Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

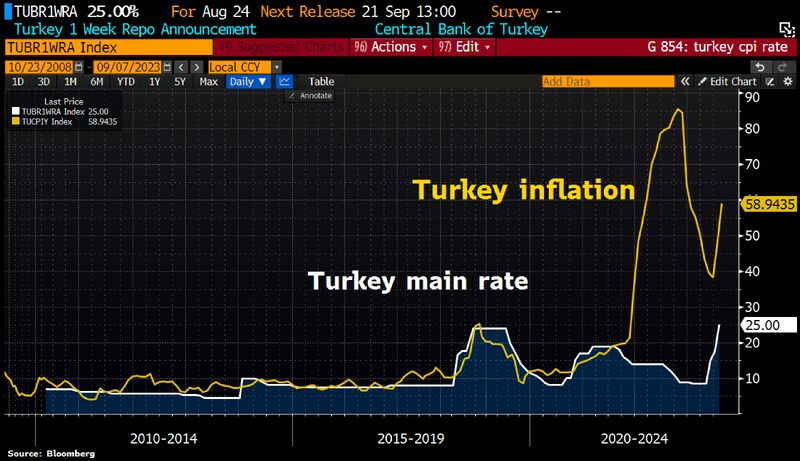

Turkey inflation has reaccelerated despite sharply increased key interest rates.

Source: Bloomberg

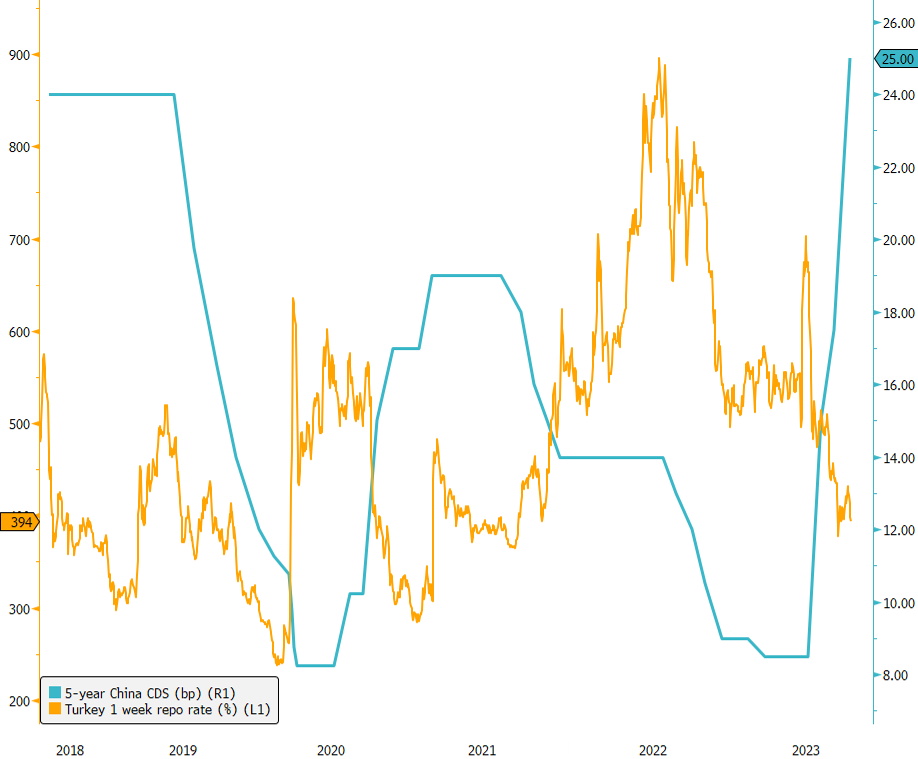

Turkey's Aggressive Rate Hike Triggers 5-Year CDS Drop!

The Turkey Central Bank has taken a significant step in its battle against inflation by implementing a supersized rate hike of 750bps, bringing rates to 25%. This move was unexpected, as the market had anticipated a more "modest" hike to 20%. Turkish fixed income assets have responded positively, with the Turkey 5-year CDS retreating below 400bps. Even Turkey's US Dollar-denominated bonds saw a boost from the news. With the Central Bank of Turkey adopting a more orthodox approach to its monetary policy, the question arises: can they successfully bring inflation back to reasonable levels? To provide context, the latest inflation figure for the month of July was at a staggering 47.8%... Source: Bloomberg

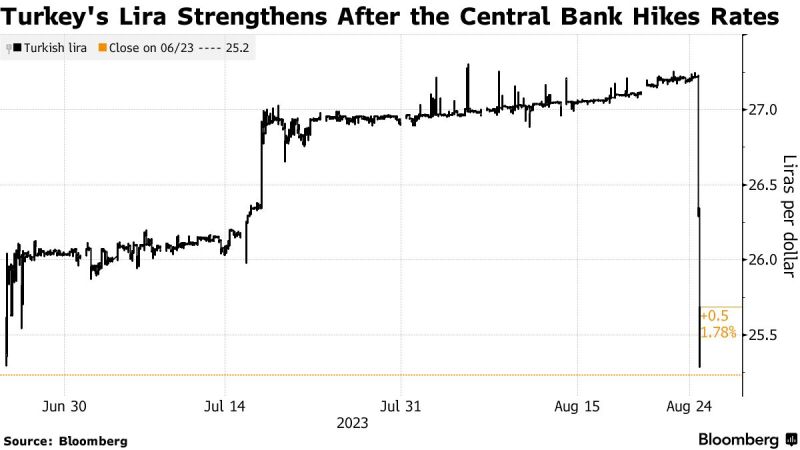

Lira Rallies as Turkey stuns with biggest rate hike in years

The central bank raises benchmark rate by 750 basis points. Turkish currency surges more than 5% against the dollar. The Monetary Policy Committee, under Governor Hafize Gaye Erkan, raised the benchmark one-week repo rate to 25% from 17.5%, the sharpest increase since 2018. Most economists polled by Bloomberg predicted a hike to 20%. It’s the latest indication that Turkey’s new administration is prepared to move away from the unorthodox policies — including ultra-loose borrowing costs — that were championed by President Recep Tayyip Erdogan but caused foreign traders to flee the country’s bond and stock markets en masse. Source: Bloomberg

A public library made up entirely of books once destined for landfill. 🙌🏼

Source: Daniel Abrahams

Turkish Central Bank Implements another Significant Rate Hike!

The Turkish Central Bank (CBT) has taken another important step, raising its key rate by 2.5% to 17.5%. Though it slightly missed market expectations (18.5%), the chosen monetary policy path has instilled confidence among investors. This is evident as the 5-year Turkish Credit Default Swaps have hit a new low, not seen since November 2021. Furthermore, Turkish government and corporate bonds denominated in USD have demonstrated an impressive performance, gaining +6% in 2023. In addition to these developments, it is noteworthy that Turkey has recently received substantial economic support from the UAE, totaling more than $50 billion. Could this influx of support help mitigate the sharp weakness experienced by the Turkish Lira? Source : Bloomberg.

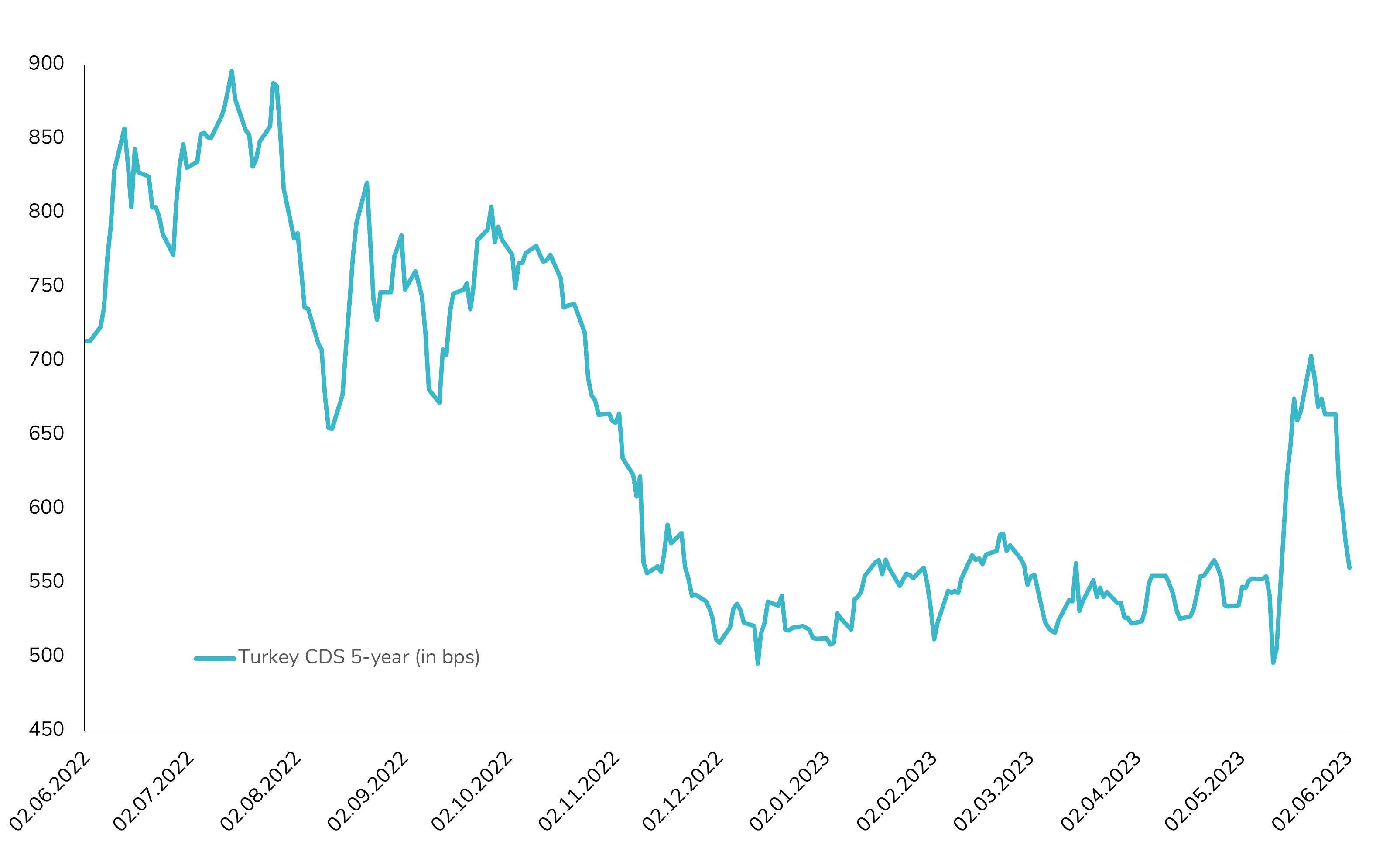

Turkey 5-year CDS back to pre-election levels!

Market sentiment initially turned negative as the first-round results showed an unexpected rise in Erdogan's prospects for securing another presidential term. However, in a remarkable turnaround, Turkey's 5-year CDS has already returned to pre-election levels just days after Erdogan's re-election. The appointment of Mehmet Simsek as Minister of Treasury and Finance signals a positive shift towards a more conventional economic approach, bolstering market confidence post-election. Could this indicate a forthcoming adoption of a more conventional monetary policy strategy by the Turkish Central Bank? Source : Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks