Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

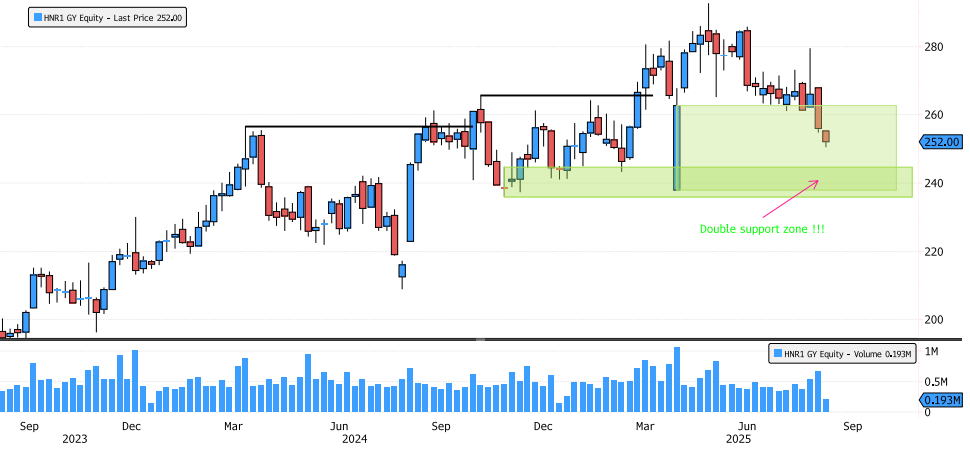

Hannover Rück Approaching Double Support Zone

Hannover Rück has been in a bullish long-term trend since 2012! The last swing has consolidated 15% since the May highs, nearing the 78.6% Fibonacci retracement. The stock is now entering the major weekly swing support zone between 238-262, while also approaching the second major support zone from the January 2024 swing at 236-244. Keep an eye on the price action to confirm the potential end of this consolidation. Source: Bloomberg

Salesforce in a Good Spot!

Salesforce (CRM) has been consolidating since December 2024 and is now down 38%. The stock is back in the major swing support zone between 212-273. Last week was particularly interesting, with a break below the April lows creating a liquidity grab and a reversal, forming a Hammer candle. Source: Bloomberg

Berkshire Reaching Major Support Zone

Berkshire Hathaway has consolidated more than 15% since the May highs and is now approaching the major swing support zone between 440-456. Keep an eye on the price action over the next few days for potential developments. Source: Bloomberg

AstraZeneca Trying to Breakout

After several months of rebounding from the major support zone between 9330-9730, AstraZeneca is now showing signs of a potential breakout. Keep an eye on the 11086 resistance for any confirmation of the breakout. Source: Bloomberg

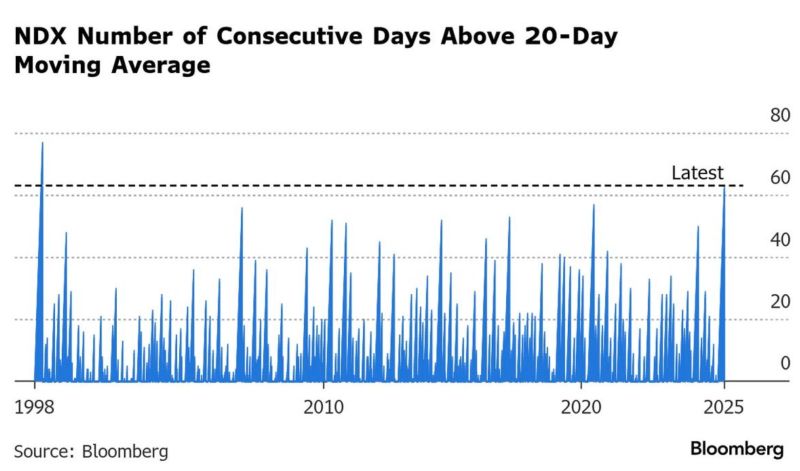

Nasdaq posted its 63rd consecutive day above its 20-day moving average, the longest streak since the dot com bubble.

Source: zerohedge, Bloomberg

U.S. Dollar Index $DXY on track to get a Death Cross ☠️ on the weekly chart for the first time since January 2021

🚨 The last 2 weekly Death Crosses marked the bottom 📈 Source: Barchart

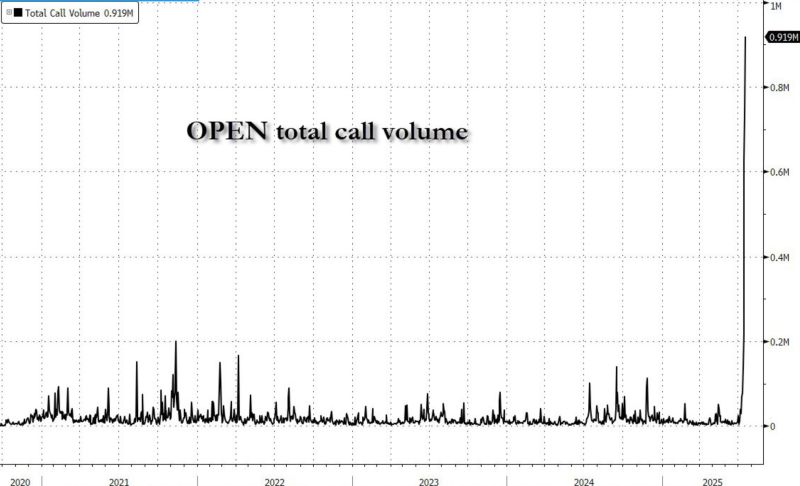

The biggest gamma squeeze in history ???

Source: zerohedge

Investing with intelligence

Our latest research, commentary and market outlooks