Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

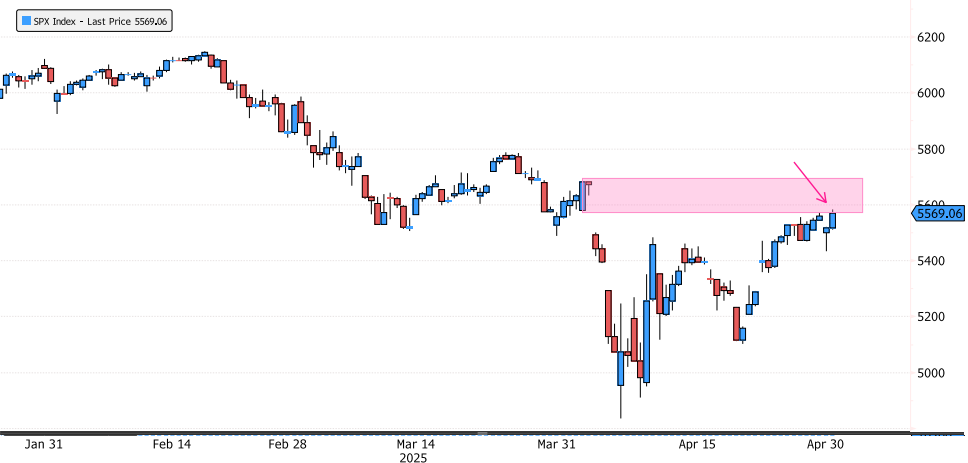

S&P 500 Index Back on 1st Supply Zone

The S&P 500 Index has rallied 17% since the lows and is now back on the 1st important supply zone between 5571-5695. Will it be able to close above 5695? Keep an eye on the price action over the next few days. Source: Bloomberg

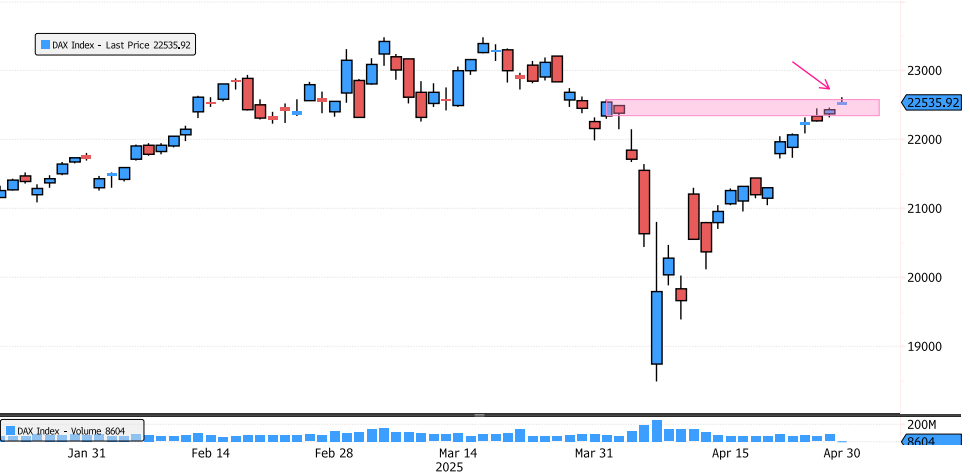

DAX Index Back on 1st Supply Zone

The DAX Index has recovered 22% since the lows in just 17 opening days! It’s now reaching the first supply zone between 22,343-22,573. Will the market be able to close above 22,573? Keep an eye on the price action over the next few days. Source: Bloomberg

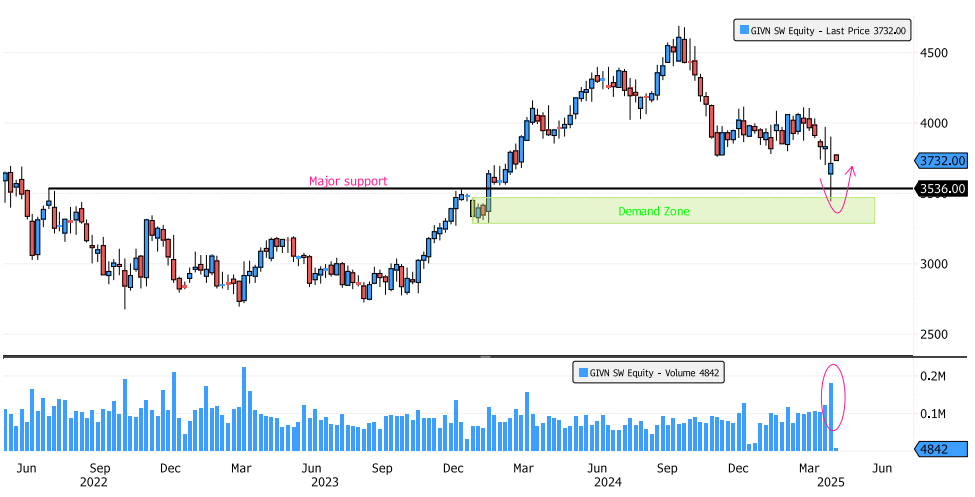

Givaudan Positive Reaction Last Week

Givaudan (GIVN SW) showed a positive reaction last week, rebounding strongly and closing the week above major support at 3536. The stock rebounded sharply from the demand zone between 3287-3468, and has consolidated 26% since the September 2024 high. It’s also at the 61.8% Fibonacci retracement. These technical levels aligning suggest a significant moment for the stock.Source: Bloomberg

Nvidia Entering Major Support Zone

After a 34% consolidation since January, Nvidia is now back on the major swing support zone between 90.69-103.41. Keep an eye on the price action for potential opportunities. Source: Bloomberg

ASML Approaching Major Support Zone

ASML has consolidated 44% since July 2024! For the moment, the trend remains bearish, but the stock is approaching a major support zone between 534-566. Keep an eye on the price action in the next few days for any potential opportunities. Source: Bloomberg

ABB Back on Very Interesting Zone

ABB has consolidated 20% since the highs and is now approaching the March 2024 breakout level. The stock is also in a major demand zone between 40.77-43.60. Keep an eye on the price action for potential opportunities. Source: Bloomberg

Microsoft Back on 1st Major Support Zone

Microsoft (MSFT) has consolidated 21% since the July 2024 highs! The stock is now back on the 1st major support zone between 363-374. While this zone is key, we can't exclude the possibility that the market may continue its downside toward the breakout level at 350, or even towards the 2nd major support zone between 310-330. Keep an eye on these key levels for price action. Source: Bloomberg

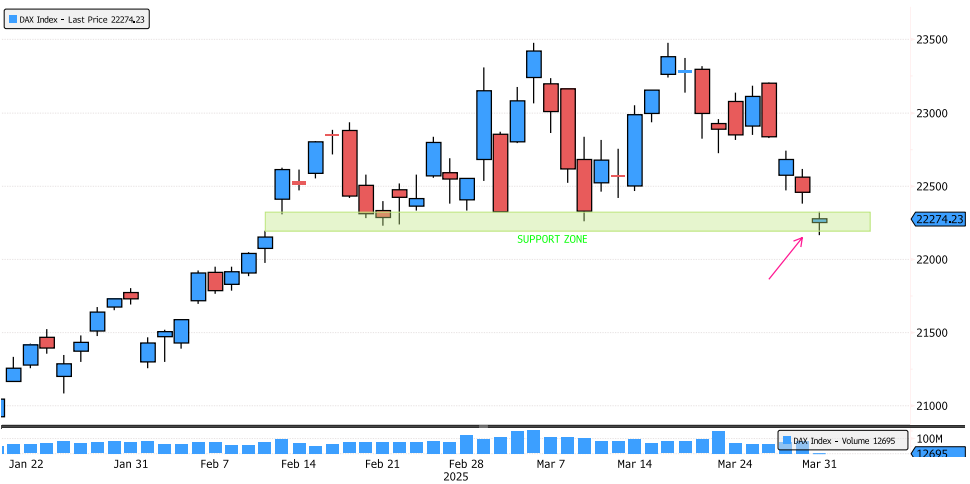

DAX Index on Critical Support Zone

The DAX Index remains in a very strong bullish trend! After a recent 5% consolidation, the index is back at the major support zone between 22,190-22,320. Keep an eye on the price action for potential opportunities. Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks