Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Gold reaching key support level

Gold (XAU) is reaching key support level 1808. Keep an eye. Source : Bloomberg

ASML still holding major support 545

ASML (ASML FP) is holding support 545 since more than two weeks. This level is very important, keep an eye on it. Source : Bloomberg

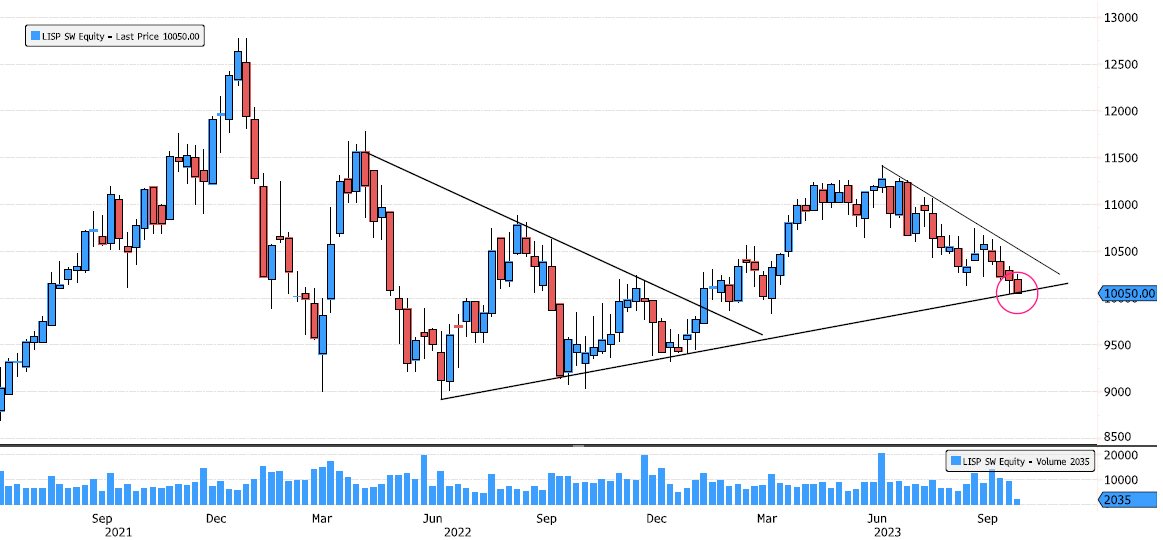

Lindt & Spruengli testing June 2022 trendline support

Lindt & Spruengli (LISP SW) is back on June 2022 trendline support. Keep an eye on it. Source : Bloomberg

A death cross on the Euro-dollar

Watch out the key 1.05 support level. There is not safety net underneath Source: TME Activate to view larger image,

Aryzta 5 year breakout ?

Aryzta (ARYN SW) is trying to breakout the 5 year consolidation. Last two attemps in April and July failed. Will it have enough strenght this time ? Source : Bloomberg

Bitcoin breakout ?

Bitcoin (XBTUSD) is trying to breakout July downtrend resistance. Keep an eye at these levels. Source : Bloomberg

FTSE MIB Index testing double support

FTSE MIB Index is testing again major support zone and December uptrend. Keep an eye on this level. Source : Bloomberg

Yes, the S&P 500 chart ($SPX) "looks" terrible (Head & Shoulders, trading below 50d and 100d MA, etc.) but it also looked ugly during September 2021 and had a last leg up in the 4 months that followed

Source: Nautilus Research

Investing with intelligence

Our latest research, commentary and market outlooks