839 from last November. This level also aligns with the 50% Fibonacci retracement, reinforcing the idea of a healthy consolidation back into the discount zone. Ultimately, the week closed back above 91,306, forming an enormous hammer candle, a strong reversal signal. Keep an eye on the price action over the next few days. Source: Bloomberg

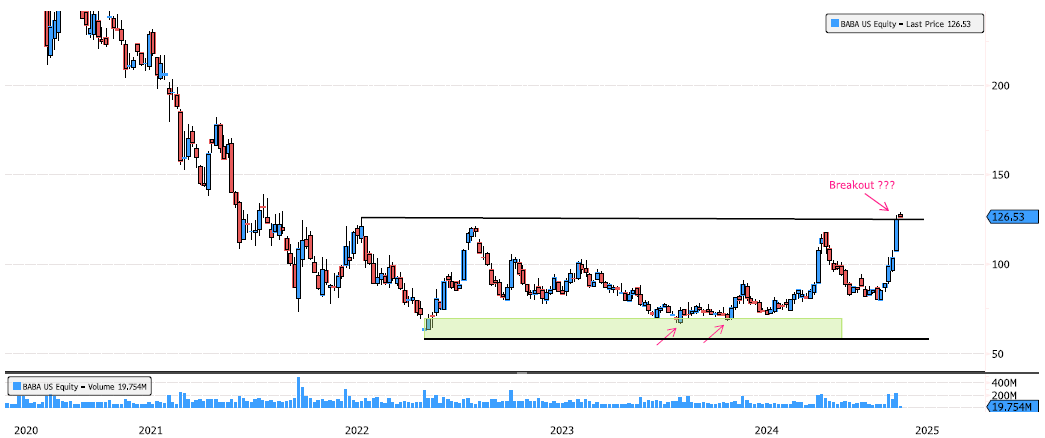

Alibaba Trying to Break Major Resistance?

Alibaba (BABA US) has been in a bearish long-term trend since 2020, consolidating as much as 57% from its peak. This week, there are the first signs of a breakout of the major resistance at 125.84, and volume has picked up over the past 3 weeks, which is a positive indication. Keep an eye on the price action for potential developments. Source: Bloomberg

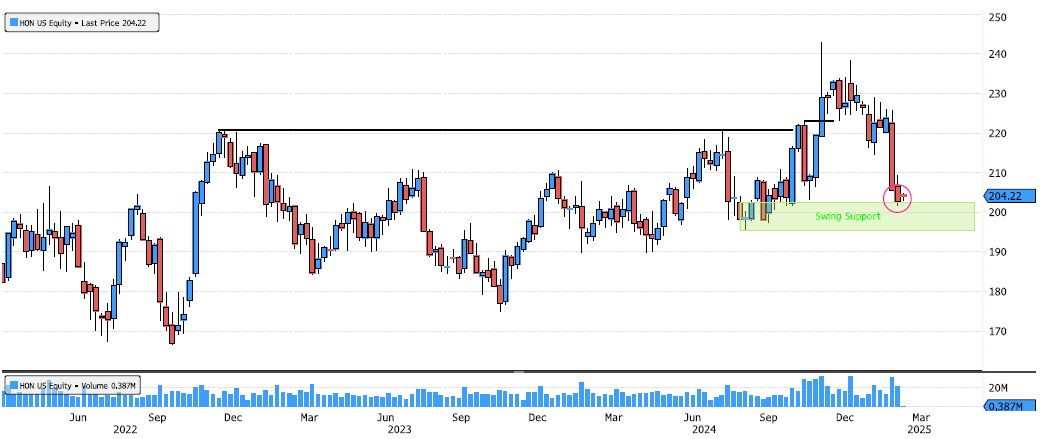

Honeywell Back on Swing Support Zone

Honeywell (HON US) has consolidated 17% since November but remains in a bullish long-term trend. The stock is now back on the swing support zone. Keep an eye on the price action for potential opportunities. Source: Bloomberg

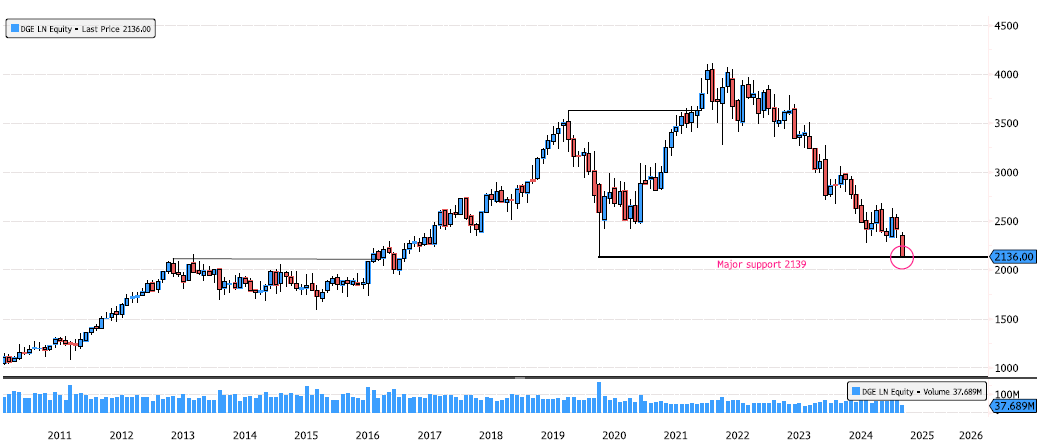

Diageo on Major Support Level

Diageo has consolidated 48% since January 2022, but the long-term trend (monthly chart) remains bullish. The stock is currently testing a major support level at 2139. Keep an eye on the price action for potential opportunities. Source: Bloomberg

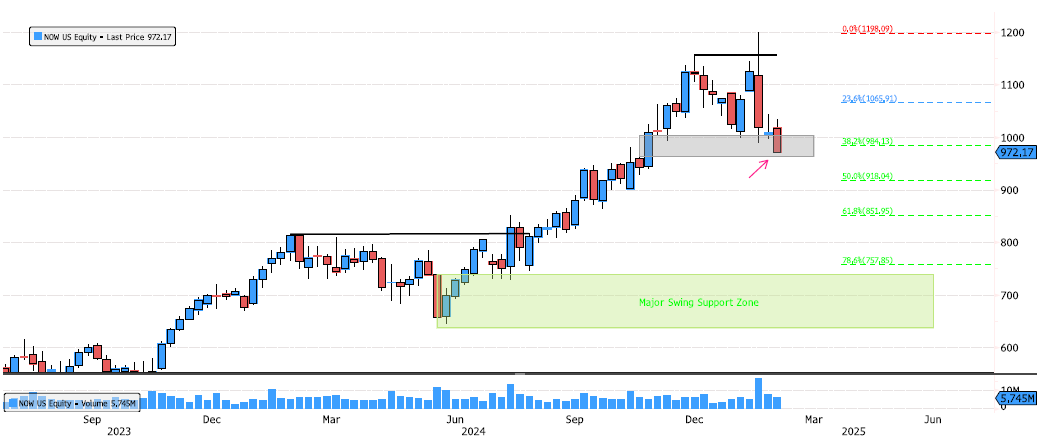

ServiceNow Reaching 1st Key Level

ServiceNow (NOW US) has consolidated 19% since its January high, but the stock remains in a bullish trend. The consolidation that started last December is now approaching the first interesting imbalance zone between 964-1004. Another level to watch is the 50% Fibonacci retracement at 918. Keep an eye on these levels for potential opportunities. Source: Bloomberg

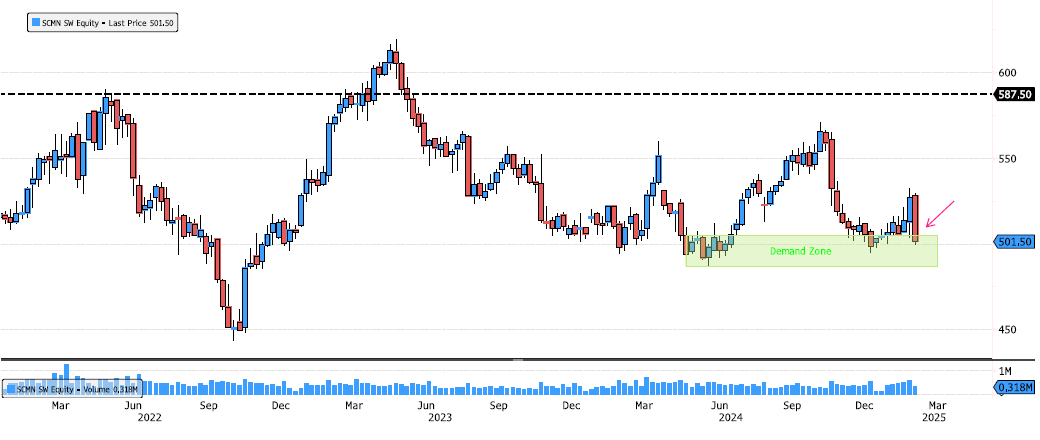

Swisscom Back in Demand Zone

Swisscom (SCMN SW) is under pressure following its earnings release. The stock had reacted bullishly in December, with a 7% rebound from the demand zone between 486.50-505. Keep a close eye on this demand zone, as this level is crucial for the stock's next move. Source: Bloomberg

Nestlé: The End of a 2-Year Consolidation?

Nestlé (NESN SW) has consolidated 44% since January 2022! Recently, the stock rebounded off the 2003 bullish trend line and also from the demand zone between 73-77. Keep an eye on this potential turning point. Source: Bloomberg

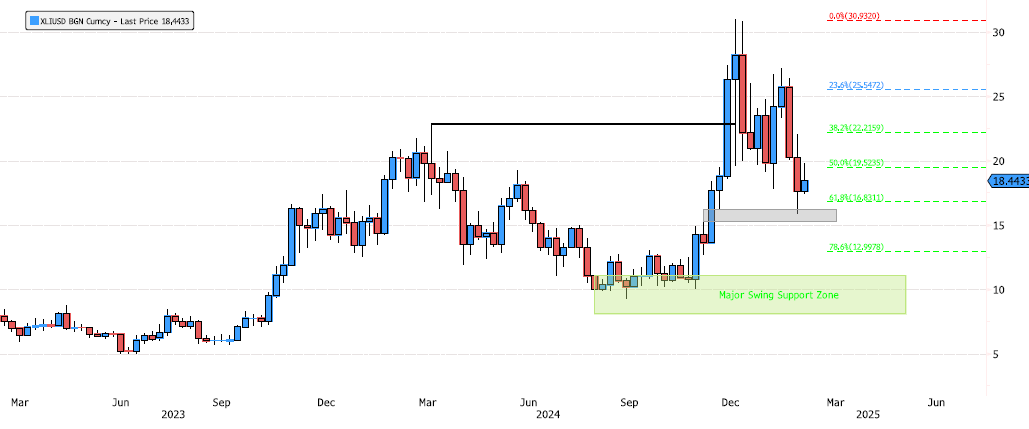

Chainlink Reaching Discount Zone

Chainlink (XLIUSD) has consolidated 48% since its December highs. It has pulled back more than 50% on the Fibonacci retracement, confirming that it has reached the discount zone. Additionally, it has rebounded from the imbalance zone between 15.35-16.20. Keep an eye on the price action for potential opportunities. Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks