Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Ether $ETH relative to bitcoin $BTC is breaking out after a multi-month consolidation.

Is this bearish for bitcoin? No. It just means that we might be at the beginning of the so-called "altcoin season" where other cryptos start to outperform bitcoin. But it does NOT mean that bitcoin is heading south. The new all-time highs in Coinbase, Robinhood and other crypto-related stocks and assets like Galaxy Digital are additional evidence that the crypto bull market might actually gathering speed. Source. J-C Parets NB: this is not an investment recommendation. Do your own research

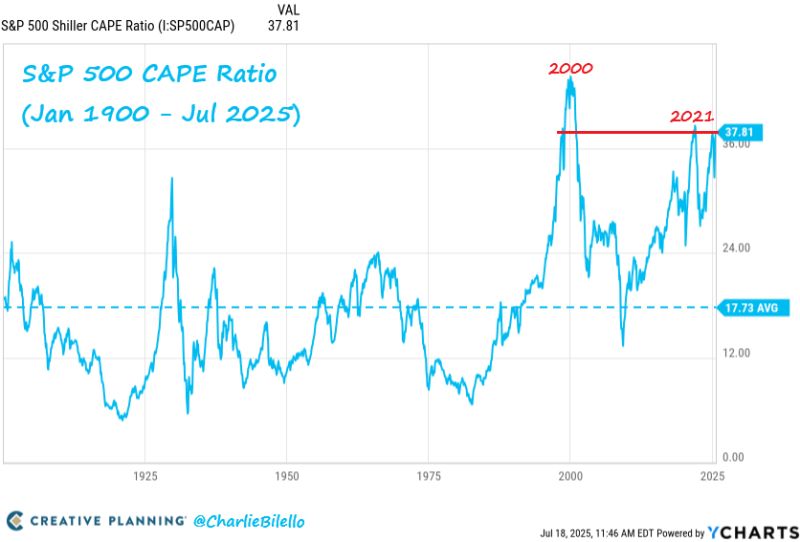

The SP500's CAPE Ratio is about to cross above 38 for the 3rd time in history, now higher than 98% of historical valuations. $SPX

Source: Charlie Bilello

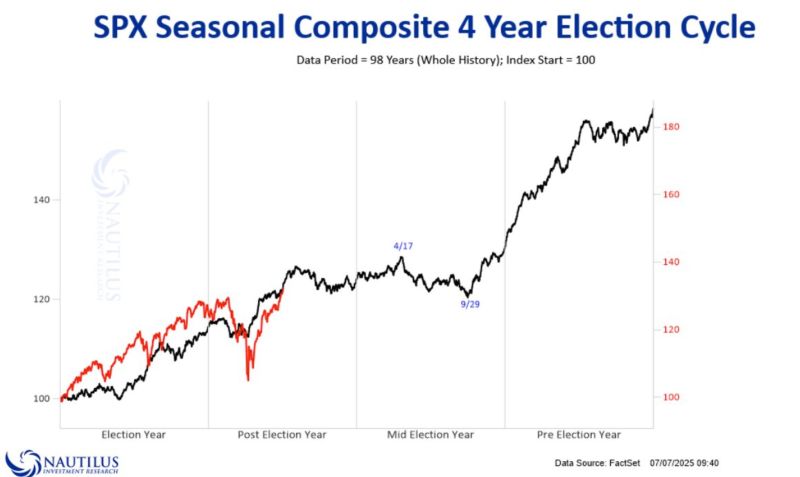

Nautilus Research ➡️ 2025 vs. 4-year Election Cycle Composite.

A last "hurrah" before some troubles ahead?

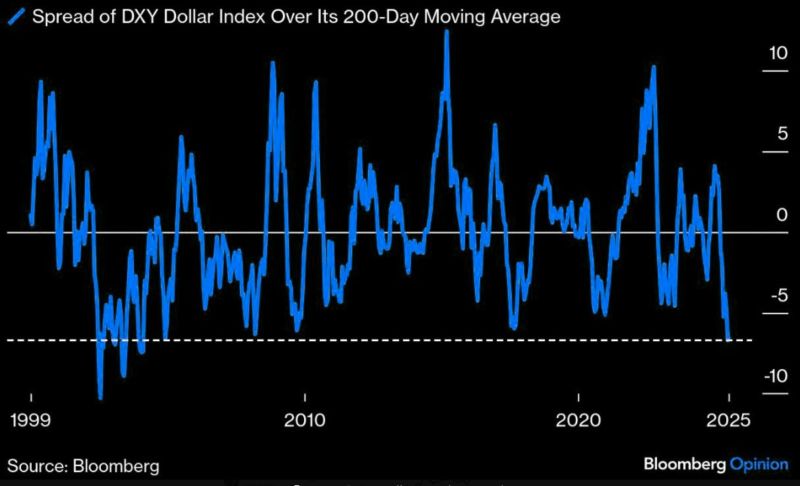

BREAKING: U.S. Dollar

U.S. dollar Index $DXY is now trading below its 200 Day Moving Average by the largest margin in 21 years. Source: Bloomberg

The SP500 has traded above its upper Bollinger Band for the past 8 days.

The last time it did that was in July 2024 and then $SPY promptly corrected by 10%. Source: Barchart

A golden cross for the S&P 500 (the S&P 500's 50d moving average has crossed above its 200d moving average).

Source: Bloomberg, Kevin Gordon

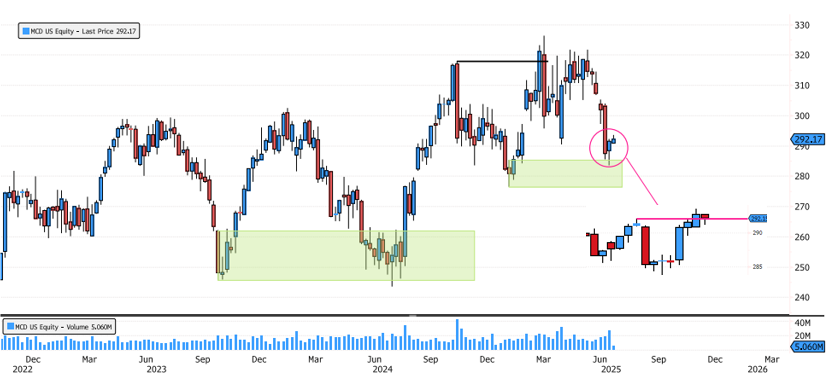

McDonald's Reacting on Major Swing Support

McDonald's (MCD) has consolidated 13% since the highs and is now back on the major swing support zone between 276-286. Yesterday, we saw some positive price action on the 4-hour chart, indicating a potential short-term trend change. Keep an eye on the price action over the next few days for further developments. Source: Bloomberg

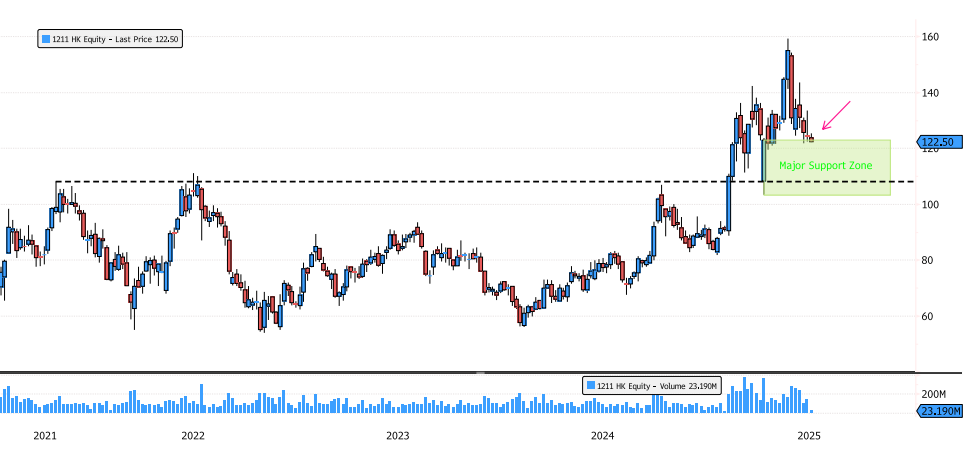

BYD Entering Major Support Zone

Since the May high, BYD (1211 HK) has consolidated more than 20%! The stock is now entering a major support zone between 103-123. Additionally, BYD is back at the 61.8% Fibonacci retracement, which places it in the discount zone. Keep an eye on the price action over the next few days for potential developments. Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks