Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

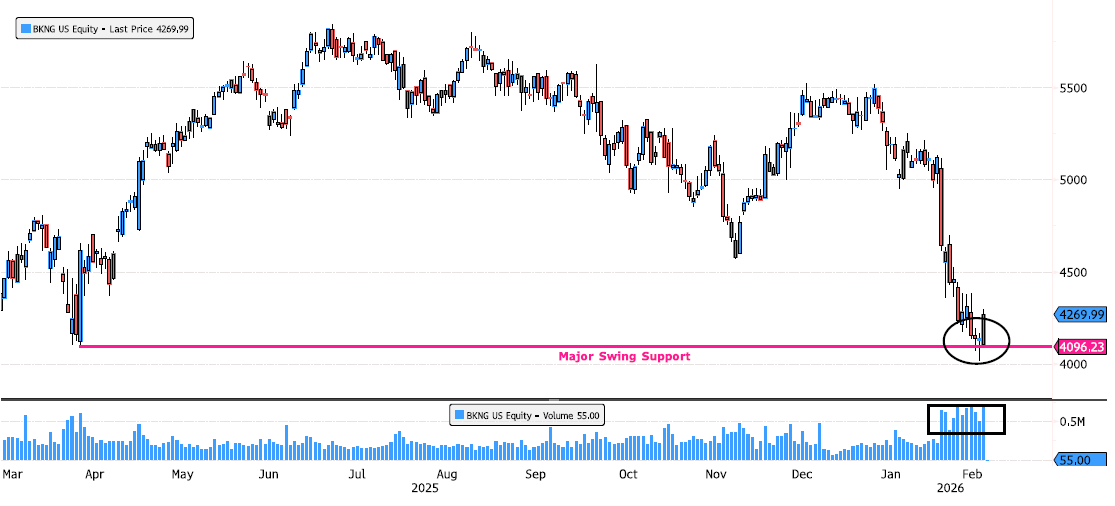

Booking Holdings (BKNG) – Swing Support Holding on Earnings

Booking Holdings (BKNG) rebounding right where it matters — on major swing support during earnings week. After consolidating 31% over the last 32 weeks, the stock has now tested the 4096 key swing level for three consecutive sessions. 👉 Important detail: Price pierced intraday, But never closed below 4096 That tells us institutions were willing to defend the level. Yesterday’s session printed a strong power bar, suggesting demand stepping in at support. Another key observation: Since topping around 5000, volume has been consistently elevated all the way down to the 4100 area. This isn’t a quiet drift lower. This is heavy participation. Now the question becomes: Is this accumulation at support… or just temporary stabilization before another leg down? 📍 Next level to watch: 4438 If price can build momentum and reclaim 4438, that would strengthen the case for a broader rebound and potential shift in short-term structure. Until then, 4096 remains the line in the sand. Source : Bloomberg

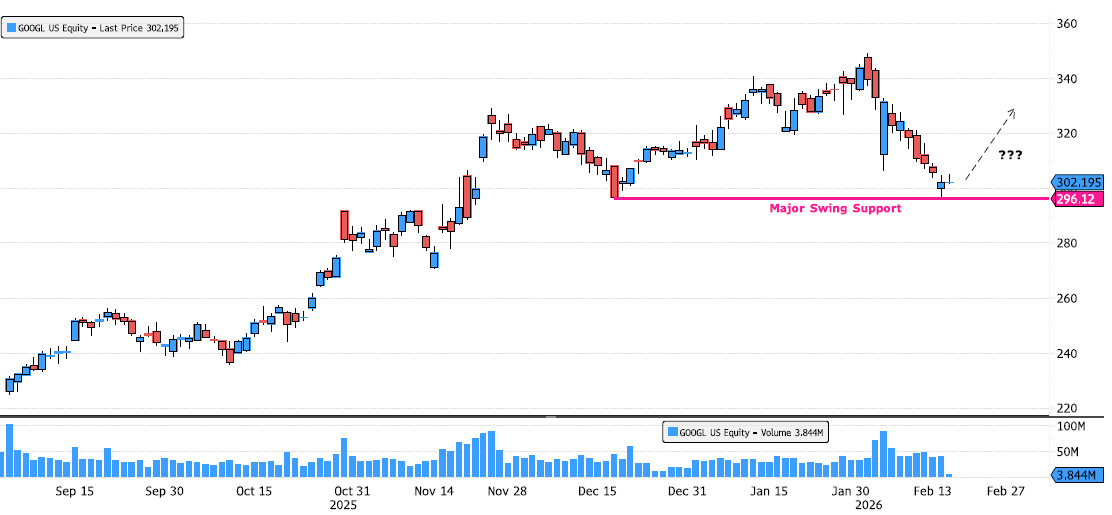

Alphabet Inc. back on swing support

The stock has consolidated roughly 15% since the beginning of February, digesting prior gains and working off overbought conditions. Yesterday’s session saw a rebound right on major swing support at 296.12, with an intraday low at 296.25 — a precise technical reaction that shouldn’t be ignored. It’s still a bit early to call for a confirmed reversal, but this level is clearly one to monitor closely. What would strengthen the bullish case? • 📈 A clear pickup in volume • 🟢 Strong follow-through candles off support • 🔁 Higher lows on lower timeframes • 💥 Reclaiming short-term moving averages If buyers step in with conviction, this zone could mark the start of the next leg higher. If not, a clean break below opens the door to further downside. For now, it’s about watching price + volume confirmation. Are you waiting for confirmation — or positioning early at support? Source: Bloomberg

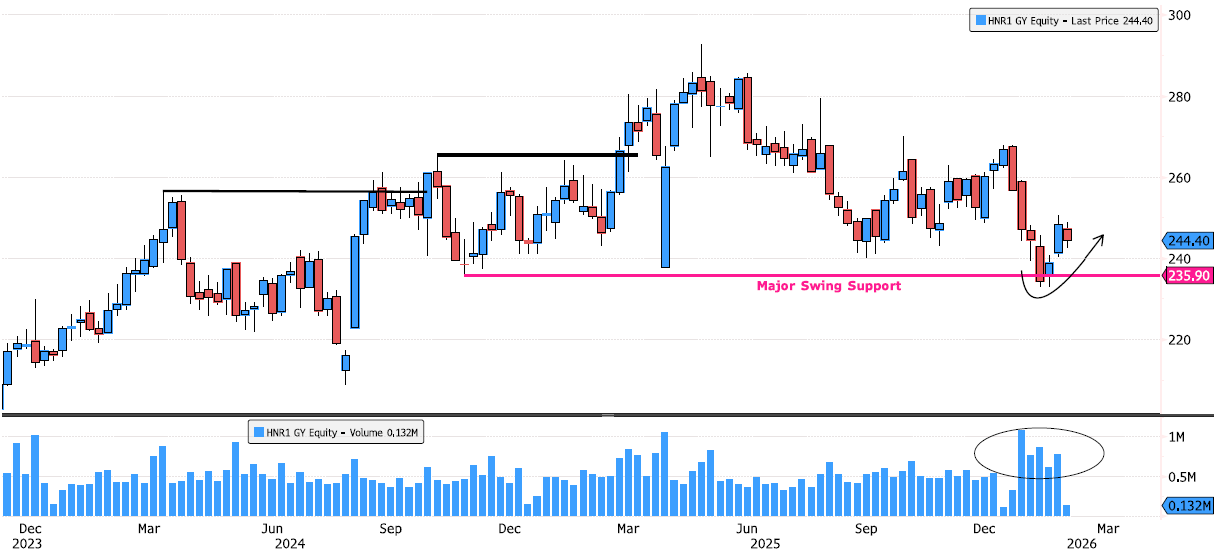

Hannover Rueck reacting on swing support

After a +20% consolidation from the May 2025 highs, price has done something technically very clean 👇 Swing support at 235.90 was tested at the end of January Clear liquidity sweep below that level, followed by a swift reaction Since then, positive momentum is building Volume expansion right at support → strong signal of institutional interest This kind of price–volume behavior often suggests absorption at key demand, rather than distribution. As long as price holds above the reclaimed support, the structure favors a base-building phase with upside potential. Source: Bloomberg

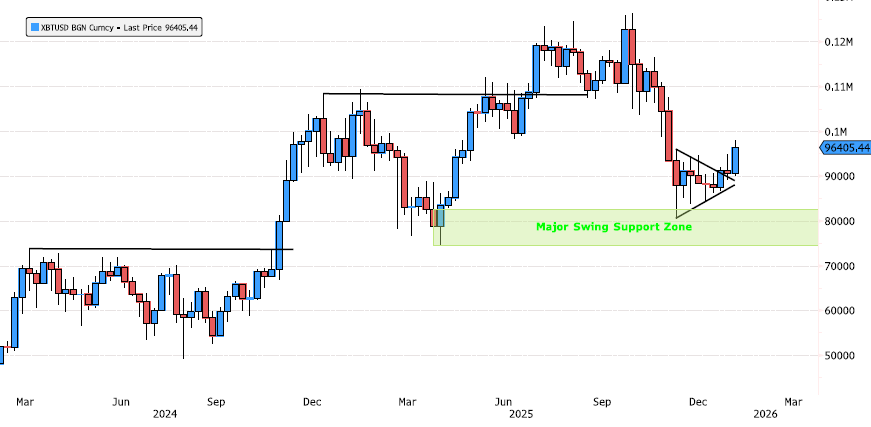

Bitcoin: Breakout After a 36% Consolidation – Strength Building Up

Bitcoin has consolidated 36% since the October highs, digesting gains in a healthy and structured way. 🔺 Over the past 8 weeks, price action formed a triangle consolidation, now breaking out to the upside 📉 The move successfully tested the major swing support zone at 74’545 – 82’531 📐 Price traded back to the 78.6% Fibonacci retracement, a level often seen in strong continuation trends 🔍 What matters next: ➡️ A weekly close above 96’000 would significantly strengthen the bullish scenario and confirm renewed upside momentum. As always, patience and confirmation remain key at these levels. Source: Bloomberg

Siegfried Holding rebounding from a major long-term level

After a 42% consolidation since September 2024, Siegfried is starting to show early signs of a trend change. 🔹 The stock successfully tested a major swing support zone at 56.60–70.35, a technically significant area 🔹 Volume is picking up, confirming renewed interest 🔹 A strong +24% move from the lows signals momentum returning ⚠️ That said, chasing the move here would be risky. After such a sharp rebound, patience is key. 👉 Pullbacks toward former resistance / short-term supports could offer much cleaner entry opportunities. This is a name to keep on the radar, not to rush into. Source: Bloomberg

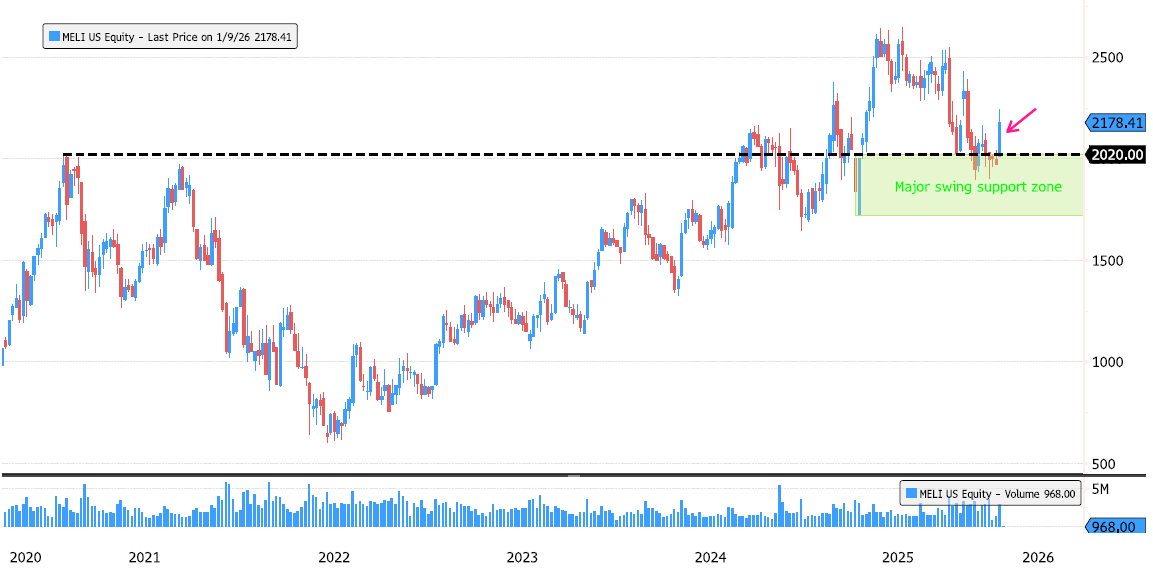

MercadoLibre bouncing off a major long-term level

After a +28% consolidation from the July 2025 highs, MercadoLibre (MELI US) is showing constructive technical signals. 🔹 Price has pulled back to the 78.6% Fibonacci retracement 🔹 A double bottom is forming on the last swing support zone 1,724 – 2,020 🔹 This area is technically critical: - Former 2021 highs - A 5-year consolidation zone - Strong historical demand level This confluence makes the current zone a key structural support, worth close monitoring for confirmation of a medium-term rebound.

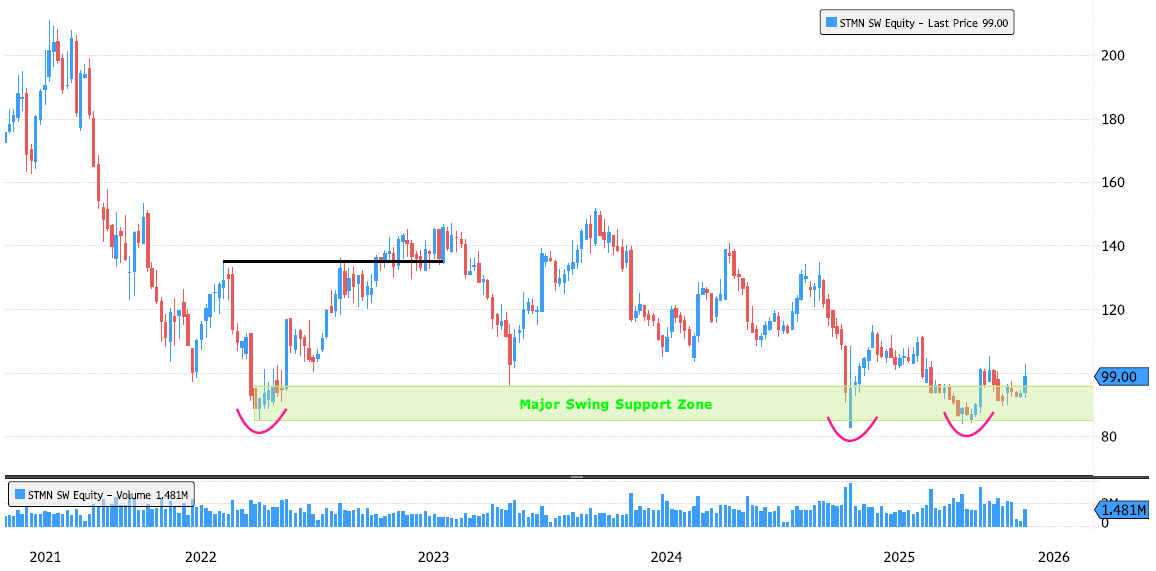

Straumann — Is a low forming?

Back in March 2023, the trend flipped from bearish to bullish after a ~59% consolidation over 10 months. Following nearly two years of another consolidation, we’re now seeing early signs of a bottoming process. 📊 Key technical observations: Strong volume reaction on the major swing support zone (85–95) Structure suggesting a potential inverted Head & Shoulders Still early-stage, but clearly one to monitor closely 🎯 Next resistance: 105.25 If confirmed, this setup could lay the groundwork for the next bullish leg. Confirmation remains essential. Source: Bloomberg

⚠️ Silver – Bearish Reversal Day Alert

Silver (XAG) is printing a bearish engulfing pattern today — one of the most reliable reversal signals in technical analysis. 📈 Context matters: The market has rallied more than +50% since the ~50 level last November. Price is trading in all-time high territory, where profit-taking and volatility often increase. 🧠 What this suggests: A consolidation would be healthy and logical at this stage. A 50% Fibonacci retracement of the recent leg points toward a potential target around 64.78. Such a move would help the market rebuild energy rather than signal a trend break. 🔎 Big picture: Long-term trend remains bullish. However, the market likely needs more fuel before attempting a sustainable continuation higher. ➡️ In short: stay cautious in the near term, respect the signal, and watch how price behaves during any pullback. Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks