Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Bitcoin consolidation phase, key levels

The last swing 83'479 – 124'514 is now in consolidation phase. 👉 Key levels to watch for a potential rebound: 107'278 → minor support 99'469 → 50% Fibonacci retracement 98'252 → strong support zone Source : Bloomberg

DAX Index nearing key support !

Since the July 10th highs, the DAX has pulled back more than 5%, while the S&P 500 gained around 5% over the same period. The index is now approaching a major support zone at 23,050–23,250. Watch closely in the coming days — price action around these levels could be decisive. Source: Bloomberg

Apple on the verge of forming a Golden Cross for the first time since June 2024

The last one sent $AAPL soaring 21% over the next 6 months. Source: Barchart

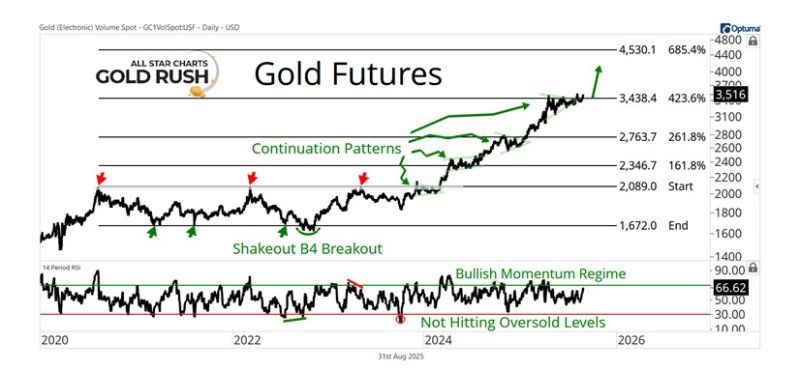

What's next for gold?

Here's the technical analysis view from J-C Parets: "After spending months coiling beneath the 423.6% Fibonacci extension, Gold futures are now resolving higher. This has been the pattern time and time again. Gold pauses at an extension level, builds energy, then launches to the next target. Every one of those continuation patterns has marked the beginning of another leg higher, and this one looks no different. As long as this breakout sticks, we think 4,500 is next". Source: All Star Charts team

Chocoladefabriken Lindt – Retesting Breakout Level

After a consolidation of more than 16% since the June highs, Lindt has now come back to retest the support zone at 11'090–11'750, which also coincides with the February breakout level. We’re seeing constructive price action on the shorter timeframes, suggesting that this level is attracting buyers and could act as a solid base. Source: Bloomberg

SP500 market breadth has been improving

Indeed, 68% of S&P 500 stocks are now trading above their 200-day moving average, the most this year 📈 Source: Barchart

A friendly reminder of bitcoin seasonality

Source: Ryan Rasmussen @RasterlyRock, Bitwise Asset Management

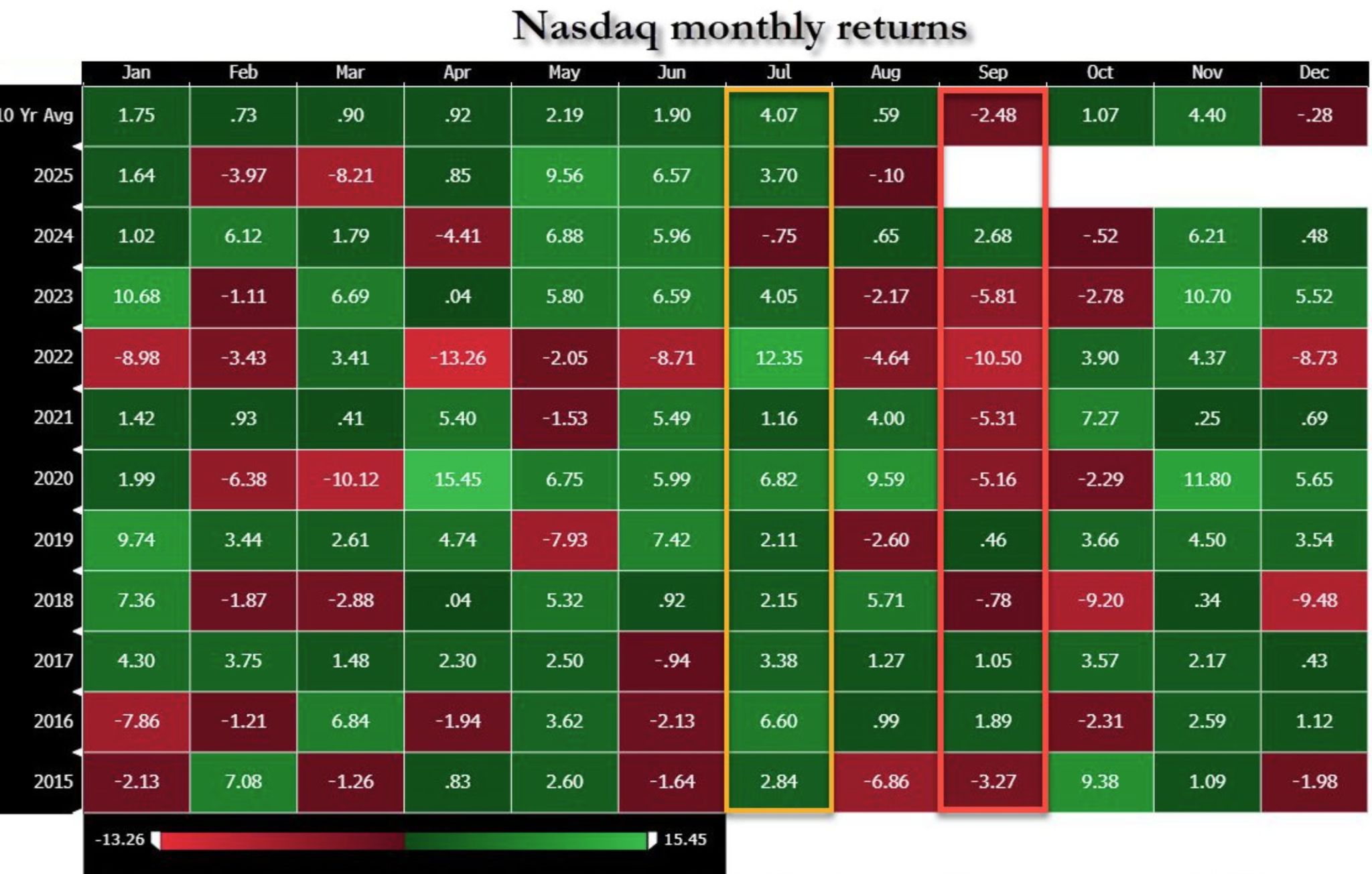

July Nasdaq seasonals were great. September's are not.

Source: zerohedge

Investing with intelligence

Our latest research, commentary and market outlooks