Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

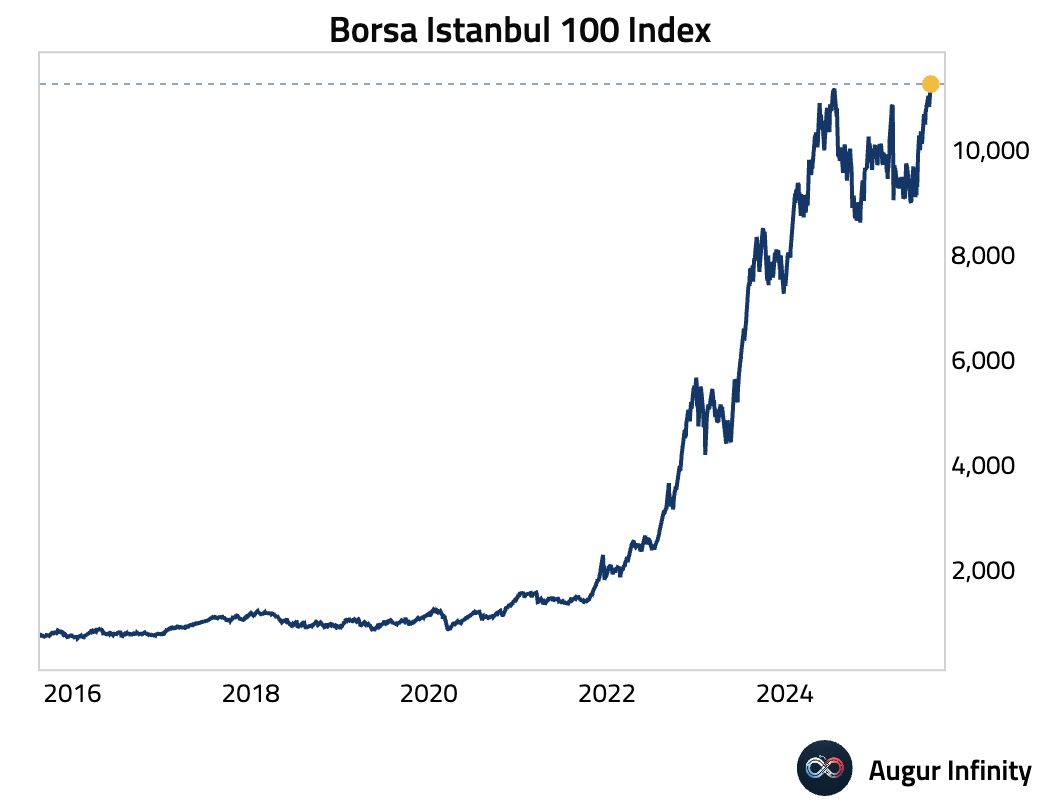

🔴 Turkey Lira dropped to an all-time low after Istanbul mayor and Erdogan rival arrested.

Imamoglu, the 53-year-old Istanbul mayor, was seen as the next opposition party candidate for the Turkish presidency and was expected to be nominated on Sunday. Charges for the arrest, which Imamoglu and his party reject, include terrorism and organized crime. Source: CNBC, Bloomberg

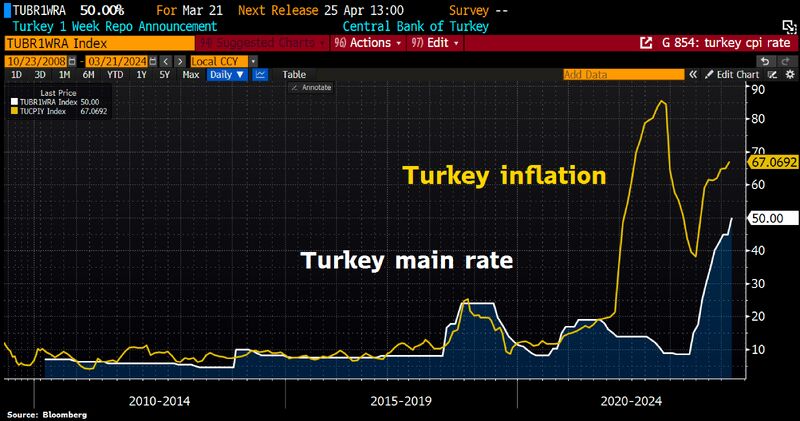

Turkey raises benchmark rate unexpectedly by 500bps to 50%.

But main rate still way below inflation of 67.1%. Source: Bloomberg, HolgerZ

🇹🇷 A Surprise Resignation at the Central Bank of Turkey (CBT) 🌟

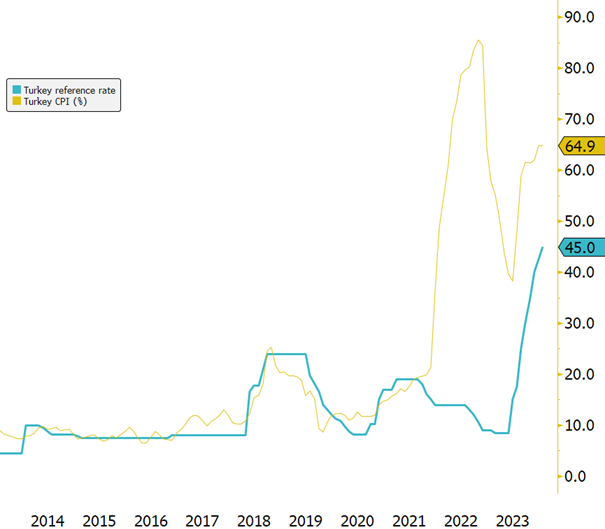

Governor Hafize Gaye Erkan's sudden resignation from the Central Bank of Turkey (CBT) has stirred questions about its impact on monetary policy and financial markets. Erkan, who made history as the first woman to lead the CBT, took office less than eight months ago with a mandate to adopt a more orthodox monetary policy. She swiftly raised the benchmark interest rate to 45% to combat soaring inflation. Following Erkan's exit, her deputy, Fatih Karahan, assumed leadership. With experience from the New York Federal Reserve and Amazon, Karahan is expected to maintain a strict monetary stance. He affirmed a commitment to monetary tightening until inflation aligns with the CBT's goals. This transition arrives amid high consumer price inflation, expected to remain around 65% for January. Karahan's appointment underscores the nation's policy continuity and commitment to economic stability through orthodox monetary measures. As financial markets react, we'll closely watch the CBT's policy decisions under Governor Karahan's leadership and their impact on the Turkish economy. 🇹🇷📈 Source: Bloomberg #CBT #TurkeyEconomy #MonetaryPolicy #MarketImpact

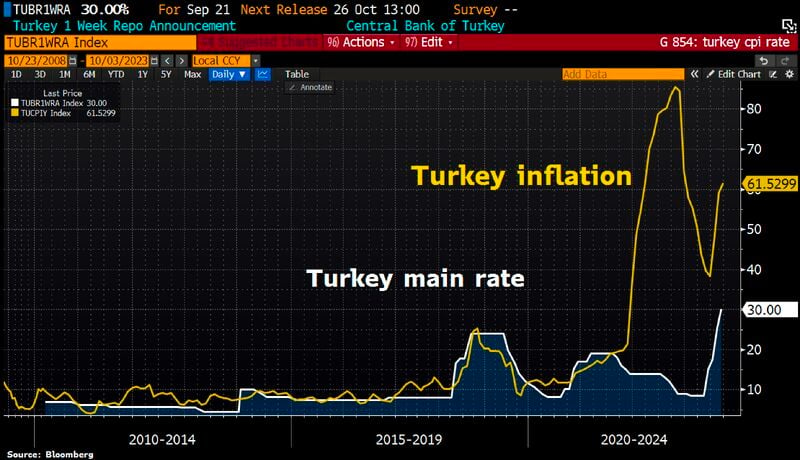

Turkey’s central bank hiked its key interest rate to 40% on Thursday

The lira was trading at 28.766 to the dollar following the news, slightly stronger against the greenback. The rate increase was double economists’ expectations, who had forecast a 250-basis-point hike. The move was seen as a continuation of the bank’s attempt to combat high inflation and a falling lira. Inflation in the country came in at a whopping 61% in October Source: Bloomberg, CNBC

Turkey’s Inflation tops 60% despite massive interest rate hikes as oil surge worsens outlook

Source: HolgerZ, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks