Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

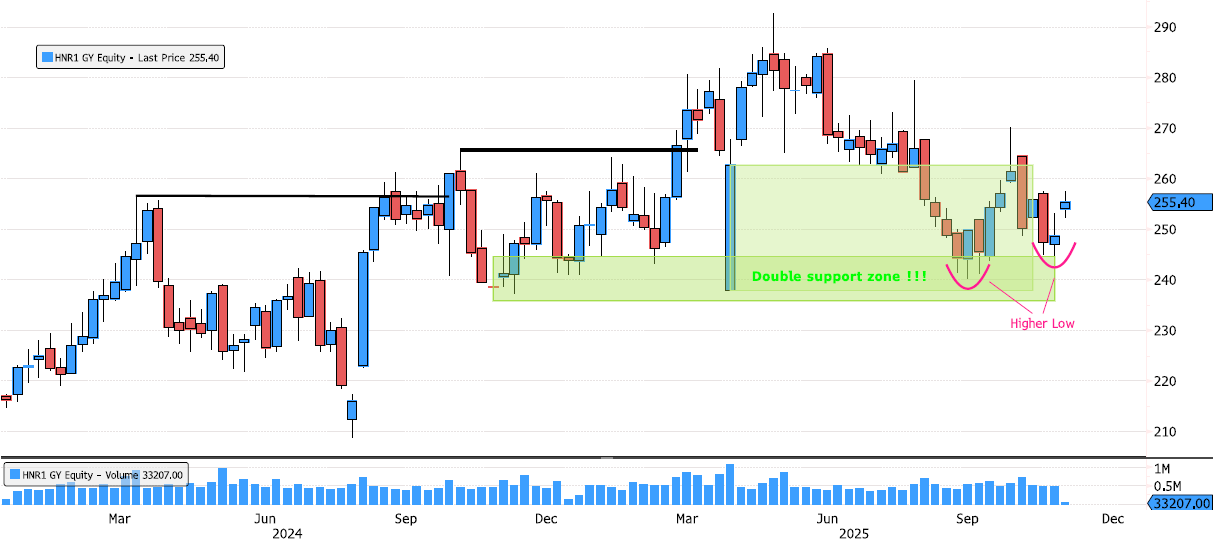

Hannover Rueck – Higher Low Confirmed!

After an 18% consolidation since May, Hannover Rueck seems to be regaining strength. A first low formed in September, followed by a 12% rebound — a sign of buyers stepping back in. Recently, the stock retested the double support zone and confirmed a higher low, strengthening the case for a potential trend reversal and offering what looks like a second opportunity for momentum traders. Source: Bloomberg

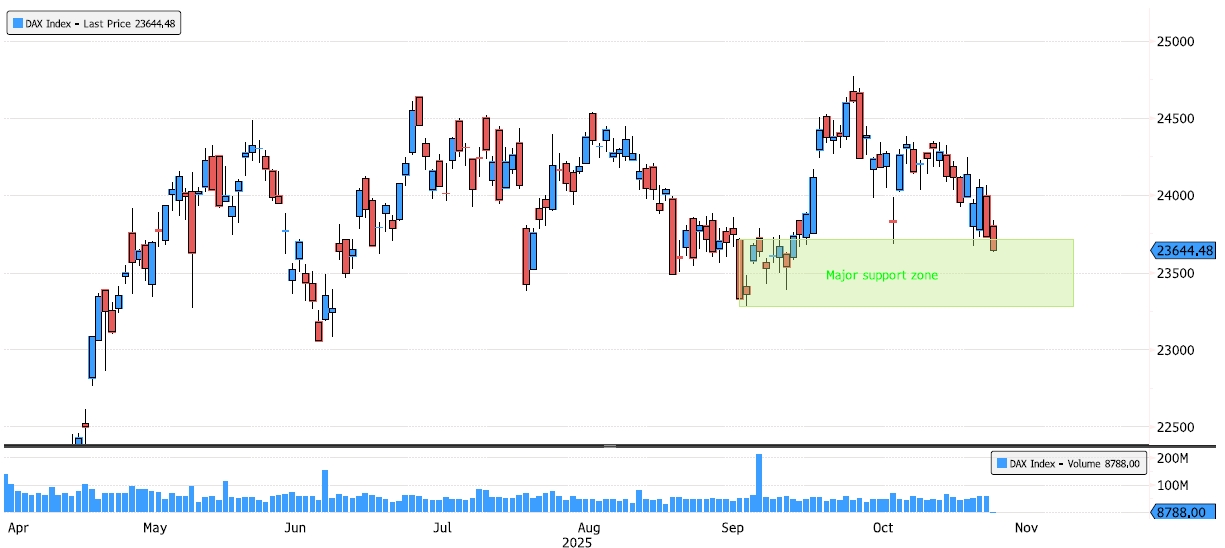

DAX Index reaching major swing support zone!

Nearly 5% consolidation since the October high! A lot of stops have been triggered after breaking below 23,684, providing the fuel for a potential rebound toward new highs. The index is now entering a major swing support zone between 23,284 and 23,712 — keep an eye on price action in the coming days to confirm a possible low. Source: Bloomberg

Givaudan – Trend reversal on short-term time frame

After a 32% consolidation since September 2024, we’re now seeing signs of a short-term trend reversal! This is a very advanced signal that still needs confirmation from breakouts on longer time frames. On the monthly chart, Givaudan has reached an imbalance zone that could act as a strong support area — and we’re about 10% away from the major support zone starting around 2875. Source: Bloomberg

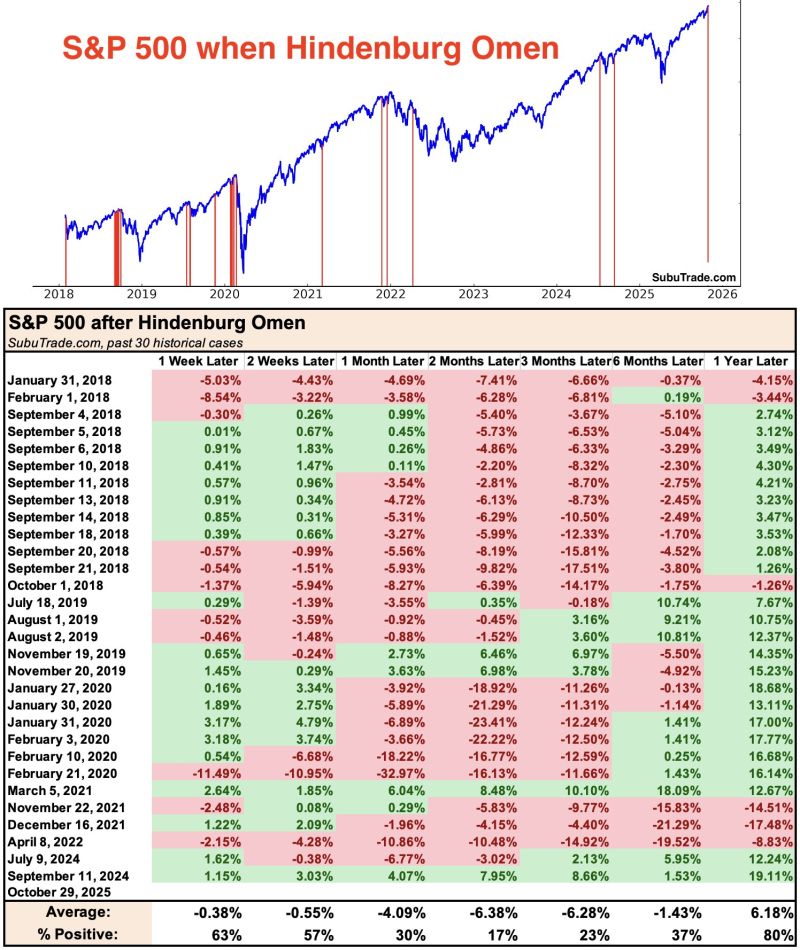

😨 Weak breadth: a Hindenburg Omen was triggered yesterday 🚨

The past 30 times this happened, $SPX fell 83% of the time 2 months later ➡️ What is a Hindenburg Omen ??? The Hindenburg Omen is a technical analysis signal that’s often cited as a warning of a potential stock market crash or major correction. It’s named (dramatically) after the Hindenburg airship disaster, implying that markets might be headed for a similar fiery fate when the signal appears. Here’s what it actually means 👇 ⚙️ The Mechanics The Hindenburg Omen triggers when a specific combination of conditions occur on the New York Stock Exchange (NYSE): 1. A large number of stocks hit new 52-week highs and a large number hit new 52-week lows — on the same day. 2. The number of new highs and new lows both represent more than 2.2% of all issues traded. 3. The NYSE composite index is above its level from 50 trading days ago (i.e., the market is still in an uptrend). 4. Market breadth (the McClellan Oscillator) is negative. 💡 What It Signals - This combo suggests internal conflict in the market — investors are both euphoric (driving some stocks to new highs) and fearful (dumping others to new lows). - That kind of divergence often happens before major turning points — when optimism and fear coexist uneasily. ⚠️ The Catch - It’s not a guaranteed crash predictor. - Historically, it’s produced lots of false alarms, but most major market crashes (like 2008) were preceded by one. So, think of it as a “storm warning” — not a crash forecast. When it flashes, investors tend to watch liquidity, breadth, and credit spreads much more closely. Source: Subu Trade: h/t @McClellanOsc

Booking Holdings rebounding on 50% retracement

The stock has consolidated about 15% since July and reached the imbalance zone between 4,878 and 5,038. This area also corresponds to the 50% Fibonacci retracement from the latest swing (4,096–5,839). A confirmation is still needed to validate that this level will hold — keep an eye on 5,327 for a potential breakout confirmation. Source: Bloomberg

JPMorgan Chase – Positive rebound on swing support

The stock rebounded two days ago on a key swing support zone! Support at 291.44 was tested but managed to hold, with a close above that level. This could mark the end of the consolidation phase and the beginning of a new upward move. Source: Bloomberg

Nestlé – Trend Reversal Confirmed

After a 46% consolidation since January 2022, we finally have confirmation that the trend is reversing. The breakout above 78.27 marks the end of the consolidation phase, establishing 70.42 as the likely low. Interestingly, the stock broke below its 2003 long-term trend in July this year, but has now reclaimed it, confirming that this historical level remains valid. While a pullback could occur following a new high, it’s still too early to define a swing top — momentum is clearly back. Source: Bloomberg

Aryzta reaching first support

Aryzta remains in a bullish long-term trend. Currently in the discount zone (below 50% Fibonacci) and even below 61.8% (last swing 57.72 – 87.60). It’s now trading on the first support zone at 66.40 – 70.48. 👉 A rebound could take shape here, so keep an eye on the price action. That said, we can’t exclude a break lower with a retest of the major support zone 57.72 – 61.60. Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks